- What is EIP-7702?

- The Technical Foundation of EIP-7702 in Hybrid Exchange Development

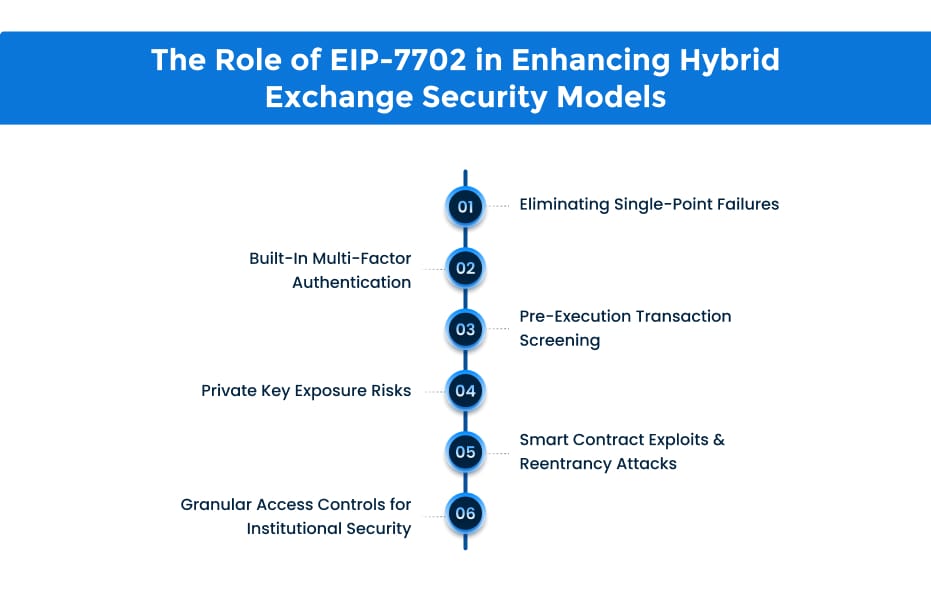

- The Role of EIP-7702 in Enhancing Hybrid Exchange Security Models

- Why Enterprises Should Invest in Hybrid Exchanges Powered by EIP-7702?

- How to Build a Hybrid Exchange Integrated with the EIP-7702 Protocol?

- How Much Does Hybrid Crypto Exchange Development Integrated with EIP 7702 Cost?

Hybrid exchanges are stuck between two worlds—centralized liquidity and decentralized control. But what if you didn’t have to choose? EIP-7702 unlocks the best of both by letting EOAs act as temporary smart contract wallets, bringing gas efficiency, programmable security, and seamless execution to hybrid crypto exchange development.

“Imagine trustless trading, lower transaction costs, and enterprise-grade security—all without overhauling your entire infrastructure. Sounds like the future? It is.”

Let’s break down how EIP-7702 is revolutionizing hybrid cryptocurrency exchanges and why forward-thinking businesses need to pay attention.

What is EIP-7702?

EIP-7702 is a proposed Ethereum Improvement Proposal that enhances account abstraction by allowing Externally Owned Accounts (EOAs) to temporarily function as smart contract wallets within a single transaction. This mechanism provides EOAs with dynamic programmability, enabling them to execute smart contract-like functionalities—such as batched transactions, custom signature schemes, and gas fee sponsorship—without requiring a permanent contract upgrade.

Hybrid Exchange Development: Where EIP-7702 Fits In?

EIP-7702 introduces a pivotal improvement in how users interact with on-chain settlement mechanisms while benefiting from centralized order execution. Integrating Traders can access advanced security features like programmable trade conditions, trustless escrows, and automated settlement within a single transaction by enabling EOAs to temporarily adopt smart contract capabilities. This advancement reduces friction in hybrid crypto exchange development models, allowing for gas-efficient, self-custodial trading while preserving the speed and liquidity advantages of centralized execution layers. Ultimately, EIP-7702 fosters a more fluid integration between decentralized and centralized exchange components, improving user autonomy without compromising efficiency.

This gives a high-level view of EIP-7702 and its role in hybrid exchanges, but the real innovation is in the technical framework. Let’s break down how it works and why it matters.

The Technical Foundation of EIP-7702 in Hybrid Exchange Development

EIP-7702 transforms hybrid exchanges by introducing programmability, security, and efficiency at the account level. Granting EOAs smart contract functionality temporarily allows hybrid crypto exchange development to boost automation, lower gas expenses, and align with institutional requirements while keeping user control intact.

Key Technical Innovations:

- Ephemeral Smart Contract State: Enables temporary smart contract behavior per transaction, unlocking advanced programmability without permanent upgrades.

- Gas-Optimized Transactions: Allows EOAs to bundle multiple operations, reducing gas overhead in hybrid cryptocurrency exchange development.

- Advanced Authorization Models: Supports multi-signature authentication, custom signing algorithms, and delegated approvals for enhanced security.

- Trustless Escrow & Automated Settlement: Facilitates escrow-based trading and conditional trade execution, strengthening self-custody.

- Seamless Liquidity Pool Integration: Enables EOAs to interact with DeFi liquidity pools, optimizing on-chain asset management.

- Reduced Private Key Risks: Minimizes persistent contract deployments, lowering exposure to phishing attacks and key leaks.

Hybrid crypto exchange software achieves greater flexibility, security, and efficiency, shaping the future of institutional hybrid exchanges by integrating EIP-7702-driven capabilities. A key aspect of this transformation is its impact on security models, where EIP-7702 strengthens authentication mechanisms, reduces attack surfaces, and enhances transaction integrity.

The Role of EIP-7702 in Enhancing Hybrid Exchange Security Models

Ethereum’s EIP-7702 is redefining security in hybrid crypto exchange, introducing dynamic account abstraction and advanced authentication mechanisms. This evolution fortifies hybrid crypto exchange software, mitigating key vulnerabilities and elevating institutional security standards.

- Eliminating Single-Point Failures: Traditional EOAs rely on static keys, making them susceptible to breaches. EIP-7702 enables EOAs to act as smart contracts, integrating programmable security policies to prevent unauthorized access in cryptocurrency exchange.

- Built-In Multi-Factor Authentication: Enterprises can now implement on-chain MFA, reducing phishing risks and securing fund withdrawals—a critical advancement in hybrid crypto exchange development.

- Pre-Execution Transaction Screening: EIP-7702 allows custom security layers before transaction finalization, preventing fraud, spoofing, and front-running in Hybrid Crypto Exchange Software.

- Private Key Exposure Risks: Traditional EOAs depend on a single private key, making them highly vulnerable to theft, phishing, and leaks. Enterprises can integrate dynamic key rotation and smart contract-based authentication, ensuring greater control over account security in hybrid cryptocurrency exchange development.

- Smart Contract Exploits & Reentrancy Attacks: Hybrid exchanges rely on complex smart contracts, which can be exploited through reentrancy attacks or malicious contract interactions. EIP-7702 strengthens security by enabling conditional execution logic, ensuring safer, controlled smart contract transactions.

- Granular Access Controls for Institutional Security: EOAs lack role-based access controls, meaning a single compromised key can lead to total asset loss. EIP-7702 introduces modular permissions, multi-signature approvals, and tiered access models, enhancing institutional security in hybrid crypto exchange development.

EIP-7702 fortifies hybrid exchange development by embedding enterprise-grade security, ensuring a highly scalable, resilient, and fraud-proof trading environment. But security is just the beginning—this proposal also optimizes transaction efficiency, enhances liquidity flow, and refines compliance protocols. Let’s break down the key benefits of EIP-7702 in hybrid exchanges.

Why Enterprises Should Invest in Hybrid Exchanges Powered by EIP-7702?

Enterprises now have an unprecedented opportunity to architect trading platforms that seamlessly blend the liquidity of CEXs with the security and autonomy of DEXs. Here’s why forward-thinking businesses must embrace hybrid cryptocurrency exchange development powered by EIP-7702.

- Smarter Trade Execution: EIP-7702 enables EOAs to function like smart contracts, allowing seamless, multi-step transactions, which enhances liquidity flow within crypto exchange software.

- Institutional-Grade Security: EIP-7702 mitigates private key risks, making hybrid exchanges more secure with multi-signature authentication, programmable access controls, and time-locked transactions.

- Reduced Gas Fees: EIP-7702 optimizes gas costs by enabling transaction batching, automated fee adjustments, and efficient execution models, reducing overhead for traders and investors.

- Built-in Regulatory Compliance: Hybrid exchanges can integrate on-chain KYC/AML measures, ensuring seamless regulatory adherence while maintaining decentralization.

- Superior User Experience: Smart contract-enabled EOAs simplify account recovery, gasless transactions, and delegated trade execution, offering a smoother user experience.

- Fail-Safe Transactions: EIP-7702 reduces failed trades, ensuring reliable order execution with auto-revert mechanisms and rollback capabilities.

- Future-Ready for Cross-Chain Liquidity: EIP-7702 enables frictionless cross-chain transactions, making hybrid exchanges more adaptable to the evolving DeFi landscape.

Hybrid crypto exchange development is evolving, and enterprises must embrace EIP-7702 to build resilient, regulation-ready, and scalable platforms. However, the real challenge lies in implementing this innovation effectively. So, how can businesses seamlessly integrate EIP-7702 into their hybrid exchange architecture?

How to Build a Hybrid Exchange Integrated with the EIP-7702 Protocol?

For enterprises navigating the complexities of hybrid cryptocurrency exchange development, integrating EIP-7702 is no longer optional—it is an essential step toward achieving enterprise-grade resilience, regulatory alignment, and unparalleled market competitiveness. Let’s explore its key steps:

- Architecting the Framework – A hybrid exchange blends centralized trade execution with decentralized custody, ensuring security without compromising speed. The architecture must include a modular order-matching engine and non-custodial asset management that align with EIP-7702’s programmable accounts.

- Integrating EIP-7702 – EIP-7702 transforms hybrid crypto exchange software by enabling gas-efficient transactions, smart contract-based trade execution, and enhanced security. Enterprises must restructure their wallet infrastructure to support temporary smart contract states for EOAs.

- Securing On/Off-Chain Operations – Hybrid exchanges must synchronize on-chain execution with high-speed off-chain order books to balance scalability and transaction finality. EIP-7702’s programmability enhances high-frequency trading, automated market-making, and liquidity pooling while maintaining decentralization.

- Ensuring Compliance – Hybrid crypto exchange development must embed KYC-enabled smart contracts, real-time audit trails, and automated risk management with growing institutional adoption. EIP-7702 streamlines institutional onboarding through whitelisting, compliance automation, and secure asset monitoring.

- Testing & Future-Proofing – Enterprises must conduct penetration testing, security audits, and performance optimization to safeguard against MEV exploits, front-running, and liquidity fragmentation. Future-proofing involves AI analytics, quantum-resistant cryptography, and cross-chain integrations.

EIP-7702 is the key to next-gen hybrid exchanges, combining security, compliance, and efficiency. Enterprises integrating this innovation will set the benchmark for scalable and future-proof digital trading ecosystems.

How Much Does Hybrid Crypto Exchange Development Integrated with EIP 7702 Cost?

Building a hybrid crypto exchange development solution with EIP-7702 requires advanced smart contract engineering, institutional security, and a high-performance trading framework. Costs depend on customization, account abstraction, liquidity aggregation, and compliance infrastructure. EIP-7702 enhances hybrid cryptocurrency exchange development by enabling EOAs to act as smart contract wallets, improving gas efficiency, security, and transaction execution. This demands AI-driven order matching, optimized trade validation, and seamless on-chain/off-chain integration.

Security and compliance remain critical, requiring multi-signature authentication, MPC wallet security, and KYC/AML automation. Additionally, on-chain auditing ensures regulatory alignment. The cost of hybrid crypto exchange software depends on customization, infrastructure robustness, and security frameworks. Enterprises investing in a scalable hybrid exchange must prioritize institutional liquidity, seamless execution, and regulatory adherence to stay ahead in the evolving trading landscape. Given the complexity of integration, consulting with an experienced hybrid crypto exchange software development company is the best approach.

Dominate the Hybrid Exchange Market with The Development Firm

Building a hybrid crypto exchange development solution integrated with EIP-7702 requires expertise in blockchain security, smart contract engineering, and institutional-grade infrastructure. At Antier, we specialize in crafting high-performance hybrid exchanges that offer seamless interoperability, enhanced security, and optimized transaction execution. Our team ensures scalability, compliance, and liquidity aggregation, empowering enterprises to stay ahead in the evolving crypto landscape. With cutting-edge technology and tailored solutions, we transform visions into reality. Hire our experts today and build a future-proof hybrid exchange designed for growth, efficiency, and long-term success in the digital asset market.

Your Hybrid Exchange, Built by Industry Leaders!