Cryptocurrency adoption is soaring worldwide and we cannot lie because statistics show that. The global cryptocurrency users reached 562 million in 2024. The biggest brands, investment firms, and renowned institutions are embracing cryptocurrency. As new users continue to flock to exchanges to buy hyped cryptos (mostly), the demand for secure, scalable, and user-friendly cryptocurrency trading platforms will rise.

Apart from security, scalability, and user-friendliness, liquidity is a significant driver of a cryptocurrency exchange’s success. It should be an essential consideration for businesses seeking white label crypto exchange platforms to enter the multi-billion dollar market. Let’s shed some light on:

- Significance of Liquidity and Why New Crypto Exchanges Struggle

- How Robust White Label Crypto Exchange Platforms Address Liquidity Challenges

- Key Strategies for Improving Crypto Exchange White Label

- Benefits of Enhanced Liquidity for Whitelabel Crypto Exchange

- Choosing Antier’s White Label Crypto Exchange Software Development Solution

Without much ado, let’s begin.

Significance of Liquidity and Why New Crypto Exchanges Struggle

Liquidity is a fundamental requirement for any crypto trading platform exchange to function efficiently. It remains one of the biggest hurdles for many players, especially the new entrants, whether they’re building a digital asset trading setup from scratch or using a crypto exchange white label.

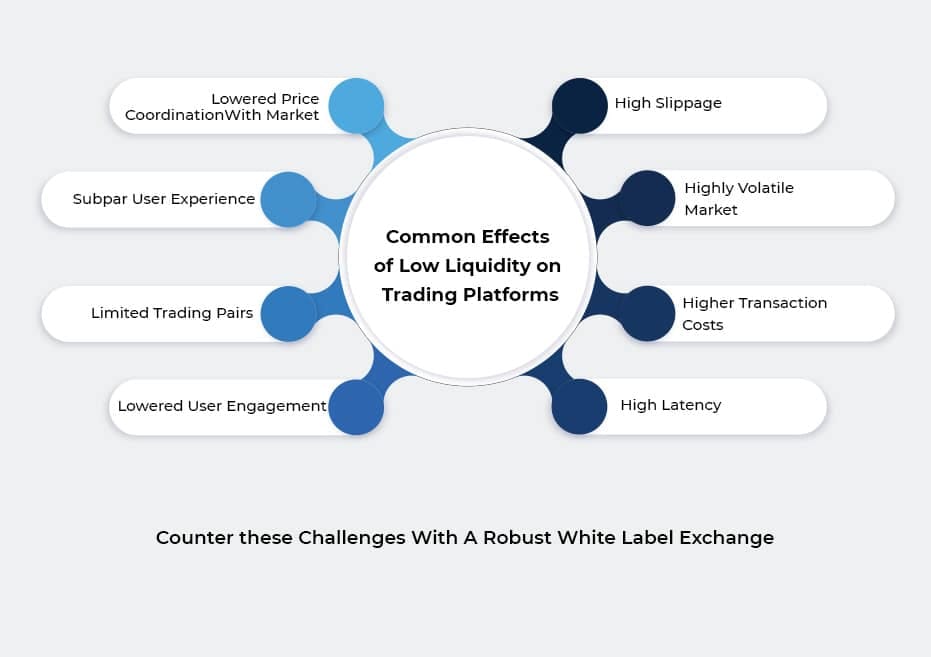

When liquidity is low, the market becomes volatile, causing large price swings when orders are placed. Low liquidity also leads to increased slippage, higher transaction costs, and longer wait times for order fulfillment. These factors adversely affect trading volumes and deter traders from using the Whitelabel crypto exchange-based platform, creating a vicious cycle of low user engagement and low liquidity. Moreover, traders may even find major price disparities between the low-liquidity trading platform and the rest of the market, disrupting the average user experience.

On the other hand, high liquidity attracts traders, prevents market manipulation, and facilitates fast and efficient transactions. For entrepreneurs and businesses looking to launch a trading platform using a white label crypto exchange platform, addressing liquidity concerns is crucial for ensuring a seamless trading experience.

Let’s now discuss a few reasons why liquidity woes the new exchanges the most:

1. Lack of Trust: New crypto exchanges may struggle to build trust and credibility among traders. It prevents them from depositing funds or using a platform, leading to lower liquidity.

2. Limited Assets Listed: Small exchanges built using substandard crypto exchange white labels often support only a few trading pairs, limiting the number of users and market participants.

3. High Fees: Newcomer crypto trading platforms may charge higher fees to cover their initial expenses and operating costs, which can discourage traders from using their platform.

4. Lack of Effective Marketing: Rookie exchanges may struggle to attract users and increase their visibility without efficient and strategic marketing and promotion services.

5. Competition from Established Exchanges: Established exchanges have a significant edge in terms of liquidity, reputation, and user base, making it hard for new entrants to compete.

How Robust White Label Crypto Exchange Platforms Address Liquidity Challenges

White label crypto exchange platforms are just off-the-shelf trading infrastructure that cryptopreneurs can customize to craft and launch their trading platforms. It can help businesses ace development and design; however, the real challenges come when they try to incorporate sufficient liquidity to attract traders and facilitate frictionless trades. Without proper liquidity, even a well-designed trading platform will struggle to retain users.

So, reputed white label crypto exchange software development companies usually address these liquidity issues by offering robust liquidity solutions with their feature-rich, ready-made solutions.

- Liquidity Aggregation: Many white label exchanges leverage liquidity aggregation techniques that pool liquidity from multiple sources, including CEXs and DEXs, to ensure a steady flow of buy and sell orders on their crypto trading platforms.

- Liquidity Pools: AMM-based white label crypto exchange platforms facilitating decentralized trading usually feature liquidity pools. These special smart contracts encourage users to provide liquidity by providing a portion of trading fees as an incentive.

- Partnership with Major Exchanges: Renowned white label exchange providers can help new exchanges form partnerships with larger, established platforms to “borrow” liquidity. Through APIs and cross-exchange networks, new exchanges can access liquidity from larger platforms, ensuring a seamless experience for their users.

Key Strategies for Improving Crypto Exchange White Label

We already discussed why new entrants in the cryptocurrency exchange market usually face liquidity issues. With an unwavering commitment to building trust, offering competitive fees, expanding asset listings, and implementing efficient marketing strategies, new cryptocurrency exchanges built using white label crypto exchange platforms can ace the space.

Let’s now discuss more practical strategies that can help cryptocurrency exchange platforms secure robust liquidity and offer a high-quality user experience.

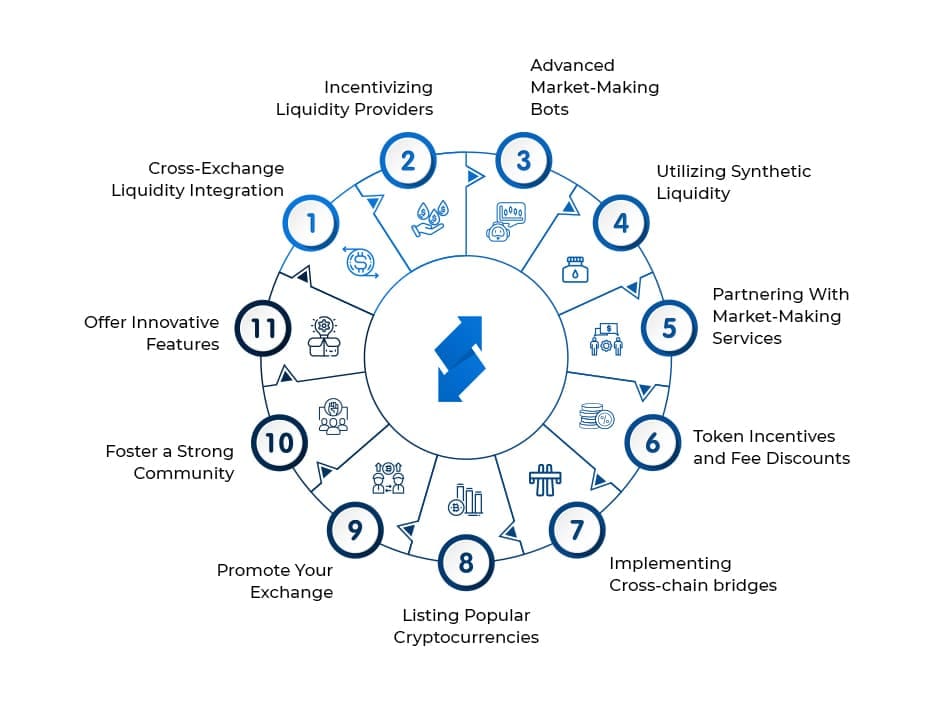

1. Cross-Exchange Liquidity Integration

Exchanges can leverage APIs and connectors to connect to larger exchanges and aggregate their liquidity. Decentralized exchanges can shake hands with popular DeFi protocols to tap into their liquidity pools and attract new users. These solutions provide access to deeper liquidity pools, reducing the chances of high slippage and ensuring better trade execution.

2. Incentivizing Liquidity Providers

Exchanges built using superior whitelabel crypto exchanges can implement reward mechanisms such as staking, restaking, yield farming, or any other to encourage users to provide liquidity by holding assets on their platform. This approach can boost liquidity and widen the user base, especially for smaller or decentralized exchanges.

3. Advanced Market-Making Bots

By integrating advanced market-making bots, exchanges built using highly scalable crypto exchange white labels can automate the process of liquidity provision. These bots tirelessly submit buy and sell orders to keep the order books filled and alive 24*7, ensuring stabilized prices and minimized price gaps.

4. Utilizing Synthetic Liquidity

Synthetic liquidity providers can use derivatives like options or perpetual contracts to create synthetic assets that mimic the behavior of cryptocurrency or real-world assets. These synthetic assets can then be traded on the exchange, increasing the overall liquidity of underlying assets.

5. Partnering with Market-Making Services:

Many renowned white label crypto exchange software development companies offer unparalleled market-making services to address liquidity shortages. Market makers provide liquidity by placing buy and sell orders to ensure a balanced order book, reducing slippage, and improving the overall trading experience.

6. Token Incentives and Fee Discounts

Offering tokens or discounts on trading fees to early traders and liquidity providers can significantly drive user engagement, increasing trading volume and liquidity over time. Beginners leveraging white label crypto exchange software development, as well as experienced players in the crypto exchange industry, can attract traders by strategically running fee discounts, giveaways, incentive programs, etc.

7. Implementing Cross-Chain Bridges:

Cross-chain bridges connect multiple blockchains, allowing users to trade assets across different networks. Besides being a lucrative value proposition that excites trading activity, this also broadens the overall pool of potential buyers and sellers, leading to greater liquidity. You can integrate a fully functional cross-chain bridge to your crypto trading platform by partnering with a reliable white label crypto exchange software development company.

8. Enhance Organic Engagement:

Enhance your exchange’s organic engagement by listing popular cryptocurrencies catering to different trader preferences, introducing unique features, and providing a unified trading experience by incorporating margin trading, derivatives, copy trading, etc. It attracts advanced traders and increases trading activity. You can also consider utilizing promotion tactics, social media, forums, and events to create awareness, attract new users, and build a vibrant community around your trading platform built using a robust whitelabel crypto exchange. An active community can contribute to increased liquidity and user engagement.

Benefits of Enhanced Liquidity for Whitelabel Crypto Exchange

1. Improved User Experience: High liquidity means faster trade execution and lower slippage, attracting more traders and enhancing user satisfaction.

2. Higher Trading Volumes: Adequate liquidity drives higher trading volumes, which in turn attracts more traders, creating a positive loop for growth.

3. Enhanced Profit Potential: Heightened users’ interest in crypto exchange white label-based platforms due to high liquidity stimulates increased trading activity and higher profit potential.

4. Price Stability: With more liquidity, prices remain stable, and volatility is reduced, making the platform more attractive to both retail and institutional traders.

5. Increased Platform’s Credibility: Adequate liquidity signals a healthy and trustworthy platform, helping new exchanges build credibility and attract larger market participants.

Choosing Antier’s White Label Crypto Exchange Software Development Solution

Antier’s whitelabel crypto exchange is fortified with market-leading features, including:

- High TPS and Advance Matching Engine

- Spot Trading: Market, Limit, and Stop Limit Orders

- Automated KYC and AML

- 500+ Cryptocurrencies & Fiat Support

- External Liquidity Module

- Referral and Reward Program

- Fiat On/Off Ramp

- Enterprise-Grade Multi-cryptocurrency Wallet

- Advance Admin Back Office

- Advance Chart Tools

- Crypto Swapping

- Multichain Support

- Margin Spot Trading

- Derivatives/Perpetual Futures Trading

- Automated Market Making Bot

- Multi-Lingual Support

- Peer to Peer Trading

- Customer Support Chat

You can learn more about features and White Label Crypto Exchange Price by scheduling your free demo and sharing your customization requirements today.

Final Word

A smooth and efficient experience is pivotal to the growth of your crypto trading platform. A business can lead the future of cryptocurrency trading with a feature-rich white label crypto exchange platform integrated with robust liquidity solutions. So, if you are ready to become one of the pioneering crypto exchanges, Antier can comprehensively support you with all the required solutions.

At Antier, we specialize in robust White Label Crypto Exchange Software Development that addresses these liquidity issues head-on. We also offer market-making and other suitable services to boost your liquidity. With the best liquidity solutions as per your budget and preferences, we ensure your platform thrives in the dynamic crypto market. Whether you’re launching a centralized or decentralized crypto exchange, liquidity is the key to success, and our expertise can help you achieve it.

Explore our solutions to boost your bottom line!