How to Launch Your Metaverse IDO Launchpad?

July 24, 2024

Mitigating DeFi Risks: Essential Strategies for Protection

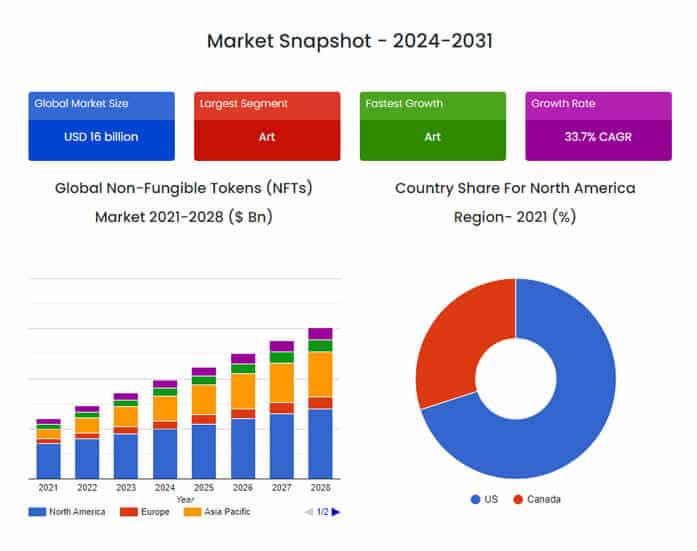

July 24, 2024Non-fungible tokens, or NFTs, have exploded onto the digital scene, fundamentally altering the way we interact with and own digital assets.

As the NFT ecosystem continues to flourish, the need for effective NFT portfolio management becomes increasingly crucial. While the initial surge focused on high-profile acquisitions and rapid price appreciation, a more sophisticated approach is essential for long-term success. Managing a thriving NFT collection presents unique challenges.

The Need for Portfolio Management in the NFT Space

First, the volume and diversity of NFT projects are overwhelming. One needs a structured way of monitoring ownership details, market ups and downs, and general trends in various NFT marketplaces. Second, since the NFT market is still in its formative years, it requires an in-depth understanding of the underlying fundamentals, community engagement, and utility brought about by each NFT. An effective NFT portfolio management app does not only come with buying an NFT; rather, it is engaging with the underlying community.

Furthermore, tax implications for NFT ownership and transactions are still developing. Keeping a meticulous record of acquisition costs, sale prices, and associated fees is essential for accurate tax reporting. Robust portfolio management tools can streamline this process and ensure compliance with evolving tax regulations. Finally, as the NFT market matures, the ability to analyze historical data, identify emerging trends, and assess the long-term potential of specific projects becomes paramount. NFT portfolio management solutions equipped with data analysis capabilities can empower collectors to make informed investment decisions and optimize their NFT holdings.

The Importance of NFT Portfolio Management

The phenomenal rise of NFTs has opened a new chapter in digital asset ownership. However, with this exciting opportunity comes the responsibility of managing a potentially complex and ever-evolving portfolio. Just like traditional investment portfolios, best NFT portfolio management is paramount for mitigating risk, maximizing returns, and achieving long-term success in this dynamic space.

A. Risk Mitigation:

- Diversification Strategies: The NFT landscape boasts a vast array of projects, each with varying levels of risk and reward. A diversified portfolio that distributes holdings across different categories (art, collectibles, gaming, etc.) mitigates the impact of a single project’s decline.

- Minimizing Losses During Market Downturns: Similar to traditional markets, the NFT market experiences periods of volatility. By strategically allocating resources and employing calculated selling strategies during downturns, collectors can minimize potential losses and preserve portfolio value.

B. Maximizing Returns:

- Identifying High-Potential Assets: Effective NFT portfolio management app goes beyond simply acquiring popular NFTs. Deep research into project fundamentals, creator reputation, community engagement, and long-term utility offered by each NFT empowers collectors to identify assets with high growth potential.

- Strategic Buying and Selling Decisions: Timing is crucial in the NFT market. Portfolio management tools and data analysis can provide valuable insights to identify opportune moments for buying and selling based on market trends, project developments, and overall market sentiment.

C. Tracking Performance:

- Monitoring Changes in Value: The NFT market is constantly evolving. Regularly monitoring the value of individual NFTs and the overall portfolio health ensures informed decision-making.

- Assessing Overall Portfolio Health: NFT-based portfolio management involves analyzing the performance of individual NFTs alongside the entire collection. This holistic view allows collectors to identify underperforming assets, rebalance their holdings, and adjust strategies as needed.

By implementing these core principles of portfolio management, NFT collectors can navigate the exciting yet challenging NFT landscape with greater confidence. It empowers them to make informed decisions, mitigate risks, and ultimately, maximize their returns within the ever-expanding world of digital assets.

Features of an NFT-Based Portfolio Management Solution

NFT-Based Portfolio Management solutions offer a suite of features specifically tailored to the NFT ecosystem. Let’s explore some key features that can elevate your NFT portfolio management experience:

- Comprehensive Asset Tracking: Consolidate all your NFT holdings across different wallets and marketplaces in a single, unified interface. Gain a clear overview of your entire collection, including individual NFT details, acquisition costs, and current market value.

- Real-Time Market Data & Analytics: Stay informed with real-time price updates and insightful market data for your NFTs. NFT portfolio tracker allows you to track historical price trends, analyze floor prices for collections, and identify potential buying or selling opportunities.

- Advanced Portfolio Performance Tracking: Gain valuable insights into the overall health and performance of your NFT portfolio. Monitor key metrics like total value, diversification across categories, and individual NFT performance to make informed investment decisions.

- Community Engagement & Research Tools: Access integrated tools to research NFT projects, explore artist profiles, and delve into community discussions. Stay up-to-date on project developments, assess community sentiment, and identify high-potential projects before they gain mainstream attention.

- Tax Reporting & Compliance Tools: Simplify tax reporting with automated tools that track acquisition costs, sale prices, and associated fees for your NFT transactions. Generate tax reports easily and ensure compliance with evolving tax regulations.

- Secure & Encrypted Storage: Store your NFT data securely within the platform’s encrypted environment. Secure access with multi-factor authentication ensures the safety of your valuable NFT collection.

- Smart Alerts & Notifications: Receive customizable alerts for price fluctuations, upcoming project developments, or new NFT drops within your preferred categories. Stay ahead of the curve and react to market opportunities in a timely manner.

- Data-Driven Investment Strategies: Leverage data analysis features to identify emerging trends, assess project fundamentals, and predict future value potential. Make informed investment decisions based on data-driven insights rather than pure speculation.

These features empower NFT collectors to manage their portfolios with greater efficiency, make informed investment decisions, and navigate the ever-evolving NFT landscape with confidence.

Key Strategies for Effective NFT Portfolio Management

The NFT market presents a captivating realm of opportunity, brimming with unique digital assets and the potential for significant returns. However, navigating this dynamic space requires a strategic approach. Here, we delve into key strategies for best NFT portfolio management, empowering you to build a robust and successful collection.

1. Research and Due Diligence

- Understanding Projects and Artists: Before committing to an NFT, delve into the project’s purpose, roadmap, and utility it offers. Research the artist or creator’s background, reputation within the NFT community, and artistic vision.

- Analyzing Market Trends: Staying informed about current market trends is crucial. Analyze historical data, identify emerging project categories, and gauge overall market sentiment to make informed investment decisions.

2. Setting Clear Goals

- Short-term vs. Long-term Investment Strategies: Define your investment goals. Are you seeking quick flips or building a long-term collection with appreciation potential? Align your buying and selling strategies with your specific goals.

- Personal Risk Tolerance Assessment: The NFT market is inherently volatile. Assess your risk tolerance thoroughly. A diversified portfolio minimizes risks, but exploring high-potential projects with higher risks can lead to greater rewards if your risk tolerance allows for it.

3. Utilizing Tools and Platforms

- Portfolio Tracking Software: Manage your NFT collection efficiently with dedicated and best NFT portfolio tracker software. These tools provide real-time updates on NFT values, track purchase history, and offer valuable insights for informed decision-making.

- Data Analytics for Informed Decisions: Leverage data analytics platforms to gain valuable insights into project performance, market trends, and community engagement. This data can empower you to identify high-potential projects and make strategic buying and selling decisions.

By implementing these key strategies, you can transform your NFT-based portfolio management from a speculative venture into a calculated and rewarding journey within the digital art and collectibles frontier.

Use Cases for NFT Portfolio Management

NFT portfolio management solutions offer a robust toolset that caters to the specific needs of NFT collectors in the technical intricacies of the blockchain ecosystem. Here’s how:

- Cross-chain Aggregation and Tracking: These solutions act as a single source of truth for your entire NFT portfolio. By leveraging blockchain APIs and interoperable protocols, they aggregate data from various wallets and marketplaces, even across different blockchains. This enables comprehensive portfolio tracking irrespective of the underlying network your NFTs reside on.

- Real-time On-chain Data Analysis: Move beyond basic price tracking. NFT portfolio management app integrates with on-chain data feeds, providing real-time insights into key metrics like transaction volume, smart contract activity, and NFT ownership history. This allows collectors to identify emerging trends, assess project health, and make informed investment decisions based on raw blockchain data.

- Automated Smart Contract Monitoring: Never miss a critical project update again. Portfolio management solutions can be configured to monitor specific smart contracts associated with your NFTs. This can provide automated alerts for upcoming governance votes, token unlocks, or minting events, allowing for strategic participation in project development.

- Advanced Portfolio Performance Analytics: NFT portfolio management tools go beyond basic portfolio value tracking. They leverage sophisticated analytics engines to calculate key performance indicators (KPIs) like Sharpe Ratio and MVR (Markowitz Volatility Ratio) specific to the NFT market. This empowers collectors to assess risk-adjusted returns, portfolio diversification, and optimize their investment strategies based on a data-driven approach.

- Secure Enclave Storage and Multi-Signature Transactions: NFT portfolio solutions prioritize security. They may employ secure enclave storage for private keys, utilizing hardware security modules (HSMs) to protect sensitive cryptographic information. Additionally, integration with multi-signature transaction wallets allows for advanced access control and mitigates the risk of unauthorized NFT transfers.

- Customizable NFT Rarity Scoring: Move beyond simple floor price analysis. Some solutions incorporate advanced rarity scoring models based on on-chain data and community sentiment. This allows collectors to identify rare or undervalued NFTs within collections, potentially uncovering hidden gems with high investment potential.

Manage Your NFTs Like a PRO with Antier!

Don’t settle for fragmented data and missed opportunities! Antier’s best NFT portfolio management suite seamlessly integrates across blockchains and marketplaces, providing actionable insights, automated smart contract monitoring, and advanced rarity scoring tools. Secure your NFTs with industry-leading practices and explore the potential of algorithmic trading. Take control of your digital assets and become an NFT powerhouse. Explore Antier today and unlock the full potential of your collection.