Top 10 Hypercasual Game Development Companies

March 6, 2025

Blockchain For Pharma Supply Chains: Regulatory Challenges and Prominent Solutions

March 6, 2025Crypto trends come and go, but some shifts are too big to ignore—XRP’s growing presence in institutional finance is one of them. While Bitcoin and Ethereum have long dominated discussions about crypto adoption, XRP is now stepping into the spotlight, thanks to recent developments at the highest levels.

Enterprises are paying closer attention to its real-world applications with the U.S. government adding XRP to its crypto reserves. But to fully harness its potential, businesses need an XRP crypto wallet that is secure, regulation-compliant, and designed to handle institutional-grade transactions. So, why is now the best time to invest in XRP wallet development? What features should a modern XRP wallet have? And how are institutions preparing for a blockchain-driven financial future?

Let’s explore.

How U.S. Crypto Reserve Shifts Are Driving XRP Crypto Wallet Adoption?

The U.S. government’s decision to add XRP to its strategic crypto reserves is reshaping the landscape for XRP wallet development. Enterprises increasingly turn to XRP-based wallets for secure and scalable digital asset management with growing regulatory clarity and institutional interest. This shift, coupled with key industry developments, is driving a surge in XRP wallet adoption and reinforcing its role in the evolving financial ecosystem.

Key Developments Boosting XRP Wallet Adoption

- U.S. Government Endorses XRP : President Donald Trump announced XRP’s inclusion in the U.S. crypto reserve alongside Bitcoin, Ethereum, SOL, and ADA, signaling institutional trust in XRP.

- XRP Price Surge : Following the announcement, XRP’s price jumped from $2.23 to $2.99, reflecting strong investor sentiment and increased demand for XRP-powered financial solutions.

XRP wallet adoption is poised for significant growth with increasing institutional support and regulatory clarity. Businesses investing in crypto wallet development can leverage this momentum to build secure, scalable, and regulation-compliant digital financial solutions. As global finance shifts toward blockchain-based ecosystems, institutions increasingly leverage XRP wallets for seamless transactions and asset management. This surge is fueled by the need for secure, scalable, and regulation-compliant solutions in a rapidly evolving digital economy.

Why Is Institutional Adoption of XRP Crypto Wallet Accelerating?

The institutional shift toward XRP wallet development is not just about efficiency—it’s about preparing for the next generation of blockchain-based finance. XRP’s role in DeFi, CBDCs, and tokenized assets is making it a crucial player in global digital finance strategies.

-> Growing Role in DeFi & Tokenization

- XRP is expanding beyond payments, powering tokenized assets, smart contracts, and DeFi applications.

- Institutions are leveraging XRP’s blockchain infrastructure for real-world asset tokenization.

-> XRP & Central Bank Digital Currencies (CBDCs)

- Ripple is working with central banks to explore CBDC issuance on XRPL.

- Institutional-grade crypto wallets will play a role in bridging CBDCs with traditional banking systems.

-> Institutional Liquidity Pools & Automated Trading

- XRP’s deep liquidity pools are attracting hedge funds and institutional traders.

- AI-driven trading strategies for XRP-based liquidity management are on the rise.

-> Security & Compliance in an Evolving Regulatory Landscape

- ZKPs and quantum-resistant encryption are shaping the next-gen security of XRP crypto wallets.

- Businesses are adopting crypto wallet development solutions that align with evolving regulatory frameworks.

XRP wallet development will be a core component in enabling seamless transactions, asset tokenization, and next-gen financial applications as institutions prepare for the future of digital finance.

What Are the Key Features of a Modern XRP Crypto Wallet?

A modern XRP crypto wallet must meet the evolving needs of businesses, enterprises, and Web3 adopters by offering security, scalability, and seamless interoperability. Here are the key features that define a cutting-edge XRP wallet development solution:

- Multi-Layer Security – Implements private key encryption, MultiSig, and biometric authentication for robust protection.

- Native XRPL Support – Enables instant, low-fee XRP transactions, trustlines, and future smart contract compatibility.

- Cross-Chain & Multi-Asset Support – Supports multiple cryptocurrencies, built-in DEX swaps, and XRPL-issued tokens.

- DeFi & Staking – Facilitates XRP-based DeFi lending, staking (if introduced), and yield farming for passive income.

- Fiat On-Ramp & Off-Ramp – Allows direct XRP purchases and withdrawals via bank transfers, cards, and fiat gateways.

- White Label Customization – Offers API, SDK, and branding options for enterprises launching their own XRP wallet.

- AI-Powered Portfolio Management – Uses AI for transaction analytics, real-time alerts, and risk management insights.

- Escrow & Payment Channels – Supports time-locked payments and scalable microtransactions on the XRP Ledger.

- NFT & Token Management – Enables users to store, trade, and manage XRPL-native NFTs and issued tokens.

- Regulatory Compliance & KYC/AML – Integrates KYC verification and AML measures for compliance.

A modern XRP wallet must go beyond basic storage—it should offer a crypto-friendly neobanking solution. There’s never been a better time to invest in building an enterprise-grade XRP wallet with rising institutional interest. Seizing this moment will position businesses for long-term success in the crypto economy.

Why Now Is the Best Time to Build an Enterprise-Grade XRP Wallet?

The digital asset space is evolving fast, and XRP is at the center of this transformation. Now is the perfect time for businesses to invest in next-gen financial solutions with its low-cost transactions, high-speed settlements, and increasing institutional adoption. As enterprises shift toward blockchain-based payments and asset management, having a secure and scalable XRP-powered platform can set businesses apart in the competitive market.

One of the biggest drivers behind this trend is the growing institutional interest in XRP. Major financial players recognize its potential for cross-border payments, DeFi, and tokenized assets. The demand for enterprise-grade solutions is only increasing with advancements in smart contracts and blockchain-based liquidity management. Businesses can position themselves ahead of the curve by acting now. Governments worldwide are moving toward well-defined crypto regulations, ensuring a safer and more compliant environment for digital asset adoption. Enterprises that develop secure, KYC/AML-compliant platforms today will be better equipped to operate within evolving regulatory frameworks while maintaining a seamless user experience. But how do you go about building a high-performance XRP wallet that meets enterprise needs? From defining key features to ensuring top-tier security, let’s break down the essential steps to develop a robust and future-ready XRP-powered platform.

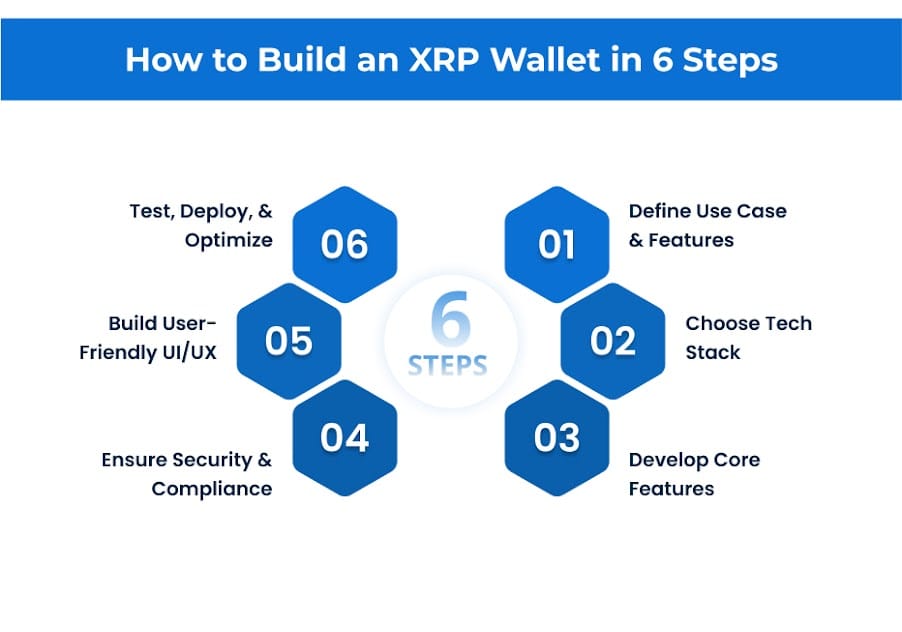

How to Build an XRP Crypto Wallet?

Creating a high-performance XRP crypto wallet requires a structured approach. Here’s a step-by-step guide:

1. Define Use Case & Features

- Determine if the wallet will be custodial or non-custodial.

- Identify target users—businesses, retail users, or financial institutions.

- Select key functionalities: multi-asset support, staking, fiat on-ramp, etc.

2. Choose Tech Stack

- Blockchain: XRP Ledger (XRPL) for seamless transactions.

- Backend: Node.js, Python, or Go for secure API interactions.

- Frontend: React Native (mobile) or Angular/React (web).

- Database: PostgreSQL, MongoDB, or Firebase for efficient storage.

3. Develop Core Features

- XRPL Integration: Enable trustlines, escrow, and payment channels.

- Multi-Asset Support: Facilitate seamless swaps and DEX integration.

- Advanced Security: Implement private key encryption, MultiSig, and biometric login.

4. Ensure Security & Compliance

- KYC/AML Integration: Follow global crypto regulations.

- Penetration Testing: Identify and fix vulnerabilities.

- Cold & Hot Wallet Management: Secure fund storage with multi-layer encryption.

5. Build User-Friendly UI/UX

- Intuitive Dashboard: Real-time portfolio tracking and analytics.

- One-Tap Transactions: Simplified XRP transfers with QR codes.

- Multi-Platform Support: Web, mobile, and browser extension compatibility.

6. Test, Deploy & Optimize

- Beta Testing: Ensure smooth performance across platforms.

- Scalability Enhancements: Optimize for high transaction volumes.

- Regular Updates: Integrate new XRPL features and security patches.

Building an enterprise-grade XRP crypto wallet demands security, scalability, and seamless user experience. Businesses can unlock new opportunities in the evolving crypto space with the right features, compliance, and tech stack.

How Much Does XRP Wallet Development Cost?

The cost of developing an XRP crypto wallet depends on several factors, including features, security standards, and scalability requirements. A basic solution may focus on essential functions like secure transactions and multi-asset support, while an enterprise-grade wallet integrates advanced security, compliance, and DeFi capabilities. The choice of tech stack, third-party integrations, and regulatory compliance measures also impact development complexity. Additionally, factors like cross-platform compatibility and user experience play a crucial role. Whether building from scratch or opting for a customizable white label crypto wallet solution, businesses must align their budget with long-term goals to create a secure, scalable, and future-ready platform.

Why Are Businesses Choosing White Label Crypto Wallet Solutions?

Businesses are increasingly opting for white label crypto wallet solutions as they offer a faster, cost-effective, and scalable way to enter the digital asset space. These solutions enable businesses to focus on user acquisition and growth while ensuring regulatory compliance and security. Here’s why they are becoming the go-to choice:

- Faster Time-to-Market – Pre-built infrastructure allows businesses to launch quickly.

- Cost-Effective Development – Eliminates the need for extensive in-house development.

- Custom Branding & Features – Fully customizable UI, features, and integrations.

- Regulatory Compliance – Comes with built-in KYC/AML and security protocols.

- Seamless Integration – Supports blockchain networks, DeFi, and fiat gateways.

White label crypto wallet solutions offer a smart, scalable path for businesses to enter the crypto space with ease. Adopting a ready-made yet customizable wallet ensures long-term growth and competitive advantage as digital finance evolves.

Build Your Enterprise-Grade XRP Wallet with Antier

Antier is a leading crypto wallet development company, delivering cutting-edge XRP wallet solutions that combine security, scalability, and regulatory compliance. Our expertise in white label crypto wallet development ensures a seamless, enterprise-ready platform tailored to your business needs. We empower businesses to thrive in the evolving blockchain landscape with advanced security protocols, AI-driven portfolio management, and seamless DeFi integration. Whether you need multi-asset support, fiat on/off ramps, or institutional-grade compliance, we provide end-to-end solutions.

Leverage our proven track record and industry expertise—launch your XRP wallet with us today!