The real estate market is now breaking the traditional barriers through innovative Real Estate tokenization platforms. While property investment has historically been the domain of wealthy individuals and institutions, blockchain is rewriting the rules. Real estate tokenization transforms physical properties into digital assets, making investment accessible to a broader audience. This groundbreaking approach not only fractionalizes property ownership but boosts liquidity to an otherwise rigid market.

And, with smart contracts, the industry is moving toward a future where property investment is more transparent, efficient, and inclusive. The transformation promises to unlock trillions in real estate value while creating new opportunities for investors worldwide.

Challenges with Traditional Real Estate: How Tokenization Solving Them

The traditional Real Estate investment limits the market opportunities for investors due to several reasons discussed below:

- Investment Accessibility

PROBLEM: The high capital requirements for real estate investment often exclude retail investors and limit the participation to wealthy individuals and institutions.

SOLUTION: Real estate tokenization offers Fractional ownership that allows small-scale investors to own property shares with minimal capital requirements.

-

Market Liquidity

PROBLEM: Traditional real estate sales processes are lengthy and complex, making it difficult to quickly access invested capital.

SOLUTION: The digital token allows businesses to enable instant trading on secondary markets, providing immediate liquidity and flexible exit options.

-

Transparency

PROBLEM: Real estate transactions lack transparency, with fragmented records and hidden fees complicating due diligence processes.

SOLUTION: Blockchain creates permanent, transparent records of ownership and transactions, ensuring complete visibility and trust.

-

Cost Efficiency

PROBLEM: Multiple intermediaries in traditional real estate transactions result in high fees and extended processing times.

SOLUTION: In Real Estate tokenization, smart contracts automate processes and eliminate unnecessary intermediaries, significantly reducing transaction costs and time.

-

Global Access

PROBLEM: International property investment through traditional methods faces regulatory hurdles and complex cross-border transactions, limiting market accessibility.

SOLUTION: With the Real Estate Tokenization platform, investors can invest in global property without worrying about geographical boundaries while maintaining regulatory compliance.

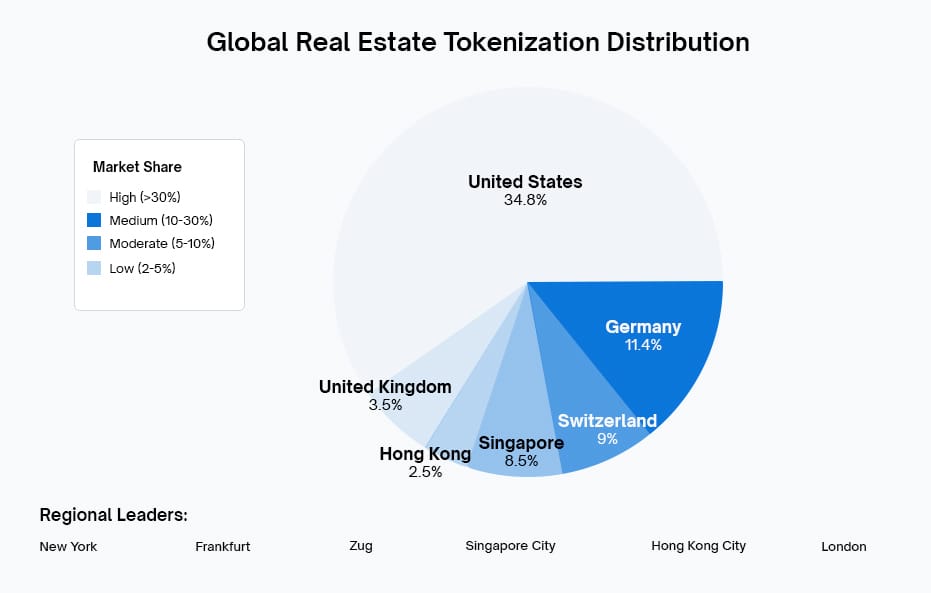

Regional Leaders in Real Estate Tokenization

1. United States (34.8% of Global Initiatives)

The U.S. leads the tokenization revolution, offering unprecedented opportunities for real estate professionals. The recent Bitcoin ETF approval has opened doors for traditional investors, while platforms like RealT and RedSwan are already transforming property investments. With tokenized assets exceeding $1.25 billion, the market is primed for real estate tokenization.

Regional Leader – New York: Manhattan’s luxury real estate market is embracing tokenization, allowing brokers and agencies to fraction high-value properties for broader investor access. The robust regulatory framework makes it ideal for launching tokenized real estate platforms.

2. Germany (11.4% of Global Initiatives)

Germany’s clear regulatory environment under KMAG law provides a secure foundation for real estate tokenization. The country’s alignment with the EU’s MiCA regulation offers unprecedented market access across Europe, making it attractive for real estate platforms seeking EU expansion.

Regional Leader – Frankfurt: Deutsche Börse’s infrastructure provides real estate professionals with reliable tokenization solutions, backed by strong financial institutions and regulatory clarity.

3. Switzerland (9% of Global Initiatives)

Switzerland’s privacy laws and financial regulations make it ideal for real estate tokenization platforms. The country’s experience with tokenized bonds provides a tested framework for property tokenization.

Regional Leader – Zug: “Crypto Valley” hosts 500+ blockchain companies, offering real estate professionals’ immediate access to technical expertise and investor networks for tokenization projects.

4. Singapore (8.5% of Global Initiatives)

Singapore’s Project Guardian and GL1 blockchain initiative provides a sophisticated infrastructure for real estate tokenization. The country’s regulatory clarity makes it perfect for Asian market entry.

Regional Leader – Singapore City: Progressive regulations and strong financial infrastructure enable the quick launch of tokenized real estate platforms, with ready access to Asian investors.

5. Hong Kong (2.5% of Global Initiatives)

Hong Kong’s recent regulatory clarity and successful tokenization of large bonds demonstrate its potential for real estate tokenization. The approval of crypto ETFs signals growing institutional acceptance.

Regional Leader – Hong Kong City: HSBC’s multi-currency tokenized products provide a template for real estate tokenization, with strong institutional support.

6. United Kingdom (3.5% of Global Initiatives)

The UK’s FSMA regulatory sandbox enables real estate professionals to test tokenization platforms safely. Coadjute‘s success in reducing property transaction times showcases the market’s potential.

Regional Leader – London: Prime real estate tokenization in Canary Wharf and Mayfair demonstrates the market’s readiness. The FCA’s clear guidelines facilitate quick platform launches.

Key Takeaways for Real Estate Professionals:

- Choose jurisdictions based on regulatory clarity and market readiness

- Partner with established financial institutions for credibility

- Focus on regions with successful tokenization precedents

- Consider market access and investor base when selecting locations

- Leverage existing infrastructure and technical expertise

Real Estate Tokenization: Stakeholder Benefits

Property Owners

- Unlock Liquidity: RWA enables property owners to tokenize their assets and access a global pool of investors.

- Reduce Costs: It shares cost-saving benefits through automated processes like rent collection and maintenance through smart contracts.

- Enhance Transparency: Provide immutable records of ownership and transactions.

For Investors

- Democratize Access: Retail investors can unlock high-value projects through the Real Estate Tokenization Platform.

- Increase Diversification: There could be fractional ownership across multiple properties and regions.

- Ensure Security: Blockchain can help to offer secure and transparent investment opportunities.

For Businesses

- Accelerate Fundraising: Tokenize projects contribute to raising capital from a global investor base.

- Expand Market Reach: It can help to attract investors from different regions and demographics.

Potential Applications of Real Estate Asset Tokenization

Tokenizing real estate assets offers exciting opportunities across a range of sectors, making it easier for investors to access a diverse set of property types. Here are some key areas where tokenization is making an impact:

Residential Real Estate

- Single-Family Homes: Tokenization allows individual investors to purchase fractional shares in single-family homes, broadening access to real estate investment.

- Multi-Family Units: Investors can purchase tokens representing stakes in multi-family buildings, receiving both rental income and benefits from property value appreciation.

Commercial Real Estate

- Office Buildings: Tokenizing office spaces enables investors to hold tokens that represent shares in rental income and capital appreciation.

- Retail Spaces: Shopping centers and retail stores can be tokenized, offering fractional ownership and increased liquidity for property owners and investors.

Industrial Real Estate

- Warehouses and Distribution Centers: Tokenizing industrial properties, such as warehouses, provides investors with exposure to the high-demand logistics sector, which has experienced rapid growth.

- Manufacturing Facilities: Investors can tokenize manufacturing plants, diversify portfolios, and gain exposure to the industrial sector’s expansion.

How to Tokenize a Real Estate Asset?

Tokenizing a real estate asset involves a series of essential steps to ensure smooth execution and compliance. Here’s a step-by-step guide to help you navigate the process:

- Project Ideation: Select suitable real estate assets for tokenization, ensuring clear ownership and no legal disputes.

- Choose a Tokenization Partner: Collaborate with a trusted Real Estate Platform development company for expert technical guidance.

- Initial Consultation and Requirement Gathering: The development company assesses your goals, asset type, and investor needs to align the project.

- Selecting the Blockchain Platform: Choose a scalable, secure, and compliant blockchain, like Ethereum or Polygon, for your tokenization.

- Designing Tokenomics: Develop a clear structure for token ownership, distribution, and value to attract investors.

- Token Development: Create tokens representing ownership, with smart contracts and strong security measures in place.

- Regulatory Compliance and Security: Ensure the tokenization process adheres to local and international legal frameworks.

- Token Sale: Conduct a Security Token Offering (STO) to raise capital and attract initial investors.

- Launch and Listing: List tokens on exchanges or real estate platforms to enable trading and broaden investor access.

- Ongoing Maintenance and Support: Provide continued technical support and regulatory updates, maintaining investor trust.

By 2025, the Real Estate Tokenization Platform will become essential for purchasing, selling, and listing real estate properties. It will open doors for small-scale investors to trade across borders and liquefy. The transactions will become more transparent, efficient, secure, and inclusive. For those who are willing to reap the benefits, it’s the right time to act.

How Antier Can Help?

Antier is a leading Real Estate Tokenization Development Company, dedicated to transforming your visionary ideas into tangible assets.

With Tokenization Platform Development Services, Antier empowers you to redefine real estate investment through blockchain innovation.

Our expertise spans building secure, scalable tokenization infrastructures, automating seamless transactions, optimizing property management processes, and ensuring full compliance with legal and regulatory frameworks. Antier guarantees a secure, efficient, and hassle-free transition to the world of tokenized real estate.

Let Antier be your trusted partner in shaping the future of real estate investment.