Replicating The Trump Wallet’s Success: Building the Ultimate Meme Coin Wallet For Your Business

March 24, 2025

How Businesses are Leveraging AI and IoT to Build Metaverse Ecosystems

March 24, 2025“The future of lending isn’t just about providing funds—it’s about creating experiences that empower users, enhance efficiency, and break down financial barriers.”

Ever wonder why some fintechs launch lending empires in two weeks while banks take a couple of months? Spoiler: It’s not genius—it’s infrastructure. White label P2P lending as a service (LaaS) is the invisible force turbocharging digital finance, letting companies skip the “build” phase and jump straight to “dominate.” This adaptable solution enables businesses to integrate lending platforms tailored to their needs, unlocking new potential for revenue and market reach.

This article explores how white label P2P lending is transforming digital finance with scalable, customizable solutions, key adoption drivers, and innovations shaping the future of lending.

What is White Label Lending as a Service (LaaS)?

White Label Lending as a Service (LaaS) is a turnkey, cloud-based solution enabling financial institutions, fintechs, and alternative lenders to launch customized P2P lending platforms without in-house development. White Label P2P Lending drives digital finance forward with scalable infrastructure, intelligent risk management, and regulatory adherence, optimizing efficiency and adaptability for financial institutions. The need for robust, customizable lending solutions grows as the financial sector adapts to rapid digital transformation. This has led to an increased demand for white label peer to peer lending solutions, as businesses seek to offer seamless, automated lending experiences.

The Growing Demand for White Label P2P LaaS in Digital Finance

Imagine a world where financial barriers dissolve, where lending isn’t confined to banks, and where anyone—be it an entrepreneur, a small business, or an investor—can seamlessly access capital. This isn’t a distant future; it’s happening now, powered by white label P2P LaaS solutions.

The global financial ecosystem is witnessing a paradigm shift.

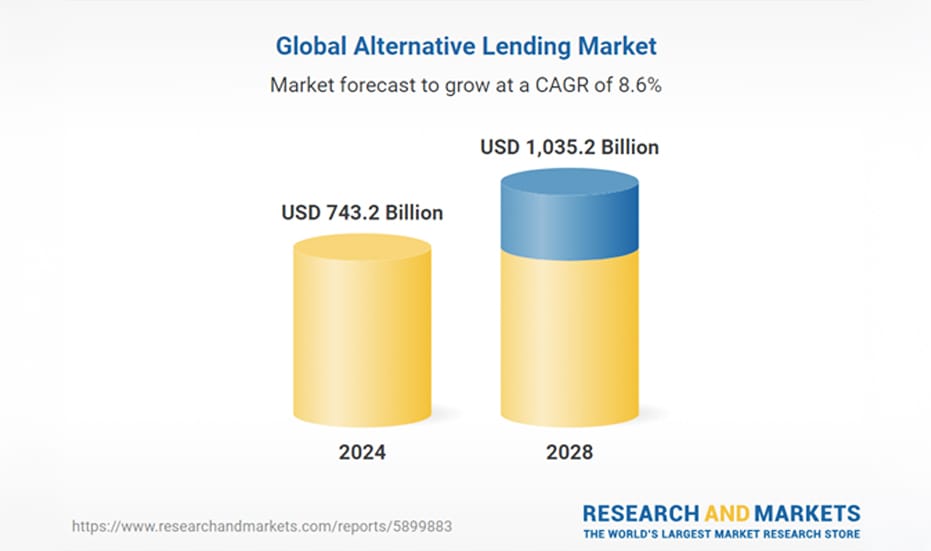

Source:- GlobeNewswire

According to recent market reports, the alternative lending sector is projected to grow at an annual rate of 12.4%, reaching a staggering $743.2 billion by 2024. This rapid expansion underscores the rising demand for agile, tech-driven financing solutions. Industry leaders are taking note of this shift.

As fintech disruptors challenge conventional banking models, white label peer to peer lending platforms are empowering institutions with scalable, regulatory-compliant, and AI-enhanced lending ecosystems. White label P2P LaaS isn’t just a technological upgrade; it’s the key to unlocking new revenue streams, expanding credit access, and future-proofing lending operations in an increasingly digital-first world.

Why Are Fintechs and Enterprises Adopting White Label P2P LaaS?

The lending industry is no longer dictated by rigid, centralized banking models. Instead, fintech disruptors, alternative lenders, and even non-financial enterprises are tapping into the flexibility of white label P2P LaaS to monetize credit distribution, enhance financial inclusion, and optimize lending operations. Whether it’s an SME-focused lending platform, a BNPL service embedded in an e-commerce platform, or a real estate-backed lending marketplace, businesses are using modular, API-driven lending technology to unlock new revenue streams without the burden of extensive infrastructure development.

The appeal of white label P2P lending solutions lies in their ability to provide scalable, cost-effective, and regulatory-compliant lending ecosystems that can be tailored to specific market needs. From automated borrower verification and AI-powered credit scoring to decentralized ledger-backed security and real-time compliance updates, these solutions empower enterprises to enter the lending market with agility and confidence.

This statement echoes the undeniable truth. The future of lending isn’t about who holds the most capital—it’s about who can deploy it most efficiently. P2P lending software enables businesses to do just that, turning traditional lending constraints into opportunities for scalable growth, diversified revenue, and enhanced borrower engagement in an increasingly decentralized financial world. The demand for flexibility, cost-efficiency, and innovation in the financial sector is pushing businesses to explore solutions that meet regulatory standards and cater to a growing digital-savvy customer base. This brings us to the growing trend of fintechs and enterprises turning towards White Label P2P LaaS.

Key Drivers of Digital Finance Acceleration with White Label P2P LaaS

The financial ecosystem is undergoing a transformative shift, with White Label P2P LaaS emerging as a powerful enabler of digital finance. By offering ready-to-deploy, scalable, and customizable lending solutions, P2P LaaS is redefining how institutions facilitate credit access, manage risk, and drive financial inclusion. Here are the key drivers fueling its rapid adoption:

- Faster Market Entry = Faster ROI: Traditional banks, fintech startups, and alternative lenders can launch their white label P2P lending platforms without the complexities of in-house development. This accelerates time-to-market while ensuring compliance with regulatory frameworks.

- Cost-Effective Scalability: Financial entities can bypass high infrastructure costs. Cloud-based deployments ensure seamless scalability, allowing businesses to expand operations as demand grows.

- AI-Driven Risk Management: Institutions leverage AI and machine learning for real-time credit risk analysis, fraud detection, and automated loan processing, enhancing efficiency and reducing operational risks.

- Expanding Financial Inclusion: P2P LaaS bridges gaps in traditional lending by enabling underserved SMEs, startups, and individuals to access funds beyond geographical limitations, fostering a globalized financial ecosystem.

- Built-In Compliance & Security: Modern white label P2P lending as a service platforms are designed with built-in KYC/AML compliance, blockchain security, and regulatory adherence, ensuring risk-free lending environments.

Financial institutions can future-proof their lending models, drive market expansion, and position themselves at the forefront of the digital finance revolution. To achieve this, it is essential to understand the technical infrastructure that powers these platforms. The Technical Architecture of white label peer to peer lending forms the backbone of this transformation, providing the framework for seamless and secure transactions.

The Technical Architecture of White Label Peer to Peer Lending-as-a-Service

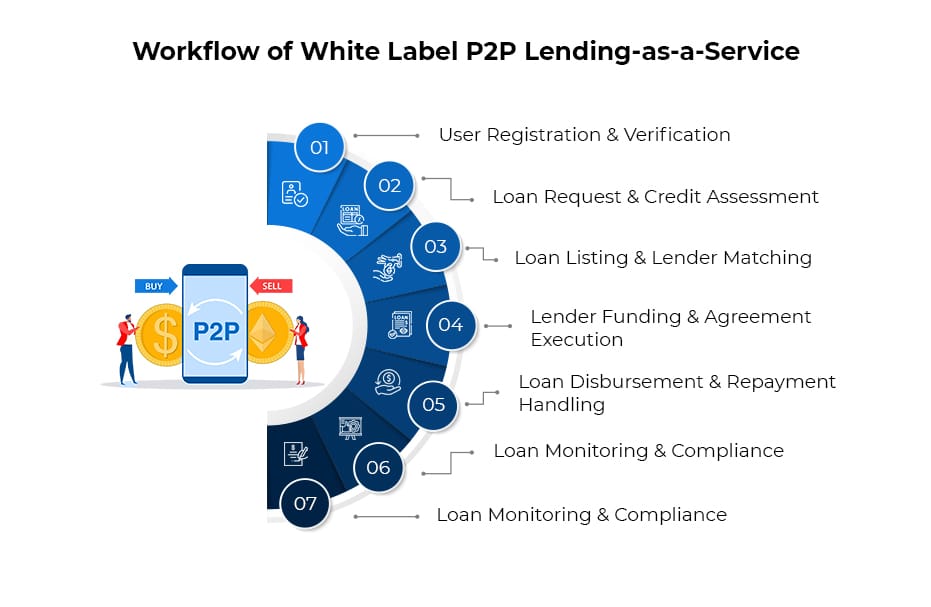

A white label peer to peer lending-as-a-service platform streamlines this process, ensuring security, automation, and efficiency. Here’s how it works:

- User Registration & Verification: Users sign up through a web or mobile app and verify their identity using KYC/AML checks from trusted third-party providers. Personal data is securely stored, ensuring compliance with regulations.

- Loan Request & Credit Assessment: Borrowers submit loan requests, and an automated system evaluates their creditworthiness using credit scores and financial history. The request details are securely recorded for transparency.

- Loan Listing & Lender Matching: Approved loan requests appear on a marketplace, where lenders can browse and choose investments based on risk level and interest rates. A smart system helps match lenders with suitable borrowers.

- Lender Funding & Agreement Execution: Lenders deposit funds into a secure escrow account, ensuring safety for both parties. The loan agreement is finalized, outlining repayment terms, interest rates, and penalties.

- Loan Disbursement & Repayments: Once funded, the loan amount is transferred to the borrower. Repayments are automatically scheduled, deducting amounts from the borrower’s account as per the agreement.

- Loan Monitoring & Compliance: The system tracks loan activity, sending reminders for repayments and ensuring compliance with lending regulations. Risk alerts notify lenders of any potential issues.

- Loan Completion & Settlement: Upon full repayment, the lender receives their principal and interest, the loan is marked as closed, and the borrower’s credit profile is updated. A detailed report is generated for records.

White label P2P lending development is setting new standards in lending with automation, strategic risk management, and seamless financial flows. Whether you’re funding or borrowing, this next-gen platform offers unparalleled speed, security, and efficiency—empowering the future of finance.

What Innovations Will Redefine White Label P2P Lending in the Next Decade?

The next decade will witness transformative innovations in white label peer to peer lending, reshaping the industry with enhanced efficiency, security, and scalability.

- AI-driven credit scoring will use alternative data for more accurate risk assessment.

- Blockchain-powered smart contracts will enable tamper-proof transactions and instant settlements.

- DeFi integration will introduce tokenized loans and cross-border stablecoin lending.

- Embedded finance via APIs will allow seamless lending integration into digital platforms.

- Automated RegTech solutions will streamline compliance with evolving financial regulations.

By leveraging these innovations, white label P2P LaaS will evolve into a highly secure, efficient, and inclusive financial ecosystem, driving new opportunities for borrowers and investors.

Unleash Growth with Antier’s P2P Lending Software

Antier, a renowned P2P lending software development company, specializes in creating white label P2P lending software that empowers businesses to launch customized lending platforms with ease. Our solutions are designed to be scalable, secure, and feature-rich, enabling you to seamlessly connect borrowers and lenders while maintaining full control over branding. Whether you’re a fintech startup or an established institution, our white label P2P lending projects provide a flexible, ready-to-deploy solution that cuts down development time and costs. Partner with us to transform the lending landscape and offer your customers a streamlined, efficient, and transparent lending experience—all under your brand!