Top 7 Cryptocurrency Wallet Trends For 2022

June 29, 2022

Decentralized Derivatives Exchange Development – The Beginner’s Guide

June 30, 2022Stable coins hold a market share of $170 billion, a relatively small share in the crypto market. However, stable coins have grown tremendously over the recent years. The largest stable coin, Tether, has a market cap of about $80 Billion, surging from 4.1 Billion at the beginning of 2020. In addition, the second most popular stable coin, the USD, has a market cap of $49 billion, as per CoinMarketCap’s data. Based on the given data, it can be concluded that stable coins play a pivotal role in the lives of crypto traders. It is a Billion-Dollar industry as more and more people are investing in it. If you’re an entrepreneur or a well-established business willing to enter this Billion-Dollar market & want to build your stable coins or wallet with the assistance of a reliable stablecoin development company, continue reading this article highlighting everything regarding stable coins.

What are Stable Coins?

Stable coins are a type of cryptocurrency whose value is tied to an asset. The asset could be a fiat currency or gold to stabilize the price of the coin.

Cryptocurrencies offer many advantages and don’t require an intermediary institute for sending or receiving payments. This means globally anyone can procure the benefits of these currencies. However, the main disadvantage of these currencies is that their price is unpredictable and keeps fluctuating quite rapidly.

These fluctuations leave people clueless about their earnings. Thus, it puts their financial security and livelihood at stake. The unpredictable nature of crypto is quite opposite of stable coins like fiat money (US Dollars) and assets (Gold). The value of Dollars changes over time while the value of day-to-day currencies rises and falls quite rapidly.

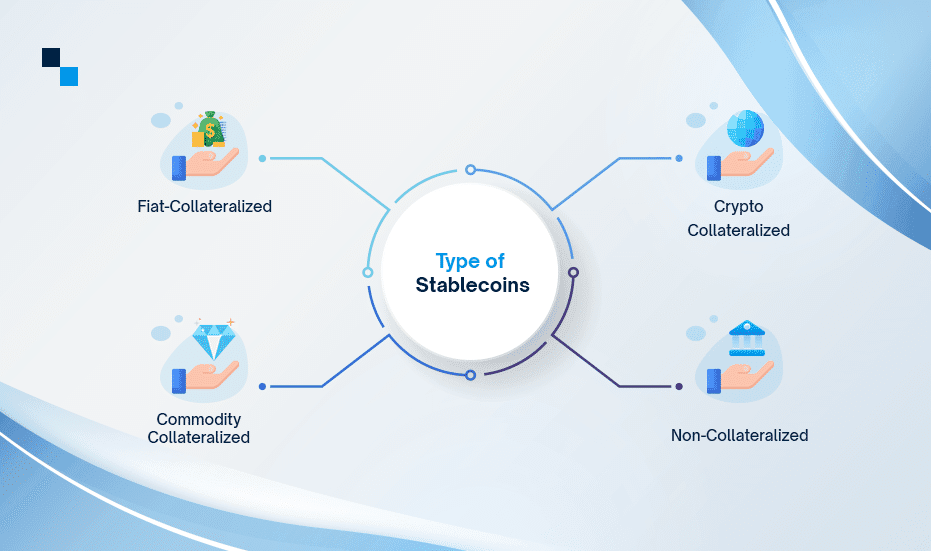

Types of Stable Coins

Stable coins have been divided into several categories, among which the collateralized type is backed with distinct asset types. Therefore, you can have your coin under the guidance of a stablecoin development company after comparing the distinct features of each coin:

Fiat Collateralized

Most of the stable coins are backed with fiat. The US Dollar is a popular fiat Currency and companies are coming up with stable coins pegged to other fiat currencies. One such example is BiLira which is tied to the Turkish Lira.

Commodity Collateralized

Certain stable coins are backed with precious metals like Gold or Silver.

Crypto-Collateralized

Some stable coins are pegged to other cryptocurrencies.

Non-Collateralized

Tether USD was backed 1-for-1 Dollars & its collateral mix shifted over time. For example, a breakdown report was provided by a company in 2021, indicating that half of its reserves were in commercial paper as short-term corporate debt.

Why Use Stable Coins?

Stable coins aren’t impacted by price volatility, which isn’t the case with other cryptocurrencies. In 2010, a programmer bought pizza for 10,000 for $688M at the Bitcoin peak predicted for November 2021. Scarcely did he know that by buying peak price bitcoins, the merchant would lose $200 Million at the year-end. As a consequence, many merchants hesitate to make payments via Crypto.

The disadvantages offered by crypto became an advantage for stable coins. During stablecoin development, the focus is laid on building secure, immutable, transparent, and decentralized control. The best part is there are negligible chances of losing the guarantee and stability of the Fiat Currency.

Initially, crypto holders took advantage of stable coins during market declines or crashes. For example, once there is a drop in the price of Bitcoin, the holder can convert it into a stable coin in minutes on a single platform. This would save him from huge losses.

When this option was absent, the crypto user used to move their capital back to fiat. Unfortunately, many crypto exchanges were devoid of Fiat currency. Either there was no provision to use Fiat currency or it was charged exorbitantly for transferring the existing crypto into fiat.

Stable coins have given promising results compared to crypto applications. It has benefited industries trying to make international payments promptly and securely. This is why more and more businessmen are learning more about “How to create stable coin?”. Whether you are a migrant sending money back to the family or a businessman sending money to the suppliers overseas can carry out these tasks quickly and securely.

Stablecoins would be used in the financial service ecosystem (FSE). In the case of decentralized cross-border lending, stable coins offer a secure environment so that Peer to Peer transactions can occur without using volatile cryptocurrencies such as Bitcoin or aren’t going to charge a fee to convert money into local currency.

Real-World Applications of Stable Coins

- Commercial Transactions

Stable coins can be used like other coins for performing commercial transactions. In South Korea, people can make their tea & coffee payments with it. Crypto cards were introduced to help stable coins enter mainstream spending. One such example of this is Visa and Mastercards, which have introduced the concept of payment cards to perform transactions in USDC. Stable coins are widely used while performing overseas money transfers as it doesn’t involve conversions in different fiat currencies. If you have USD-backed stable coins, there is no need to convert them into their currency and lose a percentage of the fee.

- Streamline Recurring P2P Payments

Stable coins have come up with the concept of smart contracts that are kept on a Blockchain network & work without intervention from a third party. These transactions are completely transparent, traceable, and cannot be reversed & are ideal for making salary and loan payments, rent payments, and subscriptions.

For instance, an employer can set up a smart contract that would transfer the salary to the employee’s account on a certain date. Businesses with employees working globally can take advantage of stablecoin development that will make the transactions faster and would impose low processing fees.

- Quick & Cost-Effective Remittances For Migrant Workers

Most migrant workers rely on Western Union for sending money. The process is costly and time-consuming. Also, this makes a person lose a huge chunk of money as fees. The disadvantages offered by these money transfer agencies have been eliminated by crypto, which allows faster transactions at low fees. The only issue is that it undergoes fluctuations overnight; stable coins have eliminated these concerns. Workers and families across the world leverage digital wallets to perform faster transactions with low fees and without price volatility. One such example was the Novi Crypto wallet introduced by Meta (Facebook) which allowed seamless transfers between the USA and Guatemala. Meta is planning to introduce its own stable coin, Diem, once it gets approval from the regulators.

How to Create a Stable Coin?

Below is the step-by-step process that highlights the way to create a stable coin:

#Step 1: Determine the Type of Stable Coin to be Developed

There are two significant stable coin categories, the collateralized & the non-collateralized. If long-term stability is your ultimate goal, go for an algorithmic stable coin. Otherwise, preference must be given to collateralized coins during stablecoin development.

#Step 2: Get an Idea of the Technology & Platform Needed to Build Stable Coins

Once you have chosen the type of stable coin, select the platform where the coin is to be built. Earlier, Ethereum was the only platform that introduced the concept of stable coins. Currently, there are other platforms that enable stablecoin development.

#Step 3: Create Visual and Technical Designs

The next step is stable coin design that depicts the flow of stable coin transactions and their detailed working.

#Step 4: Development, Integration of Blockchain Platform

The design is accompanied by a development process. During stablecoin development, smart contracts are created, and nodes are launched on the Blockchain platform.

The Bottom Line

Stable coins have enormous potential and will streamline financial services in the near future. Enter the Billion-Dollar stable coin market under the guidance of proficient stable coin development experts at ‘Antier Solutions.’ We offer an array of stable coin services, including white paper creation, stable coin development, landing page design, and marketing. Our experts will offer you guidance at every step so that you reach your goals and get desired results.

Connect with our subject matter experts to share your business needs.