Top 5 RPG Games to Play in 2025

January 15, 2025

What Does the Future Hold for Metaverse Real Estate Development?

January 16, 2025Table of Contents :

The pace of digital transformation in the financial sector has accelerated manifold in the last few years. Trends in digital and crypto banking are expected to revolutionize in 2025. With new technologies such as blockchain, AI, and decentralized finance (DeFi) that are changing the industry, growth is monumental.

A leading digital banking development company is committed to helping you get the actionable insights that help you grow exponentially. The article is meant to analyze the emerging trends, opportunities, and strategies that will help drive 10X revenue growth in digital bank and cryptocurrency banking. We will also highlight how businesses can use these trends through crypto banking development services to ensure sustained success.

How Digital Banks Define the Future of Finance?

Digital banks are the evolution of the traditional banking system, which is now entering a technological and customer-centric model. It makes use of advanced technologies such as AI, machine learning, and blockchain to improve user experiences, enhance security, and operate efficiently.

The innovations pursued by a crypto banking development company include mobile banking applications, online financial planning tools, and AI-driven advisory systems. They not only save on the costs of operations but also improve the efficiency with which the banks work, allowing for competitive pricing as well as added features.

Crypto banking represents the integration of traditional finance and digital assets. Users can now view, trade, and invest in cryptocurrencies alongside fiat currencies. The crypto banking development services are motivated by the provision of services such as crypto-backed loans, staking, and frictionless crypto-to-fiat transactions.

Crypto banking will seamlessly integrate with traditional platforms by 2025 so that the user experience will be uniform. This development will drive mass cryptocurrency adoption and crypto banking will form the core of financial innovation.

Why 2025 is the Year of Transformation in Digital Banking?

The world’s financial ecosystem is at a crossroads. With billions now accessing digital financial services and the adoption of cryptocurrency to unprecedented levels, 2025 is going to be an innovation year in banking. With the digital banking development company leading the charge, several other factors contribute to this transformation:

- Increased Adoption of Cryptocurrency

Governments and institutions increasingly accepting cryptocurrencies as a legitimate financial instrument accelerate their adoption worldwide.

- Growing Demand for Decentralized Finance (DeFi)

DeFi platforms are reshaping user expectations, emphasizing transparency, autonomy, and decentralization as essential features of any banking platform.

- Evolving Consumer Expectations

Tech-savvy users demand not just financial services but also seamless, engaging, and educational experiences.

- Shift to Mobile and Wearables

In 2025, mobile-first platforms and integrations with wearable devices will dominate the market, requiring platforms to prioritize portability and real-time accessibility.

Emerging markets, in particular, are embracing digital bank solutions due to their convenience and accessibility. At the same time, the crypto banking development company unlocks unprecedented opportunities for financial inclusion by addressing unbanked populations.

The financial sector is on the brink of a monumental transformation. For businesses aiming to stay competitive, leveraging expert crypto banking development services is essential.

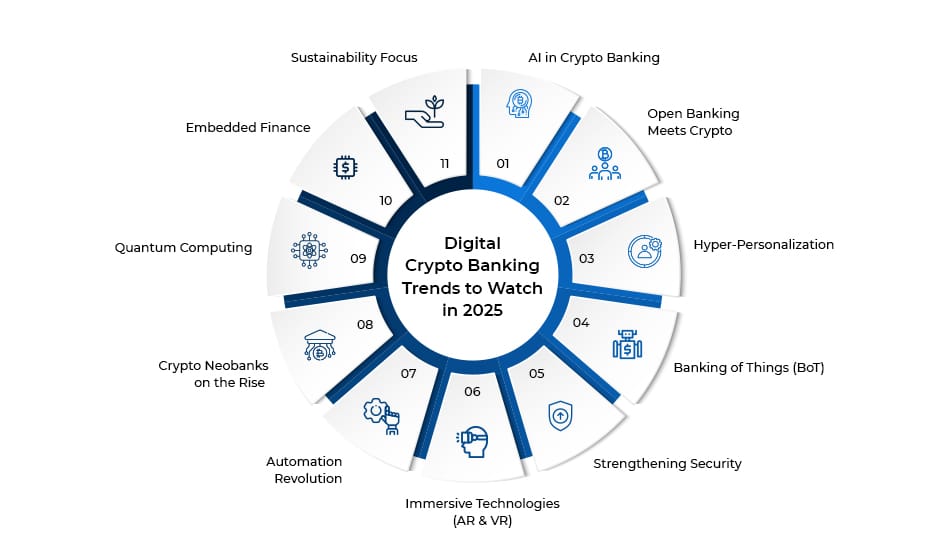

Top Trends in Digital Crypto Banking for 2025

The financial sector is at the cusp of a revolution, with digital and crypto banking rapidly evolving to meet the demands of tech-savvy users. As a leading digital banking development company, we’ll now delve into the top trends that will shape the industry in 2025. Businesses looking to leverage these trends can benefit from cutting-edge services to stay ahead of the curve.

Digital Crypto Banking Trends to Watch in 2025

1. AI-Powered Crypto Banking

Artificial Intelligence (AI) continues to drive innovation in the digital banking space, transforming both user experiences and operational efficiency.

- Personalization : AI analyzes user behavior to provide tailored recommendations for loans, savings, and investments, empowering users of the digital bank with customized financial solutions.

- Fraud Detection : Machine learning algorithms detect anomalies in real time, reducing fraud risks and bolstering security for crypto banking platforms.

- Operational Efficiency : AI-driven tools automate workflows, lowering costs and boosting productivity for banks utilizing the assistance of a crypto banking development company.

2. Open Banking for Crypto

Open banking is paving the way for collaborative ecosystems where third-party developers access banking data through APIs.

- Enhanced Services : Through open banking, customers enjoy a wide range of financial products seamlessly integrated into digital bank platforms.

- Revenue Growth : Financial institutions that adopt open banking gain new revenue streams by offering premium integrations with crypto banking services.

This trend is particularly relevant for crypto banking development services aiming to create open, scalable platforms.

3. Hyper-Personalized Crypto Banking

In 2025, hyper-personalization will redefine customer engagement by leveraging AI, big data, and advanced algorithms.

- Tailored Solutions : Customers receive personalized financial plans based on their data, enabling them to achieve goals effectively through digital banks and crypto banking platforms.

- Customer Retention : Banks offering context-aware, meaningful services experience increased loyalty, enhancing their competitive edge.

4. Banking of Things (BoT) in Crypto

The integration of banking functionalities into IoT (Internet of Things) devices is redefining convenience for users.

- Convenience : Smart devices, such as appliances that enable transactions or autonomously manage finances, offer unparalleled user experiences.

- Data Insights : IoT devices generate valuable data, enabling a digital banking development company to refine services and introduce innovative financial products.

5. Fortifying Crypto Banking Security

As digital and crypto banking platforms grow, so do the risks of cyber threats. Cybersecurity has become a cornerstone for any digital bank looking to ensure trust and compliance.

- Biometric Authentication : Facial recognition, voice analysis, and fingerprint scanning are replacing traditional password systems, offering robust protection against unauthorized access.

- AI-Driven Threat Detection : AI monitors networks in real-time to detect anomalies and mitigate potential attacks.

- Decentralized Security Models : Blockchain technology underpins decentralized security, ensuring data immutability and safeguarding sensitive information.

6. Immersive Technologies in Crypto Banking

Immersive technologies offered by the crypto banking development company like Augmented Reality (AR) and Virtual Reality (VR) are set to redefine customer engagement in digital banks.

- AR-Powered Financial Education : AR interfaces help customers visualize investment portfolios, account statements, and financial goals.

- Virtual Banking Environments : VR creates immersive experiences, such as virtual bank branches where customers can interact with advisors from the comfort of their homes.

- Enhanced Customer Support : Combining VR with AI chatbots offers dynamic, lifelike assistance to users navigating their finances.

7. Automated Crypto Banking Processes

Digital banking development company provides automation for streamlining banking operations, making processes faster, error-free, and cost-efficient.

- RPA (Robotic Process Automation) : Tasks like account opening, KYC compliance, and loan processing are now automated, reducing manual effort and improving accuracy.

- Chatbots: AI-powered bots handle customer queries efficiently, ensuring 24/7 support for both digital and crypto banking services.

- Smart Automation in Crypto Banking : Automating cryptocurrency transactions, wallet updates, and staking processes enhances user satisfaction.

8. Rise of Crypto Neobanks

Neobanks, digital-only banking entities, are leading the charge in financial innovation. With no physical branches, neobanks rely entirely on cutting-edge technology.

- Cost-Effectiveness : The absence of physical infrastructure reduces operational costs, enabling competitive pricing for services.

- Global Accessibility : Neobanks cater to underserved markets, offering financial inclusion to millions.

- Crypto Integration : Many neobanks are now embedding crypto banking development services, making it easier for users to manage both fiat and digital assets seamlessly.

9. Quantum Computing in Crypto Banking

Quantum computing, though in its nascent stages, holds transformative potential for the financial sector.

- Enhanced Risk Modeling : Quantum algorithms process complex risk calculations at unprecedented speeds.

- Improved Cryptography : Quantum-resistant encryption ensures the security of digital and crypto banking platforms against future threats.

- Portfolio Optimization : Quantum computing enables precise investment strategies, benefiting both users and financial institutions.

10. Rise of Embedded Finance

Embedded finance is revolutionizing how financial services are offered by integrating them directly into non-financial platforms, such as e-commerce websites, apps, and marketplaces.

- Expanded Reach for Digital Banks : Digital banks can use embedded finance to seamlessly offer services like buy-now-pay-later (BNPL), digital wallets, and micro-loans within popular platforms, significantly broadening their customer base.

- Enhanced User Convenience : By embedding financial services into everyday activities, banks eliminate friction for users, creating a smoother and more engaging customer experience.

- New Revenue Streams : Embedded finance opens up lucrative opportunities for a digital banking development company to design innovative solutions that integrate financial capabilities with third-party platforms.

For instance, an e-commerce platform with an embedded crypto payment option could attract tech-savvy users and drive higher transaction volumes. This is where crypto banking development services play a pivotal role in creating scalable and secure solutions.

11. Embracing Sustainability in Banking Practices

Sustainability is becoming a key differentiator in the banking sector, with consumers and businesses prioritizing eco-friendly and socially responsible solutions.

- Green Financing : A digital bank offers eco-friendly loans and investment options to support renewable energy projects, electric vehicles, and other sustainable initiatives.

- Paperless Banking : By digitizing operations, banks reduce their environmental impact and appeal to environmentally conscious customers. This aligns with the offerings of a forward-thinking digital banking development company, ensuring that every solution is as efficient as it is sustainable.

- Blockchain for Transparency : Blockchain, a cornerstone of crypto banking development services, enables transparent tracking of green investments, ensuring funds are utilized for sustainable projects.

How Does a Digital Banking Development Company Drive Innovation for Revenue Increase?

1. Modernizing Legacy Systems

Classical systems in banks were perhaps as good as anyone would expect, but they were supposed to prevent the banking sector from having a future-proof opportunity in the digital world. A digital banking development company improves these old systems to be transformed into modern systems, such as scalability, the security of systems, and speed of execution.

- API Integration : Open Banking APIs make possible the connection of classical and modern financial institutions.

- Cloud Migration : Conducting operations on the cloud can increase flexibility, reduce costs, and permit easier access to data in real-time.

- Blockchain Upgrades : Incorporating blockchain into legacy systems improves transparency and security, a crucial step for crypto-enabled banking.

2. Building Scalable and Flexible Platforms

Scalability is critical as user demands grow. A robust platform built by a crypto banking development company ensures uninterrupted performance even during peak usage.

- Microservices Architecture : This approach allows platforms to update individual components without disrupting the entire system.

- Customizable Solutions : Tailored platforms accommodate specific business needs, whether it’s crypto lending, tokenized assets, or seamless fiat-to-crypto transactions.

The Path Forward: Seizing Opportunities in 2025

The convergence of digital and crypto banking in 2025 provides an unparalleled opportunity for business growth if businesses are ready to innovate and adapt. Be you an old-established financial institution or a startup coming into the market, establishing a digital bank is the way forward for success.

Key Takeaways :

- Use AI, blockchain, and immersive technologies to build the latest platforms.

- Prioritize security and compliance to create trust and minimize risks.

- Keep up with the evolving trends through open banking, neobanking, and quantum computing, to name a few.

- Invest in user-centric designs and scalable infrastructure to meet future growth and provide value to customers.

With all these, along with collaboration with Antier, the leading provider of crypto banking development services, your ascension to a 10X revenue growth trajectory through 2025 is no longer unattainable but inevitable.