Transforming Your Lottery Business with Metaverse Casino Game Development

September 15, 2022

Knowing Essential Aspects of Developing A White Label Hybrid Exchange

September 16, 2022The advent of next-gen technologies and digital trends in a little over a decade has simply changed the meaning of banking. Traditional banking systems are gradually adapting to the changing times- credit cards and touchless and cashless payments are a few real-life examples where the entire world adopted these practices which became the new normal with time.

Out of all, one notable invention that took the entire banking industry by storm is Crypto Friendly core banking platform.

What is a Crypto Friendly Core Banking Solution?

Crypto friendly banks are similar to traditional banks that provide a set of crypto-related services such as deposits and withdrawals, savings, lending, borrowing, and investing and are completely digital due to the growing demands and concerns of modern customers.

Crypto-friendly banks for business hold great potential of bringing crypto transacting, holding, and investing at ease, considering that these offerings will be made available to users across the same user-friendly dashboards being used for regular banking services.

Popular Examples of Crypto Banks Include:

- Revolut

- BankProv

- Wirex

- Ally Bank

- Barclays

- JPMorgan

- Goldman Sachs

- Bitwala

- Coinbase

Highlights of Crypto Banking Solutions

- Instant Settlements

- Better Capital Optimisation

- Minimized Counterparty Risks

- Improved Contractual Performance

- Maximized Transparency

- Enhanced Financial Solutions

- Reduced Error Handling and Reconciliation

- Better Compliance & Accountability

- Strengthened Security

- Faster Transactions

Metaverse: The Silver Bullet For Banking Space

What if I say instead of standing in the never-ending queue in the bank, you get to virtually visit your bank branch while resting on the couch?

Anyone would be amazed by such services.

This is what metaverse has to offer to modern bank customers while uplifting the entire banking industry!

Metaverse is here to present an immersive experience in a completely virtual environment backed by technologies like augmented reality (AR), virtual reality (VR), and the blockchain where individuals get to meet, interact, and where digital assets such as property, land, items, and avatars can be purchased and sold.

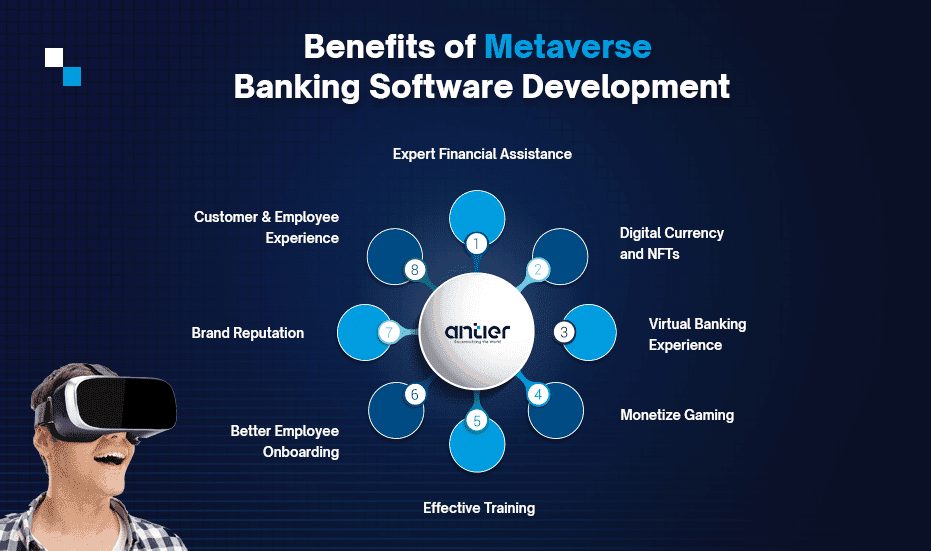

- Virtual Banking Experience

Rather than wasting time and effort visiting the bank branch and standing in long queues, metaverse crypto banking solutions help in bringing every banking operation to the fingertips of the user. All they need to do is have a stable Internet connection and set a secure pin and password to login into their virtual bank branch in the form of a customized avatar. That’s it! You are set to go. Paying bills, checking balances, and making transfers with AR/VR channels are all just a click away.

- Expert Financial Assistance

Metaverse crypto banking solutions hold the capability of ensuring virtual, accessible, and convenient financial planning and reviews, mortgage advice delivery, virtual annual portfolio reviews, and a lot more in a hassle-free manner. Modern banks powered with metaverse technology will offer virtual services but with a human touch that helps in strengthening customer interactions and relations in the long run.

- Digital Currency and NFTs

Since individuals are willing to spend real money for owning virtual assets, digital assets can now be exchanged and valued in the market. NFT tokens are a form of digital data that is stored in a blockchain, at this point, banks and financial institutions can utilize this chance for launching Exchange Traded Funds (ETF).

- Effective Training

Banks can build numerous use cases such as showing fund transfers, creating deposits, loans, credit cards, etc. These types of training and education tend to be more productive and fruitful unlike the traditional tutorials and teaching methods. In the long run, these tactics will enable banks in retaining customers and ensuring customer loyalty.

- Better Employee Onboarding

Metaverse helps with training sessions that aren’t confined to customers but will be helpful in ensuring a healthy yet strong bonding experience and understanding with new joiners and ensuring a more hassle-free onboarding process.

- Monetize Gaming

With the virtual gaming industry thriving like never before, banks can grab the opportunity to connect with the virtual games and reap more money while users play the games and earn rewards and get the loan and numerous other benefits in return. Banks can even invest in custom banking blockchain development solutions to go the extra mile and bring more functionalities.

- Customer and Employee Experiences

Implementing AR/VR technology will enable the banking industry in creating user and employee experiences in 3D. Metaverse banking will allow users to pay bills, make transactions, and check balances backed by AR/VR channels along with creating connection, fun, a sense of community, and create a simulated customer environment.

- Brand Reputation

Being an early adopter of next-gen technologies including metaverse will enable banks and financial institutions to grab the attention of the younger generation, data scientists, emerging banking enthusiasts, and most importantly, potential customers. These digital asset banking solutions will help in taking the brand name to new heights and gaining a competitive edge in the market.

The Takeaway

The concept of metaverse banking is all geared up to bring together individuals, spaces, and things in both the virtual and real worlds where modern banks and financial institutions get the chance to evoke a sense of community, share value, and build trust across their clientele in the long run. Metaverse in banking is not only a technology trend but has a great potential that is yet to be explored.

Investing in this thriving space is a win-win idea for banks, startups, and financial institutions in today’s time while gaining a competitive edge in the global market.

Jump into this bandwagon and leverage metaverse crypto banking solutions with Antier. We are a globally recognized digital agency with decades of experience in the crypto space backed by a strong portfolio of diverse crypto banking projects. Book a free consultation now.