Why is a Blockchain KYC Solution Crucial for Businesses in 2024?

August 30, 2024

How Does Crypto Wallet-as-a-Service(WaaS) Enhance User Adoption?

August 30, 2024The convergence of real estate and blockchain technology is ushering in a new era of financial innovation. As the global real estate market continues to expand, there is a growing demand for efficient, transparent, and secure transaction methods. Stablecoins, pegged to fiat currencies or commodities, offer a promising solution to address these challenges. Stablecoin development holds the potential to completely transform real estate transactions by utilizing blockchain technology, offering a host of advantages to both buyers and sellers. The adoption of stablecoins in the real estate sector is rapidly gaining traction. Their ability to facilitate cross-border transactions, reduce settlement times, and enhance transparency is particularly appealing to investors and developers. Additionally, stablecoins can mitigate the risks associated with traditional payment methods, such as fraud and exchange rate volatility.

This blog will help you explore the various applications of stablecoin development solutions in real estate transactions. We will discuss how stablecoins can be used for property purchases, rent payments, mortgage financing, and fractional ownership. Furthermore, we will also explore the perks of stablecoin development solutions in real estate transactions, how they overcome the challenges of conventional transactional systems, the leading stablecoins, and the future nexus. Businesses and investors can take the lead in this game-changing sector by realizing the potential of stablecoin development in the real estate sector.

The Technical Nexus: Stablecoin Development and Real Estate Finance

The growing demand for stablecoin development in real estate financial transactions is driven by several key factors. First, stablecoins offer reduced volatility, providing a reliable medium of exchange that mitigates the risks associated with traditional cryptocurrencies. This stability is crucial for real estate transactions, where price predictability is essential. They enable faster and cheaper cross-border payments, streamlining international transactions that often involve high fees and lengthy processing times. Stablecoins also make programmable money possible through smart contracts, which automate agreements and eliminate the need for middlemen, increasing efficiency..

The increased transparency provided by blockchain technology builds trust among stakeholders, while stablecoins also ensure global accessibility, allowing a wider range of investors to participate in real estate markets. Moreover, their ability to support seamless compliance and regulation addresses legal concerns, and they enhance liquidity by enabling fractional ownership of properties. These advantages collectively contribute to the rising adoption of stablecoin development solutions in the real estate sector.

Challenges Faced By Traditional Real Estate Transactional Systems

Traditional real estate transactions are fraught with complexities that often hinder efficiency and escalate costs. The process typically involves numerous intermediaries—brokers, lawyers, notaries—each adding layers of approval, documentation, and fees, which can significantly delay transactions. Paper-based documentation and manual workflows are prone to errors, creating additional risks of miscommunication or even fraud. Settlement periods are notoriously lengthy, often taking weeks or months as financial institutions navigate payment processing and document verification. Geographic boundaries and differing legal jurisdictions further complicate cross-border transactions, making international deals particularly cumbersome. Moreover, the lack of transparency in traditional methods makes it challenging for parties to monitor transaction progress or validate counterparties, underscoring the demand for more secure, streamlined, and transparent real estate solutions.

Can Stablecoins Address The Pain Points of Conventional Real Estate Transactions?

Absolutely,Yes! Stablecoin development solutions have the potential to transform the conventional real estate transaction landscape by addressing many of its inherent pain points. Through the use of blockchain technology, stablecoins can streamline processes, offering a faster, more secure, and more efficient alternative to the traditional methods. Stablecoins help ensure transparency by minimizing transaction delays and removing the need for middlemen and settlement times.

Additionally, stablecoins offer greater ease for cross-border transactions, breaking down jurisdictional barriers and enhancing trust among international buyers and sellers. This makes stablecoin development a pivotal innovation for the real estate sector’s future. Scroll down to check the wide range fo advantages real estate businesses can leverage by investing in stablecoins in 2024.

Benefits of Leveraging Stablecoin Development Solutions in Real Estate Financial Transactions

Leveraging stablecoin development solutions can significantly enhance financial transactions in the real estate sector. Here are the key benefits:

🏢 Reduced Volatility

Stablecoins are designed to maintain a stable value, minimizing the fluctuations commonly associated with traditional cryptocurrencies. This stability allows real estate businesses to conduct transactions without the risk of sudden value changes, making budgeting and financial planning more predictable.

⏱️Faster and Cheaper Cross-Border Payments

Stablecoins facilitate quick and cost-effective cross-border transactions. Unlike traditional banking methods, which can take days and incur high fees, stablecoin transactions can be processed within minutes at a fraction of the cost, making international real estate deals more efficient.

📉Programmable Money for Smart Contracts

Stablecoins can be integrated into smart contracts, enabling automated and self-executing agreements. This innovation streamlines processes such as escrow services, property transfers, and rental agreements, reducing the need for intermediaries and minimizing administrative overhead.

📊 Increased Transparency

Blockchain technology, which underpins stablecoins, offers an immutable ledger that enhances transparency. All transactions are publicly verifiable, reducing the risk of fraud and building trust among buyers, sellers, and investors in the real estate market.

💰 Providing Stability

By using stablecoins, real estate transactions benefit from a reliable medium of exchange that mitigates the risks associated with price volatility. This stability is particularly advantageous in negotiations and long-term contracts, where price predictability is crucial.

🌍Global Accessibility

Stablecoins enable broader access to real estate investments by allowing anyone with internet access to participate in the market. This democratization of real estate investment opens up opportunities for a diverse range of investors, including those who may not have had access to traditional real estate markets.

📝Seamless Compliance and Regulation

Stablecoin development solutions can be designed to comply with regulatory standards, making it easier for real estate businesses to adhere to legal requirements. This built-in compliance can simplify the due diligence process and foster trust among stakeholders.

🏡Increased Liquidity for Real Estate Assets

Tokenizing real estate assets with stablecoins enhances liquidity by allowing fractional ownership and enabling assets to be traded on secondary markets. This increased liquidity can attract more investors and facilitate quicker sales, benefiting both buyers and sellers.

Real estate companies can transform their operations by utilizing stablecoin development solutions. To maximize the benefits, partnering with a reputable and experienced stablecoin development company is essential. A world-class stablecoin development company with its expertise in blockchain technology and a proven track record can help you design and implement impeccable stablecoin solutions tailored to your specific real estate needs.

How Stablecoin Development Helps Safeguard Real Estate Investments Against Inflation?

As real estate faces inflationary pressures, stablecoins are gaining traction for their ability to protect investments. In 2024, stablecoin development is seeing a surge, with USD-backed assets like stabilizing property transactions globally. Real estate investors are increasingly using stablecoins to reduce risks and preserve value in erratic markets as inflation reaches its highest point in decades. Let us have a closer look at how stablecoin development can play a significant role in managing inflation risks in real estate investments. Here’s how:

- Hedging Against Inflation- Stablecoins are typically pegged to fiat currencies, providing a stable store of value that can help mitigate the effects of inflation. In environments where inflation rates are high, holding stablecoins can protect investors from the depreciation of their purchasing power compared to traditional fiat currencies.

- Preserving Value- Unlike cash, which can lose value due to inflation, stablecoins offer a more secure alternative for storing wealth. This stability is particularly beneficial in real estate, where property values may rise in response to inflation, allowing investors to preserve their capital in a stable form while still having the opportunity to invest in appreciating assets.

- Facilitating Quick Transactions- The speed and efficiency of stablecoin transactions can enable real estate investors to act quickly in a rapidly changing economic environment. This agility allows them to capitalize on investment opportunities before inflation erodes potential gains.

- Access to Global Markets- Stablecoins facilitate cross-border transactions without the high fees and delays associated with traditional banking systems. This access allows investors to diversify their portfolios internationally, potentially offsetting inflation risks in their local markets.

- Integration with Tokenized Real Estate- As real estate assets are increasingly tokenized, stablecoins can be used to represent fractional ownership, providing liquidity and the ability to hedge against inflation while participating in the real estate market.

Investing in stablecoin development services is crucial to protect against inflation and financial instability. These solutions provide stability and transparency, ensuring your real estate assets remain protected from economic risks. Hiring experts in stablecoin development empowers you to build a resilient investment strategy for today’s rapidly changing financial landscape.

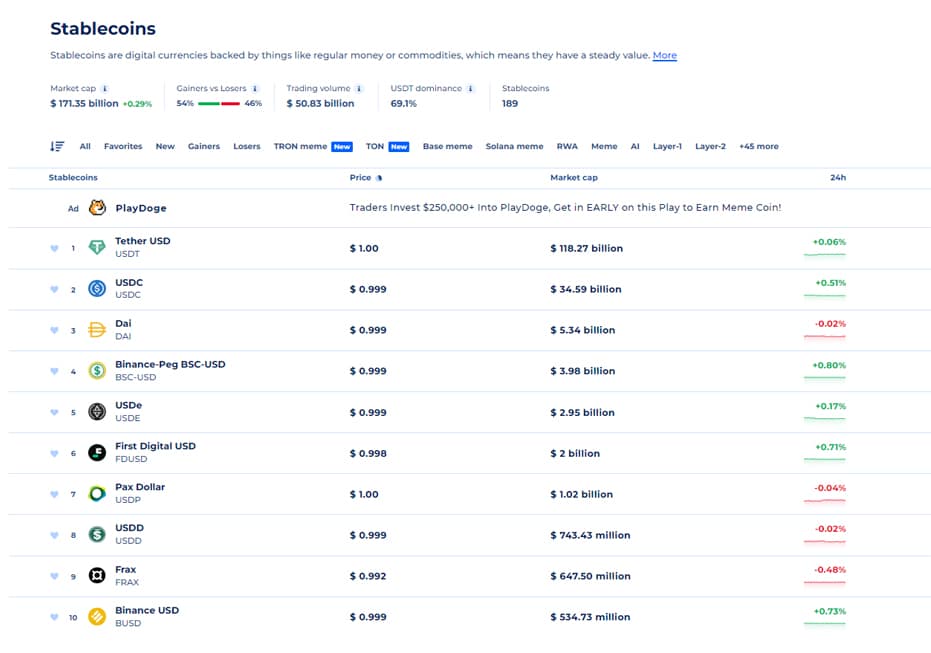

Top-Performing Stablecoins Used In Real Estate Transactions

- USDT (Tether)- As one of the oldest and most widely used stablecoins, Tether offers strong liquidity and stability, making it a popular choice for large-scale transactions, including real estate.

- USDC (USD Coin)- Backed by major institutions like Coinbase and Circle, USDC is known for its transparency and regulatory compliance, making it a secure option for real estate deals.

- DAI (Dai)- A decentralized stablecoin backed by crypto collateral, DAI’s flexibility and decentralization appeal to those in the real estate sector who prioritize a decentralized financial model.

- BSC-USD (Binance Peg)- With its connection to the Binance Smart Chain (BSC), BSC-USD offers low transaction fees and fast settlements, making it an attractive option for real estate investors looking for efficient and cost-effective solutions.

- USDE(Ethena) – Known for its growing adoption in various sectors, USDE provides stability and security, making it a suitable stablecoin for real estate transactions, particularly for international deals.

Hire Stablecoin Development Services From The Top Blockchain Firm

Stablecoin development offers a transformative solution for businesses and investors seeking stability in volatile markets, particularly in sectors like real estate. Transactions can be made safe, transparent, and resistant to inflation by utilizing stablecoins. This development can benefit investors by reducing market uncertainty and safeguarding their assets. Choosing this path allows businesses to offer seamless, efficient transactions, which can lead to greater trust and long-term success in any industry.

Partnering with a top-notch stablecoin development company is a smart decision for businesses looking to design the finest solutions. Antier leverages its expertise to ensure that your stablecoin project is tailored to your specific needs, from security protocols to scalability and regulatory compliance. Our professionals in blockchain will support you, giving you access to a strong, innovative platform that will increase your investment opportunities and your company’s capacity for innovation in the cutthroat digital economy. Let our experience guide you toward creating stablecoin solutions that drive long-term value and market leadership.