What if I tell you that you can explore banking not by visiting a physical branch, but by simply stepping into a world of virtual wonder from the comfort of your own home? Yes.. that’s true!

We are no longer confined to brick-and-mortar institutions or the limitations of geographical boundaries. This is all possible with metaverse banking taking centre stage in this digital world. It is a thrilling new frontier that bridges the worlds of traditional finance and digital innovation seamlessly.

This article will walk you through the concept of virtual banks where you don’t queue at counters but engage with avatars in stunning digital lobbies, making you aware of the trend of metaverse banking development with ultimate feature-packed solutions and easy steps to launch.

Without any delays, let’s start!

What is Metaverse Banking?

Metaverse banking refers to a new and innovative financial ecosystem that exists within the Metaverse, a virtual and interconnected digital universe. In the Metaverse, users have the opportunity to conduct a wide range of financial activities, including banking, investing, and managing digital assets in a virtual environment.

Want to explore this in detail, click here.

To enter this virtual space, you would require metaverse banking solutions that are specialized platforms and services designed to facilitate financial transactions and banking activities within the metaverse. These solutions are tailored to the unique needs and characteristics of the metaverse.

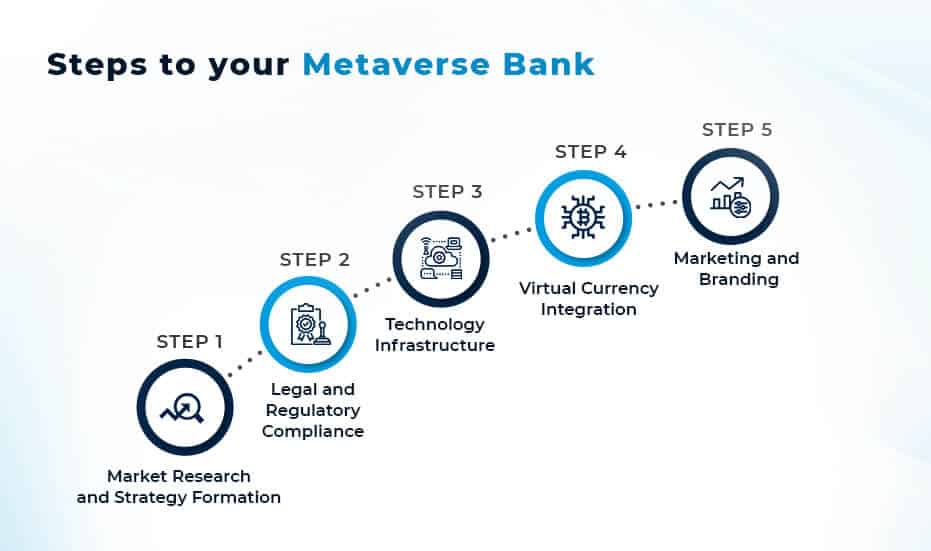

5 Easy Steps to Your Metaverse Bank Development

Step 1. Market Research and Strategy Formation

- Begin with in-depth market research to understand the Metaverse community’s financial needs and behaviours.

- Identify your target audience within the metaverse, whether it’s gamers, virtual real estate investors, or NFT enthusiasts.

- Formulate a comprehensive strategy that outlines your market positioning, competitive advantages, and a clear value proposition. This strategy will be the foundation of your virtual bank’s success.

Step 2. Legal and Regulatory Compliance

- Consult with legal experts who understand the regulatory landscape of the Metaverse.

- Ensure compliance with data protection laws, virtual asset regulations, and other relevant legal requirements.

- Implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to maintain financial integrity within the virtual environment.

Step 3. Technology Infrastructure

- Select a Metaverse banking solution that aligns with your business goals. This may involve partnering with a Metaverse banking solution provider or choosing metaverse banking development on your own technology.

- Invest in secure and scalable hosting and data storage infrastructure to ensure the safety of user data and assets.

- Create a user-friendly interface that allows easy access and navigation for your Metaverse banking services.

Step 4. Virtual Currency Integration

- Adopt the Metaverse’s digital economy by integrating virtual currencies, cryptocurrencies, and NFTs into your banking system.

- Implement seamless conversion and management tools to facilitate transactions and asset management.

- Offer users the ability to manage their digital assets effectively within your banking platform.

Step 5. Marketing and Branding

- Develop a multi-faceted marketing strategy that includes both online and Metaverse-specific promotional efforts.

- Engage with the Metaverse community through social media, forums, and virtual events.

- Create a distinctive brand identity that resonates with the Metaverse audience, reflecting innovation, trustworthiness, and a user-centric approach.

By following the above-mentioned steps, you will be well-prepared to venture into your Metaverse banking development journey. These are the building blocks that can help you create a secure, compliant, and user-friendly virtual banking platform tailored to the unique needs of the Metaverse community.

Why Invest in Metaverse Banking Development?

Whenever a startup or business expansion is planned, the ultimate motive behind it is to earn more, which somehow depends on the customer experience. Metaverse banks can be the problem solvers here, as the banks can open doors to newer earning opportunities along with an improvised customer experience.

The major business benefits that metaverse banking development can offer are :

1. Diversified Revenue Streams

Metaverse banks offer a wide array of revenue sources. This includes transaction fees for virtual currency exchanges, commissions on in-game purchases, and management fees for virtual assets. Moreover, as the metaverse evolves, new opportunities for monetization, such as NFT (non-fungible token) trading, can arise. This diversification of income streams provides financial stability and potential for growth.

2. Global Accessibility

One of the most significant advantages of metaverse banking solutions is their global accessibility. Users from different parts of the world can access virtual banks that too from the comfort of their homes, opening up a vast international customer base. This global reach allows businesses to expand their services without the traditional limitations of physical branches.

3. Enhanced User Engagement

Metaverse banks leverage the immersive and interactive nature of virtual worlds to enhance user engagement. Users can navigate through virtual branches, attend financial education seminars conducted in 3D spaces, or participate in gamified activities related to their finances. This interactivity not only makes banking more enjoyable but also fosters deeper customer engagement and better bonding.

4. Partnership Opportunities

By entering the metaverse, banks can form strategic partnerships with metaverse platforms, game developers, and virtual world creators. These collaborations can lead to various business opportunities. For example, partnering with a popular virtual world platform can provide access to an established user base, which can be targeted for financial services. Additionally, collaborating with game developers can lead to co-branded experiences, such as in-game banking services.

5. Brand Exposure and Reputation

A bank can greatly increase its brand exposure and reputation by establishing a presence in the metaverse. It positions the bank as forward-thinking and technologically innovative, securing its future. This can be a powerful magnet for tech-savvy customers and potential partners who seek out institutions that embrace cutting-edge digital solutions.

6. Innovation and R&D

Metaverse banks are at the forefront of financial technology (FinTech) and innovation. They continuously explore new technologies and solutions to provide seamless virtual banking experiences. This emphasis on innovation creates opportunities for research and development, enabling banks to stay competitive and adapt quickly to evolving customer needs.

All these benefits seem to be futuristic and power boosters for your existing bank. Therefore, establishing a virtual bank by investing in metaverse banking development seems to be a fruitful option with a strong client base and multiple revenue generation options.

Major Metaverse Banking Use Cases

Metaverse banking, within the virtual world, offers a range of compelling use cases. These scenarios demonstrate the unique advantages of providing financial services in the metaverse. Some of the prominent metaverse banking use cases are:

1. Virtual Currency Exchange and Trading

- Metaverse banks facilitate the exchange of real-world currencies for virtual currencies like metaverse NFTs or cryptocurrencies.

- Users can engage in currency trading, taking advantage of price fluctuations in virtual currency markets.

2. Digital Asset Management

- Metaverse banks offer digital wallets for users to store and manage various digital assets, including cryptocurrencies, NFTs, and virtual properties.

- These wallets provide a secure and user-friendly interface for asset tracking and organization.

3. In-Game Financial Services

- Within the metaverse, users can access in-game banking services to manage their finances in virtual environments.

- Gamers can make in-game purchases, sell virtual assets, and earn rewards within the gaming ecosystem.

4. Virtual Real Estate Transactions

- Metaverse banks play a pivotal role in virtual property transactions, including the buying and selling of virtual land, real estate, and digital properties.

- Users can leverage secure digital contracts and payment gateways for these transactions.

5. Micropayments and Microtransactions

- Metaverse banking supports micropayments, enabling users to make small transactions for virtual goods, services, or content.

- This use case is particularly important for creators, artists, and content providers who monetize their work in the metaverse.

6. Virtual Events and Ticketing

- Metaverse banks handle ticket sales for virtual events, such as concerts, conferences, or immersive experiences.

- Users can securely purchase tickets, gaining access to these events via their digital wallets.

7. Business Services for Virtual Entrepreneurs

- Metaverse banks offer tailored financial services for virtual businesses and entrepreneurs.

- This includes loans, financing for virtual startups, and corporate banking services within the metaverse, fostering economic growth in the virtual economy.

8. Financial Education and Advisory

- Metaverse banks provide financial education and advisory services in virtual spaces.

- Users can attend virtual seminars and workshops on financial literacy, investment strategies, and other relevant topics.

How Antier can Help?

As the metaverse continues to integrate into our daily lives, the versatility and impact of metaverse banking is quite apparent. The opportunities that metaverse banking solutions offer are multiple and make the business expansion easy and worthy. Metaverse banks are not just facilitators of transactions; they are enablers of immersive financial experiences, fostering a new era of global, secure, and interactive virtual economies.

If you also wish to start your own virtual bank, Antier can be your ideal partner as a leading metaverse banking solution provider. We offer tailored metaverse banking solutions that cater to the specific needs of businesses venturing into the virtual realm, and each solution aligns with your unique requirements. With Antier by your side, you can efficiently enter this new space and climb the ladder of success with ease.

What are you waiting for? Get in touch now!