Scalability, liquidity, and security are the pillars of any successful crypto exchange, and DTX is mastering all three. Built with a hybrid framework, DTX combines centralized order matching with decentralized asset custody, offering traders the best of both worlds. The growth potential is enormous with projections estimating a $5 trillion market soon.

But here’s a question for you—what’s stopping you from seizing this extraordinary opportunity? As the cryptocurrency exchange market expands, it’s attracting investors from every corner of the globe, all eager to capitalize on the wealth of possibilities. This is a pivotal moment for those looking to take advantage of the shifting tides in global finance. In today’s blog, we’ll explore what’s fueling DTX exchange’s impressive growth, break down its revolutionary features, and discuss the strategies putting it at the forefront of the crypto exchange industry.

Let’s jump right in!

Why Investors Are Watching DTX Exchange: Growth Projections and Market Disruption

DTX Trading Platform is garnering significant attention, combining advanced technology, liquidity solutions, and a hybrid model that merges both centralized and decentralized elements. Cryptocurrency exchange development is setting new standards for the industry by offering a robust trading platform that accommodates traditional and crypto assets.

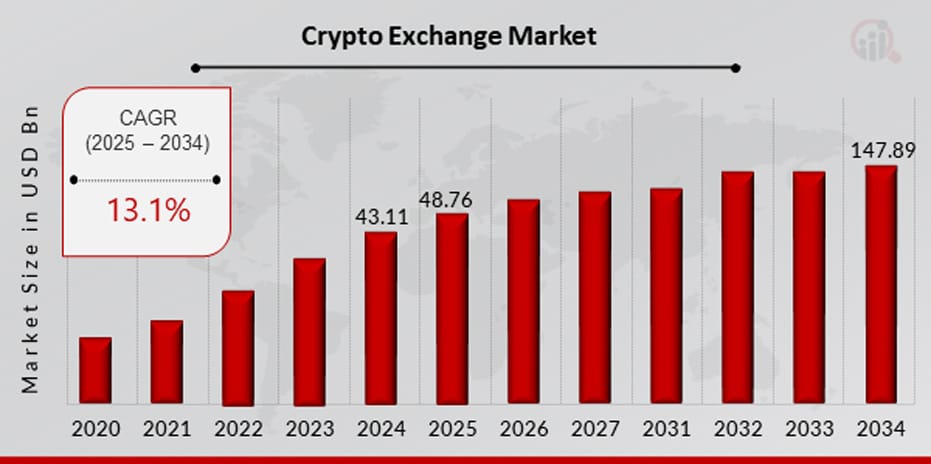

Source:- https://www.marketresearchfuture.com/reports/crypto-exchange-market-22858

The crypto exchange market was valued at 43.11 USD billion in 2024 and is projected to grow from 48.76 USD billion in 2025 to 147.89 USD billion by 2034. This growth represents a CAGR of approximately 13.1% during the forecast period from 2025 to 2034, indicating an expanding market that investors are eager to capitalize on. As the demand for digital assets and DeFi continues to rise, cryptocurrency exchange development is increasingly becoming a focal point. The hybrid model offered by DTX exchange merges the efficiency and user experience of centralized exchanges with the security and autonomy of decentralized systems, offering the best of both worlds. This approach makes the platform uniquely positioned to attract institutional and retail investors, ensuring liquidity while maintaining security and scalability.

Did you know?

“DTX Exchange Surges Towards $15M in Record-Breaking Presale”

Moreover, the DTX cryptocurrency exchange is designed with advanced trading features, including high-frequency trading engines and smart contract automation, giving it a competitive edge. Cryptocurrency exchange industry is poised to take advantage of the growing market and is a key player in the next wave of crypto exchange evolution with its comprehensive solutions in blockchain integration, asset management, and trading security. Investors are watching this growth closely, anticipating significant returns as the platform continues to disrupt the industry.

From 0 to 500,000 Holders: How DTX Cryptocurrency Exchange Cultivated a Thriving Community?

DTX exchange didn’t just stumble into success—it engineered it. Surpassing 500,000 registered wallets in record time, the DTX cryptocurrency exchange leveraged a mix of cutting-edge technology, community-driven incentives, and a seamless trading experience to capture the market’s attention. According to The Tribune, DTX raised over $11.8 million during its presale phase, a clear indication of investor confidence and market demand.

So, how did they scale so quickly? First, DTX adopted a hybrid exchange model, merging the security of decentralized platforms with the speed and convenience of centralized trading. This approach allowed users to trade over 120,000 financial instruments—including crypto, stocks, and forex—with up to 1,000x leverage. Add to that the integration of VulcanX, a high-performance blockchain capable of processing 200,000 transactions per second, and the exchange became a magnet for serious traders.

Did you know?

“DTX Exchange Surpasses $13.2 Million, Attracts 10,000 Daily Signups”

Beyond tech, DTX understood the power of community. Strategic partnerships, interactive AMAs, and reward-driven referral programs fueled exponential user growth. Their liquidity pools ensured smooth transactions, while rigorous security audits built trust. DTX didn’t just gain holders—it built a strong, engaged community by combining advanced trading technology with a user-first approach, ensuring lasting growth and investor trust. DTX trading platform is in an excellent position to expand its feature set and continue enhancing the trading experience with a growing and engaged community behind it.

Let’s explore!

One of the key reasons why the DTX cryptocurrency exchange is gaining attention is its commitment to offering cutting-edge features that set it apart from other hybrid exchanges. Here are some of the standout features that differentiate DTX from the competition:

- Smart Liquidity Aggregation: DTX exchange implements smart liquidity aggregation to address liquidity fragmentation, pooling liquidity from centralized and decentralized sources.

- Cross-Chain Compatibility: DTX crypto exchange supports cross-chain compatibility, enabling seamless transfer of assets across multiple blockchains. This reduces transaction delays and costs, enhancing market liquidity and connectivity.

- AMM & Order Book Integration: DTX exchange offers deep liquidity and fast execution by integrating AMM with traditional order book trading. Traders benefit from minimal price slippage, allowing for better market efficiency.

- Staking: DTX allows users to stake their assets and earn passive rewards. This incentivizes engagement and enhances liquidity within the platform.

- Mobile Applications: DTX crypto exchange development offers mobile applications, providing users with the flexibility to trade on the go and access their accounts anytime, anywhere.

- Spot Trading: Spot trading on DTX enables users to buy and sell digital assets directly at market prices, offering simplicity, speed, and competitive fees for retail traders.

- Derivatives/Perpetual Futures: Experienced traders can take advantage of derivatives and perpetual futures on DTX, allowing them to speculate on price movements without holding the underlying assets.

- Peer-to-Peer Trading: DTX’s P2P trading allows users to trade directly with one another, offering privacy and control while often securing better rates than traditional exchanges.

- Fiat On/Off Ramp: DTX offers a fiat on/off ramp, enabling easy conversion between fiat currencies (USD, EUR) and cryptocurrencies, bridging traditional finance with digital assets.

- Launchpad: The DTX trading platform features a launchpad for new projects, enabling them to raise capital through token sales, and providing secure and transparent investment opportunities for users.

These features enhance the usability of the DTX exchange and attract a wide range of traders. The platform’s extensive features make it an attractive option for all traders, but how does DTX exchange remain secure while offering diverse services? How does DTX exchange strike the perfect balance? Here’s a breakdown of the core strategies that set it apart.

Key Strategies to Build One of the Best Crypto Exchanges like DTX

What does it truly take to build a crypto exchange that excels in today’s highly competitive market? The secret lies in the strategic approaches behind DTX crypto exchange development, which have propelled it to the forefront, establishing it as one of the best crypto exchanges like DTX.

- Institutional-Grade Security Framework: A premier exchange must fortify its architecture with multi-layered encryption, hot & cold wallet segregation, and AI-driven threat detection. DTX integrates biometric authentication, real-time risk analytics, and multi-signature wallets to mitigate vulnerabilities. Such an approach ensures DEX development remains resilient against cyber threats while offering traders ironclad security.

- High-Performance Trade Engine: A best-in-class crypto exchange like DTX employs an ultra-low latency matching engine to facilitate seamless order execution. Sub-millisecond trade execution, advanced liquidity aggregation, and scalable microservices architecture drive uninterrupted trading, accommodating high-frequency traders and institutional investors.

- Liquidity Optimization via Smart Routing: DTX deploys AMM, cross-chain liquidity pools, and algorithmic trade routing to ensure optimal price discovery and minimal slippage. Investors seeking DTX crypto exchange development must prioritize sophisticated liquidity mechanisms to attract high-volume traders.

- Modular & Scalable Architecture: Future-ready exchanges demand modular frameworks with containerized deployment using cloud-native scalability and on-demand API integrations. This ensures the platform adapts to evolving market demands while maintaining operational efficiency.

- Compliance-Driven Smart Contract Audits: In the era of DeFi, regulatory adherence is non-negotiable. Automated KYC/AML verification, compliance-ready smart contracts, and regulatory sandbox integration are critical components of DEX development, positioning the platform for global expansion.

These strategies are theoretically effective and proven methods that industry leaders use to stay competitive and secure. If you’re building an exchange, implementing these components will certainly give your platform the technical sophistication and operational robustness needed to succeed. The next logical question is how to implement it with a clear strategy in mind.

Let’s break down the process of developing one of the best crypto exchanges like DTX.

How to Develop a Hybrid Trading Platform like DTX Exchange

- Design a Hybrid Architecture: Integrate centralized matching engines with decentralized protocols. The centralized engine ensures fast trade execution, while blockchain technology provides control over assets. This hybrid structure enhances both security and liquidity, a core feature of DTX crypto exchange development.

- Develop a High-Performance Matching Engine: Build a high-frequency trading engine capable of processing millions of orders per second. This engine should be optimized for low latency, ensuring rapid order matching, as seen in the DTX trading platform.

- Implement Smart Contracts: Leverage smart contracts on blockchain networks to automate and secure trades. These contracts execute transactions without intermediaries, ensuring transparency and reducing trust issues in cryptocurrency exchange development.

- Create Liquidity Solutions: Incorporate AMMs and liquidity pools to ensure deep liquidity. These systems bridge centralized order books with decentralized liquidity pools, facilitating smooth transactions for all users.

- Ensure Cross-Chain Interoperability: Support cross-chain trading to enable seamless transactions between different blockchain networks. This expands the range of tradable assets and ensures users can trade freely across multiple blockchain ecosystems.

- Implement Robust Security Features: Use multi-signature wallets, two-factor authentication, and end-to-end encryption to protect user data and funds. Prioritize regulatory compliance to ensure the platform’s legitimacy.

- Focus on Scalability and User Experience: Ensure the cryptocurrency exchange development platform can handle high traffic without compromising performance. Use cloud-native technologies and microservices to support scalability while maintaining a seamless, user-friendly interface.

By following these seven steps, businesses can successfully build a DTX Trading Platform that combines speed, security, liquidity, and scalability, offering an unparalleled trading experience for users. Now that the development process is clear, it’s time to focus on the financial side. Let’s discuss the factors involved in creating a platform like DTX, and how to approach budgeting for it.

How to Estimate the Cost of Building a Hybrid Trading Platform?

Estimating the cost of building a hybrid trading platform can be quite a challenge, but understanding the key factors helps. First, the complexity of DTX crypto exchange development comes into play. You are blending centralized and decentralized systems, so top-tier infrastructure and tech are essential. Don’t forget about DEX development, as blockchain integration and liquidity solutions are crucial here. Security is a big one too—think multi-signature wallets, smart contracts, and regulatory compliance.

Additionally, you need to factor in scalability, UI/UX design, and ongoing maintenance. All these elements together shape the final cost, so it’s important to budget wisely to get a top-notch platform. A reliable development partner can provide everything you need for your hybrid trading platform. From crypto exchange development to ensuring full security and a seamless user experience, choosing a cryptocurrency exchange development company with expertise in all aspects of the process ensures you get a fully integrated, scalable solution with minimal hassle.

The Final Words

DTX Exchange is setting new standards in the crypto exchange market with its hybrid model, cutting-edge technology, and strong community growth. It’s poised for continued success and market disruption with features like high-frequency trading engines, cross-chain compatibility, and staking. For businesses looking to build their own exchange, Antier, a leading crypto exchange development company, provides a proven framework that blends speed, security, and scalability. If you’re ready to tap into the $5 trillion market, now is the perfect time to invest in the right crypto exchange development strategies. Let’s elevate your platform to new heights.