Artificial Intelligence in Asset Tokenization for Smart Real Estate Platform Development

April 9, 2025

DePAI Explained: Understanding the Next Frontier of AI and Robotics

April 10, 2025“Crypto Traders Want Leverage – Your Exchange Should Deliver It Now”

There’s a shift happening under the surface of crypto trading, and it’s moving fast. It’s not about listing more tokens or building another wallet feature. It’s about “Leverage”. Smart leverage. Margin trading exchange isn’t a nice-to-have anymore. It’s becoming the financial backbone of high-performance exchanges. The platforms embracing this shift aren’t just surviving the market cycle, they’re thriving, scaling faster, and unlocking revenue in ways traditional spot trading never could.

But here’s the truth: launching a margin-enabled exchange isn’t just about flipping a switch. It takes precision-built infrastructure, compliance-ready architecture, and tech that moves as fast as the markets do.

This might be your moment if you’re eyeing a bigger slice of the crypto trading economy. Let’s break down what it takes to launch, scale, and profit from a margin trading exchange in 2025.

Why Traders Love Margin Trading Exchange in 2025?

The year 2025 redefines how traders engage with crypto markets, and margin trading exchanges are taking center stage. As volatility returns and institutional capital floods, leveraged positions are no longer just tools — they’re strategies. Traders today aren’t just chasing volatile moves for quick wins — they’re using leverage as a calculated tool to maximize capital efficiency, hedge positions, and extract value across market cycles.

The evolution of margin trading reflects the maturity of the crypto space — we’re no longer in an era of blind risk, but of smart leverage.

So, why the love?

- Higher Profit Potential: Traders can open 10x, 25x, or even 100x positions, multiplying gains, especially appealing in Bitcoin’s current breakout above $80,000.

- AI-Powered Risk Management: Platforms are using predictive algorithms to auto-adjust margin calls and protect positions. This has increased confidence, especially among newer entrants.

- Institutional Liquidity: Hedge funds and asset managers are injecting deep liquidity into margin-enabled exchanges with ETF approvals rolling out globally.

Even Mike Novogratz, CEO of Galaxy Digital, noted in a Bloomberg interview:

As the appetite for leveraged trading continues to rise, margin trading platforms aren’t just facilitating trades, they’re building powerful monetization engines behind the scenes. While traders capitalize on amplified positions, platforms themselves are leveraging built-in mechanisms to create recurring revenue. This shift raises a critical question for new entrants and established players:

How Margin Trading Platforms Are Generating Revenue?

“Margin Trading is No Longer Optional — It’s a Growth Catalyst”

Today’s margin trading exchange platforms are capitalizing on a select few high-demand revenue models that offer scale, sustainability, and speed. Here’s what’s driving revenue in 2025:

- Interest on Margin Loans: This remains the most lucrative stream—platforms charge borrowers interest on leveraged capital, compounding revenue with each trade held overnight.

- Liquidation Penalties: As volatile markets trigger liquidations, platforms collect significant fees when users fail to meet margin requirements.

- Dynamic Funding Rates: Platforms profit directly from perpetual swaps and leveraged instruments by controlling the spread between long and short positions.

- Advanced API Access & Premium Subscriptions: High-frequency traders and institutions pay for low-latency APIs, priority execution, and proprietary analytics tools.

- Copy Trading & Performance Fees: Social trading features now allow margin trading exchanges to take a cut from successful trades copied across the user base.

- Cross-Collateral Lending Models: Platforms open new interest-based earning streams from underused assets by accepting diverse assets (like NFTs or tokenized RWAs) as collateral.

These revenue streams reflect the evolving nature of Margin Trading Exchange models in 2025. Platforms can unlock sustainable growth with the right strategy and robust margin trading exchange software. As demand for leveraged trading increases, revenue opportunities continue to expand.

Thinking of Launching a Margin Trading Exchange? Here’s What You Need

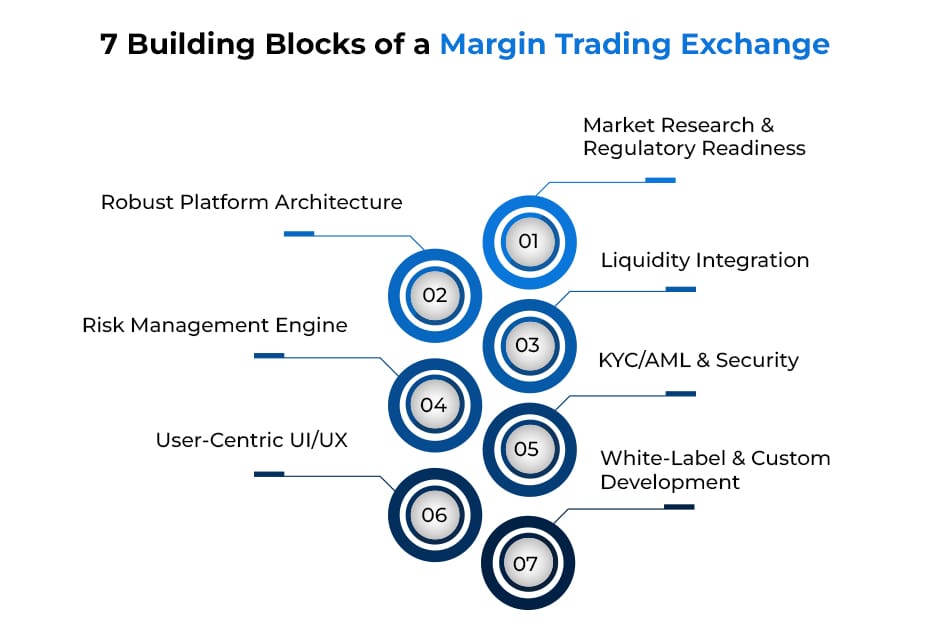

Launching a margin trading exchange in 2025 requires a strategic blend of technology, compliance, and market insight. With the demand for leverage-based trading at an all-time high, entering the space is promising, but success depends on getting the essentials right. Here are the key steps to get started:

1. Market Research & Regulatory Readiness – Understand your target market and ensure compliance with local and international financial regulations.

2. Robust Platform Architecture – Choose scalable and secure margin trading exchange software that supports real-time trading, order matching, margin calculation, and risk control mechanisms.

3. Liquidity Integration – Partner with prime liquidity providers to ensure deep order books and reduce slippage during high-volume trades.

4. Risk Management Engine – Implement automated liquidation systems, margin calls, and configurable leverage limits to manage platform exposure.

5. KYC/AML & Security – Integrate strong user verification processes and end-to-end encryption to protect user data and funds.

6. User-Centric UI/UX – Deliver an intuitive interface with advanced charting tools, position tracking, and a seamless mobile experience.

7. White-Label & Custom Development – Partner with a trusted white label margin trading exchange development team to build, deploy, and scale efficiently.

The demand is growing, the tech is mature, and the opportunity is real. Your platform could be the next success story in the leveraged trading space with a robust plan and proven margin trading exchange software.

How Much Does Margin Trading Exchange Development Cost?

The cost of margin trading exchange development depends on several variables, including trading engine performance, leverage modules, KYC/AML integration, and liquidity provider APIs. Advanced features like cross-margining, dynamic risk assessment, and institutional-grade security frameworks further shape the development timeline. For enterprises aiming to launch quickly without compromising scalability or performance, partnering with a leading crypto exchange development company offers a significant edge. While custom development offers complete flexibility, businesses can achieve faster deployment and seamless trading experiences through a white label exchange solution, optimized for speed, compliance, and multi-asset margin trading execution.

White Label Margin Trading Exchange: Your Shortcut to Profit

Launching a margin trading exchange in 2025 requires robust architecture, real-time risk management, and high-speed matching engines. A white label margin trading exchange solution accelerates go-to-market while offering institutional-grade features like cross-margin support, multi-collateral trading, and automated liquidation engines. Businesses can tap into revenue from trading fees, funding rates, and leveraged positions without months of custom development.

Cut to the edge:

- Deploy in weeks, not months.

- Minimize upfront tech burden.

- Maximize profitability from day one.

White label margin trading exchanges are the fastest path to scalable, long-term growth. They offer a proven framework to enter the market quickly, with institutional-grade infrastructure, customizable modules, and built-in compliance. For visionaries looking to monetize leverage without building from scratch, white label is the smart move.

But building profit-ready exchanges takes more than just speed — it demands precision engineering and deep domain expertise.

Antier: The Dev Force Behind Profitable Margin Exchanges

Institutions Want Leverage. Will They Find It on Your Exchange?

At Antier, we don’t just develop trading platforms — we craft high-performance margin trading exchanges that institutions trust and traders crave. From blazing-fast matching engines to advanced risk control and cross-collateral systems, our tech stack is built to scale and profit. Whether it’s a custom build or a white label margin trading exchange launch, we bring your exchange vision to life faster, smarter, and stronger.

In a market where milliseconds matter and stability drives trust, Antier, a renowned margin trading exchange development, is the dev force behind profitable margin exchanges. Ready to build where the money moves? Let the world trade on your terms. We’ll code it.