Why White Label Gaming Solutions Are the Future of Game Development?

April 8, 2025

Exploring the Best Mobile Wallet App Development Companies- 2025

April 8, 2025Gold has been among the safest commodities for trading for thousands of years. It’s a symbol of wealth and security against economic uncertainties. However, with the evolution of the financial landscape, the approach to gold management and trading has also changed. Tokenized gold Assets now represent the physical gold as digital tokens on a blockchain for secure and transparent trading. The Gold Tokenization Development Services not only combine security with flexibility and accessibility but also represent exciting trading opportunities.

Entrepreneurs and companies looking to enter this space require a Gold Tokenization Platform, and this guide walks through the process. Read on to learn about the essential components, technical requirements, regulatory considerations, and implementation steps for creating a gold tokenization platform.

What Is Gold Tokenization?

Gold tokenization converts ownership rights of physical gold into digital tokens on a blockchain. Each token represents a specific amount of gold (typically 1 gram or 1 troy ounce) stored in secure vaults. These tokens can be bought, sold, and transferred instantly across the globe, unlike physical gold, which is cumbersome to transport and divide.

Key Benefits of Gold Tokenization

- Fractional Ownership: Investors can purchase small amounts of gold, reducing barriers to entry.

- Enhanced Liquidity: Digital Gold tokens are tradable 24/7 on global markets.

- Reduced Costs: The Tokenized Gold Assets have lower storage, insurance, and transaction fees compared to physical gold.

- Transparency: The transaction and ownership details of Tokenize Gold assets are on blockchain, which is immutable.

- Programmability: The Gold Tokenization Platform uses smart contracts to enable the automatic execution of trades, dividends, and other functions, so there is no chance of false transactions and thefts.

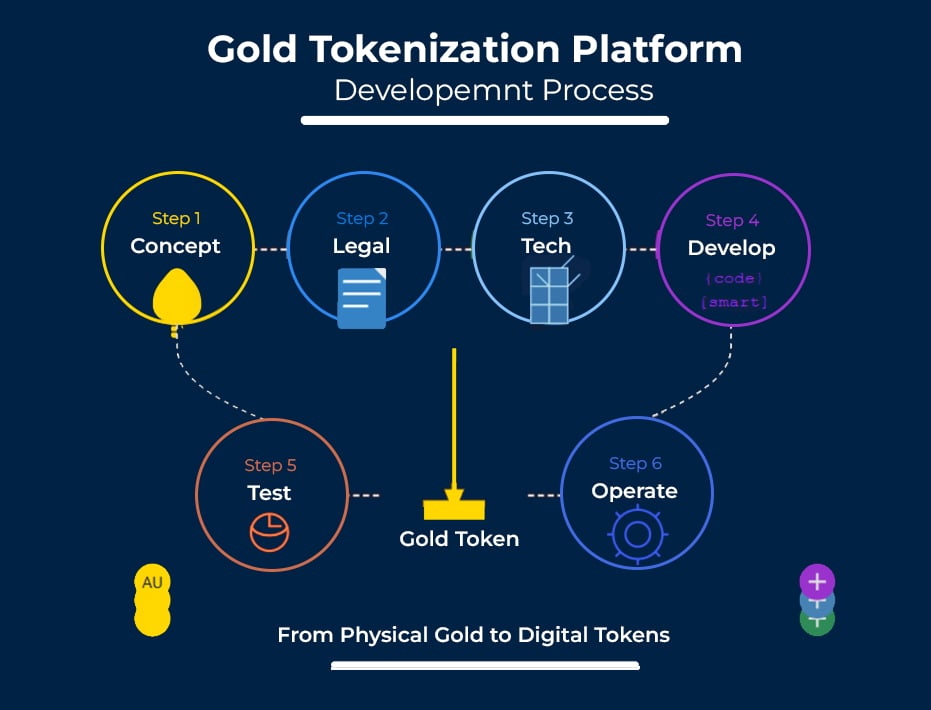

How To Build a Gold Tokenization Platform on Blockchain: A Step-By-Step Guide

Step1: Conceptualization

Start by defining why you want to Tokenize Gold Assets. Do you want to make gold ownership more accessible by allowing people to buy fractions of gold? Or you want to make gold trading faster and simpler. Your core purpose shapes everything that follows.

For example, if accessibility is your goal, you’ll design a platform that lets people buy very small amounts of gold, maybe just a few dollars’ worth. If you’re focusing on trading, you’ll prioritize features that make transactions quick and seamless.

Tokenization Model

Once you know the purpose, you need to decide what your tokens represent. Most platforms choose one of two approaches:

- Fixed quantity model: Each token equals a specific amount of gold (like 1 gram or 0.1 ounce)

- Variable price model: Tokens fluctuate in value to always equal a certain dollar amount of gold

The fixed model is more intuitive for users (“I own 10 grams of gold”), while the variable model might be easier for certain financial applications.

Targeted Audience

Who will use your platform? Regular people looking to diversify your savings? Serious investors? Professional traders? Each group has different needs:

- Crypto investors looking for “stable” assets.

- Traditional investors wanting blockchain benefits for gold holdings.

- People in regions with currency instability seek gold exposure.

- DeFi participants looking for gold-backed collateral.

Step 2: Legal and Regulatory Framework

Beyond standard regulations, blockchain gold tokens have unique requirements:

Compliance Research

This step is crucial. You need to thoroughly understand:

- Securities laws in your jurisdiction (gold tokens may be classified as securities)

- Money transmission regulations

- Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements

Partner with lawyers who specialize in both financial regulations and blockchain technology. This combination of expertise is essential to navigate this complex area.

Custodian Partnerships

You need someone trustworthy to physically store the gold. Look for established gold custodians with:

- Strong security measures.

- Insurance coverage.

- Regulatory compliance.

- Experience working with digital assets.

Negotiate detailed agreements covering liability, access rights, insurance, and audit procedures.

Audit Systems

Trust is everything for a gold-backed token. Set up regular third-party audits to verify that:

- The physical gold exists in the specified quantity.

- It meets quality standards.

- It’s properly secured.

- The token supply accurately reflects the gold reserves.

Make audit results publicly available to build trust with users.

Step 3: Technical Architecture

Your blockchain choice decides everything from transaction speed to security. Each blockchain offers different benefits for gold tokenization:

- Ethereum: This is the largest ecosystem but has higher gas fees.

- Solana/Avalanche: Faster transactions, lower fees.

- Binance Smart Chain: Cost-effective with wide adoption.

- Polygon: Ethereum scalability with lower costs.

- Hyperledger: A Private blockchain for enterprise solutions.

Smart Contract Standards

The Smart contracts will govern how your gold tokens will function on the Blockchain network. Beyond Basic ERC-20/721, your Gold Tokenization Platform requires:

- ERC-1155 for both fungible/non-fungible gold representations

- EIP-2535 Diamond standard for upgradable contracts

- Layer 2 solutions for reducing transaction costs

Web3 Integration

Your platform needs integration of:

- Web3.js or Ethers.js libraries for blockchain interaction.

- Multi-signature wallet for transactions.

- Cold storage solutions for private keys.

- Regular security audits of smart contracts.

- Bug bounty programs.

- Penetration testing.

Step 4: Development Process

Advanced Smart Contract Development

Gold tokenization needs specialized contracts for:

- Reserve proof verification.

- Oracle integration for gold prices.

- Governance mechanisms for upgrades.

- Fee structures for operations and redemptions.

- Emergency pause functionality.

Vault Integration

Connect your platform to your physical gold storage:

- Develop APIs to receive vault confirmation of gold deposits/withdrawals

- Implement oracle systems (like Chainlink) to get real-time gold prices

- Create automated systems to adjust token supplies based on vault activity

- Build inventory management systems to track specific gold bars

Core Platform Features

Beyond basic token functionality, include:

- A user-friendly wallet interface

- KYC/AML verification processes

- Multiple payment options for purchasing tokens

- Redemption processes for converting tokens back to physical gold

- Real-time reporting on gold reserves and token circulation

- Price feeds showing current gold values

Step 5: Testing and Deployment

Security Testing

Financial platforms require extensive security measures:

- Hire specialized firms to audit smart contracts

- Conduct penetration testing on all platform components

- Run stress tests to ensure stability under load

- Test against common attack vectors (like replay attacks)

User Testing

Before launch, test with real users to:

- Verify that the onboarding process is clear

- Ensure buying and selling works smoothly

- Check that all features are intuitive

- Identify any confusion points in the user journey

Deployment Strategy

Plan a phased rollout:

- Internal testing environment

- Limited beta with selected users

- Public testnet with play money

- Mainnet launch with limited functionality

- Full feature rollout

- Post-launch Operations

Platform Monitoring

Set up comprehensive monitoring systems:

- Smart contract activity monitoring

- Transaction volume alerts

- Unusual activity detection

- Price movement tracking

- Vault inventory reconciliation

User Support and Education

Gold tokenization is still new to many people. Provide:

- Clear documentation explaining how the platform works

- Educational content about gold as an investment

- Responsive customer support

- Responsive customer support

Continuous Improvement

The blockchain space evolves rapidly. Plan for:

- Regular security updates

- Feature enhancements based on user feedback

- Scaling solutions as user numbers grow

- Compliance updates as regulations change

Revenue Generation from Gold Tokenization Platform

Successful gold tokenization platforms generate revenue through multiple streams:

- Transaction Fees: 0.5%-2% on purchases and sales

- Storage Fees: 0.5%-1% annually based on holdings

- Redemption Fees: Flat fee plus logistics costs

- Premium on Gold Price: Small markup on gold spot price

- API Access: Fees for institutional or partner access

This is just the beginning

The Success of Gold Tokenization Platform Development requires careful attention to regulatory requirements, security best practices, and user experience. By following this guide, entrepreneurs can build platforms that make gold ownership more accessible, transparent, and flexible than ever before.

Partner With Antier to Build Custom Gold Tokenization Platform

Embark on your journey to develop a Custom Gold Tokenization Platform with Antier. Our team of seasoned blockchain developers and marketers offers comprehensive solutions, guiding you from concept to deployment. With expertise in creating secure, scalable, and user-friendly platforms, we ensure your venture into digital gold assets is seamless and successful.