The financial landscape is undergoing a profound transformation, driven by the rise of blockchain technology and the emergence of Real-World Asset tokenization. By converting physical assets such as real estate, art, commodities, and private equity into digital tokens on a blockchain, tokenization unlocks a new era of investment opportunities, enhanced liquidity, and increased accessibility.

At the forefront of this revolution is Asset Tokenization Studio (ATS) – Hedera’s open-source platform. It empowers issuers to seamlessly create, manage, and operate digital securities while ensuring full compliance with global regulations, including SEC Regulations D (506-b, 506-c) and Regulation S. ATS democratizes access to asset tokenization with key components and features, all open source under the Apache 2.0 license. The source code will soon be available on GitHub, making innovation in asset tokenization more accessible than ever.

Core Implementation: Building a Foundation

At the heart of an effective ATS lies a robust technological foundation. This often involves leveraging the ERC-1400 standard, a foundational token standard that provides a comprehensive framework for managing digital securities.

Key Modules: The core implementation layer typically includes essential modules such as:

- Access Control: Implementing role-based access control allows issuers to assign specific permissions (e.g., minting, transferring) to different users, enhancing security and governance.

- Control Lists: Approval and blocklists ensure that only authorized parties can engage in token transactions, crucial for KYC/AML compliance and regulatory adherence.

- Supply Cap: Setting a maximum token supply prevents unauthorized minting, maintaining transparency and investor trust.

- Pause Function: Allows issuers to temporarily halt all token transfers during audits, security threats, or other critical events.

- Lock Function: Enables the freezing of specific tokens or accounts, useful for restricted trading periods, legal holds, or tokens subject to vesting schedules.

- Snapshots: Captures token holder balances at specific points in time, providing accurate records for audits, dividends, or voting rights.

This modular approach provides a flexible and adaptable foundation for managing digital securities effectively.

Defining and Customizing

Building upon this core, the next layer focuses on defining specific types of digital securities, such as equities and bonds. This layer also incorporates provisions for processing corporate actions like dividend payments and coupon payments.

Crucially, this layer emphasizes customization. Issuers can tailor the tokenized securities to comply with specific legal and regulatory requirements in different jurisdictions. This flexibility is crucial as the regulatory landscape continues to evolve.

Streamlining the Process with Technology

ATS platforms leverage cutting-edge technology to streamline the tokenization process:

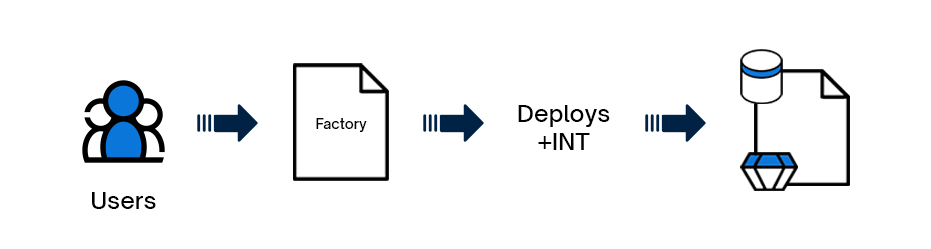

- Smart Contracts: Automated and standardized through the use of enhanced factory contracts, audited by reputable firms like A&D Forensics. These smart contracts simplify the deployment of security tokens, ensuring consistency and reducing development time.

- Software Development Kit (SDK): An SDK provides developers with a set of tools and libraries to easily interact with ATS smart contracts and build decentralized applications (dApps) on the underlying blockchain.

- User-Friendly Interface: A user-friendly web interface enables both technical and non-technical users to interact with the platform, manage digital securities, and monitor transactions without requiring in-depth technical knowledge.

Advanced Architecture

The underlying architecture of a robust ATS often involves a sophisticated interplay of smart contracts:

- Factory Contracts: These contracts act as blueprints, creating new instances of specific security tokens (e.g., equities, bonds) according to predefined parameters.

- Resolver Contracts: These contracts act as intermediaries, directing token operations to the appropriate logic modules based on the specific action required.

- Proxy Contracts: These contracts act as intermediaries between the user and the underlying token logic, enabling seamless upgrades and modifications without disrupting existing token functionality. This architecture, based on the ERC-1400 standard and its interoperability with other key standards like ERC-20, ERC-1410, ERC-1594, ERC-1643, and ERC-1644, ensures a robust and scalable foundation for managing digital securities.

Key Advantages of Utilizing an ATS:

- Streamlined Tokenization Process: ATS significantly streamline the complex process of tokenization, reducing time, effort, and the potential for human error.

- Enhanced Security: Leveraging blockchain technology and robust security protocols enhances the security and transparency of the tokenization process, mitigating risks and protecting investor interests.

- Regulatory Compliance: ATS providers ensure compliance with relevant laws and regulations, mitigating legal and reputational risks for issuers.

- Access to Expertise: Provides access to a team of experts in blockchain technology, finance, law, marketing, and other relevant fields.

- Increased Efficiency: Automation and streamlined workflows improve operational efficiency and reduce administrative overhead.

- Expanded Investor Reach: Connects issuers with a wider pool of potential investors, including both retail and institutional investors, broadening the market for tokenized assets.

- Improved Investor Experience: User-friendly interfaces and streamlined processes enhance the investor experience, making it easier to participate in tokenized asset markets.

The Future of Asset Tokenization Studio

The future of Asset Tokenization Studio is bright. As the asset tokenization market matures, we can expect to see further innovation and specialization within the space. Key areas of development include:

- Artificial Intelligence (AI) and Machine Learning (ML) integration: Utilizing AI and ML to optimize tokenization processes, improve risk assessment, and enhance investor matching.

- Expansion into new asset classes: Exploring the tokenization of novel asset classes, such as intellectual property, real-world data, and even carbon credits.

- Development of new token standards and protocols: Continuously refining and developing new standards and protocols to enhance security, interoperability, and efficiency within the tokenization ecosystem.

- Cross-border collaboration: Fostering collaboration between regulators, industry players, and academic institutions to address emerging challenges and shape the future of the tokenization industry.

- Decentralized Autonomous Organizations (DAOs): Leveraging DAOs to govern and manage aspects of the tokenization process, enhancing transparency and community involvement.

Final Words

By leveraging the power of blockchain technology, providing comprehensive support to issuers and investors, and fostering a collaborative ecosystem, Asset Tokenization Studio is poised to unlock the full potential of tokenization, transforming the way we own, trade, and manage assets across a wide range of sectors.