Missed Doge and Pepe? Your Second Chance Lies In Meme Coin Development On BNB Chain

April 7, 2025

Your Roadmap from IDO Launchpad to a Thriving DEX Aggregator in 2025 and Beyond

April 8, 2025Let’s get one thing straight—crypto banking isn’t just evolving, it’s shape-shifting. And at the center of this transformation? A tiny, embedded chip that’s quietly rewriting the rules of mobile finance: eSIM. No more juggling physical SIM cards, worrying about cross-border accessibility, or waiting for KYC approvals that feel like a paperwork marathon. We’re talking about secure identity baked directly into the device, real-time authentication baked into the architecture, and connectivity that travels faster than your assets ever could.

If that sounds like science fiction, welcome to the future of decentralized banking—already in motion. While most players are still figuring out how to scale trust, compliance, and convenience, a select few are leveraging eSIM to do all three simultaneously. And the result? A new breed of mobile-native, globally agile, crypto-friendly Neo banks that don’t play by yesterday’s rules.

You don’t have to imagine what’s possible. It’s already happening. The question is: are you building with it, or watching from the sidelines?

Let’s unpack the tech that’s changing everything.

What is eSIM? And Why Does It Matter in a Digital Asset Banking Solution?

An eSIM—Embedded Subscriber Identity Module—is more than just a telecom advancement; it’s an architectural leap forward for secure, mobile-native finance. Unlike traditional SIMs, eSIMs are hardwired into devices, allowing digital profiles to be provisioned remotely, securely, and instantly. In a digital asset banking solution, where decentralized architecture and real-time authentication are non-negotiable, eSIM acts as a foundational enabler. It provides secure device-level identity, tamper-resistant onboarding, and geo-agnostic accessibility, unlocking new dimensions of user experience and compliance at scale.

As projected by GSMA, eSIM adoption is accelerating toward 7 billion connected devices by 2025. This surge paves the way for highly responsive, globally inclusive banking ecosystems. With eSIM for digital banking, institutions can offer remote account provisioning, real-time KYC, and biometric-linked wallet access without physical dependencies. In this evolving fintech narrative, eSIM is not merely a convenience—it’s a strategic asset. It transforms how digital banking platforms operate, scale, and serve users in the era of Web3 finance.

How Does eSIM Create Winners in Crypto Neo Banking?

The integration of eSIM is rapidly emerging as a transformative edge for digital-first financial institutions, particularly those navigating the evolving terrain of crypto neo banking. eSIM allows:

- Seamless Global Onboarding, Redefined : eSIM eliminates the limitations of physical SIM logistics, allowing crypto Neo banks to instantly onboard users across borders. Through remote provisioning, users can activate their accounts and wallets without delays—no paperwork, no hardware dependency. This frictionless approach positions early adopters of eSIM technology in crypto banking leagues ahead in scalability.

- Biometrically-Secured Identity Layer : eSIM empowers real-time identity authentication using biometrics by leveraging embedded encryption at the device level. This innovation aligns perfectly with evolving KYC/AML regulations, enabling faster compliance without compromising security. It creates a tamper-proof layer of trust for high-value clients and regulators.

- 24/7 Wallet Connectivity for Institutional Access : eSIM’s always-on connection ensures that traders, asset managers, and enterprises can interact with digital wallets continuously. Whether executing high-frequency trades or managing multi-chain portfolios, the uninterrupted access provides the reliability demanded by elite users, transforming standard platforms into truly premium Digital asset banking solution environments.

- Empowering Banking in Emerging Markets : In underbanked regions, eSIM acts as a digital bridge, delivering blockchain-powered financial services directly to mobile users.

- Infrastructure Built for Scale and Reach : The global infrastructure is primed for expansion with forecasts projecting over 3.5 billion eSIM-enabled devices by 2025. Crypto neo banking eSIM integration is effectively future-proofing their operations, offering services that travel as freely as the user does.

eSIM is not a trend—it’s the technology quietly reshaping the landscape of digital finance. For those at the helm of crypto neo banking, adopting it now is not just smart—it’s strategic. The era of winners has begun. Where do you stand?

Web3 Enterprises Are Already Leveraging eSIM Technology in Crypto Banking

Web3-native institutions harness eSIM technology in crypto banking to unlock always-connected, device-authenticated access to decentralized financial systems. This shift toward eSIM-backed architecture enables a new class of borderless, programmable finance, where user onboarding, wallet verification, and multi-region digital asset access operate without friction.

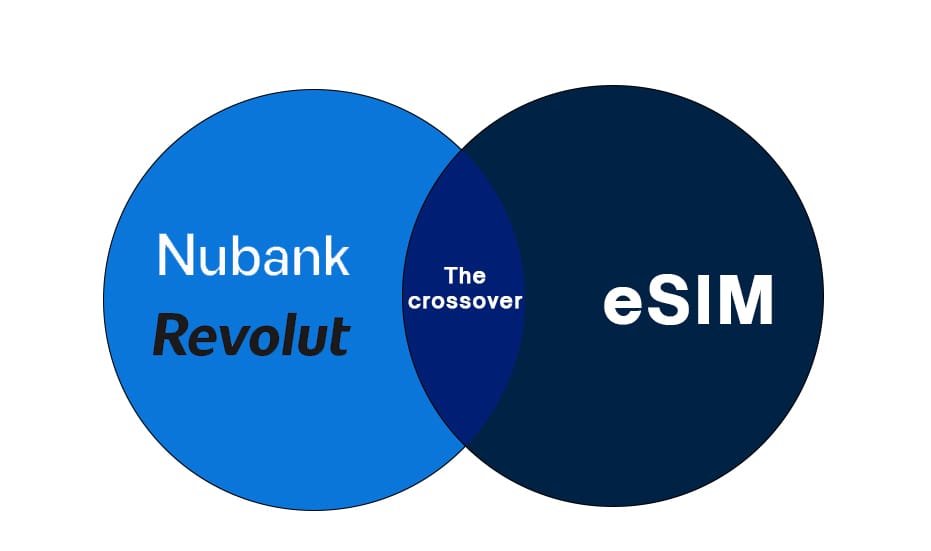

Leading the transformation is Revolut, which has integrated eSIM to deliver seamless mobile data access in over 100 countries. Paired with its crypto trading and custody services, this infrastructure ensures that users experience real-time portfolio management and secure token transactions, even while roaming. This is a clear demonstration of how crypto neo banking eSIM integration is driving operational uptime and user autonomy.

Meanwhile, Nubank—one of Latin America’s fastest-scaling fintechs—has deployed eSIM to support its digital-first banking experience across 40+ jurisdictions. Nubank is a strong model for hybridized digital asset banking solutions with compliance tooling from Chainalysis and growing crypto integrations.

The trajectory is unmistakable: eSIM for digital banking is no longer a novel add-on—it’s fast becoming a cornerstone of modern crypto banking architecture. Crypto neo banks embracing eSIM-led mobile authentication and international interoperability are setting the stage for the next era of decentralized finance, defined by autonomy, speed, and global scale. Still, pioneering such a transformative path brings inherent challenges. Regulatory fragmentation, hardware dependencies, and integration complexities persist—but they’re not deal-breakers. In fact, they’re catalysts for innovation.

Challenges? Yes. But eSIM in Crypto Neo Banking Wins Big

As crypto neo banking accelerates toward a mobile-first future, eSIM technology in crypto banking is gaining traction as both an innovation and an infrastructure enabler. While the path to adoption isn’t without friction, the strategic advantages eSIM offers are too significant to ignore. From streamlining identity to enabling borderless connectivity, it’s redefining how decentralized finance scales across devices and geographies.

As the demand for borderless, secure, and user-centric banking grows, eSIM for digital banking is evolving from a niche feature into a critical enabler. The shift is clear—crypto neo banks that embrace eSIM are better positioned to lead the next era of scalable, mobile-native digital asset finance.

eSIM and CBDCs: A Future-Forward Connection

As the financial world moves steadily toward digitization, the intersection of eSIM technology and CBDCs opens new doors to innovation. This fusion isn’t just a vision for tomorrow—it’s quietly becoming a core enabler for next-generation banking. While eSIM is already playing a powerful role in crypto neo banking by offering secure, tamper-proof mobile identity and seamless global connectivity, its potential stretches even further when paired with the rise of CBDCs.

“Imagine a future where CBDCs aren’t limited to apps or online platforms but are directly embedded into mobile devices via eSIM.” The result? A highly secure, frictionless, and always-on digital payment environment that doesn’t rely on third-party wallets or infrastructure. From simplified compliance to real-time transaction execution, the synergy between eSIM and CBDCs could pave the way for a new wave of inclusive, programmable finance.

This evolving connection represents more than just a technological upgrade—it’s a shift toward a digitally sovereign financial ecosystem where central banks, consumers, and fintechs converge. The real question is: how prepared is your financial model for this inevitable future? As this future-forward landscape unfolds, the role of expert solution providers becomes paramount. If you’re aiming to integrate eSIM capabilities into your banking stack, partnering with a specialized crypto banking development company can turn vision into execution, with speed, security, and scale.

Bridge Crypto and Connectivity—Partner With Antier

The future isn’t waiting—and neither should you. At Antier, we’re turning the promise of eSIM in digital banking into powerful, real-world platforms. From crypto neo banking eSIM integration to CBDC-ready wallets, tokenized asset flows, and hyper-secure digital identity layers, we build everything you need to lead in Web3 finance. Whether you’re launching from scratch or scaling up, our crypto banking solution providers are ready to architect your success.

Why follow the trend when you can define it? Let us be your launchpad into the future of digital finance.