How can businesses navigate the complexities of crypto neo-banking, where liquidity volatility, regulatory challenges, and security threats remain persistent obstacles? The answer lies in AI agents—a game-changing force in financial automation. Their rise in crypto-friendly neo banking solutions signifies a shift toward self-learning transaction models, AI-driven fraud detection, and intelligent asset management.

As financial markets become data-intensive and highly dynamic, integrating AI agents is no longer optional but a strategic imperative. With the ability to orchestrate real-time financial decisions and mitigate operational inefficiencies, AI-driven crypto neo-banking is shaping the future of financial autonomy. Businesses that embrace this evolution can position themselves at the forefront of a high-growth, AI-powered financial revolution, unlocking unparalleled revenue potential in the decentralized economy.

The Rise of AI Agents in Crypto Neo-Banking

The incorporation of AI agents into crypto neo-banking addresses critical challenges that exist in the digital financial ecosystem. Despite the rapid proliferation of crypto-friendly neo-banking solutions, institutions often grapple with scalability issues, cybersecurity threats, and the complexities of regulatory compliance. The dynamic nature of cryptocurrency markets further exacerbates these challenges, necessitating advanced technological interventions. AI agents, with their real-time data analysis and autonomous decision-making abilities, emerge as critical in navigating these complexities. Their implementation not only improves operational efficiency, but it also strengthens security protocols, resulting in robust and compliant financial operations.

As the demand for sophisticated crypto neobank development services escalates, the integration of AI agents stands as a testament to the industry’s commitment to innovation and resilience. This confluence of artificial intelligence and digital banking not only augments the functionality of neo-bank app platform development but also sets a new standard in delivering secure, efficient, and user-centric financial services. However, let us have a closer look at the difference between an AI-agent crypto neo-banking and convention neo-banking systems.

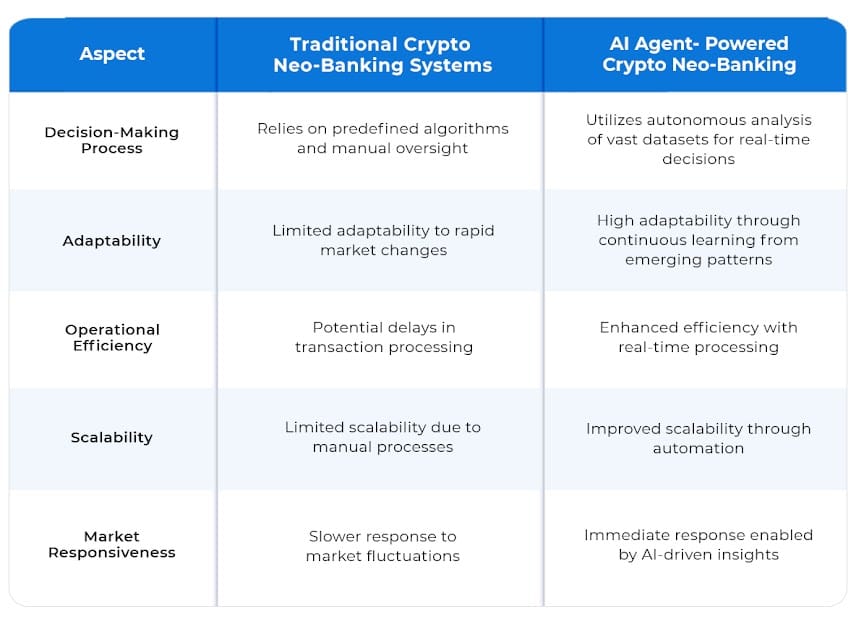

AI Agents vs. Traditional Neo Banking Systems

The integration of AI agents into crypto neo-banking solutions represents a significant evolution in the financial sector. Despite their innovation, traditional crypto neo-banking systems frequently rely on manual oversight and preset algorithms, which can limit their ability to adjust to swift changes in the market. AI agents, on the other hand, are made to independently examine enormous datasets, pick up on new trends, and make decisions in real time, all of which improve operational responsiveness and efficiency.

This advancement addresses several pain points inherent in traditional systems, such as delayed transaction processing and limited scalability. As the demand for advanced crypto neobank development services grows, the adoption of AI agents is becoming increasingly prevalent, offering more dynamic and efficient solutions.

Why Invest in Crypto Neo Banking With AI-Agent Integration?

- Fraud Prevention & Enhanced Security – AI agents continuously monitor transaction patterns and user behavior, ensuring real-time fraud detection and protection against security breaches. Their ability to detect anomalies proactively reduces cyber threats, guaranteeing higher security standards for investors and businesses.

- Advanced Crypto Asset Analysis – AI-driven algorithms analyze market trends and crypto asset performance, providing investors with precise insights and predictive analytics to enhance decision-making. This results in more accurate asset management, better portfolio optimization, and informed investment strategies.

- Automated Trading & High-Speed Execution – AI agents enable automated trading and high-frequency trading strategies, ensuring swift execution and optimal investment opportunities. This algorithmic trading boosts liquidity and minimizes risks, enabling faster responses to market fluctuations and enhancing overall profitability.

- Hyper-Personalized Services – AI agents tailor financial services and crypto asset recommendations based on individual user preferences and transaction history. This hyper-personalization increases user satisfaction and loyalty, offering bespoke solutions that meet specific financial needs and driving higher customer engagement.

- Regulatory Compliance & KYC/AML Automation – AI agents streamline KYC/AML compliance by automating real-time monitoring and ensuring adherence to international regulations. This reduces the complexity of legal frameworks and minimizes the risks associated with regulatory violations, ensuring smooth operational workflows for businesses.

- Real-Time Market Insights – AI agents provide real-time insights by processing vast amounts of data, offering actionable intelligence to stay ahead of market trends and optimize investment strategies. This empowers businesses to act quickly, improving market competitiveness and enhancing profitability.

- Cost Reduction & Operational Efficiency – AI agents in crypto-friendly neo- banking solutions significantly reduce operating costs by automating repetitive tasks like fraud detection, customer support, and transaction verification. This increased efficiency allows businesses to scale faster and improves service quality while minimizing the need for human intervention.

- Faster Decision-Making & Transaction Processing – AI agents integrated with neo-banking solutions enable instant decision-making and rapid transaction processing. With the capability to evaluate data in real-time, crypto neo-banks can offer faster approvals, ensure quicker access to funds, and improve user satisfaction by eliminating delays in high-stakes financial environments.

- Global Market Accessibility – AI agent crypto neo-banking app facilitates global accessibility by enabling seamless transactions across borders and integrating multiple cryptocurrencies, all while ensuring compliance with varying regulations worldwide. This makes crypto neo-banking platforms more accessible to a global investor base, allowing users to interact with markets internationally.

- Strategic Growth Opportunities – With AI-driven analytics, crypto neo-banks can identify emerging trends, investment opportunities, and new market segments. AI helps businesses unlock strategic growth opportunities by offering insights into areas with untapped potential, ensuring they stay ahead of competitors and maintain a leadership position in the market.

- Real-Time Customer Support & Engagement – AI agents enhance customer support by offering instant, 24/7 responses through chatbots and automated systems. This ensures continuous engagement, addressing user inquiries, transaction issues, and concerns in real-time, fostering a deeper connection, and improving overall customer satisfaction.

Key Features of AI Agents in Crypto-Neo-Banking

✓ Real-Time Data Processing : AI agents process vast amounts of transactional and market data instantly, ensuring immediate responses to market fluctuations in crypto-neo-banking.

✓ Autonomous Decision-Making : AI agents autonomously execute transactions and adjust investment strategies based on market analysis, enhancing operational efficiency in NeoBank App Platform Development.

✓ Natural Language Processing (NLP) : AI agents use NLP for dynamic, user-friendly interactions via text and voice, enhancing customer support and engagement in crypto-friendly neobanking solutions.

✓ Anomaly Detection for Security : AI agents monitor transactions in real-time, identifying fraud risks and enhancing security with intelligent anomaly detection systems.

✓ Machine Learning-Driven Portfolio Optimization : AI agents continuously optimize portfolios, analyzing market trends, risks, and user preferences for personalized financial management.

✓ Automated Compliance Monitoring : AI agents automatically track evolving regulatory requirements, ensuring compliance with global crypto regulations for Crypto Neobank Solution Providers.

✓ Multi-Currency & Multi-Chain Transaction Support : AI agents enable seamless cross-chain and cross-currency transactions, optimizing cost efficiency for global users.

✓Risk Assessment Models : AI agents assess user behavior and market conditions, evaluating potential risks and adjusting financial strategies in real-time.

✓ Hyper-Personalized Financial Assistance : AI agents provide customized financial recommendations based on user data, enhancing the personalized experience in crypto-neo-banking.

✓ Smart Contract Automation : AI agents integrate with blockchain to execute smart contracts autonomously, reducing the need for intermediaries and improving transaction speed.

✓ Voice Recognition Authentication : AI agents use voiceprints for secure authentication, enabling password-free, hands-free access to crypto accounts.

✓ User Behavior Analytics : AI agents track user interactions, providing insights for further personalized offerings and enhancing engagement in crypto-neo-banking.

How to Build a Crypto Neo-Banking Platform with AI-Agent Integration?

An AI-agent-driven crypto-neo-banking platform development demands a structured approach, leveraging blockchain scalability, AI automation, and cryptographic security. Let us have a deeper understanding of the strategic approach followed by a renowned and experienced crypto Neobank solution provider. Implement these five advanced steps:

Step 1. Architect the AI-Powered Blockchain Infrastructure

Design a decentralized financial architecture with AI-compatible smart contracts, cross-chain liquidity protocols, and distributed ledger integration to facilitate high-speed, trustless transactions.

Step 2. Engineer an AI-Infused Banking Core

Develop a self-optimizing financial engine integrating machine learning-driven risk modeling, predictive analytics, real-time transaction orchestration, and autonomous asset management to enhance operational intelligence.

Step 3. Implement AI-Driven User Experience & Interaction Layer

Build a cognitive banking interface with AI-governed behavioral analytics, biometric multi-factor authentication, NLP-based virtual financial assistants, and adaptive UI frameworks for dynamic user personalization.

Step 4. Integrate AI-Enabled Security, Compliance & Governance

Deploy AI-augmented cryptographic security mechanisms, decentralized identity management (DID), zero-knowledge proof authentication, and real-time anomaly detection for regulatory compliance and fraud mitigation.

Step 5. Optimize, Deploy, and Calibrate AI-Agent Functionality

Execute synthetic AI training models, conduct high-frequency transaction stress testing, implement real-time AI-driven algorithmic adjustments, and integrate autonomous market-adaptive strategies for seamless AI-agent deployment.

Now that you are completely aware of the top-notch reasons why this integration is a smart investment during this bullish period, the features to include, and the creation process,. These extremely complex AI-agent development procedures were followed by crypto-neo-bank development. Services achieve a next-generation crypto-friendly neobanking solution that operates with unparalleled efficiency, intelligence, and security.

The Future of AI Agents in Crypto Neo-Banking: What’s Next?

The fusion of AI agents with crypto neo-banking is accelerating the evolution of autonomous financial ecosystems in the Web3 era. AI-powered agents are redefining crypto-friendly neobanking solutions, enabling real-time decision-making across multi-chain networks, decentralized liquidity pools, and cryptographic governance frameworks. As crypto neobank development companies advance AI Agent’s role, the industry is moving towards self-regulating, AI-governed banking infrastructures that eliminate traditional inefficiencies.

Future NeoBank App Platform Development will see AI agents autonomously executing on-chain asset rebalancing, predictive financial modeling, and AI-driven compliance enforcement. These intelligent agents will integrate with DAOs and cross-chain oracles, ensuring seamless adaptation to global regulatory landscapes. This transition marks the rise of AI-native digital banking, where self-learning financial systems will orchestrate a high-frequency, trustless financial paradigm, redefining the foundations of decentralized banking.

Create 100x Customer-Centric Crypto Neo Banking Platform With Antier

The integration of AI agents into crypto neo-banking is reshaping financial ecosystems, enabling self-learning transaction models, autonomous liquidity orchestration, and AI-driven risk intelligence. This next-gen transformation presents businesses with 100x ROI potential, leveraging algorithmic asset optimization, AI-enhanced trading engines, and adaptive compliance automation to maximize financial scalability.

Investing in this disruptive paradigm requires expertise. Antier, a leading crypto neo banking development company, offers certified blockchain experts to architect cutting-edge, AI-powered neo banking infrastructures. Connect with Antier’s fintech specialists to develop a high-performance, AI-driven banking solution, engineered for autonomous financial intelligence and long-term business growth in the decentralized economy.