The demand for stablecoins is anticipated to surge as the cryptocurrency landscape matures and regulatory frameworks become more defined. This growth will be fueled by the increasing adoption of stablecoin development solutions, making them even more useful for everything from managing money in new digital ways to buying and selling things online.

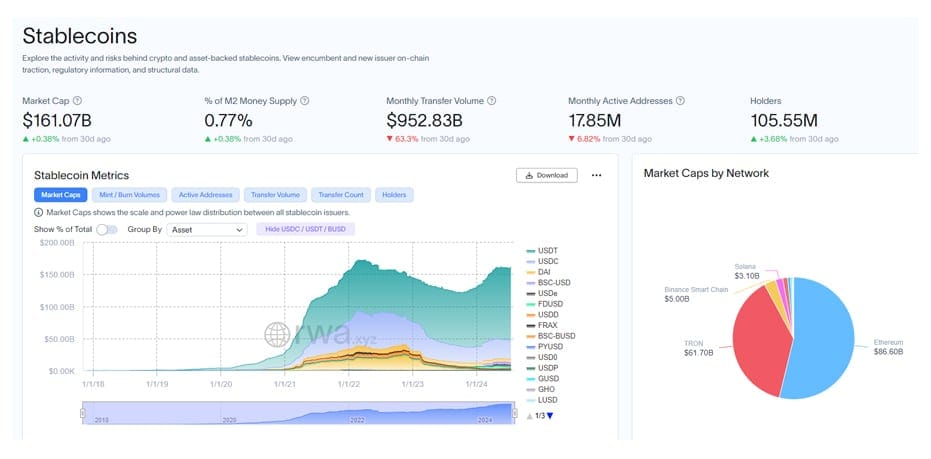

According to RWA.xyz, the number of addresses holding stablecoins has surged by approximately 15% in 2024, reaching a record high of over 104.92 million by July and a market cap of stablecoins, currently hovering around $160 billion, is distributed across various networks. This suggests growing mainstream adoption and potential for future growth.

Investing in a stablecoin development solution offers a way to participate in the crypto space without the extreme price swings of other cryptocurrencies. They can be a haven during market volatility and a useful tool for fast and cheap transactions.

Top Driving Forces Fueling Stablecoin Growth in 2024

Stablecoin development solutions become more effective as their usage grows, leading to smoother operations for many users.

Stablecoin development solutions are creating a splash in the 2024 crypto landscape, offering a compelling alternative to traditional cryptocurrencies. Here’s a breakdown of the key factors driving their growth:

- Tokenized Payments: The recent rise in tokenized payments underscores the effectiveness and economical nature of stablecoin transactions, backed by the US dollar. Stablecoins provide a reliable stability source in contrast to regular cryptocurrencies’ volatility. Investors from institutions seeking safe havens and the possibility of a modernized US dollar have been pulled in by this attraction. Stablecoin development solutions’ position as a key component of contemporary finance in the 2024 cryptocurrency space is cemented by the pursuit of efficiency, cost reduction, and transaction digitization.

- Crypto Gets Stable: Stablecoins and other lower-volatility crypto assets are gaining popularity, which is a big change in the industry. For institutional investors, Stablecoin development solutions present a strong alternative since they reduce the risks associated with more volatile cryptocurrencies and give them a dependable way to enter the market. Stablecoins’ legitimacy and stability are bolstered by this convergence of traditional financial and cryptocurrency markets, solidifying their status as promising assets in 2024.

- Connecting Old and New Finance: Despite regulatory roadblocks, USD-backed stablecoins are gaining significant momentum. Stablecoin development solutions foster a more inclusive atmosphere in well-established financial institutions through transparency initiatives. This symbiosis is further strengthened by the fact that over 90% of stablecoin transactions are denominated in USD, acting as a crucial bridge between traditional and digital finance. The unwavering stability of USD-backed stablecoins amidst regulatory uncertainties positions them as trustworthy instruments that align with the global dominance of the US dollar.

- Surging Demand Ignites Innovation: The increasing popularity of stablecoins is sparking a wave of creativity within the cryptocurrency sector, especially in exploring how to build a stablecoin. Innovators are continually developing fresh applications for stablecoins, pushing the limits of technological advancement. These digital assets are pivotal to the expansion of DeFi, offering a dependable and steady measure of value. This facilitates the development of inventive financial solutions accessible to anyone with internet access. Stablecoin development solutions extend beyond traditional payment uses, finding applications in loyalty programs, supply chain management, and voting systems. This ongoing evolution holds the potential for thrilling prospects in digital finance.

The future of Stablecoin development solutions appears bright, with these driving forces propelling their continued growth and mainstream adoption.

As the technology matures and regulations evolve, stablecoin development solutions have the potential to revolutionize how we interact with digital assets and reshape the global financial landscape.

Benefits of Investing In Stablecoin Development Solutions Services in 2024

Investing in stablecoin development solutions and services in 2024 provides numerous advantages for investors and businesses alike, enabling them to leverage the benefits of digital currencies while mitigating the volatility often seen in other cryptocurrencies.

Here’s why it’s beneficial:

- Stability in a Stormy Market: Cryptocurrencies are known for wild price swings. Stablecoins pegged to assets like the US dollar, offer a haven. You get exposure to the crypto market without the rollercoaster ride.

- Crypto on Autopilot: Stablecoins lets you stay invested in the crypto ecosystem without constantly monitoring prices. Stablecoin development solutions allow for easy conversion between fiat and stablecoins. This lets you capitalize on crypto opportunities without directly holding volatile assets.

- Earn While You Hold: Some platforms pay interest on holding stablecoins. It’s like a crypto savings account, letting your investment grow passively.

- Future Potential: As crypto adoption increases, stablecoins could become the go-to currency for digital transactions. Stablecoin development solutions are designed to integrate these features, allowing users to earn passive income on their investments.

Overall, investing in stablecoin development solutions in 2024 aligns with the growing interest in efficient, secure, and transparent financial transactions.

How to Build a Stablecoin: Understanding the Steps to Development

Developing a stablecoin requires careful planning and execution across several key stages. Stablecoin development solutions involve a strategic approach encompassing several key steps to ensure its success and effectiveness in the market.

These are-

Step 1: Formulating a Strategic Plan

The initial phase of stablecoin development solutions involves crafting a robust strategy. This step entails analyzing market demands, identifying target use cases, and determining the specific type of stablecoin that aligns with these objectives.

Step 2: Drafting the Whitepaper

A critical component of the stablecoin development solutions is preparing a comprehensive whitepaper. This document serves as the foundational blueprint, outlining the project’s vision, technological framework, tokenomics, and governance structure. It plays a crucial role in attracting investors and stakeholders by providing clarity and transparency about the stablecoin’s purpose and implementation.

Step 3: Token Creation and Management

Once the strategic direction and whitepaper are established, the focus shifts to technical implementation, specifically on how to build a stablecoin. Depending on the chosen type, whether fiat-backed, commodity-backed, or algorithmic, the development team ensures proper management of reserves or collateral to maintain price stability and operational integrity.

Step 4: Launch and Marketing Strategy

After completing stablecoin development solutions and establishing protocols, the next crucial step is successfully launching it into the market. This stage involves devising a comprehensive marketing strategy to build awareness and drive adoption among target audiences. Utilizing multiple channels and platforms enhances visibility and engagement, attracting potential investors and users to the stablecoin ecosystem.

Each step plays a crucial role in establishing credibility, attracting investments, and fostering widespread adoption. With a clear roadmap and diligent execution, stablecoin development solutions can navigate complexities and position themselves as reliable pillars of stability in the digital economy.

Seeking a comprehensive guide on how to build a stablecoin, check out Antier’s detailed blog: 4 Steps to Build a Stablecoin

Top 5 Stablecoins Based on Market Capitalization

Stablecoin development solutions are gaining traction with businesses and people globally. However, it’s important to remember that the regulatory landscape surrounding stablecoins is still evolving.

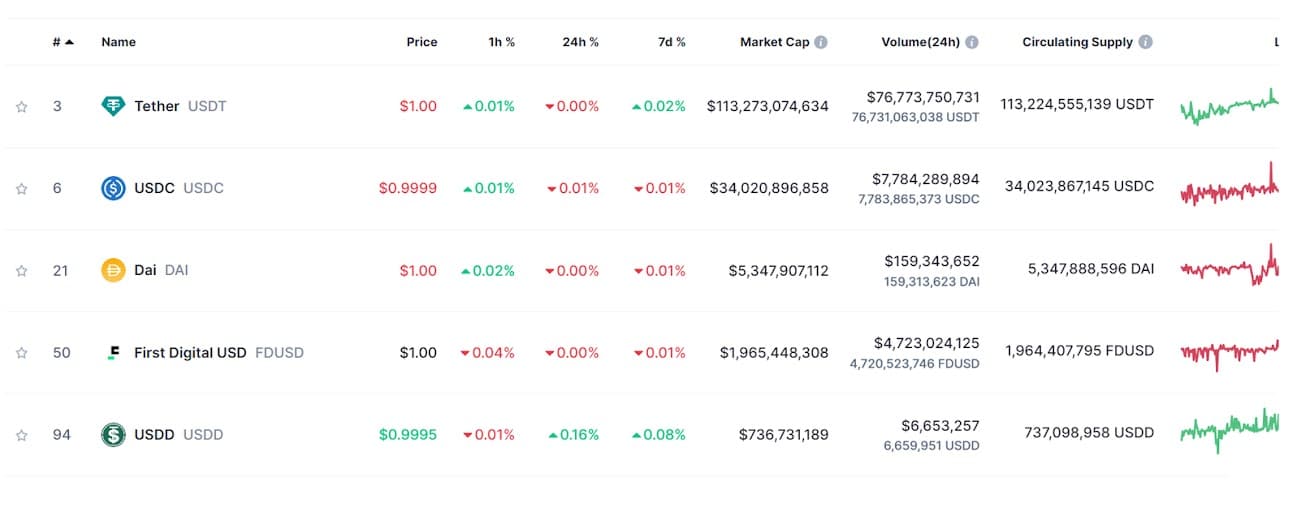

Here’s a look at the top 5 stablecoins by market capitalization:

- Tether (USDT): Tether remains the undisputed leader in the stablecoin market. It’s pegged to the US dollar and enjoys widespread adoption across crypto exchanges.

- USD Coin (USDC): USDC is another major US dollar-pegged stablecoin, gaining significant traction in recent years. It’s backed by a consortium of regulated financial institutions, offering a layer of trust for some users.

- DAI (DAI): DAI is a unique stablecoin in that it’s decentralized and not directly pegged to any single asset. Instead, it uses a system of smart contracts and collateralized debt positions to maintain its price stability.

- First Digital USD (FDUSD): This stablecoin is pegged to the US dollar and issued by First Digital Corporation, a licensed trust company. While not as widely used as Tether or USDC, it offers a regulated alternative.

- USDD (USDD): USDD is a relatively new entrant in the stablecoin space, backed by Tron DAO Reserve. It’s also pegged to the US dollar, but its recent launch means it has a smaller market capitalization compared to the others on this list.

Wrap-Up

The surging demand for stablecoins, driven by factors like tokenized payments and institutional interest, presents a significant opportunity for stablecoin development solutions. These solutions offer a chance to participate in the crypto space with more stability and pave the way for a future of efficient, secure, and transparent financial transactions.

Considering the intricacies involved in stablecoin development, partnering with a renowned stablecoin development solutions provider, Antier is a strategic choice. We possess the expertise to navigate the complexities of crafting a robust strategy, drafting a compelling whitepaper, and ensuring technical execution aligns with your vision. You can significantly increase your chances of success in this burgeoning crypto market by leveraging our experience.

Intrigued to learn more about how to build a stablecoin? Visit our website to uncover how stablecoin development solutions can propel your business into the future of finance.