Among the most sought-after solutions in decentralized finance are staking platforms where a user can earn passive income through the act of locking his cryptocurrency assets. However, the development and maintenance of a sustainable long-term DeFi staking platform requires a focus on scalability and security. As the DeFi domain grows, pressure mounts from user demands, network congestion, and malicious actors urging platforms to adapt and evolve. Therefore, future-proofing one’s staking platform would mean not just scalability and security for the longevity and relevance of a staking platform but also the anticipation of new trends and user needs. We’re going to outline strategies and best practices for DeFi staking platform development to help businesses develop platforms that last the test of time in this guide.

Table of Contents

- DeFi Staking Platforms: A Brief

- The Need for Scalability in DeFi Staking Platform Development

- Scalability Solutions for DeFi Staking Platforms

- How & Why to Ensure Security in the DeFi Staking Platform?

- Building a User-Centric DeFi Staking Platform- Essential Considerations

- Compliance and Regulatory Considerations

- Future Trends in DeFi Staking Platform Development

- Final Remarks

DeFi Staking Platforms: A Brief

A DeFi staking platform is basically a decentralized application, or dApp, allowing users to lock their cryptocurrency assets into smart contracts in order to earn staking rewards. They are different from traditional financial systems because they lack central authorities to ensure transparency, efficiency, and security.

Benefits:

- Passive Income Opportunities: Users earn rewards by staking their tokens, often receiving interest in the form of the staked cryptocurrency.

- Decentralization: Eliminates the need for intermediaries, giving users greater control over their funds.

- Ecosystem Growth: Staking supports network security and scalability while incentivizing user participation.

DeFi staking platform development with scalability and security at its core can help businesses attract more users while staying ahead of industry trends.

The Need for Scalability in DeFi Staking Platform Development

Why Scalability Matters?

Scalability is the ability of a system to handle an increasing number of transactions without compromising performance. For DeFi staking platforms, scalability is crucial because:

- Increased User Adoption: As more users join the DeFi staking platform, it must support higher transaction volumes seamlessly.

- Cost Efficiency: Scalable platforms reduce gas fees, making staking more attractive to users.

- Enhanced User Experience: Faster transaction speeds lead to a smoother user journey.

- Market Competitiveness: A scalable platform can adapt to growth and outperform competitors, ensuring long-term success.

- Support for Innovations: Ensuring scalability in DeFi staking platform development allows for the integration of advanced features like AI-driven insights or cross-chain functionalities.

Common Scalability Challenges

- Network Congestion: All the prominent blockchains, for example, Ethereum have high traffic issues, which delay their transactions and don’t provide the best user experience.

- High Gas Fees: High demand can lead to high transaction fees, which deters users and reduces activity on the platform.

- Smart Contract Limitations: Poorly designed contracts can make performance suffer at peak activity times and raise the operational cost.

- Infrastructure Bottlenecks: Limited processing power or outdated architecture can hinder growth and lead to downtime.

Future-proofing your DeFi staking platform requires addressing these challenges with innovative solutions tailored to the platform’s unique requirements.

Scalability Solutions for DeFi Staking Platforms

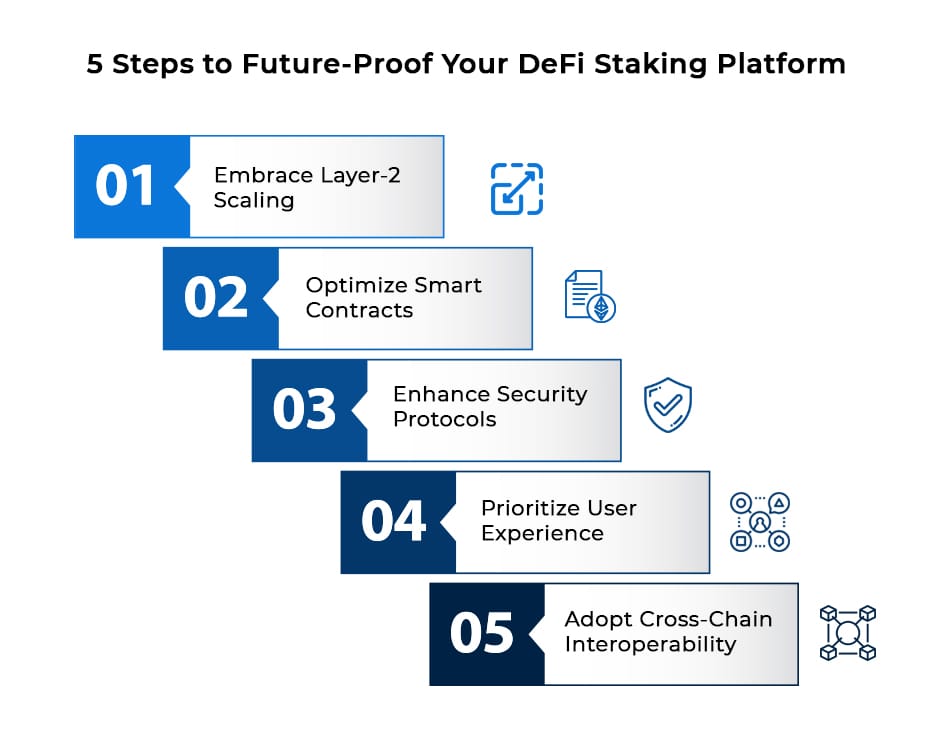

- Layer-2 Solutions

Layer-2 scaling solutions, such as rollups and sidechains, offload transactions from the main blockchain while maintaining security. These solutions for the DeFi staking platform development reduce congestion and fees, enabling platforms to handle more users. Popular examples include Optimistic Rollups and zk-Rollups, which offer unique advantages in terms of speed and cost-effectiveness.

- Sharding

Sharding divides the blockchain into smaller partitions or shards that process transactions independently. This method increases throughput and scalability without compromising decentralization in the DeFi staking platform. Every shard acts like a mini-blockchain where parallel processing of transactions and data storage can take place. Even platforms like Ethereum 2.0 are using sharding for better performance.

- Optimized Smart Contracts

Well-designed smart contracts have minimized gas usage and therefore result in quicker execution. Using tools such as Solidity Optimizers and modular contract architectures reduces operational costs while improving reliability. Constant contract review and upgradation ensures increased overall efficiency of the platform.

How & Why to Ensure Security in the DeFi Staking Platform?

Common Security Threats for DeFi Staking Platform Development

- Smart Contract Vulnerabilities: Poorly written code can be exploited by attackers, leading to the loss of funds or platform downtime.

- Phishing Attacks: Malicious actors may deceive users into revealing sensitive information through fake websites or messages.

- Front-Running: Exploiting the time delay in transactions to gain an unfair advantage by altering the order of execution.

- Private Key Compromise: Unauthorized access to the DeFi staking platform with users’ private keys can lead to fund theft and loss of trust in the platform.

- Oracle Manipulation: Attackers may exploit oracles to tamper with data fed to smart contracts, leading to erroneous outputs and financial losses.

- Sybil Attacks: Creating multiple fake identities to manipulate network processes or governance mechanisms.

Best Practices for Security

- Conduct Comprehensive Audits: Regularly audit smart contracts post the DeFi staking platform development to identify and mitigate vulnerabilities. Independent third-party audits add credibility and reliability.

- Implement Multi-Signature Wallets: Require multiple authorizations for sensitive transactions to enhance security and reduce risks of fraud.

- Adopt Decentralized Oracles: Use reliable and tamper-resistant oracles for accurate data inputs. Oracle redundancy ensures data integrity.

- Enable Two-Factor Authentication (2FA): Add an extra layer of security on the DeFi staking platform for user accounts, reducing risks from compromised credentials.

- Monitor in Real-Time: Deploy monitoring tools to detect and respond to suspicious activities immediately. Use AI-powered tools for anomaly detection.

- Educate Users: Provide clear guidelines and warnings about potential threats, ensuring that users follow best practices for securing their accounts.

Building a User-Centric DeFi Staking Platform- Essential Considerations

Importance of User Experience

User experience (UX) is a critical component in the success of any DeFi staking platform development. An intuitive, seamless, and engaging interface not only attracts users but also ensures they stay and actively participate. A poor UX can lead to frustration and user attrition, negatively impacting the platform’s reputation and profitability.

- Features That Enhance Usability

- Responsive Design: Ensure the DeFi staking platform is accessible across devices, including desktops, tablets, and mobile phones.

- Simplified Onboarding: Streamline the registration and staking process with user-friendly guides and tutorials.

- Transparent Metrics: Display clear and real-time information on staking rewards, locked assets, and other key metrics.

- Customizable Dashboards: Allow users to personalize their experience by selecting preferred views and features.

- Integrated Support: Provide quick and efficient customer support through chatbots, FAQs, and live assistance.

- Gamification Elements: Add reward-based elements during the DeFi staking platform development such as badges or leaderboards to increase user engagement.

- Localization: Offer multilingual support to cater to a global audience and ensure inclusivity.

Compliance and Regulatory Considerations

- Navigating Legal Challenges

Operating a DeFi staking platform requires adherence to a complex web of regulations that vary across jurisdictions. While DeFi inherently promotes decentralization, regulatory compliance ensures the platform’s long-term sustainability and protects users. Key considerations include:

- AML and KYC Compliance: Implement anti-money laundering (AML) measures and know-your-customer (KYC) protocols to verify users and prevent illicit activities.

- Licensing Requirements: Obtain appropriate licenses in regions where the platform operates to ensure legal legitimacy.

- Tax Obligations: Clearly define tax reporting processes for users to meet their local financial obligations.

- Privacy Laws: Adhere to data protection regulations related to the DeFi staking platform development to ensure the privacy and security of user information.

- Adopting Governance Models

Integrating governance mechanisms fosters transparency and aligns the platform with regulatory expectations. Options include:

- DAO Implementation: Decentralized Autonomous Organizations (DAOs) enable community-led decision-making while ensuring platform accountability.

- Transparent Reporting: Regularly update stakeholders on the platform’s financial performance, audits, and compliance status.

- Smart Contract Regulations: Code smart contracts to automatically enforce regulatory requirements, minimizing human error.

Adopting proactive compliance strategies builds user trust and enhances the platform’s reputation, making it a preferred choice for stakeholders.

Future Trends in DeFi Staking Platform Development

1. AI and Automation

The integration of AI and machine learning is transforming the DeFi staking platform by enhancing operational efficiency and user experiences. Examples include:

-Predictive Analytics: Use AI to forecast staking rewards and market trends, helping users make informed decisions.

-Automated Portfolio Management: Offer AI-driven tools for users to optimize their staking strategies and maximize returns.

-Enhanced Security: Leverage AI for real-time threat detection and fraud prevention.

2. Cross-Chain Interoperability

As the blockchain ecosystem expands, cross-chain interoperability is becoming essential for the DeFi staking platform development. Advantages include:

-Access to Diverse Assets: Enable users to stake tokens across multiple blockchain networks seamlessly.

-Enhanced Liquidity: Interoperability reduces fragmentation and fosters a more robust ecosystem.

-Future-Proofing: Platforms that support multiple blockchains are better equipped to adapt to industry changes.

3. NFT Integration

The merging of DeFi and NFTs can unlock new opportunities, such as staking NFTs to earn rewards or collateralizing them for loans. Exploring NFT utilities in your DeFi staking platform can add an innovative edge.

4. Sustainability Initiatives

As the world focuses on eco-friendly solutions, DeFi staking platform development can adopt sustainable practices by integrating green blockchains or incentivizing eco-conscious behaviors.

Final Remarks

Future-proofing your DeFi staking platform is not just about addressing current challenges; it’s about anticipating future needs and integrating cutting-edge solutions to stay ahead.

Pointers to Remember

- Scalability and security are the cornerstones of a successful DeFi staking platform.

- User-centric designs and compliance ensure trust and loyalty.

- Staying updated with trends like AI and cross-chain interoperability can keep your platform competitive.

Developing a DeFi staking platform that is scalable, secure, and user-friendly requires expertise and innovation. As a leading DeFi staking platform development provider, Antier specializes in creating tailored solutions that cater to your business needs. Ready to future-proof your platform? Let’s build together.