- No More Screen-Switching Chaos With DEX Aggregators

- Upcoming New Era of DEX Aggregator Development

- The Problem: Why DEX Aggregators Need an AI+ L2 Upgrade in 2025

- AI: The Invisible Architect of Smarter Trades

- Building Your Own AI DEX Aggregator in 2025: A 5-Step Blueprint

- AI DeFi Aggregator Development: Challenges & Solutions

- How Are Top DEX Aggregators Optimizing Trades in 2025?

- AI DEX Aggregator Development on L2: Merging Intelligence With Infrastructure

No More Screen-Switching Chaos With DEX Aggregators

Crypto data aggregation platforms have transformed how users interact with DEXs. Because let’s face it, who has time to juggle five tabs just to find the best price for a digital asset or place a big crypto trade?

Enter DEX aggregators: your one-stop solution for analyzing prices, snagging the lowest fees, and executing trades seamlessly, all while dodging the frustration of slippage. By pooling liquidity from across the market and executing trades at the best prices, they’ve already outshined standalone DEXs in efficiency.

Upcoming New Era of DEX Aggregator Development

But here’s the twist: it’s 2025, and six years since the pioneer DEX aggregator burst onto the scene. Today, the space is buzzing with contenders, all vying to get the largest market pie. The race isn’t just about survival anymore but about reinventing convenience. The platforms are constantly innovating, striving to achieve everything from near-instantaneous trades to AI-powered order routing for cost-effective transactions. So, if you’re considering DEX aggregator development in 2025, here are some challenges that you need to address with AI and L2 integration.

The Problem: Why DEX Aggregators Need an AI+ L2 Upgrade in 2025

Today’s DEX aggregators are revolutionary, pouring and pooling liquidity from exchanges and market makers and scouring the cryptoscape to find the best prices. But they’re battling bottlenecks that threaten to stall the DeFi revolution. Let’s dissect the core challenges plaguing traditional DEX aggregators—and why 2025 demands a fusion of AI and Layer 2 solutions for DEX Aggregator Development to overcome them.

1. High fees: The Gas Guzzlers of Ethereum’s Layer 1

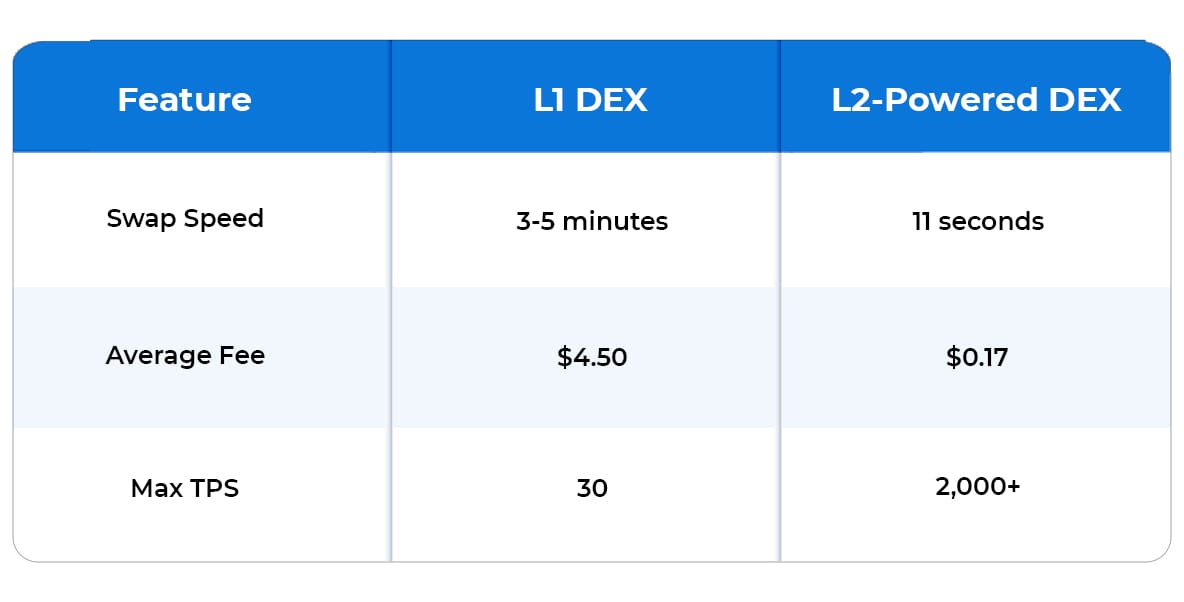

Ethereum lays the foundation for DeFi, but its gas burns holes in wallets. Gas fees (transaction costs) spike unpredictably during network congestion, turning simple swaps into wallet-draining nightmares.

- Gas Wars: When prices drop or yield farms launch, bots and whales battle for block space, pushing fees to $100+ per transaction, and pricing out retail traders.

- Fee Inequity: Paying 50 to swap 100 tokens isn’t inefficient but absurd. Traditional finance (TradFi) platforms like Robinhood charge pennies for stock trades, but DeFi’s “permissionless” ethos ironically excludes those it aims to empower.

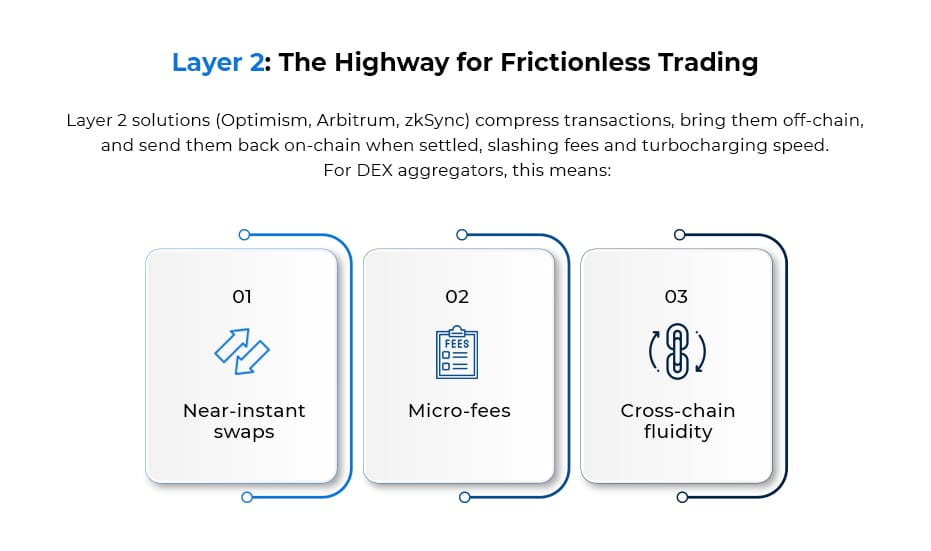

L2 DEX Aggregator Development significantly reduces fees by 100x, but most aggregators still default to L1, leaving users to pay fees from their savings.

2. Latency: Cross-Chain Swaps Stuck in the 90s

Users won’t tolerate “dial-up internet speeds” in a 5G world. Cross-chain swaps promise a borderless DeFi experience, but the L1 DEX aggregator development solutions make users feel like sending a fax across continents.

- Bridge Bottlenecks: Moving assets from Ethereum to Polygon or Solana can take minutes (or hours) due to slow finality and clunky bridge designs that lock tokens on one chain and mint equivalents on others. By the time your USDC arrives, the arbitrage opportunity is gone.

- Fragmented Liquidity: AI DEX Aggregators built on L1 split routes across chains, but delays in execution leave trades vulnerable to price swings. Imagine ordering a coffee, waiting 10 minutes, and paying a few dollars more for your cappuccino due to a sudden price surge.

As newcomers in DeFi face a labyrinth of networks, wallets, and pending transactions, the complexity may scare them off, barricading mainstream adoption.

L2 Cross-Chain DEX Aggregator Development leverages native bridges that batch transactions, reducing gas costs by 90-99%.

Platforms like Starknet and Optimism can significantly optimize trades.

3. Static Routing: Algorithms Unable To Match Crypto Speed

Algorithms can’t predict volatility—they react, often too late. Current DEX aggregator development relies on algorithms that operate in the present—snapping up the best price at the exact millisecond they check, but crypto still moves faster.

- Volatility Blindspots: A “perfect” route selected at 12:00:00 PM might crumble by 12:00:02 PM when a whale dumps tokens or a lending protocol liquidates. Static algorithms can’t anticipate these shifts, leaving users with slippage or failed trades.

- Maximal Extractable Value Exploitation: MEV bots exploit these delays caused by conventional DEX aggregator development caveats, front-running trades, and siphoning value from unsuspecting users.

Without AI, aggregators are like GPS systems that ignore traffic jams and road closures.

AI DEX Aggregator Development changes the course as they anticipate volatility before they hit DEXs. Leveraging Chainlink or Pyth oracles for off-chain data, aggregators can conveniently optimize the trading paths. Innovative DEX aggregator platforms can also leverage advanced machine-learning models to scrape news and social media sentiments.

AI: The Invisible Architect of Smarter Trades

AI transforms DEX aggregators from dumb routers into predictive engines. Here’s what AI DEX aggregator development introduces:

- Predictive Liquidity Routing:

AI models analyze historical data, market sentiment, and real-time liquidity pools to predict optimal trade routes before you click “swap.” Think of it as Google Maps for DeFi—avoiding congestion and roadblocks. - Anomaly Detection:

Spotting rug pulls or sandwich attacks in real-time? AI’s neural networks flag suspicious activity, shielding users from exploits. - Dynamic Slippage Adjustment:

Instead of static slippage tolerances, AI DEX aggregators adjust parameters mid-trade based on volatility spikes, MEV bots, or sudden liquidity shifts. - Personalized Trading Strategies:

Machine learning tailors user recommendations based on their portfolio, risk appetite, and past behavior—like a robo-advisor for DeFi degens. - Dynamic Fee Optimization: AI can dynamically adjust trading strategies based on fluctuating gas fees and liquidity conditions, ensuring the most cost-effective trades.

Building Your Own AI DEX Aggregator in 2025: A 5-Step Blueprint

The future isn’t waiting. If you’re considering an L2 AI DEX Aggregator Development, follow these steps:

- Pick Your Layer 2:

- Optimism for EVM ease

- zkSync for privacy and scalability.

- Arbitrum for EVM compatibility, ecosystem depth, and low risk.

- StarkNet for complex AI computations.

- Train Your AI Model:

- Use on-chain data (Uniswap, Curve) and off-chain signals (Twitter sentiment, CoinGecko trends) to predict liquidity shifts.

- Partner with platforms like Chainlink for real-time Oracle feeds.

- Integrate Cross-Chain Liquidity Into Your AI DEX Aggregator:

Deploy bridges to Ethereum, Solana, and Cosmos. AI should weigh trade-offs between chain speed and liquidity depth. - Security First:

Audit smart contracts and train AI to detect exploits. - Design for Humans:

Mask the complexity. A clean UI with AI-powered alerts beats a cluttered dashboard. - Test Relentlessly: Simulate flash crashes, MEV attacks, and cross-chain chaos.

AI DeFi Aggregator Development: Challenges & Solutions

Building an AI DEX aggregator on L2 isn’t all sunshine:

1. Data Oracles: AI needs quality data.

Solution: Partner with Chainlink or Pyth for L2-optimized feeds.

2. On-Chain AI Limits: Heavy ML models can’t run on-chain.

Fix: Off-chain computation (e.g., AWS) + zk-proofs for verifiability.

3. Regulatory Gray Areas: AI-driven trades might attract scrutiny.

Fix: Mitigate with transparent, open-source models.

How Are Top DEX Aggregators Optimizing Trades in 2025?

Want some motivation for AI DEX Aggregator Development on L2? These pioneers are already enlightening your path:

- Matcha: Leveraging L2 solutions to optimize cross-chain swaps, the pioneering DEX aggregator enables seamless swaps across chains, saving slippage and high costs.

“With bridgeless, trust-minimized cross-chain swaps now available on ZKsync Era, 1inch expects a notable uptick in trading volumes and user adoption,” Sergej Kunz, co-founder of 1inch, told CoinDesk.

- 1inch DEX Aggregator: The pioneering aggregator recently integrated zkSync to offer lower gas fees and a faster cross-chain trading experience. Through its integration powered by “Fusion+” technology, the DEX aggregator plans to achieve 10,000 TPS.

- Rubic AI DEX Aggregator: Embracing AI, the DEX aggregator enhances transactional capabilities and gives users access to predictive analytics.

AI DEX Aggregator Development on L2: Merging Intelligence With Infrastructure

L2 solutions grant the aggregators the speed and scalability to the infrastructure. But speed alone isn’t enough for ideal DEX aggregator development, so AI becomes the brain to the brawn. Together, they’re the boosters DeFi needs.

The question now isn’t about whether this fusion is essential or not but how your aggregator will set the pace in a world where top contenders have already taken this route.

In the race for next-generation DEX development powered by AI and Layer 2 solutions, Antier has emerged as a trailblazer, combining deep technical expertise with a user-first philosophy. Whether you’re a future-oriented startup or an enterprise, Antier’s AI+L2 expertise has got you covered.

Don’t wait for someone else to take the lead if you have some standout AI DEX aggregator development ideas. Antier’s team is already scripting the future of the DeFi. Schedule a call to start building your AI-powered, L2-native DEX aggregator today.