How to Build a Trading Platform Leveraging White Label Exchange on Aptos?

April 11, 2025

Why the Pharma Industry Needs Blockchain for Drug Traceability in 2025

April 14, 2025The race to redefine finance is on, and the winners are choosing more intelligent infrastructure, not just sleeker apps. As embedded finance reshapes how consumers interact with money, businesses are no longer asking if they should integrate digital banking; they’re asking how fast they can do it, and who they can trust to do it right.

That’s where your choice of a neo banking as a service provider becomes mission-critical. It’s about plugging into a trend and aligning with a platform that can architect your success, scale with your ambition, and secure your future.

Let’s decode how to make that decision, strategically!

What is Neo Banking As a Service?

Neo Banking as a Service (NBaaS) is the powerful engine behind the new wave of digital financial innovation. At its core, it enables businesses, whether fintech startups, SaaS platforms, or eCommerce ecosystems, to offer banking-like services without becoming a licensed bank. Think of it as banking infrastructure, delivered via APIs, fully modular, and instantly scalable.

Instead of building everything from scratch—compliance systems, payment rails, customer verification, account management—you plug into a pre-built tech stack offered by a neo banking as a service provider. You can launch virtual IBANs, digital wallets, branded cards, real-time payments, or FX services with minimal development overhead.

How Secure and Compliant Is the NBaaS Platform?

Security and compliance aren’t just checkboxes, they’re the foundation of any reliable NBaaS architecture. Today’s high-performing NBaaS platforms need to go far beyond basic encryption. The best platforms are built with security at their core, adhering to global standards like ISO/IEC 27001, SOC 2 Type II, PCI-DSS, and PSD2 to ensure airtight data protection and regulatory compliance across multiple regions.

It doesn’t stop there. The top-tier NBaaS solutions also come with RegTech capabilities, real-time KYC and KYB, automated AML checks, and detailed audit trails that keep everything transparent and compliant.

Choosing a security-first NBaaS Provider has never been more critical, as cyber threats are becoming more sophisticated and data breaches are hitting new highs. It’s about ticking security boxes and understanding how each provider handles regulatory updates, data localization needs, and ongoing risk management. That level of diligence can make all the difference when scaling a secure and compliant financial product. But security is just one piece of the puzzle. It’s important to look at how a neo banking as a service provider contributes to the larger picture—building a connected, scalable, and innovative digital banking ecosystem.

Role of NBaaS Provider in Developing a Digital Banking Ecosystem

Building a modern banking experience today means more than great design—it demands real-time tech, compliance, and agility. A skilled neo banking solution provider provides all that and more, helping you launch smarter, not harder.

Here’s how a modern Neo Banking as a Service Provider powers digital transformation :

- Modular Core Banking Infrastructure – NBaaS platforms replace legacy systems with cloud-native, API-driven modules that allow faster product rollouts.

- Regulatory & Compliance Shield – The right provider integrates KYC, AML, and fraud detection natively, ensuring your digital bank is secure and regulator-ready.

- Real-Time Payments & FX – From instant transfers to global payouts, neo banking as a service (NBaaS) platforms unlock real-time, multi-currency capabilities.

- White-Label Branding – Neo banking solution providers help businesses offer fully branded interfaces, cards, and experiences.

- Data-Driven Intelligence – NBaaS infrastructure provides real-time analytics, helping you personalize offerings and optimize customer journeys.

- Developer-Friendly Tooling – Top banking as a service providers drastically reduce integration time with prebuilt SDKs, sandbox access, and plug-and-play APIs.

One of the top banking as a service providers doesn’t just enable banking, they co-create ecosystems that drive revenue, retention, and regulatory trust. However, the real challenge lies in identifying a partner who can meet both your current requirements and future ambitions. This is where understanding the critical evaluation factors becomes vital.

Considerable Factors While Choosing Neo Banking as a Service Provider

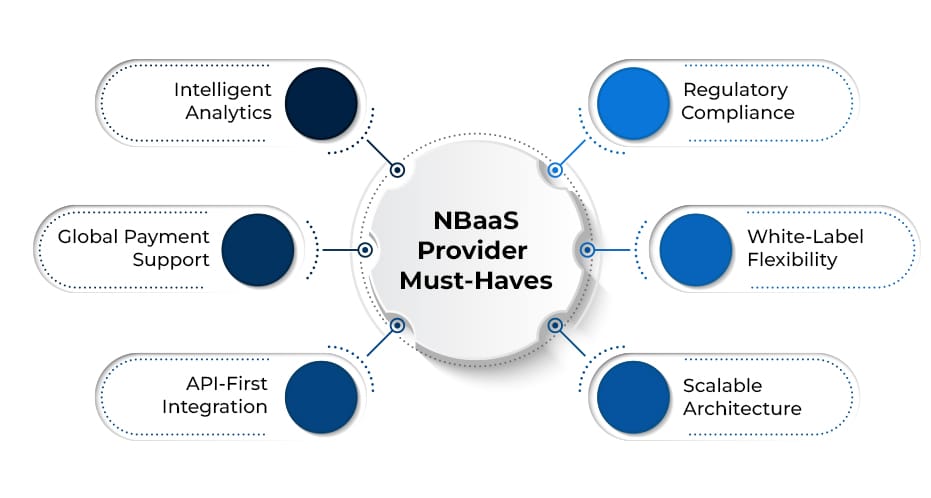

Choosing the right neo banking as a service provider can either accelerate your business or hold it back. To ensure you’re making the right call, here are six mission-critical factors you should never overlook:

- Compliance & Licensing : A reliable NBaaS provider must adhere to regional and international regulations like PCI-DSS, GDPR, and PSD2. Compliance is your first layer of trust.

- Customizability & Branding : A robust neo banking provider should offer deep white-label flexibility, letting you build and own a customer-centric experience across all layers.

- Scalability of Infrastructure : Your chosen neo banking solution provider should offer a cloud-native, modular architecture that grows with your business, without performance drops.

- Developer-First APIs : A modern NBaaS Provider should come with clean documentation, sandbox environments, and easy SDK integrations to reduce time to market.

- Global Payments & FX Readiness : Looking to go cross-border? Your provider must support global IBANs, SWIFT, SEPA, and FX management.

- Data-Driven Insights : From transaction analytics to user behavior—your neo banking as a service (NBaaS) platform should empower decisions through data.

Choose a provider that’s built for scale, speed, and strategic success. The next step? Knowing exactly what to evaluate before you commit. Here are verified strategies to help you choose the right NBaaS Provider with confidence.

Verified Strategies to Select the Ideal NBaaS Provider for Your Business Needs

Choosing the right NBaaS Provider is more than a checkbox—it’s a strategic edge.

- Check for banking licenses and compliance with PSD2, PCI-DSS, and GDPR.

- Prioritize modular APIs that plug smoothly into your tech stack.

- Ask about scalability—can they support 10x user growth?

- Look for built-in KYC/KYB, AML, and risk controls.

- Verify integration timelines—you want speed without compromising quality.

- Demand transparency in pricing, uptime, and SLAs.

These strategies turn your search for a high-performance NBaaS provider into a calculated growth move, not a risky bet. However, making the right choice isn’t just about what to look for, it’s also about knowing what to steer clear of. In a landscape filled with bold claims and fast-moving innovation, overlooking red flags or skipping due diligence can cost your business more than capital; it can delay your entire go-to-market plan.

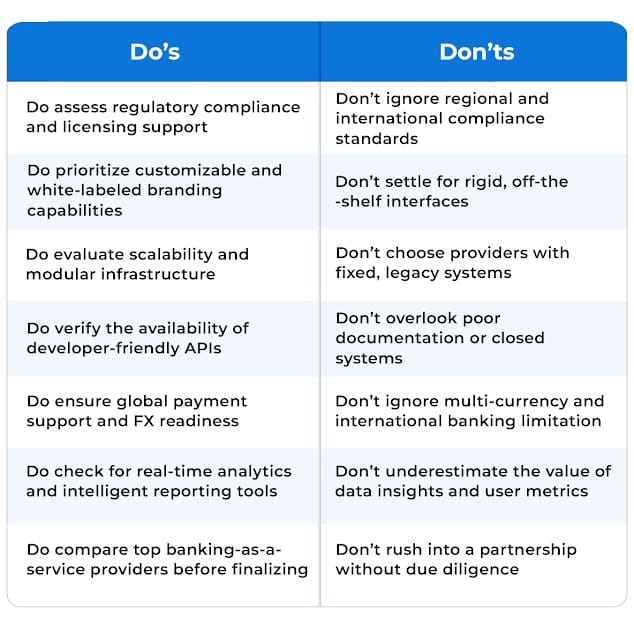

The Do’s & Don’ts of Selecting a Neo Banking as a Service Provider

Before committing to any neo banking solution provider, it’s essential to know what separates a reliable platform from a short-sighted choice. Here’s a clear breakdown of strategic do’s and critical don’ts that will guide your selection process:

As the market becomes more saturated, staying focused on what truly matters, compliance, scalability, developer readiness, and global accessibility, will separate you from the competition. Keep this checklist handy as you compare top NBaaS providers; it’ll help you make a confident, well-informed choice.

Build, Launch, Scale—All with Antier’s NBaaS Expertise

Your vision deserves a foundation. That’s where Antier, one of the top Banking as a Service providers, comes in. We offer tailored beo banking as a service (NBaaS) solutions that cover everything from digital onboarding, payments infrastructure, and virtual IBANs to advanced fraud prevention and compliance tools. We blend cutting-edge fintech engineering with deep regulatory understanding to ensure your platform is future-ready and market-compliant from day one.

Let our experts handle the complexity, you can focus on strategy and scale. Partner with Antier, the trusted NBaaS provider driving real-world results.