Table of Content

- UAE: The Current Hot Market For Cryptocurrencies

- The Bigger Picture: The Rise of Crypto Neo-Banking

- What This Means for the Global Crypto Neo-Banking Market?

- Why Is Now An Ideal Time To Invest In Crypto Neo Banking Platforms?

- The Role of UAE Crypto-Friendly Regulatory Compliance In Neo Banking

- Why Must Businesses Consider a Regulatory-Compliant Neo-Banking Solution?

- Investment Strategies: How Can Businesses Enter The Crypto Neo-Banking Revolution?

- Why Seek Help From Crypto Neo-Banking Development Companies?

- Early Movers Win Big: Build Regulatory Compliant Neo Banking Solutions

The financial epicenter of the Middle East is undergoing a seismic shift—one that is redefining the very essence of banking. The UAE, already a global powerhouse in fintech, is spearheading an era where traditional financial institutions no longer hold the monopoly over wealth management and digital transactions. The rise of crypto neo-banking app is no longer a speculative trend; it is an evolutionary leap that has just been validated by one of the region’s most influential banks. The lines between conventional banking and digital asset ecosystems are blurring, and with each passing moment, the global financial hierarchy is being rewritten.

But what does this mean for businesses and investors? The stakes have never been higher, and the opportunities never more lucrative. The UAE is no longer just an emerging hub for digital banking—it is the definitive frontier. From regulatory clarity to the rapid proliferation of blockchain-based financial services, the foundation is set for forward-thinking enterprises to carve their niche in this transformative landscape. The question now is not whether crypto neo-banking is the future; it is whether you are positioned to seize this moment before the window of opportunity closes. Are you ready to align with the new vanguard of neo-banking innovation, or will you be left behind as the financial tides turn?

UAE: The Current Hot Market For Cryptocurrencies

“Embrace the future of finance, or risk being left behind.”

The UAE has rapidly ascended as a nucleus for crypto neo-banking, propelled by its avant-garde regulatory frameworks and robust economic infrastructure. This ascent is exemplified by Standard Chartered’s initiation of digital asset custody services within the Dubai International Financial Centre (DIFC), a move sanctioned by the Dubai Financial Services Authority (DFSA). Concurrently, the emergence of digital-only banks like Wio underscores the nation’s commitment to integrating crypto-friendly banking solutions. Wio’s swift attainment of profitability within its inaugural year highlights the burgeoning demand and acceptance of digital banking innovations in the region. Furthermore, strategic investments, such as Abu Dhabi’s MGX allocating $2 billion into Binance, reflect a concerted effort to fortify the UAE’s position in the crypto neo-banking market. These developments collectively position the UAE at the vanguard of the global crypto neo-banking evolution.

The Bigger Picture: The Rise of Crypto Neo-Banking

The rapid adoption of crypto neo-banking is fueling an explosive wave of growth in the global cryptocurrency market. As traditional banks integrate digital assets, liquidity is surging, institutional confidence is rising, and user adoption is accelerating. This shift is not just a trend—it’s a financial revolution.

Countries like Switzerland, Singapore, and the UAE are actively developing crypto-friendly banking solutions, setting regulatory frameworks that encourage innovation while ensuring security. The UAE, in particular, has become a global hub for crypto neo-banking, with major financial institutions embracing blockchain-powered financial services. With multiple nations exploring their own digital banking infrastructures, the question is no longer if crypto will redefine banking but how fast traditional institutions can adapt before they risk becoming obsolete. Will your bank be a leader or a follower in this transformation?

What This Means for the Global Crypto Neo-Banking Market?

The world’s financial systems are becoming crypto-first, with traditional models being left in the dust. The global rise of crypto neo-banking isn’t just about new technology; it’s a full-scale revolution reshaping institutional investment flows, market behaviors, and regulatory standards. How will your business tap into this global shift? Now is the time to align with the emerging leaders who are redefining banking for the digital age.

- UAE’s Role as a Crypto Neo-Banking Hub- The UAE has emerged as a leading crypto neo-banking market, offering regulatory clarity through Dubai’s Virtual Asset Regulatory Authority (VARA).

- Attracting Institutional Investments- Global firms, including major banks and hedge funds, are pouring capital into UAE-based crypto-friendly banking solutions.

- Explosive Market Growth & Business Opportunities- With $30 billion+ inflows and 42% market growth, businesses investing in crypto neo-banking in the UAE gain direct access to a booming sector.

- Competitive Edge for Investors- Regulatory stability, capital influx, and blockchain integration make the UAE the prime destination for launching digital banking ventures.

With its regulatory foresight and institutional backing, the UAE’s leadership in crypto neo-banking is reshaping global finance. Businesses investing now secure a first-mover advantage in this digital banking revolution.

Why Is Now An Ideal Time To Invest In Crypto Neo Banking Platforms?

Are outdated banking systems limiting your business’s growth and flexibility? In an age where digital innovation drives financial success, traditional banking models are no longer enough. Crypto neo-banking platforms offer the solution—enabling seamless, borderless transactions, reduced overhead, and enhanced security. In the United Arab Emirates, the Digital Banks market is expected to witness a significant increase in Net Interest Income, reaching an estimated value of US$3.02bn by 2025. This remarkable projection signals a crucial opportunity for businesses to capitalize on the rapid evolution of crypto neo-banking. The ticking clock is a stark reminder: the longer you wait, the more you risk missing out on securing your position in this transformative space.

1. Regulatory Advancement & Clarity – Governments, particularly in the UAE, are providing clear legal frameworks, ensuring compliance, and reducing uncertainties for businesses entering crypto-friendly banking solutions.

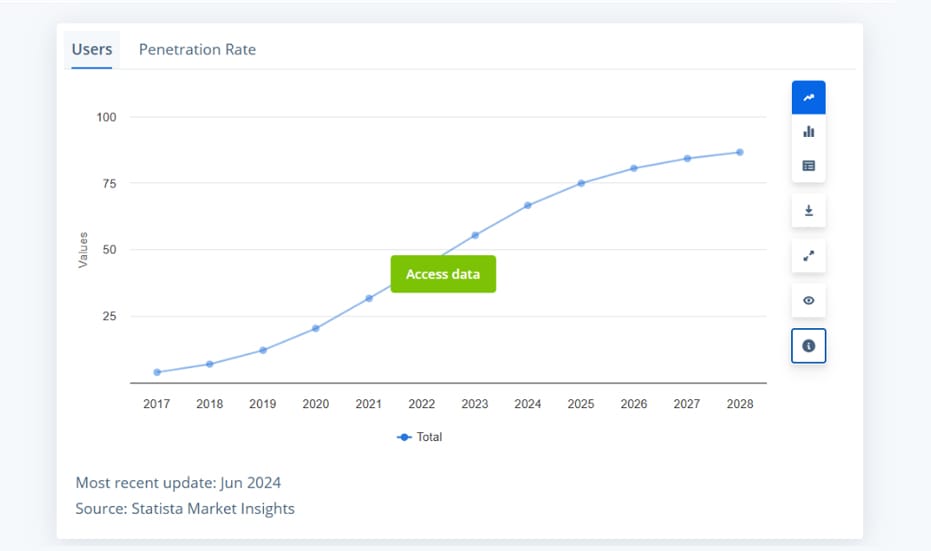

2. Explosive Market Growth & Adoption – The crypto neo-banking market is experiencing rapid expansion, with user penetration projected to exceed 40% by 2027, making it a lucrative sector for early investors.

3. Integration of Traditional & Digital Finance – Crypto neo-banks are bridging the gap between fiat and digital assets, offering seamless interoperability and advanced financial infrastructure.

4. Rising Demand for Decentralized & Borderless Banking – Traditional banking limitations are pushing global users toward crypto neo-banking in the UAE, where digital-first banking and financial inclusion are key priorities.

5. Future-Proof Investment in Financial Innovation – The convergence of blockchain, AI, and tokenized assets is redefining banking, making early investment in this space a strategic move for long-term growth.

Now is the perfect time to dive into the world of crypto neo banking platforms. With the market expanding and the demand for crypto-friendly services soaring, investors have a unique opportunity to tap into a rapidly growing sector. Crypto neo banking app development has never been more essential, and if you’re looking to stay ahead of the curve, now is your moment. Don’t miss out on this wave of innovation—seize the opportunity and invest where the future of banking is heading.

The Role of UAE Crypto-Friendly Regulatory Compliance In Neo Banking

The UAE has emerged as a global frontrunner in crypto-friendly banking solutions, crafting a regulatory landscape that balances innovation with security. With institutions like VARA (Virtual Asset Regulatory Authority) and ADGM (Abu Dhabi Global Market) leading the charge, compliance frameworks are designed to foster financial integrity while accelerating digital banking growth. These regulations eliminate uncertainties, mitigate financial risks, and establish a structured environment where crypto neo-banking in the UAE can thrive. By embedding transparency and accountability into financial operations, these frameworks bolster institutional trust and attract large-scale investments into the sector.

Why Must Businesses Consider a Regulatory-Compliant Neo-Banking Solution?

In an evolving market, how can businesses ensure they remain compliant while capitalizing on the crypto neo-banking boom? The UAE’s crypto-friendly regulations offer a unique opportunity, but failing to understand and comply could put your business at risk. How will you navigate these complexities to stay ahead of competitors? The answer lies in not overlooking the importance of regulatory compliance in the crypto neo-banking sector. Lets see the reasons behind them –

- Security and Fraud Prevention : Regulatory-compliant platforms offer built-in safeguards, reducing the risk of fraud, hacking, and non-compliance penalties, which ensures safer transactions.

- Enhanced Customer Trust : Being compliant with local and international regulations strengthens customer confidence, leading to higher adoption and loyalty among users.

- Long-Term Sustainability : Compliance ensures that businesses are future-proof, aligning with emerging global standards and regulations, which helps avoid disruption as the market matures.

- Cross-Border Efficiency : Regulatory frameworks facilitate seamless cross-border transactions, making it easier for businesses to scale and expand globally while adhering to local laws.

- Operational Legitimacy : Compliance validates the business’s legitimacy and adherence to industry standards, fostering transparency and operational efficiency.

Regulatory compliance isn’t just a checkbox—it’s a strategic advantage. Partnering with a crypto neo banking app development company gives you the peace of mind that your platform is secure, scalable, and ready for the future. Embrace compliance now to avoid pitfalls down the road and keep your business ahead of the competition.

Investment Strategies: How Can Businesses Enter The Crypto Neo-Banking Revolution?

Businesses can enter the crypto neo-banking ecosystem by adopting several investment strategies focused on innovation and blockchain integration:

- Build a crypto neo-bank offering digital currency services for traditional banking.

- Partner with existing crypto neo-banks to leverage their infrastructure and technology.

- Invest in DeFi or blockchain technology to offer services like lending, borrowing, etc.

- Tokenize existing financial products or services to create digital assets.

- Integrate stablecoins to minimize volatility in transactions and provide stable payment solutions for customers.

- Use white-label crypto neo-banking platforms to quickly launch branded services.

- Focus on Regulatory Compliance & Invest in compliance-focused solutions.

- Integrate Crypto Payments and Wallets to offer seamless transactions.

Why Seek Help From Crypto Neo-Banking Development Companies?

Partnering with experienced crypto neo-banking development companies allows businesses to leverage cutting-edge technology, regulatory expertise, and user-centric design. With secure, scalable, and compliant platforms, these experts ensure your business is ready for tomorrow’s banking needs. Are you ready to unlock the full potential of your digital banking vision?

✔ Expertise in Regulatory Compliance : Crypto neo-banking development companies are well-versed in navigating complex regulatory environments, such as UAE crypto-friendly regulations. They ensure your platform meets all legal and compliance standards, mitigating risks of legal hurdles and non-compliance issues.

✔ Custom Solution Design : These development firms specialize in building tailor-made solutions that fit the unique needs of your business. Whether it’s incorporating digital asset management or enabling seamless fiat-to-crypto conversions, they design efficient, secure, and scalable platforms.

✔Integration of Advanced Blockchain Technologies : These companies leverage cutting-edge blockchain technology to build secure, transparent, and decentralized platforms. By integrating blockchain, businesses can ensure faster and more reliable transactions, reducing costs while improving security.

✔ Optimized User Experience (UX/UI) : Crypto neo-banking platforms require a user-centric approach. Development companies possess the technical expertise to craft intuitive, high-performance UX/UI designs that enhance the customer journey and increase adoption rates.

✔ Security Protocols and Risk Management : With the rise in digital asset fraud, professional development companies implement the latest security measures, including multi-signature wallets, encryption, and two-factor authentication, ensuring the safety of both users’ funds and data.

✔ Support for Cross-Border Transactions : As the crypto neo-banking market expands globally, these development companies offer support for cross-border payments and multi-currency integration, enabling businesses to reach global customers while ensuring compliance with various local regulations.

✔ Faster Time-to-Market : By partnering with experienced crypto neo-banking development companies, businesses can accelerate the time it takes to launch their platform, giving them a competitive edge in the fast-evolving crypto neo-banking sector.

✔Ongoing Technical Support and Maintenance : Crypto neo-banking platforms require regular updates and maintenance to stay compliant with regulatory changes and to address any vulnerabilities. These development firms provide ongoing support to ensure your platform remains secure and efficient.

✔Cost-Efficiency and Scalability : Outsourcing neo-banking development to professionals is often more cost-effective compared to in-house development. These companies provide scalable solutions that grow with your business, ensuring that your platform can handle increased user demand and transaction volume without performance degradation.

✔ Incorporating Advanced Financial Products : Experienced crypto neo-banking development companies can integrate a variety of financial products into your platform, such as savings accounts, crypto loans, and investment opportunities, providing your users with a holistic digital banking experience.

When venturing into the crypto neo-banking space, having the right expertise on your side is crucial. A skilled crypto neo banking app development company can simplify the complexities of building a secure, scalable platform. They bring both innovation and security to the table, ensuring that your business is set up for success in this fast-moving industry. Don’t take on this challenge alone—trust the professionals to build a solution that meets both your business needs and regulatory standards.

Why See Early Movers Win Big: Build Regulatory Compliant Neo Banking Solutions

Neo-banking powered by crypto is not just an innovation—it’s a game-changer for businesses and investors in the UAE. With digital finance rapidly evolving, now is the time to capitalize on this transformative shift.

Are you also planning to invest in a solution that will give you a competitive edge? If yes, then partner with a prestigious firm. At Antier, we are a renowned crypto neo-banking app development company, offering cutting-edge solutions tailored for compliance and business success. Our blockchain experts stay ahead of technological advancements, market demands, and regulatory updates to build future-ready platforms. Take a look at our comprehensive services offered by our highly certified and skilled blockchain experts-

- White-label crypto neo-banking solutions

- Virtual crypto card issuance

- Fiat-to-crypto payment integration

- Multi-currency wallets

- DeFi-powered banking systems

Partner with Antier’s experts today to build a compliant, scalable, and profitable crypto neo-banking solution. Contact us now!

In the United Arab Emirates, the Digital Banks market is expected to witness a significant increase in Net Interest Income, reaching an estimated value of US$3.02bn by the year 2025.