In bygone days, customer identification posed a straightforward but challenging task for financial institutions. Traditional methods of identity verification are undergoing a digital makeover, which has led to a paramount need for robust digital identity solutions. These solutions serve as a crucial tool for verifying the authenticity of parties and confirming human presence in the digital realm. Blockchain identity solutions stand out as a potent force driving empowerment within the fintech industry, offering unparalleled security and efficiency. Explore how digital identity blockchain projects tackle the challenges encountered by fintech, reshaping the landscape of identity verification in the digital age.

What are the common digital identity frauds in the Finance sector?

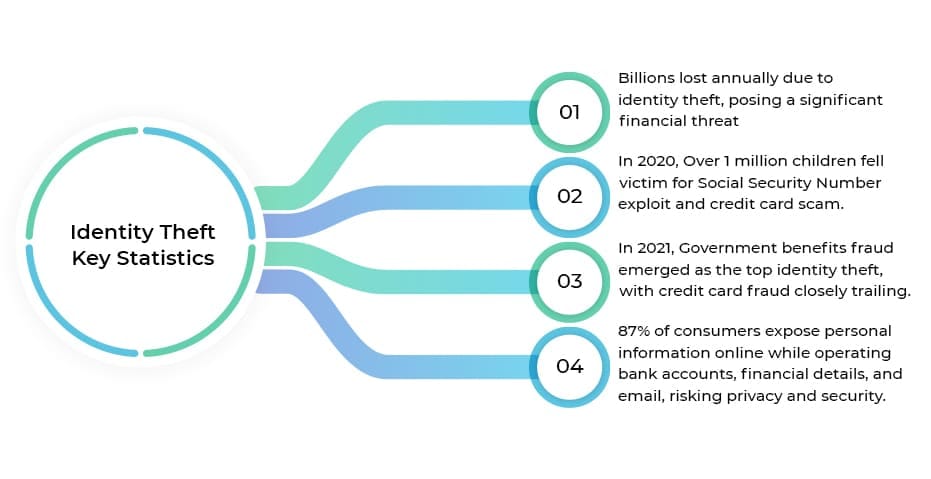

The finance sector faces escalating threats of digital identity fraud, ranging from sophisticated cyber attacks to synthetic identity theft. Understanding the details of these fraudulent activities is crucial for implementing effective security measures and safeguarding financial systems against malicious actors. Check the two common digital identity frauds that usually occur-

1. Digital identity theft- This fraudulent activity occurs when cybercriminals exploit digital financial credentials to gain unauthorized access to online banking and financial accounts. It involves acquiring sensitive information necessary to bypass digital identity verification processes undetected. Once inside, fraudsters may manipulate account settings, disable multi-factor authentication, and alter verification methods to lock users out of their accounts permanently. Despite advancements in digital identity processes, customers opting out of key protections like multi-factor authentication increase vulnerability to identity theft. This is where blockchain for identity verification comes into role.

2. Synthetic Identity Theft- It involves crafting false digital identities designed to evade detection. Fraudsters typically use stolen national ID numbers, such as social security numbers (SSNs) to fabricate new names, addresses, and personal details for synthetic identities in financial services. Monitoring national ID numbers can be challenging, allowing cybercriminals to exploit less active individuals and remain undetected for extended periods. To combat this threat, financial institutions must implement robust blockchain identity solutions and strategies, leveraging sophisticated verification technologies to detect anomalies and inconsistencies associated with synthetic identities.

As financial institutions navigate the complexities of digital identity fraud, they must take proactive measures to mitigate risks and protect consumer’s financial assets. The finance sector can fortify its defenses against evolving threats and uphold the integrity of digital transactions by leveraging blockchain identity solutions.

Understanding The Relevancy Of Blockchain For Identity In Finance

The relevance of digital identity solutions must be considered in the finance sector. Fintech firms can authenticate customers without needing multiple identification documents by streamlining the verification process. Blockchain-based digital identity platforms encompass various attributes shared by customers with service providers, leveraging innovative technologies like distributed ledger and biometrics to enhance functionality. Let us check certain types of digital identity solutions to understand their relevancy better.

5 Major Types of Blockchain Identity Solutions in FinTech

The relevancy of digital identity blockchain projects in the finance sector underscores its potential as a transformative force. It is vital to explore the various types of digital identity solutions available to deeply understand the diverse landscape of fintech with digital ID platforms. These solutions blend processes, standards, and technologies to ensure the privacy, security, and integrity of digital identities. Here are notable types of digital solutions tailored for fintech-

- Multi-factor Authentication- Multi-factor authentication stands as a cornerstone in fintech digital identity solutions. MFA demands two or more forms of user identification, such as one-time passwords or verification codes sent to users’ phones.

- Biometric Authentication- This emerges as a promising addition to fintech digital identity solutions. Leveraging unique physical traits like fingerprints, voice, and facial recognition, biometric authentication offers secure and swift identity verification methods.

- Identity and Access Management Solutions- IAM solutions are indispensable tools for managing user authentication and resource accessibility. It ensures that only authorized users can access crucial information or execute specific actions.

- Blockchain-based Identity Verification- The advent of blockchain in digital identity promises transformative changes in fintech. Blockchain for identity verification utilizes distributed ledger technology to store and verify digital identities, offering decentralization, transparency, and security.

- Self-Sovereign Identity- SSI represents a decentralized approach to digital identity implementation. With SSI, users retain control over their identity information, enabling the secure sharing of digital identity data.

Understanding these varied solutions is essential for fintech entities aiming to flourish their digital identity frameworks and ensure robust security measures. Thus, a finance industry that is looking forward to crafting blockchain identity solutions for securing, verifying, and managing customer’s identities must partner with an experienced blockchain identity management company. Ensure that the company boasts a vast team of skilled and talented blockchain experts who are well-versed in designing platforms tailored to business needs.

What are the perks of blockchain identity management in finance?

Blockchain identity management offers a multitude of benefits for the finance sector, revolutionizing traditional identity verification processes and enhancing financial inclusion. Scroll down to explore the breakdown of the advantages.

Top-notch benefits of blockchain identity solutions in the fintech sector-

- Improved Security- Blockchain’s decentralized nature ensures heightened security by encrypting and distributing identity data across the network, reducing the risk of single-point vulnerabilities.

- Easier Customer Onboarding- Blockchain-based digital identity solution streamlines customer onboarding processes by enabling seamless and efficient verification of identities, minimizing friction and delays.

- Enhanced Customer Experiences- With simplified identity verification, blockchain facilitates smoother interactions for customers, leading to enhanced satisfaction and loyalty.

- Precise Compliance- Blockchain identity management ensures precise compliance with AML and KYC regulations, providing accurate and tamper-proof identity verification records.

- Cost Efficiency- Digital identity blockchain projects reduce operational costs associated with identity verification and authentication by eliminating intermediaries and streamlining processes,

- Seamless Integration- Blockchain solutions seamlessly integrate with existing fintech infrastructure, allowing for easy adoption and compatibility with various financial platforms.

- Fraud Prevention- The immutable nature of blockchain ensures that identity data cannot be altered or tampered with, significantly reducing the risk of identity fraud and enhancing overall security measures.

Blockchain identity management in finance holds the promise of transforming the overall industry by offering robust security and efficiency, paving the way for a more secure and accessible financial ecosystem.

Wrapping It Up!

Adopting digital identity is pivotal for the future of financial services. As financial technologies evolve, so do the complexities. Leveraging blockchain identity management in the finance industry offers numerous benefits, enhancing customer experiences and operational efficiency. Financial service providers must invest in robust digital infrastructure and seek expert guidance to optimize their identity verification processes to navigate this challenge effectively.

We at Antier, help you create extensive and robust blockchain identity solutions for your tailored business needs. We are a leading blockchain development company that boasts a vast team of highly qualified and experienced blockchain professionals who are apt at creating identity management platforms that can help secure, verify, and manage the customer’s identity, gaining trust among the parties involved. The experts of our company leverage their immense expertise to develop solutions that can flourish your business.

FAQs:

Q1. How do blockchain identity solutions ensure compliance with regulatory requirements like KYC and AML?

Blockchain identity solutions ensure compliance with KYC and AML regulations by securely storing and verifying identity data on an immutable ledger. This allows financial institutions to access and verify customer information while maintaining transparency and auditability.

Q2. What happens if I lose access to my blockchain identity platform? Can it be recovered?

If you lose access to your blockchain-based digital identity, recovery options depend on the specific implementation. Some systems may offer backup mechanisms or recovery protocols, while others may require re-verification through alternative means to regain access.

Q3. Are there any privacy concerns associated with using blockchain identity solutions in finance?

Privacy concerns with blockchain identity solutions in finance primarily revolve around data protection and anonymity. While blockchain offers enhanced security and transparency, there’s a risk of exposing sensitive information if not properly managed. Additionally, users may have concerns about the permanence and immutability of data stored on the blockchain.