Guide to DeFi Smart Contracts Development

March 20, 2023

Crypto Market-Making Software & DeFi: What’s the Hype?

March 21, 2023Decentralization seems to be a buzzword at present. Decentralized exchange (DEX), Decentralized Finance (DeFi), and Decentralized Applications (dApps) are the three most commonly heard terms in recent times. Moreover, there have been a lot of questions regarding decentralization versus centralization, and have been one of the hottest topics of discussion in recent times. In addition to this, the benefits or advantages of decentralized exchanges over centralized ones have given rise to innumerable debate sessions. So, before we delve deeper into the debate, let us have a brief overview of what they are and how they work.

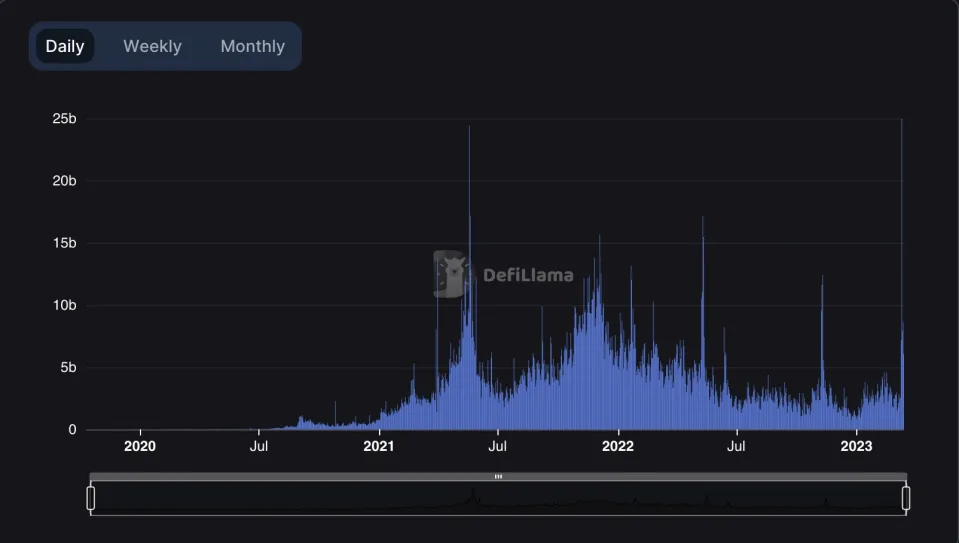

According to DefiLlama data, it was revealed that decentralized exchanges created a record high of $25 billion daily trading volume on Saturday, 11th March 2023.

The previous high was recorded May 2021 which was of $24.3 billion when bitcoin was roughly worth about $65,000 and ether about $4,400.

Centralized Exchange and Decentralized Exchange – An Overview

A centralized exchange is a crypto exchange that is like a traditional bank. It has a central authority looking over every financial transaction taking place. The centralized exchange offers a crypto wallet that is used to store crypto assets. Moreover, it maintains centralized control over all financial exchanges and wallets of users to impose regulations.

On the other hand, decentralized exchanges are crypto exchanges without any centralized authority exerting control over any financial transactions. There is no single authority figure that is in charge of users’ funds. However, there exists smart contracts and decentralized applications which automate all transactions.

Centralized Exchange and Decentralized Exchange – How Do They Work?

Centralized exchanges permit users to utilize fiat currencies such as the US dollar or other crypto assets such as Bitcoin to buy and sell crypto. These exchanges exist as a third party in transactions between the buyers and sellers to authorize transactions as well as ensure security. Therefore, they typically operate as brokers and custodians, protecting users’ assets and the trades.

Decentralized crypto exchanges on the other hand make use of blockchains to facilitate transactions. These exchanges permit direct peer-to-peer transactions without the need for any intermediaries. Decentralized exchanges are capable of offering quicker and more cost-effective transactions as compared to centralized exchanges by eliminating the need for any intermediaries or a central authority which would otherwise have required a part of the transaction fees and take more time to facilitate transactions.

Let us have a look at the volume of decentralized exchanges over the past three years.

How Decentralized Exchanges Edge Over Centralized Exchanges?

After reading through the above sections, we can get a better understanding of both centralized and decentralized exchanges, along with their working process. Now, let us delve a bit deeper into understanding how decentralized exchanges help remove dependency on centralized ones to edge over them.

Non-Custodial

In a decentralized exchange, users need not transfer their assets to any third party which is not the case in the case of a centralized exchange. In addition to this, users are always in complete control of their assets at any given point in time. Users simply connect to a decentralized exchange with their crypto wallet and any transaction needs to be signed & confirmed before its execution. This indicates that users never give up the custody of their assets, thereby appropriately aligning with the idea of the self-sovereignty of crypto.

Prevention of Market Manipulation

Decentralized exchanges play a significant role in preventing market manipulation because of their in-built nature of permitting peer-to-peer exchange of cryptocurrency. It prevents manipulation of the market by protecting the users from wash trading and fake trading which centralized exchanges cannot offer based on their nature.

Permissionless in Nature

Decentralized exchanges are permissionless in nature meaning that anyone who has an active connection to the internet can access these exchanges. There is no discrimination among traders based on their location and none of them require any kind of permission for accessing decentralized exchanges. However, in centralized exchanges traders require permission before accessing, which is exactly where decentralized exchanges can remove the dependency on centralized ones.

Anonymity

Anonymity is preserved in the case of decentralized exchanges. In contrast to the centralized exchanges, none of the users require to go through a standard identification process referred to as KYC or know your customer. The process involves the collection of users’ personal information which includes their full legal name and photo issued by the government as an identification document. It is exactly the situation where decentralized exchanges are more popular among users who wish to transact anonymously.

No Regulations

In centralized exchanges, users need to follow the set rules and regulations such as the KYC process, AML or anti-money laundering standards, etc. However, decentralized exchanges happen to operate autonomously, thereby enabling them to dodge some of the regulatory hurdles to provide the freedom of regulations to users, which is another major reason for their growing popularity in recent times.

Complete Transparency

Trading on decentralized exchanges comes with complete transparency since every trader can audit all transactions. This, in turn, provides a whole new as well as deeper insight into the trading history of tokens and ways to measure success. Transparency happens to play a key role in the popularity and success of decentralized exchanges over centralized ones.

Resistance to Censorship

Decentralized exchanges run decentralized protocols, which make sure that no parties can censor any transactions. Therefore appropriate resistance is offered to censorship in decentralized exchanges which is not the case in centralized exchanges.

Reduced Charges

Centralized exchanges charge fees for transactions because of availing of the services of third-party exchanges. However, transactions made on decentralized exchanges are devoid of such fees. Therefore, the transactions made on decentralized exchanges are more affordable as compared to the ones made on centralized exchanges because of the absence of middlemen.

Enhanced Safety and Security

Centralized exchanges have stringent security guidelines in place but decentralized exchanges have proved to be more secure. It is because of the fact that there is no requirement to deposit funds into any intermediary accounts which are more susceptible to hacking. In decentralized exchanges, traders have complete control over their funds as well as every transaction with a self-custody wallet.

No Counterparty Risk

Counterparty risk occurs at the time when there is the involvement of any third party in a transaction and it does fulfill its part of the deal and fails on its contractual obligations. However, decentralized exchanges operate without the involvement of any third party and are based on smart contracts. Therefore, counterparty risk is eliminated in the case of decentralized exchanges.

Check out the decentralized exchanges to centralized spot trade volume since January 2019.

Closing Thoughts

The debate between decentralized and centralized exchanges will be ongoing since none of them can emerge as a clear winner. With the evolution and advancement of decentralized exchanges, some of the previously existing drawbacks have been resolved. This, in turn, can play a significant role in removing the dependency on centralized exchanges to a great extent. Both decentralized and centralized exchanges come with their own pros & cons which provide them with an edge over one another in different cases. However, the pointers discussed above certainly put decentralized exchanges in a better and more popular position when compared to centralized exchanges.