Beyond Traditional Finance: Building a 100% Decentralized On-Chain Banking Infrastructure

March 24, 2025

24/7 Perpetual Futures Trading: Scalable Infrastructure for Non-Stop Markets

March 25, 2025Table of Contents

-

- The Global Crypto Gold Rush

- Top Reasons Why UAE’s Banks Must Embrace the Digital Asset Revolution

- 3 Key Challenges Banks Face When Entering the Crypto Market

- Case Study: How a Tier-1 Bank Launched a Profitable Crypto Arm in 90 Days

- The Bottom Line: Banks That Act Now Will Define the Future

- Why Partner With Antier?

The Global Crypto Gold Rush

Wall Street banks are eyeing crypto as a novel frontier for growth, plotting their next moves to make the most of the revolution. JPMorgan, Goldman Sachs, and BlackRock have already launched crypto-focused services. While the Trump administration builds a welcoming environment for digital asset players, Dubai has been emerging as a crypto hub.

The UAE’s progressive regulatory framework, epitomized by the Virtual Assets Regulatory Authority (VARA), has positioned Dubai as a forerunner. Recently, a landmark move came when Dubai’s largest state-owned bank, Emirates NBD, pioneered crypto trading on the Liv X app, setting a precedent for traditional financial services providers to consider integrating crypto offerings. (mostly trading desks or custody services).

This bold step underscores Dubai’s ambition to lead the digital economy. As the banking sector races to claim its stake in the $3 trillion market, VARA-compliant white label cryptocurrency exchange development emerges as a perfect tool that banks can leverage to stay ahead of the game.

Top Reasons Why UAE’s Banks Must Embrace the Digital Asset Revolution

With 560 million owners worldwide, crypto no longer remains a niche asset or a fleeting trend. For banks, ignoring this shift results in losing relevance.

Let’s explore more reasons why adopting crypto (and integrating white label exchange platforms) ASAP is critical for banks and conventional financial services providers:

- Evolving Customer Demand: The demographic landscape of banking customers is undergoing a seismic shift, with Millennials and Gen Z exhibiting fundamentally different financial habits compared to older generations. These tech-savvy, future-oriented users seek greater control over their funds and demand more transparency in financial transactions. Banks that fail to offer crypto services risk losing this huge chunk of business to fintechs and cryptocurrency exchange software.

- Competitive Edge: While fintechs and digital-native challengers quickly highlight near-cross-border transactions, low fees and financial inclusion, traditional banks must catch up with the race by offering crypto-related services. It helps them stay relevant, appeal to a broader customer base and save them from the risk of losing customers to more agile competitors who offer desired services with white label crypto exchange software or custom solutions. Early adopters like Emirates NBD or those with a proactive and strategic approach gain first-mover advantages, attracting tech-savvy clients and global investors.

- Revenue Growth: Beyond meeting customer demands, the transformation is about staying profitable. Traditional banking revenue models may face pressures from various factors, making diversification into new areas crucial for sustained growth. Dubai banks can unlock a multitude of revenue streams with white label exchange platforms, including crypto trading, custody, and tokenization. Banks can generate income from transactions, withdrawals, custody, listing fees, etc. Leveraging advanced white label crypto exchange development platforms, they can also introduce premium features such as margin trading and staking, further expanding their income sources.

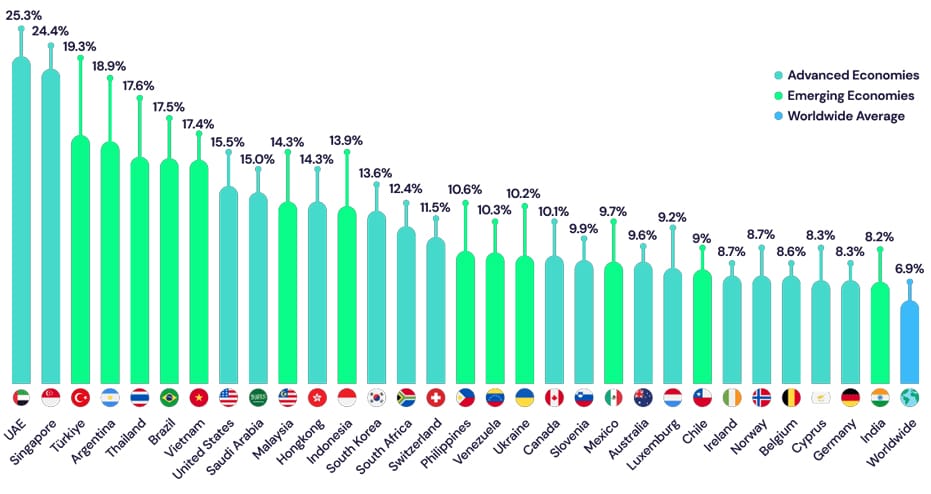

- Tapping Into the Rapidly Expanding UAE’s Crypto Market: The Emirates NBD move to dominate the digital asset arena reflects the growing demand for digital assets in the UAE, which boasts one of the highest crypto adoption rates globally.

Source: Triple AMarwan Hadi, Group Head of Retail Banking and Wealth Management at Emirates NBD, highlighted the bank’s keenness to capitalize on this trend by launching their own virtual asset offering.The increasing interest in crypto within the UAE is further underscored by the rising downloads of crypto-related applications in the region, which rose from 6.2 million in 2023 to 15 million in 2024.

- Strengthening the Overall Systems With Distributed Ledger Technology: The underlying technology powering cryptocurrencies, blockchain, also offers substantial benefits that traditional banks can leverage, including decentralization and transparency that can enhance the overall operational efficiency and security of conventional banking architectures. Be it faster, more cost-effective, and middleman-free cross-border transactions or transparent and tamper-proof records of transactions, the technology behind white label crypto exchanges is open for banks to explore.

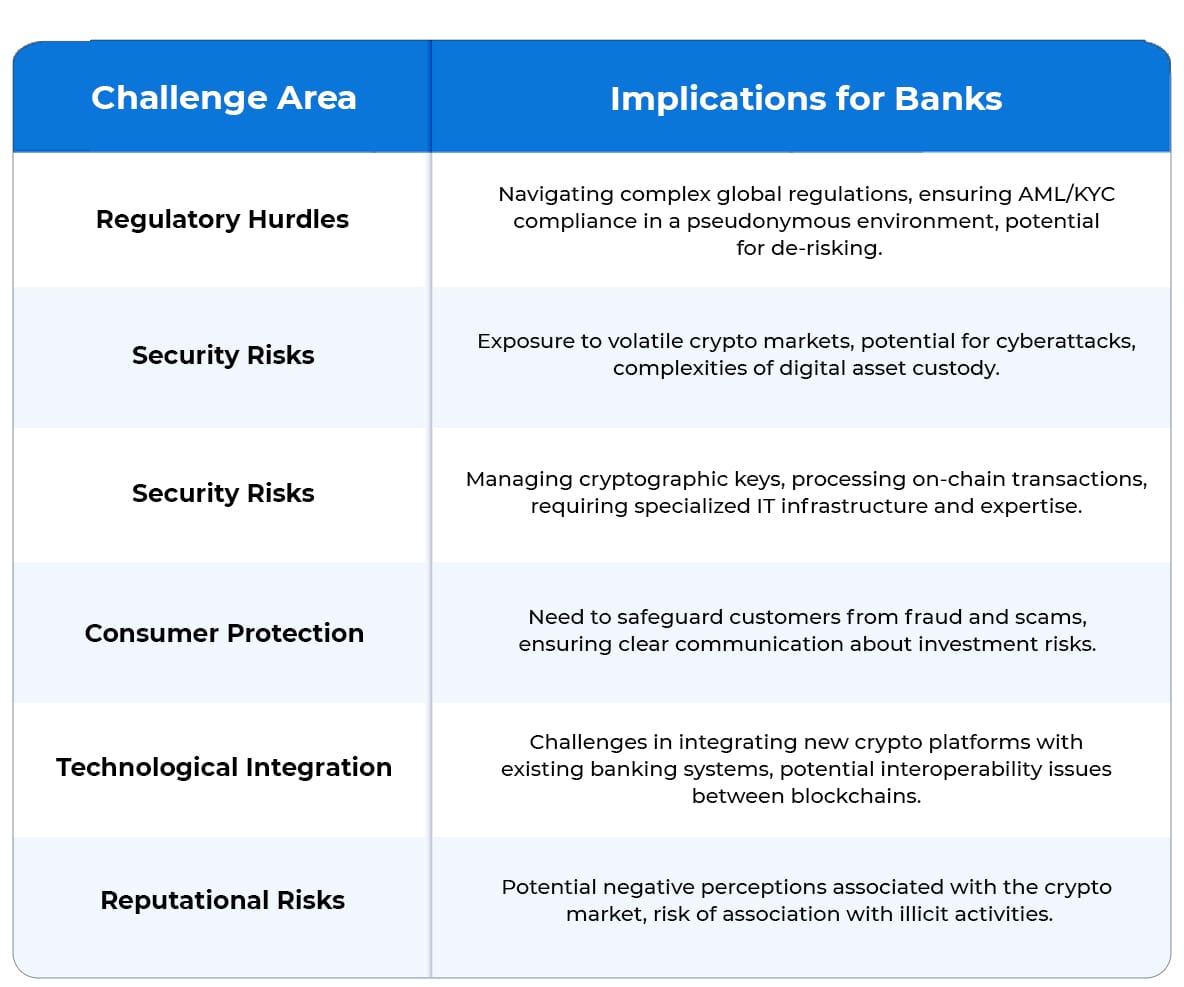

3 Key Challenges Banks Face When Entering the Crypto Market

For traditional financial institutions entering the crypto space, it isn’t just about innovation. Entering the cryptic financial markets is fraught with challenges, especially for banks that embody conventional finance. Security, compliance, technical complexities, etc., often stall the progress.

This is where VARA-compliant white label cryptocurrency exchange development solutions emerge as the ultimate solution for banks ready to lead—not follow—in the digital asset era.

Challenge 1: Regulatory Minefields

The global regulatory landscape for cryptocurrencies remains complex and fragmented. Even though Dubai has established VARA, a dedicated regulatory authority, it’s still daunting to navigate. Moreover, banks operating internationally or dealing with international clients will need to navigate potential differences in regulations across various jurisdictions. Non-compliance may lead to fines, reputational damage, operational shutdowns, etc. Despite being a necessity for banks integrating white label crypto exchange software solutions, complying with stringent AML and KYC regulations can also be particularly challenging.

Solution: Regulatory Compliance Made Effortless

Banks must consider having a robust system in place to verify user identities (such as third-party KYC, DIDs) and monitor transactions for suspicious activity to avoid potential legal problems and fines. The risk of “de-risking,” where banks choose to terminate relationships with entities deemed high-risk due to AML compliance concerns, is also a factor to consider. A reliable white label cryptocurrency exchange development partner like Antier can help banks by offering a compliant trading infrastructure with robust and compliant user authentication, risk management, and AI-based fraud detection mechanisms.

Antier’s platform is pre-built to meet VARA, FATF, and GDPR standards, so your bank can launch their crypto trading offering faster and safer. Compliance Features of White Label Exchange Platform Include:

Enjoy zero compliance headaches with:

- Automated KYC/AML workflows

- Customizable risk thresholds for transactions

- Pre-configured audit trails for regulators

Challenge 2: Security Vulnerabilities and Operational Risks

Security and operational risks represent another significant hurdle. Managing cryptographic keys, ensuring the secure custody of digital assets, and processing on-chain transactions require specialized expertise and infrastructure that may differ significantly from traditional banking operations. Furthermore, the threat of cyberattacks is ever-present in the crypto space, necessitating the implementation of advanced security protocols to protect user funds and sensitive data.

Solution: Security That Meets Central Bank Standards

Banks can’t compromise on security and crypto trading platforms become honeypots for hackers. Banks require enterprise-grade security to be integrated into white label cryptocurrency exchanges to protect user funds and data, including:

- Advanced Data Protection: End-to-end, bank-grade encryption (AES-256, TLS 1.3) and GDPR-compliant data handling.

- Cold Storage Dominance: 95%+ of assets stored offline, immune to cyberattacks.

- AI-Powered Fraud Detection: Real-time threat monitoring and response to block suspicious activity.

- Clear and transparent communication about the risks associated with cryptocurrency investments is essential, ensuring customers understand the potential risks and downsides associated with trading.

- Pick White Label Exchange Platforms With Two-factor Authentication, Hardware Security Modules for key management, Multi-Signature Wallets and Regular Security Audits

Challenge 3: Integration With Legacy Systems:

Banks often operate on legacy infrastructures that are not inherently designed to support blockchain’s speed, scalability demands, and high-frequency digital transactions, necessitating significant technical overhauls. Moreover, seamless inter-blockchain and intra-blockchain compatibility and data exchange are crucial for the smooth operations of banks integrating white label cryptocurrency exchange development solutions. While blockchain offers many benefits, interoperability issues between different blockchains can sometimes hinder seamless data exchange.

Solution: A Bank-Grade White Label Exchange Platform

- High TPS Architecture for Unmatched Performance: Ensuring speed that keeps pace with market demands so your sluggish exchange doesn’t drive users away anytime:

- 10,000+ TPS for peak trading

- <50ms latency for order execution

- Seamless fiat-crypto integration

- Auto-scaling cloud infrastructure

- Advanced data-protection mechanisms

- Custom Branding White Label Cryptocurrency Exchange: So you can launch your fully branded, feature-rich VARA-compliant crypto trading platform within weeks, not years.

-

- Banking Integrations: Fiat gateways, liquidity pools, and institutional APIs.

- Tailored UX: Customizable interfaces to mirror your bank’s identity.

Other Challenges

- Customer Education and Trust: Bridging the knowledge gap for customers who are new to digital assets and building trust in a nascent asset class remain significant hurdles for established banks. Along with user-friendly white label crypto exchange development solutions, banks can leverage gamified learning modules to educate their audiences.

- Reputational Risks: Finally, banks must also consider the potential reputational risks associated with venturing into a relatively new and sometimes controversial asset class. Negative perceptions or associations with illicit activities in the broader crypto market could potentially impact a bank’s reputation. So, banks must carefully operate their crypto arms. Additionally, they must leverage white label cryptocurrency exchanges that adhere to the strictest security measures to ensure that their platforms remain hack-proof and reliable all the time.

Case Study: How a Tier-1 Bank Launched a Profitable Crypto Arm in 90 Days

A leading European bank leveraged a premium white label crypto exchange development solution to:

- Reduce time-to-market from 18 months to 90 days.

- Attract 50,000+ users in the first quarter with a branded, user-friendly platform.

- Generate $5M+ in fees monthly, with zero regulatory incidents.

The Bottom Line: Banks That Act Now Will Define the Future

“White label crypto exchanges are the bridges banks need to secure their future in the digital asset arena.”

With institutional investors and retail users increasingly demanding access to digital assets, banks can’t risk losing relevance. However, the stakes are high: regulatory scrutiny, cybersecurity threats, and operational inefficiencies can derail even the most ambitious projects.

The answer? Partnering with a white label crypto exchange software provider that guarantees full VARA compliance, lightning-fast transaction speeds, and enterprise-grade security tailored for the banking sector.

With a VARA-compliant white label exchange platform, your bank can:

- Monetize crypto demand without operational risks.

- Strengthen customer loyalty with cutting-edge services.

- Stay ahead of competitors still stuck in legacy systems.

Banks are already leading the financial landscape. Then why not lead this digital asset revolution?

Why Partner With Antier?

Antier is a trusted partner for banks entering the crypto space, offering turnkey white label cryptocurrency exchange development solutions that combine regulatory rigor, blazing speed, and unbreakable security. We’re not just another tech vendor—we’re your strategic ally in the digital asset race. Here’s what sets us apart:

🔒Proven Compliance: Pre-integrated VARA frameworks for hassle-free audits.

🚀 Future-Proof Tech: Modular architecture ready for DeFi, NFTs, and CBDCs.

💼 Bank-Centric Expertise: Built by fintech veterans who understand institutional needs.

Let us power your digital asset ambitions with Antier’s fast, secure, and unstoppable white label crypto exchange software. Schedule a demo now!