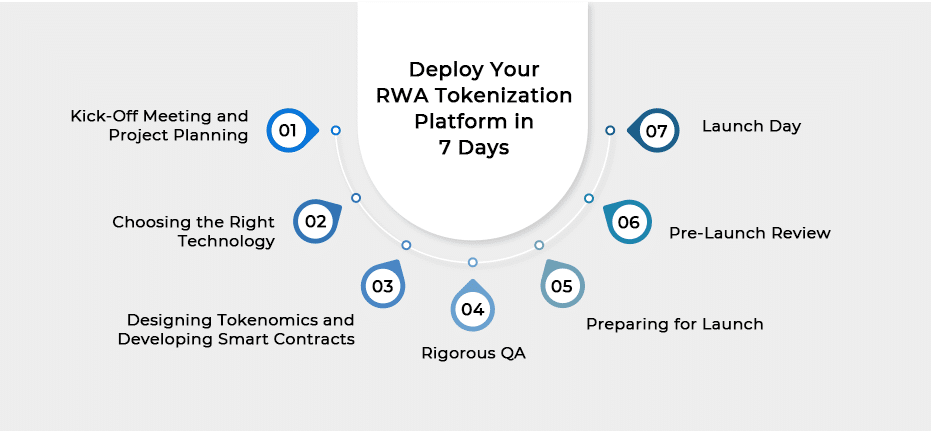

In the fast-paced world of finance, speed can be a game-changer. At Antier, we’ve perfected the art of launching RWA tokenization projects in just seven days. Here’s how we make it happen—and why a rapid launch could be exactly what you need.

Day 1: Kick-Off Meeting and Project Planning

Let’s Get Started

For your asset tokenization project, we kick off with a detailed meeting to understand your goals and set the stage for success. During this session, we’ll:

- Clarify Your Goals: Are you focusing on real estate, commodities, or another asset? We’ll pinpoint exactly what you want to achieve.

- Set Clear Milestones: We’ll map out the key steps and deadlines to ensure everything stays on track.

- Build Your Team: Assemble a team of experts, from blockchain developers to legal advisors, tailored to your project.

Day 2: Choosing the Right Technology

Picking the Perfect Fit

On day two, we’ll select the technology stack that’s right for you:

- Blockchain Platform: We’ll recommend the best blockchain platform for your RWA tokenization projects whether it’s Ethereum, Binance Smart Chain, or another option.

- Development Tools: Choose the right tools for smart contract development and integration.

- Token Standards: Decide on the most suitable token standards, like ERC-20 or ERC-721, based on your project needs.

Day 3: Designing Tokenomics and Developing Smart Contracts

Getting Down to the Details

Day three focuses on the core elements of your project:

- Tokenomics: We’ll design your tokens’ structure, including supply, distribution, and utility.

- Smart Contracts: Develop and test smart contracts to manage token issuance and compliance, ensuring everything functions smoothly.

Day 4: Rigorous QA

Making Sure Everything Works

Testing is crucial in asset tokenization project and on day four, we’ll:

- Test Smart Contracts: Look for bugs and vulnerabilities in your smart contracts.

- Check Integration: Ensure everything integrates seamlessly with your blockchain platform.

- Verify Compliance: Double-check that all regulatory requirements are met.

Day 5: Preparing for Launch

Final Touches

With testing complete, we get everything ready for launch:

- Documentation: Finalize all necessary documents, including user guides and compliance reports.

- Marketing: Create compelling content to build excitement and attract investors.

- Legal Finalization: Secure all legal agreements and regulatory approvals.

Day 6: Pre-Launch Review

Last-Minute Checks

Before going live, we’ll:

- Make Final Adjustments: Tweak any last details based on our final review.

- Decide Go/No-Go: Confirm we’re ready for a successful launch.

Day 7: Launch Day

The Big Moment

Launch day is here! We’ll:

- Monitor Everything: Keep a close eye on performance and address any issues as they arise in your asset tokenization platform.

- Provide Support: Offer ongoing support to ensure everything runs smoothly.

Benefits of a Fast Launch of a RWA Tokenization Platform

A quick launch of RWA tokenization projects and platforms can offer several key advantages:

- Market Advantage: Being first to market can give you a significant edge over competitors. Early entry means you can capture market share and set trends.

- Increased Visibility: A rapid launch can generate buzz and attract attention from investors and media, boosting your project’s profile.

- Faster ROI: Quick deployment means you start seeing returns sooner. The faster you launch, the sooner you can begin realizing the financial benefits of tokenization.

- Enhanced Investor Confidence: Investors often view rapid execution as a sign of efficiency and reliability, which can build trust and attract more funding.

Key Features of Our RWA Tokenization Platform Launch

When you choose Antier, you benefit from a RWA tokenization platform designed with crucial features for a successful tokenization project:

- Scalability: Our platform grows with your project, handling increasing volumes effortlessly.

- Security: We prioritize top-notch security to protect your assets and data.

- Compliance: Full adherence to regulatory standards, including KYC and AML requirements.

- User-Friendly: An intuitive interface that makes the process seamless for everyone involved.

- Integration: Easy integration with existing financial systems and blockchain technologies.

- Efficient Smart Contracts: Automate processes and ensure smooth operations with our reliable smart contracts.

- Analytics: Advanced tools for tracking performance and making data-driven decisions.

Top 5 Asset Tokenization Projects

Below are the top asset tokenization projects that have been making waves in the tokenization world:

1. Ondo Finance

Ondo Finance is an RWA platform that offers tokenized products that bridge between DeFi and traditional assets. OUSG is the hero product of Ondo Finance, a form of short-term investments in U.S. Treasuries that are less risky and highly liquid.

In this asset tokenization project, Investors deposit USDC to invest in the funds or ETFs, and in return, the investor is given equivalent fund tokens. Upon the investor’s desire to redeem the fund, the USDC is returned, and the tokens are burnt.

A majority of the OUSG portfolio is held by BUIDL, a brand-new tokenized fund by BlackRock. The remaining assets held are bank deposits, BlackRock’s FedFund (TFDXX), and USDC for high liquidity.

The other Ondo Finance RWA product is the Ondo US Dollar Yield Token (USDY), which can be termed as the tokenized form of bank demand deposits and short-term U.S. Treasuries. The USDY token is only available to institutional investors and non-US residents who can freely transfer the product after 40 days from its purchase.

2. Backed Finance

Backed finance has transformed the world’s financial landscape as it connects blockchain and traditional assets for virtually all DeFi applications. The digital platform makes access to tokenized fixed-income assets like government and corporate bonds easier than ever, thus diversifying portfolio investments.

For risk-taking individuals, this asset tokenization project offers tokenized equity market through Backed Finance, for example its very much in-demand Backed Coinbase Global (bCOIN) token, an ERC-20 token representing direct equity in the renowned company Coinbase Global Inc. So literally, you could own a share of the world’s leading tech company right from your digital wallet.

What sets Backed Finance apart is the emphasis on security and transparency. It means that every single one of its tokens is 1:1 backed by the underlying security, so your investments are anchored solidly. To get started with the platform, users will have to complete the KYC and AML verification process, in partnership with SumSub, in order to open the door to a safe and seamless onboarding experience.

3. Matrixdock

Matrixdock is a RWA tokenization platform issuing tokenized RWA products on the Ethereum blockchain by Chainlink. Exposure to the U.S. Treasury securities is offered in the form of STBT tokens which can be bought by the users.

STBT token is 1:1 pegged with USD, and its holders will receive a distribution of the daily interest obtained. Moreover, the token holders can mint and redeem tokens on the platform of the Matrixdock at any point in time. Further, Matrixdock will launch more RWA tokens for unlocking new opportunities in RWA investment for its users.

4. Lofty

Lofty is an RWA tokenization platform, promising to allow users to buy fractional real estate on the Algorand blockchain and run a marketplace focused on listing property available for sale in the United States.

It means the investors can generate daily rental income from the properties and the value of ownership is established based on the property in which the investment is done that gains more value. No lock-up period is involved, and investors are free to sell their stakes at any point in time whenever necessary.

The most prominent benefit of Lofty is that users can initiate buying tokens starting from $50. All the transactions on this platform involve USDC tokens.

5. Centrifuge

Centrifuge provides asset tokenization services on the entire spectrum of real-world assets, including invoices, real estate, as well as trade receivables. All these assets are tokenized into NFTs.

At the heart of Centrifuge’s platform lies the Tinlake application which allows developing pools comprising tokenized assets. The investors then can participate in the pools by purchasing DROP and TIN tokens that have entirely different risk and return profiles.

DROP tokens represent the senior tranche which gains more stable returns with minimum risk and TIN tokens represent the junior tranche which has potentially higher returns associated with a higher risk.

Conclusion

At Antier, we believe that a seven-day project launch is not just a possibility but a pathway to seizing opportunities and staying ahead in a competitive landscape. Our streamlined process ensures that you get your RWA tokenization projects live quickly and effectively, with all the benefits of a fast launch. Ready to make your mark in the world of asset tokenization? Contact us today and let’s get started!