Renewable Energy Meets Blockchain: Top 5 Tokenization Projects Shaping the Future

December 30, 2024

How to Drive Business Success with DeFi Wallet Payment Gateway Solutions?

December 31, 2024Table of Contents

- What is a Multi-Chain DeFi Exchange?

- Advantages of a Multi-Chain DeFi Exchange

- Essential Components of a Multi-Chain DeFi Exchange

- How Multi-Chain DeFi Exchange Works

- Top Blockchain Networks for Multi-Chain DeFi Development

- Applications of Multi-Chain DeFi Exchanges

- How Do You Build a Multi-Chain DeFi Exchange?

- Future Trends in Multi-Chain DeFi Exchanges

- FAQs

- Key Takeaways

Blockchain technology has grown so fast that decentralized finance has become one of the most revolutionary innovations within the financial sector. Even though the first wave of DeFi platforms was mostly developed on a single blockchain network, the multi-chain DeFi exchange development is now forcing a new paradigm shift. Such exchanges surpass the limitations of traditional platforms by providing smooth cross-chain transactions and an overall more inclusive and resilient ecosystem. This paper is a comprehensive exploration of the complexity issues inherent to multi-chain DEX development, detailing its nature, benefits, components, and future trends. Here follows an expanded table of contents designed for easy reading and navigation through this extensive article:

So, let’s first learn the reasons why multi-chain DeFi platforms created by a DeFi exchange development company have managed to attract so much prominence and shape up the industries.

Emergence of Multi-Chain DeFi Platforms

DeFi started its early development as a solution that aimed to decentralize financial transactions, make transparent transactions, and eliminate intermediaries. These platforms were facing issues such as network congestion, high transaction fees, and a lack of interoperability with a single-chain DEX development architecture and hence were restricted to scalability.

Such interconnectedness has given birth to multi-chain DeFi exchange development. These combine multiple blockchains so that smooth intercommunication and transactions across different ecosystems can be done. For instance, even trades between Ethereum, Binance Smart Chain, and Solana can be facilitated through multi-chain exchanges, which will make it easier for them to collaborate and enhance accessibility among users. Developers at the best DEX development company work on optimizing this interoperability to create innovative, user-centric solutions.

What is a Multi-Chain DeFi Exchange?

Definition and Key Features

A Multi-Chain DeFi exchange is a decentralized application that enables users to conduct financial transactions across multiple blockchain networks. In contrast to traditional single-chain DeFi platforms that only operate on one network, multi-chain exchanges by a DeFi exchange development company are distinguished through:

- Cross-chain token swaps that break down inter-ecosystem barriers.

- Single, unified liquidity pools enhance trading efficiency.

- Easy accessibility with support for multiple wallets.

- Faster transactions and optimized fee structures.

How it Stacks Up Against Single-Chain DeFi Exchanges

The basic difference lies in the level of interoperability. Single-chain DEX development operates within siloed ecosystems, which limits their functionality. On the other hand, multi-chain exchanges:

- Enable cross-chain communication to increase user interaction

- Offer diversified liquidity pools, thus increasing market depth

- Reduce network congestion by distributing transactions across multiple blockchains

For example, Ethereum’s high costs might be a challenge to a one-chain platform but not for a multi-chain platform that can use Polygon or Avalanche to reduce the cost of operations.

Advantages of a Multi-Chain DeFi Exchange

- Enhanced Cross-Chain Interoperability

Interoperability is the bedrock for multi-chain DeFi exchange development. Advanced technologies such as cross-chain bridges and oracles enable such exchanges to allow seamless, frictionless transactions across the blockchains. This, in turn, breaks the silos of individual networks into a more inclusive ecosystem.

- Improved Liquidity Across Networks

Aggregating liquidity from various blockchains will create larger and more accessible pools. This will then ensure minimal slippage, better pricing, and efficient trading. This means the user experience in swapping tokens or participating in DeFi activities with a DEX development company is seamless.

- Higher Accessibility for Users

In supporting multiple blockchain networks, multi-chain exchanges reach out to a global audience. This will make it an attractive proposition to users within different ecosystems, thereby propelling adoption and expanding the market for DEX development solutions with the DeFi exchange development company.

- Cost Efficiency and Scalability

Multi-chain DEX development distributes network traffic; therefore, they alleviate congestion, and thus transaction costs decrease significantly. Such scalability promises consistent performance even at peak demand, and for that reason, both users and developers find it suitable.

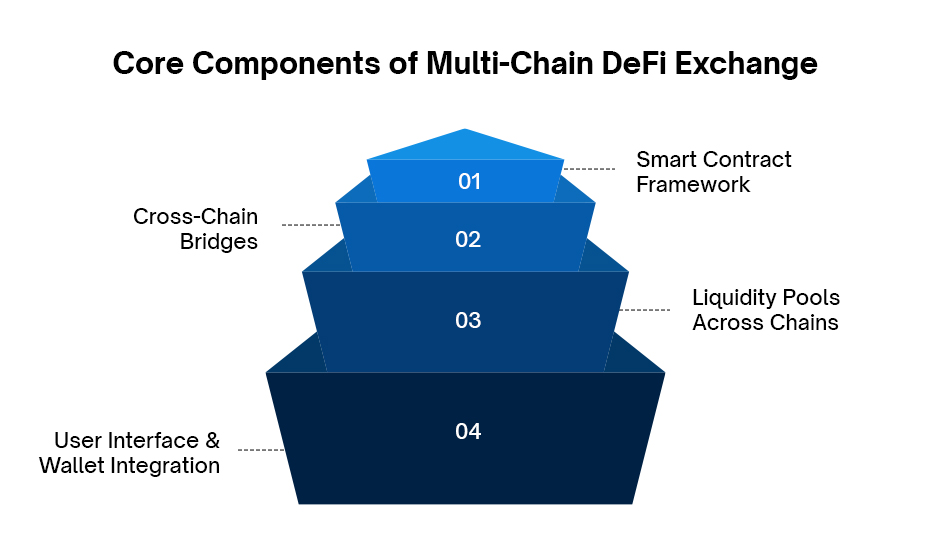

Essential Components of a Multi-Chain DeFi Exchange

- Smart Contract Framework

Smart contracts form the base for a decentralized platform and automate the transactions with great precision and security. For a multi-chain DeFi exchange development setting, these contracts are specially tailored to be executed perfectly and smoothly across different networks, while uniformity and reliability prevail.

- Cross-Chain Bridges

Cross-chain bridges form a conduit that enables the transfer of tokens and data across different blockchains. The functionality is crucial to achieve interoperability, the hallmark of multi-chain DEX development.

- Liquidity Pools Across Chains

Liquidity pools are essential for smooth trades and yield farming. DEX development company combines assets from different networks, giving users a more extensive experience of decentralized finance (DeFi).

- User Interface and Wallet Integration

User interface along with full wallet integration is important to onboard the users efficiently. Accepting wallets from multiple blockchains lets the DeFi exchange development company simplify the interaction with the user and make it accessible.

How Multi-Chain DeFi Exchange Works

Transaction Flow Between Chains

When someone makes a transaction on a multi-chain exchange, smart contracts are applied to validate the transaction. Cross-chain bridges enable asset transfer, and oracles guarantee the accuracy of data exchange. Such a process ensures clarity and efficiency.

Oracles and Cross-Chain Bridges

Oracles act as a bridge between off-chain data and blockchain environments, providing real-world information to smart contracts. Once used in conjunction with cross-chain bridges, they enable smooth operations across different networks, making the DeFi exchange development more dynamic and efficient.

Security Protocols in a Multi-Chain Ecosystem

The importance of security in DEX development cannot be overstated. Multi-chain platforms implement powerful encryption protocols, decentralized governance mechanisms, and rigorous auditing processes to secure user assets and maintain trust.

Top Blockchain Networks for Multi-Chain DeFi Development

- Ethereum

Ethereum is the industry leader due to its strong infrastructure and the availability of a massive developer base. Smart contract functionality combined with its support for protocols is a strong bedrock for multi-chain exchanges.

- Binance Smart Chain (BSC)

Low-cost and high-throughput BSC is an essential favorite for any DEX development company. The cross-chain features have also uplifted multi-chain platform capabilities.

- Polygon

Polygon’s layer-2 solutions are the most scalable and cost-effective, making them popular for a multi-chain DeFi exchange development company. Its compatibility with Ethereum makes it even more appealing.

- Solana

Solana is one of the strongest contenders in the multi-chain ecosystem, mainly because of its high-speed and low-cost infrastructure. Its focus is scalability, ensuring efficient operations. This attracts developers and users.

- Avalanche

Avalanche’s customizable blockchain architecture and fast processing of transactions make it the preferred platform for building scalable and secure multi-chain DeFi exchange development.

Applications of Multi-Chain DeFi Exchanges

Cross-Chain Token Swapping

Cross-chain token swapping is one of the most important dimensions of multi-chain DEX development. With this, users can transact their assets from one blockchain into another without any intermediaries, translating to cheap and faster processing. A typical example is that wherein users can swap Ethereum tokens directly to assets on the Binance Smart Chain with the help of integrated cross-chain bridges and smart contracts.

This should enable traders to enjoy access to more liquidity pools across networks, which developers from any DEX development company seek to optimize to deliver minimum slippage along with maximum efficiency to users.

Multi-Chain Yield Farming

This is the latest milestone in DeFi and single-chain yield-capturing has turned into an effortless activity with multi-chain DeFi. Users can, thus, now give liquidity to multiple chains with the multi-chain DeFi exchange and earn some rewards. For instance, farming across Ethereum, Polygon, and Avalanche would maximize the return per investment while minimizing the risks associated with a single blockchain.

Flexibility and scalability should entice even more people to improve on DeFi exchange development company solutions.

Decentralized Lending and Borrowing

It also tends to have decentralized lending and borrowing protocols supported through various blockchains, where users can lend assets on one network and borrow on the other, thus broadening financial access. Such exchanges permit a user to collateralize tokens from one blockchain and get liquidity in another, making an announcement about what the world has to see in actual multi-chain DeFi exchange development.

More Diverse Portfolios

Multi-chain exchanges expand the opportunity for portfolio diversification across chains. Apart from reducing risk, it allows various investment opportunities, be it through NFTs on Ethereum staking rewards on Solana, and so much more.

How Do You Build a Multi-Chain DeFi Exchange?

Steps to DeFi Exchange Development

- Define a Scope for the Project: Know the end-users, their needs and target blockchain networks.

- Explore the Appropriate Blockchain Technology: Go for Ethereum, Binance Smart Chain Bitcoin, or Solana satisfyability and inter-operability requirements.

- Create Smart Contracts: Design safe and efficient smart contracts for DeFi exchange development customized for cross-chain operation.

- Assimilate Cross-Chain Bridges: A modern cross-border link solution to effect asset transfers.

- Develop the User Interface: A user-friendly DEX development interface complete with wallet integration to ensure smooth operations.

- Test and Audit: Test thoroughly on the platform to remove faults, and make it secure.

Selecting the Best Development Company

The need for an experienced DeFi exchange development company speaks for itself: they must possess a mastery of core-relating topics like multi-chain architecture, smart contract development, and significant security protocols.

Importance of testing and auditing

Testing comprises such an indispensable part of the whole multi-chain DeFi system: that even the last item cross-chain transaction test-all of which is to be audited as regards vulnerability. Its operationalization would entail teaming up with a DEX development company that considers security its top priority to build trust in the users from its end.

Future Trends in Multi-Chain DeFi Exchanges

Adoption of Layer 2 Technology

A prominent aspect of DEX development is the Layer-2 solution. It scales multi-chain platform transaction costs and enhances transaction speed, bringing in emerging solutions such as Polygon and Optimism, therefore moving the vision to give full integration from developers.

Global Integration with Non-EVM Chains

Multi-chain exchanges are primarily focused on EVM-based chains, leaving the future to be non-EVM ones, such as Solana and Cardano. It would just raise the competition for diversity and broaden the scope of the multi-chain DEX development company.

Advanced Interoperability Protocols

Newly emerging interoperability protocols like Polkadot and Cosmos are set to revolutionize the services of the DeFi exchange development company. These protocols work to create a seamless framework of cross-chain communication, thereby easing asset movement and scaling up the platform.

FAQs

1. How Much Will It Cost To Build A Multi-Chain DeFi Exchange?

It can’t be quantified as the price varies according to how complex the platform is, how many integrated blockchains there are, and what features are added. Partnering with a reputable company for DeFi exchange development would assist in making the most efficient on resource use while cheaper development takes place.

2. How secure are multi-chain DeFi exchanges?

Security in multi-chain DeFi exchanges depends on the implementation of smart contracts, cross-chain bridges, and rigorous auditing. Trusted DEX development solutions prioritize security to safeguard user assets.

3. What’s the future of DeFi with multi-chain functionality?

The future of DeFi lies in enhanced interoperability, enabling seamless cross-chain operations. This will drive innovation and make DeFi accessible to a global audience.

Key Takeaways

As blockchain technology advances, the demand for scalable and interoperable DeFi solutions continues to grow. Multi-chain DeFi exchanges address the limitations of single-chain platforms, providing users with a seamless, efficient, and inclusive experience. With enhanced interoperability, broader user accessibility, and reduced costs, these platforms are setting a new standard for decentralized finance.

How to Get Started with Your Multi-Chain DeFi Project?

If you’re considering entering this transformative space, partnering with Antier, the skilled DeFi exchange development company is the first step. Our talent can guide you through the complexities of multi-chain DeFi exchange development, ensuring a robust and secure platform tailored to your needs.