Enterprise-Grade Wallet-as-a-Service (WaaS): Top 10 Benefits & Future-Ready Use Cases

March 7, 2025

The Role Of ISIN-Backed Tokenized Assets in Blockchain

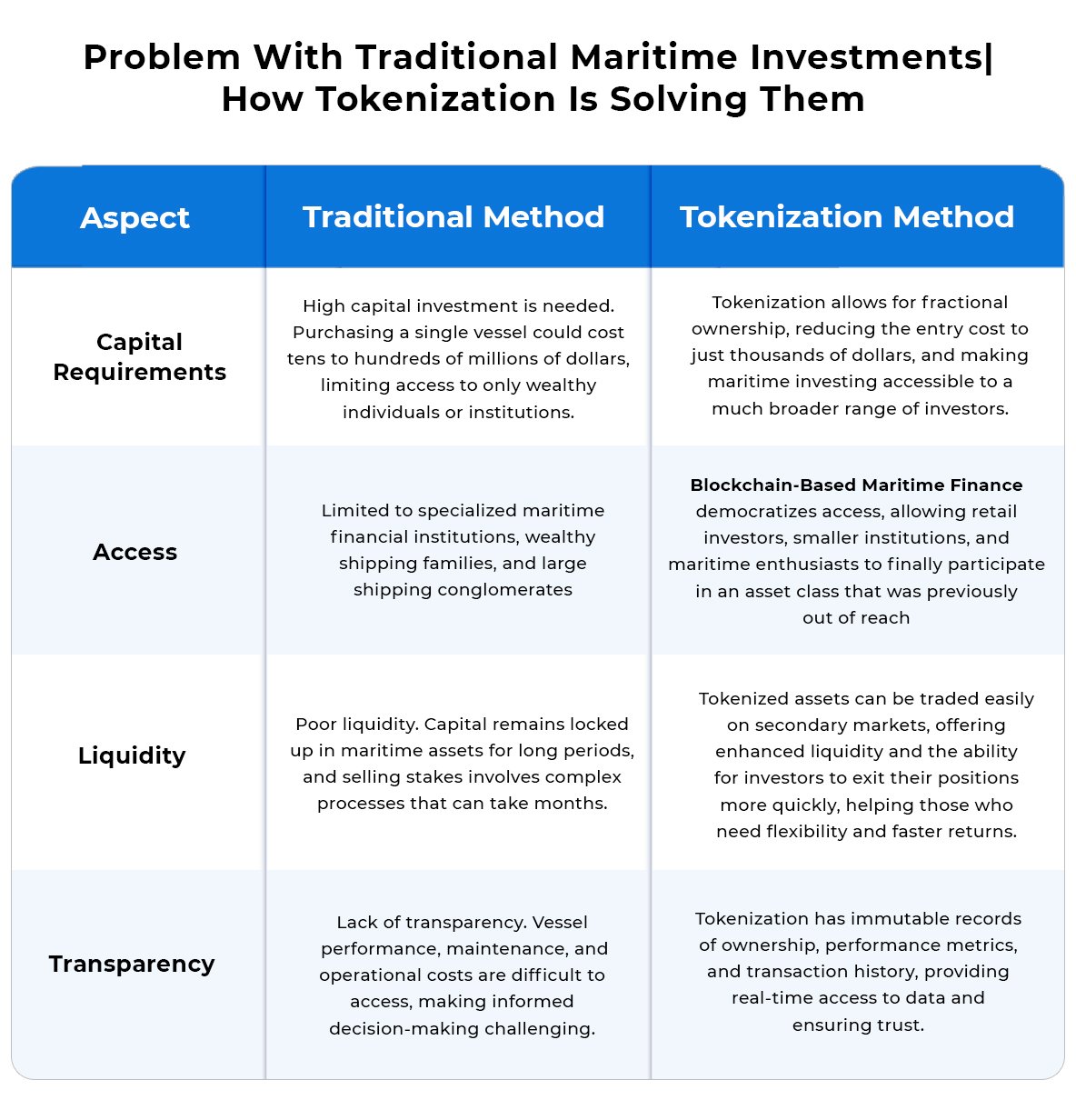

March 10, 2025While the Maritime Industry stands out to be a vital sector of global trade, it faces high entry barriers. Participation in this trillion-dollar global industry is limited to specialized financial institutions, shipping conglomerates, and high-net-worth individuals. Tokenization is now changing that! The Maritime Tokenization Platform Development redefines how maritime assets are financed, owned, and traded, creating unprecedented opportunities for investors, shipowners, and businesses.

This guide explores the role of Tokenization in the Maritime Industry, its benefits, and how to leverage the Maritime Tokenization Platform to unlock the inherent value of maritime assets.

Maritime Tokenization: Understanding The Concept

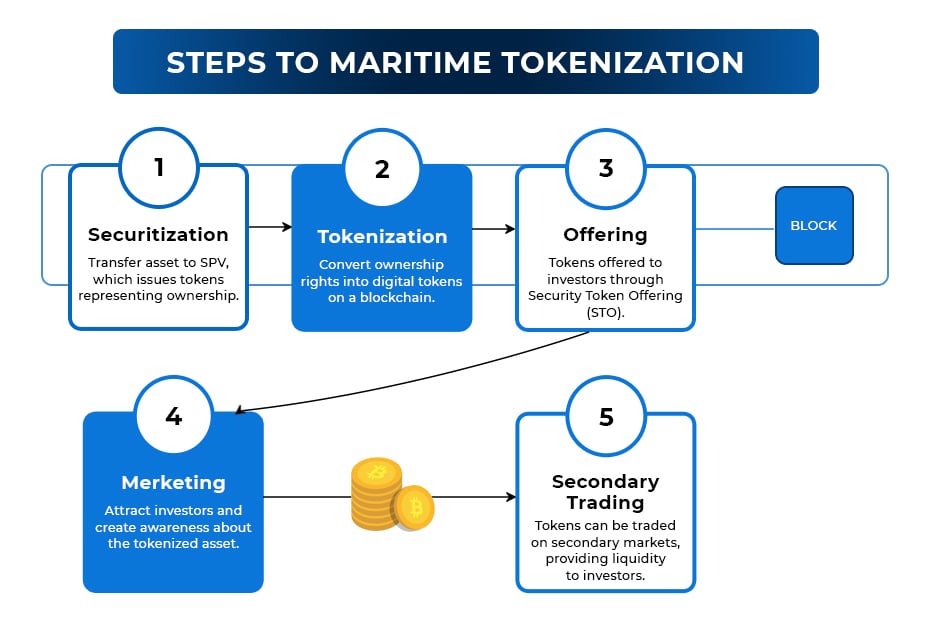

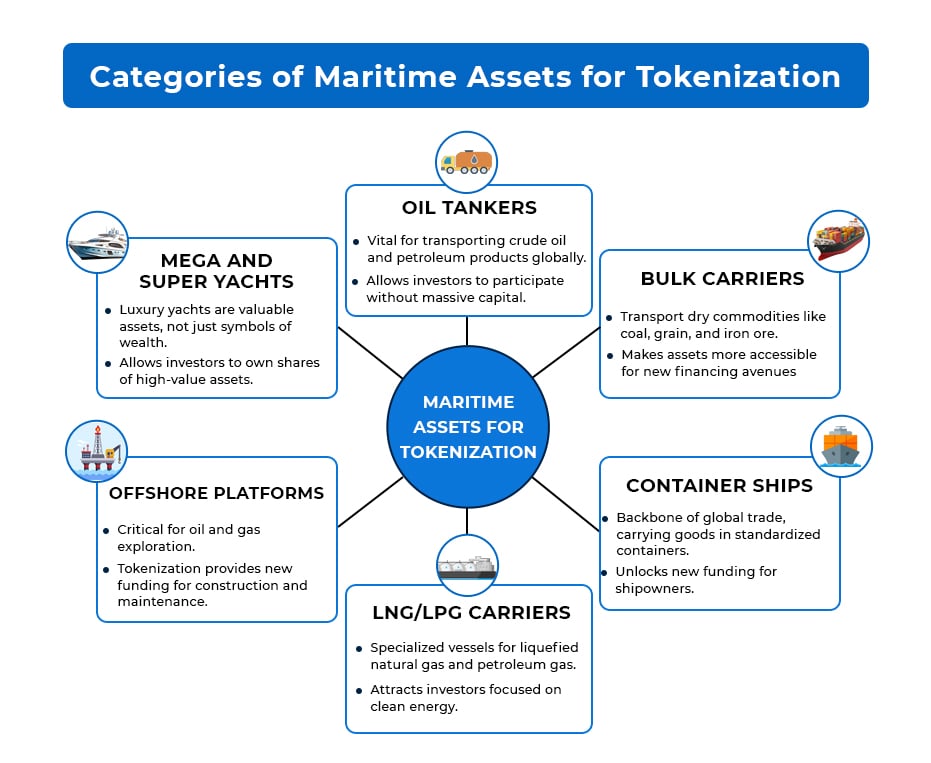

Tokenization in the Maritime Industry is converting ownership rights of Physical Maritime Assets (including Shipping Infrastructure, Tanker, and Vessels), into digital tokens. Each token represents fractional ownership of the underlying asset, allowing investors to participate at significantly lower thresholds than traditional maritime investments.

Maritime Tokenization offers a great alternative to conventional financing for Shipping companies seeking capital without giving up operational control.

For Example. A shipping company can tokenize vessel ownership to fund fleet expansion while maintaining day-to-day operational authority.

Investors receive tokens representing ownership shares with rights to portions of charter revenues—creating a mutually beneficial arrangement.

The Business Case for Maritime Tokenization

For maritime industry stakeholders, tokenization offers compelling advantages:

For Shipowners and Operators

- The Tokenization Platform contributes to capital raising without relinquishing full control of assets.

- Ship owners and enterprises can diversify funding sources beyond traditional maritime financing.

- The Maritime Finance Blockchain platform unlocks the enhanced valuation potential through increased market exposure.

- Ship owners can have streamlined management of fractional ownership

For Investors

- Tokenization offers access to previously inaccessible maritime investment opportunities.

- Investors can diversify their portfolio into an asset class with historically strong performance.

- It helps in reducing minimum investment thresholds

- Improve liquidity compared to traditional maritime investments

- Transparent asset performance tracking through blockchain.

The Role of Maritime Tokenization Platform

For shipping companies and vessel owners, Maritime Tokenization Platform Development can offer a new funding channel that doesn’t require giving up control of their assets.

Take the example of a medium-sized shipping company that was struggling to finance a fleet expansion. Traditional lenders wanted terms that would have severely limited the company’s operational flexibility.

Instead, they choose Ship Tokenization Investment for partial ownership of their existing fleet, raising the capital needed while maintaining operational control. Investors received tokens representing fractional ownership with rights to a share of charter revenues.

Key Modules for Building a Maritime Tokenization Platform

Developing a robust maritime asset tokenization platform requires several essential modules:

- Asset Management Framework: This module allows businesses to manage, distribute, and monitor Maritime Asset Management Tokens efficiently. It ensures precise control over the entire lifecycle of tokenized assets.

- Compliance: Compliance is critical in the tokenization process. This module handles KYC (Know Your Customer), AML (Anti-Money Laundering), and investor accreditation checks.

- Marketplace: A marketplace is where buyers and sellers can trade tokenized assets securely and transparently.

- Tokenization Agent: The tokenization agent oversees the issuance and distribution of Maritime Tokenized Securities and tokens, ensuring compliance with regulatory requirements.

- Transfer Agent: This module maintains accurate records of token ownership, ensuring the integrity of the token transfer process.

- Validators Network: Validators verify and validate transactions on the blockchain network, ensuring the security and accuracy of the system.

- Alternative Trading System (ATS): An ATS facilitates liquidity and price discovery for tokenized assets, making it easier for investors to trade.

- Multi-Signature Integration: Multi-sig adds an extra layer of security by requiring multiple parties to sign off on transactions.

- Multi-Party Computation Integration: MPC is a cryptographic technique that enhances security by distributing sensitive information across multiple parties.

Future Directions and Expanding Applications

As maritime tokenization matures, its applications continue to expand beyond vessel ownership. Emerging applications include:

- Tokenization of freight contracts and shipping futures

- Fractional ownership of port infrastructure and terminal operations

- Tokenized carbon offset credits related to maritime emissions

- Bunker fuel hedging instruments and other operational components

Get on Board with Antier

Antier is a leading Maritime tokenization development company that creates opportunities for both the industry and investors by building secure, transparent, and efficient tokenization platforms that turn ships and maritime assets into digital tokens.

The custom solutions empower shipowners to raise capital through Tokenized Shipping Assets while retaining control and provide investors with easy access to fractional ownership in maritime assets.