What Does the Future Hold for Metaverse Real Estate Development?

January 16, 2025

The Ultimate 2025 Guide to Gamified Crypto Wallet Development

January 16, 2025Businesses that want to remain competitive in an increasingly decentralized world must implement new strategies. For discerning investors looking to capitalize on the next wave of innovation in digital finance, embracing stablecoins within the crypto neo-banking ecosystem presents an unparalleled opportunity.

As the market matures, the growing stability, scalability, and regulatory clarity surrounding stablecoins make them a pivotal asset class. Their ability to provide predictability in volatile markets positions them as the ideal solution for crypto-friendly neo-banking platforms, offering robust returns without the risks typically associated with traditional cryptocurrencies. Investors who seize this moment can align with a transformative shift in the global financial infrastructure, tapping into the rising demand for secure, low-cost, cross-border transactions, enhanced customer experiences, and regulatory-compliant solutions. The changing financial landscape is ripe for those who act now, establishing stablecoins as a foundation for future financial systems and securing their place at the forefront of tomorrow’s digital economy.

The Growing Popularity of Stablecoins in Global Finance

The stablecoin market was valued at USD 182.6 billion in 2024 and is projected to surge to USD 1,106.8 billion by 2035, reflecting a robust CAGR of approximately 17.8% from 2025 to 2035.

Stablecoins have witnessed an exponential rise in adoption, particularly in the global finance sector, due to their inherent ability to mitigate the volatility of traditional cryptocurrencies. Major companies like Stripe and PayPal have integrated stablecoins into their payment systems, recognizing the efficiency and cost-effectiveness they offer for cross-border transactions. This surge in demand is driven by the need for fast, secure, and stable alternatives to fiat currencies, especially in global remittances and DeFi.

Financial institutions are increasingly leveraging stablecoins to provide seamless digital payment solutions, reducing reliance on traditional banking intermediaries and enabling near-instantaneous transactions. The ability of stablecoins to maintain a fixed value, often pegged to the US dollar or other stable assets, makes them an attractive option for large-scale financial services, enabling predictable pricing models and reducing exchange rate risks. As regulatory frameworks solidify, stablecoins are poised to become a core component of mainstream financial infrastructure.

Stablecoins vs. Traditional Cryptos: Which is Better for Crypto Neo Banking?

The shift between stablecoins and traditional cryptocurrencies is driving the evolution of crypto neo-banking. While assets like Bitcoin and Ethereum are integral to decentralized finance, their volatility hinders their use in everyday financial services such as payments and lending within the development of neo- banking app platform.

Stablecoins, pegged to stable assets like the U.S. dollar or gold, offer unparalleled stability, making them a superior choice for crypto neobank development services. Their predictable value ensures secure transactions, savings, and financial planning without the risks tied to cryptocurrency price fluctuations. Crypto-friendly neo-banking solutions benefit from this stability, providing reliable services for users navigating the digital financial ecosystem.

As crypto neobank solution providers integrate stablecoins, they streamline low-cost, cross-border payments and expand their adoption globally. With regulatory frameworks aligning with stablecoin structures, they have become the preferred option for crypto neobank app development companies, ensuring a secure and efficient digital banking experience. Ultimately, stablecoins are better suited for neo-banking applications, offering the stability and infrastructure required for mass adoption in decentralized finance.

Why Crypto Neo Banking With Stablecoins Is A Smart Investment in 2025?

In 2025, stablecoins are poised to redefine crypto neo-banking. With Revolut introducing its stablecoin in October 2024 to challenge industry giants like Tether and Circle, the landscape is evolving rapidly. Serving over 45 million users, this strategic move emphasizes stablecoins’ pivotal role in enhancing scalability, interoperability, and transaction efficiency across crypto neobank development services, cementing their importance in the future of digital finance. Let us go over some of the important reasons to invest in crypto neo-banking this year:

✔ Stablecoins Provide Predictability in Volatile Markets : In 2025, businesses seeking to navigate the volatility of traditional cryptocurrencies can leverage stablecoins to stabilize their financial operations. With a value pegged to assets like the USD or gold, stablecoins minimize fluctuations, making them ideal for crypto neo-banking services that require reliable financial infrastructure. For crypto neo-bank development companies, adopting stablecoins offers a consistent medium for day-to-day transactions, encouraging customer trust and engagement.

✔ Lower Transaction Fees and Faster Payments : Stablecoins significantly reduce transaction costs compared to traditional banking, particularly for cross-border transactions. This efficiency is a key factor in neo-banking app development, which aims to provide seamless experiences for businesses and consumers. For crypto neobank solution providers, integrating stablecoins into their platforms ensures businesses benefit from frictionless, low-cost payments without sacrificing security or speed.

✔ Attracting a Global Customer Base : Stablecoins’ global nature positions them as a cornerstone for businesses seeking to expand internationally. Businesses can use crypto-friendly neo-banking solutions to provide fast, secure, and predictable payment methods to customers worldwide, ensuring seamless access to digital financial services. As neo-banking app development continues to grow, stablecoin adoption enables companies to enter new markets while adhering to global financial regulations.

✔ A Competitive Edge in the Digital Economy : Businesses that integrate crypto neobank development services into their operations can gain a competitive advantage in the evolving digital economy. Stablecoins support innovation in payment systems, lending platforms, and DeFi applications. For businesses planning to invest in crypto neobank app development solutions, this shift presents an opportunity to tap into the growing demand for decentralized banking solutions that prioritize efficiency, transparency, and security.

✔ Regulatory Alignment and Stability : As global financial regulations evolve to accommodate blockchain-based assets, stablecoins are becoming increasingly favorable. They align well with regulatory frameworks due to their predictable nature, which provides a sense of security to businesses and consumers. Enterprises that collaborate with crypto neobank solution providers can ensure that their operations are compliant with changing regulations, reducing potential legal risks while tapping into new revenue streams.

✔ Sustainability and Scalability : Stablecoins offer businesses the scalability they need to grow in 2025 and beyond. With their ability to handle large transaction volumes without the risk of value depreciation, businesses can confidently scale their operations globally. For crypto neobank app platform development, the use of stablecoins enables the creation of efficient, scalable solutions that can handle the financial needs of a large, diverse customer base while maintaining system stability.

✔ Increased Transparency and Security : Stablecoins, built on blockchain technology, ensure transparency and security for businesses. Every transaction is recorded on a decentralized ledger, providing an immutable record and reducing fraud risks. This transparency makes stablecoins an attractive choice for businesses seeking to bolster trust in their financial transactions. Businesses can hire crypto neo-bank development services to integrate cryptocurrency solutions with enhanced security features, ensuring secure digital banking experiences for their users.

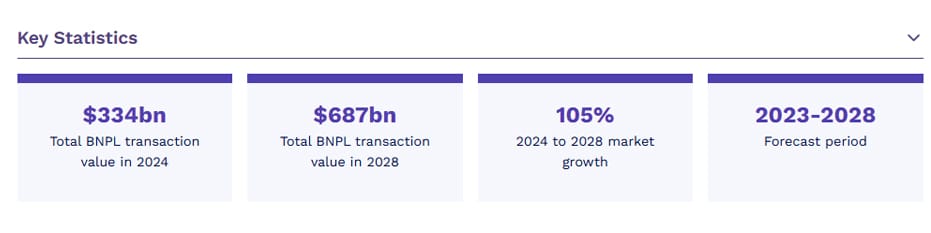

✔ Enhanced BNPL Transactions in Crypto Neo Banking : The Buy Now, Pay Later (BNPL) feature, when integrated into crypto neo banking platforms, provides businesses with a powerful tool to attract and retain customers. By combining stablecoins with BNPL, businesses can offer flexible payment options, allowing customers to purchase goods and services upfront and pay in installments. This integration ensures that the value of payments remains stable despite market fluctuations, making it an ideal solution for crypto-friendly neobanking solutions. As part of Neo-banking app development, BNPL enhances financial accessibility, driving customer satisfaction while reducing financial barriers for consumers globally.

Adopting stablecoins within crypto neo-banking is a smart investment for businesses in 2025. With benefits like cost-efficiency, regulatory compliance, scalability, and enhanced security, businesses are poised to thrive in the rapidly evolving digital financial ecosystem.

The Impact of Stablecoins on BNPL Transactions In Crypto Neo Banking

Stablecoins are transforming the Buy Now, Pay Later (BNPL) landscape by addressing critical pain points for both consumers and businesses. In traditional BNPL setups, customers often face fluctuations in the value of the currency used to pay, which can disrupt their financial planning. With stablecoins integrated into crypto neo-banking, businesses can offer BNPL services with the assurance of stable value, eliminating the risks posed by volatile cryptocurrencies.

Source Link : https://www.juniperresearch.com/research/fintech-payments/ecommerce/buy-now-pay-later-research-report/

BNPL transaction value to rise 106% worldwide by 2028, driven by regulatory breakthroughs and increased B2B use. This feature is in high demand because it combines the convenience of BNPL with the stability of crypto neobanking solutions, offering consumers predictable and secure transactions. For crypto neo banking app development companies, stablecoins provide a crucial advantage by enhancing customer trust and satisfaction. Users can confidently purchase products and services with flexible payment options, knowing their payments will retain a consistent value throughout the installment period.

In essence, stablecoins not only empower neo-banking app platforms to offer a seamless BNPL experience but also foster broader adoption by solving the volatility problem, making stablecoin-powered BNPL transactions one of the most sought-after features in the crypto neo-banking ecosystem.

Things To Know About Stablecoin Regulatory Compliance In Digital Banking

- Global Regulatory Fragmentation – Different regions have varying regulations for stablecoins, creating complexity for businesses operating internationally.

- Focus on Compliance and Transparency – Stablecoin issuers must maintain proper reserves and adhere to transparent governance practices to ensure regulatory compliance.

- AML and KYC Requirements – Compliance with Anti-Money Laundering and Know Your Customer regulations is essential for preventing illegal activities.

- Central Banks’ Involvement – Central banks are exploring stablecoins and Central Bank Digital Currencies (CBDCs), which could influence future regulations.

- Need for Uniform Global Standards – Global regulatory consistency would reduce the burden on businesses and streamline cross-border stablecoin adoption.

- Taxation of Stablecoins – Clear tax policies are necessary to address the taxation of stablecoin transactions and ensure proper reporting.

- Opportunities in Regulatory Clarity – Regions with clear regulatory frameworks will attract more businesses, fostering stablecoin adoption in crypto neo-banking.

- Global Collaboration Among Regulators – Increased international collaboration will shape the future of stablecoin regulations, ensuring a secure and sustainable financial ecosystem.

Navigating the evolving regulatory landscape of stablecoins requires expertise. A renowned crypto neo-bank development company can help you build solutions that ensure full compliance with global regulatory standards, including AML/KYC protocols, taxation laws, and transparency requirements. Their experience ensures your platform remains secure, scalable, and fully compliant, giving you a competitive edge in the growing digital finance ecosystem.

Build Crypto Neo Banking Platforms 10X Faster Now!

In today’s fiercely competitive digital finance landscape, speed and innovation are paramount. With our state-of-the-art solutions, we empower you to build crypto neo-banking platforms 10X faster, equipping your business to outpace competitors and lead the market. Our team of highly skilled blockchain professionals utilizes cutting-edge technologies and advanced methodologies to craft robust, scalable, and secure solutions tailored to your specific needs. Partnering with us means harnessing unparalleled expertise that ensures your platform is not only future-ready but positioned for long-term success. With our technical excellence, you’ll dominate the rapidly growing crypto neo-banking ecosystem and maintain a competitive edge in this dynamic market. Trust us to drive your vision forward, faster.