The Metaverse Wave: How can Businesses Prepare for it

February 1, 2024

Future Trends in P2P Crypto Exchange Development

February 5, 2024Imagine owning a tangible piece of the world economy, not some speculative digital token, but a slice of a gold mine, a barrel of oil, or even a rare gemstone. For centuries, such investments have been the exclusive domain of a privileged few, locked away behind high entry barriers and complex financial instruments. But enter the revolutionary world of commodities tokenization – a game-changer blurring the lines between the physical and digital, opening up the real world of commodities to a whole new wave of investors, including you.

This blog is your passport to this exciting frontier. We’ll demystify the concept, unpack its benefits and challenges, and equip you with the knowledge to confidently navigate this rapidly evolving landscape of commodities tokenization development. Get ready to break free from the limitations of traditional finance and embrace a future where the real world and the digital realm seamlessly intertwine.

Diving Deep: What is Commodities Tokenization?

Think of it like this: imagine taking a valuable commodity, like a barrel of oil, and chopping it into bite-sized digital pieces called tokens. Each token represents a fractional ownership stake in the underlying asset, granting you a proportional share of its value and potential returns. These tokens, just like cryptocurrencies, can be easily traded on dedicated commodity exchanges, opening up a world of previously out-of-reach investments to anyone with an internet connection.

But unlike the volatile and often speculative nature of some cryptocurrencies, tokenized commodities are tethered to real-world assets. It means their value fluctuates based on the actual supply and demand of the underlying commodity, adding a layer of stability and familiarity for traditional investors. It’s best to trust the expertise of a commodities tokenization development services provider for tokenizing commodities.

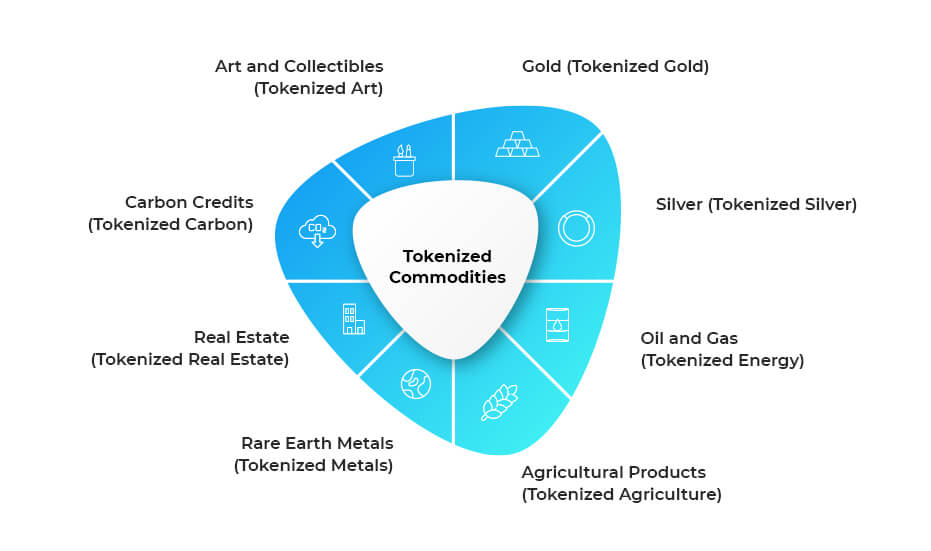

Examples of Tokenized Commodities

The world of tokenized commodities is growing rapidly, with a variety of assets being represented on blockchain platforms. Here are some prominent examples:

Gold (Tokenized Gold):

Gold has been a traditional store of value, and its tokenization allows investors to own fractions of physical gold. These tokens often represent ownership in a vault where the actual gold is stored securely.

Silver (Tokenized Silver):

Similar to gold, silver can be tokenized to provide investors with fractional ownership. It allows for more accessible investment in precious metals.

Oil and Gas (Tokenized Energy):

Tokenized commodities extend to energy resources such as oil and gas. Investors can participate in the energy sector by owning tokens that represent shares in specific oil or gas reserves.

Agricultural Products (Tokenized Agriculture):

Tokenizing agricultural commodities like wheat, coffee, or soybeans enables investors to participate in the agricultural sector. These tokens may represent ownership in specific crops or farms.

Rare Earth Metals (Tokenized Metals):

Rare earth metals, essential components in various industries, can be tokenized to provide investors with exposure to this niche market. Tokenized metal assets are divisible, making them more accessible to a broader range of investors.

Real Estate (Tokenized Real Estate):

Real estate tokenization involves converting physical real estate assets into digital tokens. Investors can then buy and trade these tokens, gaining fractional ownership in properties, reducing the barriers to entry for real estate investment.

Carbon Credits (Tokenized Carbon):

With a growing focus on environmental sustainability, carbon credits can be tokenized to create a market for trading carbon offsets. This facilitates investments in green initiatives.

Art and Collectibles (Tokenized Art):

Tokenizing art and collectibles allow investors to own fractions of valuable artworks or collector’s items. This makes high-value assets more accessible to a wider audience.

Why Now? The Allure of Tokenization

The rise of commodities tokenization isn’t just a technological gimmick; it’s a revolution driven by a potent cocktail of benefits for both investors and the wider commodities market:

For Investors:

- Democratized Access: Own a piece of a billion-dollar gold mine or a thriving coffee plantation in Brazil – all with a fraction of the capital traditionally required. Tokenization breaks down entry barriers, making previously inaccessible assets available to a broader pool of investors.

- Increased Liquidity: Bid farewell to the cumbersome and slow-moving world of traditional commodities trading. Tokenization brings agility and ease, allowing you to buy, sell, and trade your holdings 24/7 on secure digital platforms.

- Fractional Ownership: Who needs a whole barrel of oil? With tokenization, you can invest in tiny fractions, diversifying your portfolio and minimizing risk with smaller exposures.

- Transparency and Security: Blockchain technology, the backbone of this revolution, ensures a tamper-proof record of ownership and transactions, reducing the risk of fraud and manipulation. No more shady backroom deals – everything is transparent and verifiable.

For the Commodities Market:

- Enhanced Efficiency: Say goodbye to manual paperwork and time-consuming processes. Tokenization streamlines trade finance, post-trade settlement, and other workflows, slashing costs and delays.

- New Funding Avenues: Imagine unlocking a vast pool of investors previously excluded from the market. Tokenization opens doors for issuers to raise capital from a global audience, boosting liquidity and fueling growth.

- Improved Traceability: Track your coffee beans from farm to cup or follow the journey of your precious metals. Tokenization enables transparent supply chains, promoting sustainability and ethical sourcing practices.

How Does Commodities Tokenization Work?

Underneath the flashy term “commodities tokenization” lies a surprisingly intricate, yet fascinating, process. It’s like witnessing a master chef orchestrating a delicious dish, but instead of ingredients, we’re dealing with real-world commodities and digital magic. Let’s break down the key steps, demystifying the transformation from physical asset to tradable token:

Valuation

This is where it all begins. Independent experts, like seasoned financial alchemists, meticulously assess the underlying commodity. Imagine weighing a diamond on a precise scale, analyzing its clarity, cut, and color to determine its true worth. This involves a meticulous evaluation of factors like market trends, supply and demand, and quality assessments.

Tokenization

Now comes the transformation! This is where the real magic happens. The valued asset is split into digital pieces, like cutting a perfectly ripe apple into bite-sized slices. Each slice, represented by a token, embodies a proportional ownership stake in the original asset. Think of it as creating miniaturized versions of the real-world commodity, each carrying a fraction of its value and potential returns.

Platform Selection

Just like a delicious dish needs the right serving platter, these newly minted tokens require a secure and reliable platform to call home. Dedicated commodity exchanges, acting as digital marketplaces, offer a platform for investors to trade their tokens. Imagine a bustling bazaar filled with digital stalls, each displaying different tokenized commodities ready to be bought, sold, and traded.

Listing and Trading

Open for business! The tokens are listed on the chosen platform, readily available for investors to browse and purchase. Now comes the exciting part: trading! Investors can buy and sell their tokens just like any other tradable asset, with real-time market prices reflecting the ever-changing dynamics of supply and demand. Every transaction, however, is meticulously recorded on a secure blockchain ledger, a digital vault ensuring transparency and immutability.

Settlement and Beyond

When a trade is complete, the ownership of the underlying tokenized asset seamlessly changes hands, just like passing a plate of food to a hungry diner. But the journey doesn’t end there. Tokenization opens doors to a plethora of possibilities beyond straightforward trading. Imagine using your tokenized gold shares as collateral for a loan, participating in innovative DeFi applications like yield farming, or even utilizing them for fractional ownership of renewable energy projects. The possibilities are truly endless.

This five-step journey is just the tip of the iceberg. Within each stage lies a complex web of technical processes, legal considerations, and market forces. Understanding these nuances is crucial for informed investment decisions. But remember, the core concept remains the same.

Challenges and Considerations: Navigating the Uncharted

Like any burgeoning frontier, commodities tokenization comes with its own set of hurdles:

- Regulatory Landscape: The rules of the game are still being written. Regulatory frameworks are evolving rapidly, creating uncertainty for both investors and issuers.

- Technological Infrastructure: Building robust and secure platforms for tokenization and trading requires significant technological expertise and investment. Not all platforms are created equal, so due diligence is crucial.

- Liquidity and Price Discovery: New markets often face initial liquidity challenges and difficulties in establishing reliable price discovery mechanisms. Patience and a long-term perspective are key.

Before You Take the Plunge: Tips for Beginner Investors

Entering the world of commodities tokenization is exciting, but it’s crucial to approach it with awareness and caution. Here are some essential tips for beginner investors:

- Do your research: Don’t jump in blindly! Understand the specific commodity you’re interested in, the platform you’ll be using, and the underlying technological and regulatory landscape. Research the issuer’s reputation and track record.

- Stay informed: This is a rapidly evolving field. Keep up with the latest regulatory developments, industry news, and platform updates to navigate the dynamic environment.

- Start small: Don’t commit your life savings on day one. Begin with smaller investments to gain experience and assess your risk tolerance before allocating larger amounts.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different commodities, platforms, and asset classes to mitigate risk and maximize potential returns.

- Seek professional advice: If you’re unsure about navigating the complexities, consider consulting with a financial advisor specializing in alternative investments or blockchain technology.

- Smart contracts: These self-executing agreements can automate key aspects of tokenized commodity trading, further streamlining processes and minimizing risk.

- Decentralized finance (DeFi): Explore innovative DeFi applications built on top of tokenized commodities, such as lending, borrowing, and yield generation.

- Environmental, social, and governance (ESG) factors: Integrate ESG considerations into your investment decisions to support sustainable practices within the commodities market.

The Future is Tokenized: Embrace the Transformation

Commodities tokenization isn’t just a fad; it’s a fundamental shift in how we invest in and interact with the real world. While challenges remain, the potential to democratize access, increase efficiency, and enhance transparency is undeniable. As the technology matures and regulations evolve, expect to see wider adoption and even more innovative applications emerge in the years to come.

So, are you ready to be a part of this revolution? Embrace the opportunities of commodities tokenization, invest wisely, and join the global community shaping the future of finance.

This blog only scratches the surface of this vast and dynamic landscape. Feel free to delve deeper into specific areas that pique your interest. For more details, get in touch with Antier, the best Commodities tokenization Development Company and venture into the tokenization domain with ease.