Scaling to 1000X: How to Build a $DAGZ-Style Crypto Token For Exponential Growth In 2025?

February 20, 2025

AI-Predictive Analytics Integrated Crypto Neo Banking Is Taking Over—Are You Ready to Adapt?

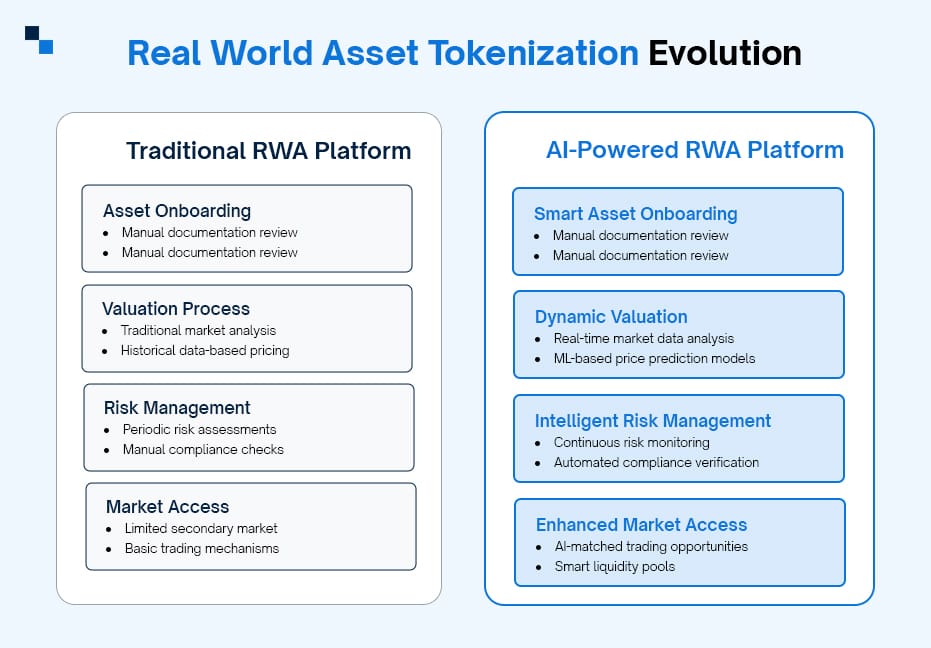

February 20, 2025AI is leading the future of asset tokenization and Real estate Companies and Fintech giants are taking the charge by integrating it to build smarter, more secure, and inclusive platforms for RWA trading. While the Market size of AI Tokenization Solutions is projected to reach $738 billion and $5 Trillion, projects like Lightchain have already integrated AI into their services to build a decentralized ecosystem that offers solutions for scalability, governance, and data privacy. While tokenization changes how we trade and own Real-World Assets, AI adds automation, data analysis, and decision-making to it for sharing a more inclusive trading experience.

This guide explores the Role of AI in Asset Tokenization Solutions and how it’s paving the way to a more inclusive, decentralized, and transparent economy.

Current Challenges in Asset Tokenization and the Role Of AI

Asset Tokenization is the process of converting rights to an asset into a digital token on a blockchain. These tokens represent ownership or a stake in the underlying asset, enabling fractional ownership, easier transferability, and enhanced liquidity. With AI in Tokenization, any real-world asset can be tokenized and made available virtually for investors to trade without geographical barriers. While tokenization itself is transformative, the process involves several challenges:

- Complex Asset Valuation: It can be subjective and time-consuming to determine the value of unique assets like real estate.

- Regulatory Uncertainties: To make sure that tokenized assets comply with local and international regulations requires meticulous attention to detail.

- Bugs and Vulnerabilities: Inadequate and poorly written smart contract code can exploit the assets and result in financial losses.

- Data Management: Handling vast amounts of data related to asset ownership, transactions, and history can be overwhelming.

- Market Dynamics: Predicting market trends and pricing tokens appropriately demands advanced analytical capabilities.

- Limited investor Accessibility: The current decentralized environment has technical complexities limiting tokenized investments.

Tokenizing Digital Assets with AI can help to overcome these challenges by automating and optimizing these processes, making tokenization faster, more accurate, and scalable.

Why Opt for AI-Powered Tokenization Techniques?

There are various benefits of AI-powered Tokenization Services:

- Effectiveness: Time and expenses are decreased by automating repetitive processes like data processing and compliance inspections.

- Accuracy: By reducing human mistakes, AI makes sure that tokenized assets are supported by trustworthy data.

- Scalability: AI-powered platforms are perfect for businesses because they can manage high asset volumes.

- Innovation: AI opens up previously unthinkable use cases like smart contracts and predictive analytics.

Key Applications of AI Tokenization Solutions

1. AI-Powered Asset Valuation

The traditional Tokenization Solutions use manual appraisals are evaluation methods, which are slow and error prone. With AI algorithms, powered by machine learning (ML), The RWA Tokenization Platforms can analyze historical data, market trends, and comparable assets to provide real-time, accurate valuations, saving investors time and effort.

For example: The Real Estate Tokenization Platform powered by AI can assess property values based on location, market conditions, and even socio-economic factors, ensuring that tokenized assets are priced fairly.

2. Smart Compliance and Risk Management

Regulatory compliance is a critical aspect of tokenization. With AI Tokenization Platforms, businesses can automate compliance checks by analyzing legal frameworks and ensuring that tokenized assets adhere to relevant laws.

Additionally, AI-driven risk assessment tools can help to identify potential risks in tokenization projects, such as fraud or market volatility, enabling proactive mitigation.

3. Data-Driven Tokenization Methods

Tokenization involves processing vast amounts of data, from asset details to transaction histories. Additionally, tokenization with AI can streamline this process by organizing, analyzing, and extracting insights from data, ensuring that tokenized assets are backed by accurate and transparent information.

For example: The Tokenization Platform for Art and Commodities can use AI to verify the provenance of a piece for authenticity.

4. Predictive Analytics for Market Trends

Fintech firms can use AI to analyze market data to predict trends and optimize token pricing. This is particularly valuable for commodities traders and private equity firms, where market conditions can change rapidly.

AI Tokenization Platforms can help businesses make data-driven decisions, maximizing the value of their tokenized assets.

5. Enhanced Security and Fraud Detection

Blockchain is inherently secure, but with AI RWA Tokenization Platforms can add an extra layer of protection. AI algorithms can detect suspicious activities, such as fraudulent transactions or unauthorized access, ensuring the integrity of tokenized assets.

Real-World Examples of AI Tokenization Platforms

RealT: Tokenizing Real Estate

RealT Tokenization Platform tokenizes real estate properties, allowing investors to purchase fractional ownership in rental properties. By leveraging AI, RealT can provide accurate property valuations and predict rental income, making it easier for investors to make informed decisions.

Maecenas: Tokenizing Fine Art

Maecenas is an art investment platform that uses blockchain and AI to tokenize fine art. AI algorithms analyze historical sales data and market trends to determine the value of artworks, enabling fractional ownership and democratizing access to high-value art investments.

Paxos: Tokenizing Precious Metals

Paxos offers tokenized gold through its PAX Gold (PAXG) token. Each token is backed by one fine troy ounce of a 400 oz London Good Delivery gold bar. AI is used to monitor market conditions and ensure the accurate pricing of tokens, providing investors with a secure and transparent way to invest in gold.

Harbor: Tokenizing Private Equity

Harbor is a platform that tokenizes private equity and real estate investments. By using AI, Harbor can automate compliance checks and ensure that tokenized assets adhere to securities regulations, making it easier for investors to participate in private markets.

Key Market Trends: The Growing Demand for AI Tokenization

The tokenization market size is growing at a compound annual growth rate (CAGR) of 19.0% from 2021 to 2026. This growth is driven by the increasing adoption of blockchain technology and the need for efficient asset management solutions.

- Financial Services Integration: AI integration into the Tokenization Platform will help financial institutions automate token issuance, manage regulatory compliance, and optimize trading strategies. Machine learning models can help to analyze market data to improve liquidity and reduce transaction costs in tokenized assets.

- Real Estate: AI-powered valuation models can help real estate developers accurately price tokenized properties. Smart contracts enhanced by AI automate property management tasks and dividend distributions for fractional owners.

- Fractional Ownership Management: AI Tokenized Platforms can help to track and manage complex ownership structures, automate dividend payments, and provide insights into portfolio diversification opportunities across tokenized assets.

- Regulatory Compliance: With AI tools, Fintech and Real Estate firms can stay compliant with evolving regulations by automatically monitoring transactions, generating compliance reports, and flagging potential regulatory issues for review.

Industries Transformed by AI Tokenization Platforms

The applications of AI tokenization are vast and span multiple industries. Here’s how different sectors can benefit:

Financial Institutions

- Banks and investment firms can use AI-powered tokenization to create digital representations of financial instruments like bonds, stocks, and derivatives. This enhances liquidity and reduces transaction costs.

Real Estate Companies

- Real estate developers and property management firms can tokenize properties, enabling fractional ownership and opening up new investment opportunities. AI ensures accurate valuations and compliance with property laws.

Commodities and Precious Metals Traders

- Tokenizing commodities like gold, oil, or agricultural products simplifies trading and reduces logistical challenges. AI can optimize pricing based on global market trends.

Art and Collectibles Marketplaces

- AI can verify the authenticity of art pieces and predict their future value, making it easier to tokenize high-value collectibles and attract investors.

Private Equity and Venture Capital Firms

- Tokenizing equity stakes in startups or private companies can democratize investment opportunities. AI ensures transparency and compliance with securities regulations.

The Future of Tokenization is AI-Driven

The AI-powered Tokenization Platforms can unlock numerous benefits while reducing manual efforts, introducing fair pricing, and enhancing transaction transparency. With AI-based Tokenization services, businesses can assess future threats, identify the latest trends, and offer actionable insights to investors. This ultimately empowers investors to tokenize diverse assets seamlessly and make platforms accessible globally.

Create a Custom AI Tokenization Platform with Antier

Bridging Traditional Finance with AI-driven Asset Tokenization, Antier Delivers Enterprise-Grade Solutions for the Future of Digital Assets. Our advanced AI Tokenization Solutions combine cutting-edge AI with robust security to transform how businesses tokenize and manage real-world assets.

Here’s what we deliver:

- Intelligent AI Integration: Custom-built AI algorithms that revolutionize asset tokenization and management while providing deep market insights

- Comprehensive Platform Development: Unified solution covering everything from AI-powered valuation to automated token management and trading

- Advanced Regulatory Framework: Built-in compliance systems that adapt to global regulatory changes in real-time

- Enterprise-Ready Infrastructure: Future-proof architecture designed for institutional-grade scalability

Transform your business with an AI-powered tokenization platform that’s built for tomorrow’s financial ecosystem.