How To Design An IDO Launchpad On The Binance Smart Chain?

May 29, 2024

Key Factors for Achieving Maximum ROI in ICO Development

May 29, 2024The financial landscape is undergoing a seismic shift fueled by blockchain technology. One of the most exciting advancements is the tokenization of real-world assets (RWAs). This process involves creating digital tokens on a blockchain that represent ownership or fractional ownership of physical assets like real estate, art, or even commodities. While various tokenization standards exist, ERC-3643, built on the Ethereum blockchain, is emerging as a game-changer, specifically designed to streamline and secure RWA tokenization.

What is ERC-3643?

ERC-3643, also known as the T-REX protocol (Token for Regulated Exchange), is a technical standard built on the Ethereum blockchain specifically designed for tokenizing real-world assets (RWAs). Here’s a breakdown of how it works:

Core Functionality of ERC-3643

ERC-3643 facilitates the creation and management of tokens that represent ownership or fractional ownership of real-world assets. These assets can be anything from real estate and commodities to intellectual property and collectibles.

So, what makes ERC-3643 such a transformative force? Let’s delve into its key features and their impact:

Key Features of ERC-3643

- Regulatory Compliance: Traditional RWA tokenization faced hurdles due to regulatory uncertainty. ERC-3643 tackles this by incorporating compliance mechanisms directly into the standard. This allows for the embedding of Know Your Customer (KYC) and Anti-Money Laundering (AML) checks within the token itself, ensuring adherence to regulations and fostering trust among investors. Imagine an investor automatically undergoing KYC/AML checks before purchasing a token representing a fraction of a building, streamlining the process and ensuring regulatory compliance.

- Enhanced Security: Leveraging the robust security of the Ethereum blockchain, ERC-3643 tokens benefit from immutability and transparency. Every transaction involving the token is publicly viewable on the blockchain, mitigating the risk of fraud and unauthorized access. This fosters a secure environment for investors and issuers. For instance, an investor considering a tokenized artwork can verify its authenticity and ownership history on the blockchain, reducing the risk of forgeries.

- Streamlined Processes: ERC-3643 streamlines the tokenization process by building upon the existing functionalities of ERC-20 tokens, a widely used standard for fungible tokens. This simplifies development and integration, reducing time and costs associated with creating and managing RWA tokens. Think of it like using a familiar building block (ERC-20) to create a new structure (ERC-3643) for tokenized assets, saving time and resources during development.

- Fractional Ownership: One of the most compelling aspects of RWA tokenization is the ability to divide assets into smaller, tradable units. ERC-3643 facilitates this by enabling the creation of tokens representing fractions of a real-world asset. This opens doors for a broader range of investors to participate in markets that were previously inaccessible due to high entry barriers. Imagine owning a piece of a valuable beachfront property for a fraction of the cost of the entire property, all thanks to ERC-3643.

- Increased Liquidity: Traditionally, RWAs are often illiquid, meaning they can be difficult to buy and sell quickly. ERC-3643 tokens can be traded on secondary markets built on the Ethereum blockchain. This enhances liquidity for investors and issuers, potentially leading to fairer pricing and more efficient asset allocation. An investor holding a tokenized artwork can now easily sell it on a secondary market to another interested collector, increasing liquidity for both parties.

How Does ERC-3643 Work?

Here’s a deeper dive into how ERC-3643 works, focusing on the mechanisms that enable its functionalities:

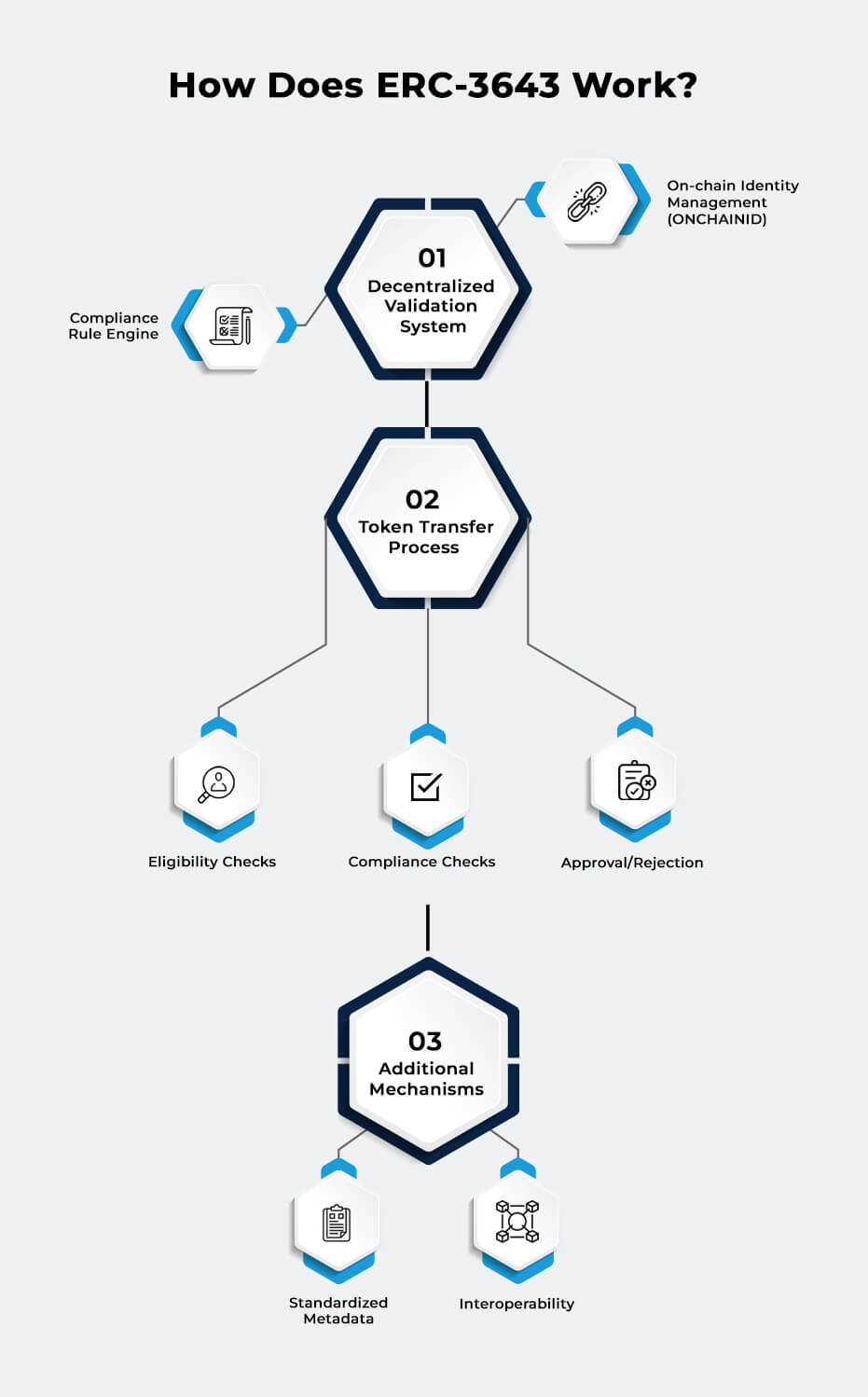

Decentralized Validation System:

Unlike traditional asset ownership, ERC-3643 relies on a decentralized validation system to ensure compliance and eligibility for token transfers. This system comprises two key elements:

- On-chain Identity Management (ONCHAINID): This acts as a decentralized identity registry that verifies the identities of both the issuer (who creates the tokenized asset) and the investor (who wants to purchase the token).

- Compliance Rule Engine: This engine, embedded within the ERC-3643 standard, enforces pre-programmed compliance rules. These rules can be tailored to specific regulations and jurisdictions, ensuring adherence to KYC/AML checks, investor accreditation requirements, and other relevant regulations.

Token Transfer Process:

When an investor attempts to transfer an ERC-3643 token, the transaction triggers the decentralized validation system. Here’s what happens:

- Eligibility Checks: The ONCHAINID verifies the identities of both the sender and receiver of the token.

- Compliance Checks: The compliance rule engine evaluates the transaction against the pre-programmed rules. This might involve checks on the investor’s accreditation status, geographic location (if applicable), or other regulatory requirements.

- Approval/Rejection: Based on the outcome of the checks, the system either approves or rejects the transfer. If the transfer complies with all regulations, it’s processed on the Ethereum blockchain. If not, the transfer is rejected, preventing non-compliant transactions.

Additional Mechanisms:

- Standardized Metadata: ERC-3643 tokens can include additional information embedded within them. This metadata can include details about the underlying real-world asset, legal documentation, and compliance certifications. This enhances transparency and facilitates due diligence for investors.

- Interoperability: ERC-3643 tokens are designed to be interoperable with other Ethereum-based applications. This allows for seamless integration with DeFi protocols and other blockchain-based services, opening doors for innovative financial products and functionalities.

Overall, the mechanisms of ERC-3643 work together to create a secure, compliant, and efficient system for tokenizing real-world assets. By combining on-chain identity verification, rule enforcement, and standardized data, ERC-3643 paves the way for a more inclusive and transparent future for asset ownership and financial markets.

Real-World Applications of ERC-3643 In Tokenization

The impact of ERC-3643 extends far beyond the technical specifications. Here are some captivating examples of its real-world applications:

- Real Estate Tokenization: Platforms like RealT leverage ERC-3643 to tokenize commercial and residential properties. This allows investors to own fractions of these properties, democratizing access to a traditionally high-barrier market. Real estate investment becomes more accessible to a wider audience, potentially leading to a more vibrant market.

- Fine Art and Collectibles: ERC-3643 opens doors for tokenizing valuable artworks and collectibles. Platforms like Codex Protocol enable fractional ownership of these assets, making them more accessible to a wider range of collectors and investors. Imagine a rare painting being divided into tradable tokens, allowing a broader audience to participate in the art market.

- Supply Chain Management: Tokenizing physical goods throughout the supply chain can be facilitated by ERC-3643. This enhances transparency, improves traceability, and minimizes the risk of counterfeiting. Consumers can track the journey of their products from origin to purchase, fostering trust and reducing fraud.

These are just a few examples, and the possibilities are constantly evolving. As the technology matures and regulatory frameworks adapt, we can expect even more innovative applications of ERC-3643 in the tokenization of real-world assets.

The Future of Tokenization: A Collaborative Effort with ERC-3643

While ERC-3643 presents a compelling vision for the future, its success hinges on collaboration between various stakeholders:

- Regulators: Clear and adaptable regulatory frameworks are essential for fostering innovation and investor confidence. Ongoing dialogue between regulators and industry leaders is crucial to create a supportive environment for RWA tokenization. Regulators need to find a balance between fostering innovation and mitigating potential risks.

- Technology Providers: Constant development and innovation are crucial for scaling ERC-3643 solutions and addressing limitations like scalability on the Ethereum blockchain. Exploring Layer 2 solutions and potential future upgrades to Ethereum itself will be key to accommodate wider adoption.

- Financial Institutions: Traditional financial institutions have the potential to play a significant role in the future of tokenization. Collaboration between these institutions and blockchain startups can lead to the development of new financial products and services built on top of ERC-3643 tokens.

- Investor Education: Public awareness and understanding of RWA tokenization and ERC-3643 remain relatively low. Educational initiatives are crucial to foster investor confidence and broader adoption. Educational resources explaining the benefits and risks of tokenized assets, along with clear guidelines on how to participate in this new financial landscape, are essential.

Building a More Inclusive Financial System with ERC-3643

By overcoming these challenges and fostering collaboration, ERC-3643 has the potential to revolutionize the financial landscape in several ways:

- A More Inclusive Financial System: ERC-3643 empowers individuals with a wider range of investment opportunities, potentially democratizing access to traditionally exclusive asset classes. Fractional ownership allows individuals with smaller capital to participate in markets like real estate or fine art, previously out of reach due to high entry barriers.

- Enhanced Efficiency and Transparency: The streamlined processes and inherent transparency of blockchain technology will lead to a more efficient and transparent financial ecosystem. Tokenization can automate tasks, reduce paperwork, and improve traceability within various financial processes. Additionally, the public ledger nature of blockchains fosters trust and reduces the risk of fraud.

- Innovation and New Investment Products: The possibilities for innovative financial products built on top of tokenized RWAs are limitless. Imagine index funds tracking baskets of tokenized assets or structured products offering exposure to real estate or commodities within a DeFi (Decentralized Finance) ecosystem. ERC-3643 opens doors for the creation of entirely new asset classes and investment strategies.

Conclusion

ERC-3643 is not just a technical standard; it represents a paradigm shift in how we perceive and interact with real-world assets. By enabling secure, compliant, and fractional ownership, ERC-3643 unlocks a new frontier for investors and issuers alike. As the technology matures, regulatory frameworks evolve, and collaboration intensifies, we can expect ERC-3643 to play a pivotal role in building a more inclusive, efficient, and innovative financial future. Streamline real-world asset tokenization with ERC-3643, the secure standard for compliant ownership and trading! Want to redefine asset ownership? Start tokenizing with ERC-3643.