How the Metaverse Learning Platform Development is Transforming Virtual Campus Tours?

June 3, 2024

Margin Mania: Can Decentralized Margin Trading Exchanges Beat Centralized Giants?

June 4, 2024Table of Contents

- Introduction

- Understanding Decentralized Cryptocurrency Exchange Development on Solana

- DEX Development On Solana: Features To Consider

- Exploring 2024’s Top 6 Solana-Powered Decentralized Crypto Exchange Software Solutions

- Building A Thriving Decentralized Crypto Exchange Software On Solana: 10 Steps

- Future Outlook: DEX Development On Solana

- Conclusion

Introduction

The DeFi revolution is in full swing, and Solana, with its blazing-fast transaction speeds and low fees, has emerged as a primary battleground for innovation. DEX development on Solana offers a compelling opportunity for entrepreneurs seeking to tap into the bustling, opportune market.

This comprehensive guide equips you with everything you require to navigate the blooming Solana ecosystem with a power-packed DEX.

Understanding Decentralized Cryptocurrency Exchange Development on Solana

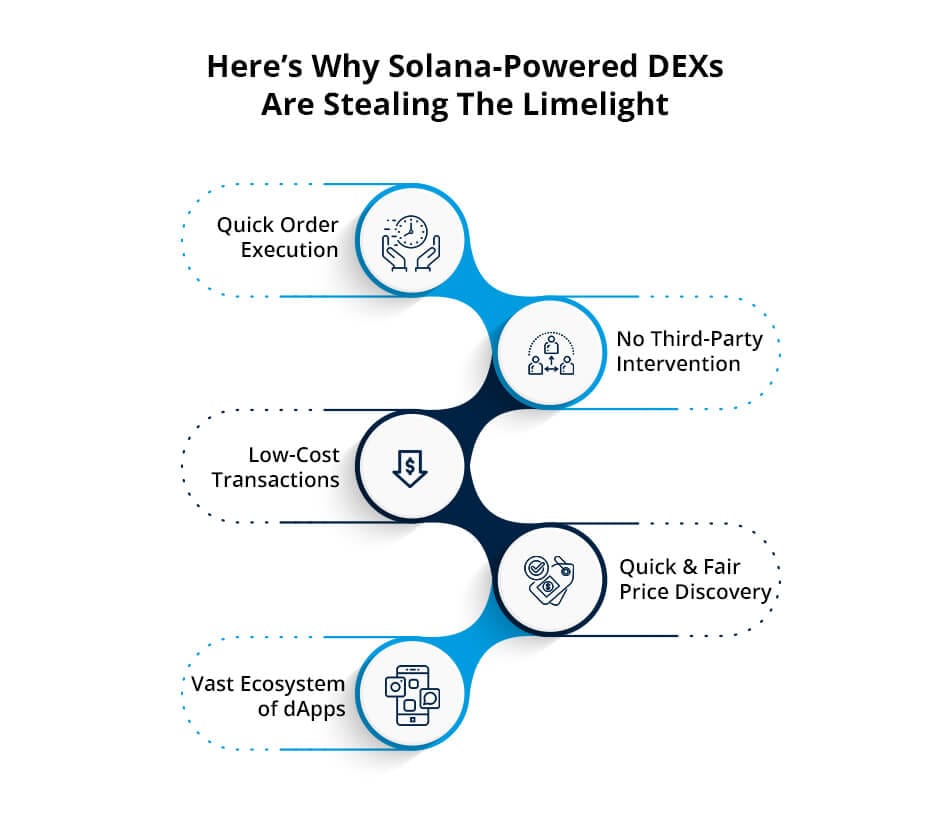

While Ethereum currently dominates the DeFi landscape, its scalability limitations often lead to high transaction fees and sluggish performance. Conversely, Solana boasts low latency and fees, high transaction throughput, and scalability, making it an ideal contender for DEX development. The amazing blockchain ecosystem stands out in the crowded blockchain ecosystem for its various advantages to traders and businesses, such as:

-

- Sensational Scalability: Solana can efficiently handle over 65,000 transactions per second, significantly outpacing other networks with its exceptional horizontal scaling. High scalability future-proofs your Decentralized Crypto Exchange Software for potential user growth as the network can handle increased loads efficiently without congestion.

- Low Latency: Solana swanks 400 milliseconds (approx.) of block times, a significant improvement over Ethereum’s current state. Its combination of Proof-of-History (PoH) & Proof-of-Stake consensus mechanisms enables near-instantaneous transaction finality, translating to high transaction throughput and minimal slippage, significantly enhancing the CX on Decentralized Crypto Exchange Software.

- Security and Interoperability: With its advanced cryptography features and consensus mechanism, Solana ensures the confidentiality and integrity of transactions, promoting an ecosystem that prioritizes the security of user assets. The platform is also known for its interoperability features

- Robust Ecosystem: Solana’s thriving developer community and comprehensive tooling support expedite the Decentralized Cryptocurrency Exchange Development process, reducing time-to-market. The vibrant, active, and supportive Solana community offers invaluable resources, documentation, and fixes for developers building DEX on Solana.

- Cost-Effectiveness: Due to an efficient architecture, transaction costs on Solana are quite low, often less than $0.01. Minimal fees doesn’t only make it an attractive choice for users seeking cost-effective trading but also for entrepreneurs aspiring for DEX Development.

DEX Development On Solana: Features To Consider

Solana DeFi has witnessed significant growth, with decentralized exchanges leading the charge. Given its efficiency and composability, the fastest-growing blockchain ecosystem holds an edge over the old DeFi leader, Ethereum. Decentralized Crypto Exchange Software solutions account for the lion’s share of total value locked (TVL) on Solana due to their following exceptional features:

- High Transaction Speed

- Automated Market-Making Models

- Decentralized Order Books

- Minimal Trading Fees

- Trustless Trading

- Concentrated Liquidity Pools

- High Scalability

- Advanced Security

- Cross-Chain Interoperability

- Flexible Smart Contracts

- Seamless Wallet Integration

- Staking and Governance

- Margin Trading

While these features already exist in trade-facilitating Solana DeFi platforms, A Decentralized Cryptocurrency Exchange Development project can excel by offering a standout user experience through innovative, exclusive features and an easy-to-navigate and compelling user interface. One must also remember that the features of Solana DEXs are not limited to the list mentioned above. The Solana DeFi ecosystem is vast and evolving. So, comprehensive market research is indispensable while planning your DEX Development project.

Exploring 2024’s Top 6 Solana-Powered Decentralized Crypto Exchange Software Solutions

Well, Well, Well..!

We are making things easier for you, putting forward a well-curated review of the top 5 Solana-based DEXs currently winning over the Solana DeFi cryptoscape.

Let’s Start…!

1. Serum

A well-known, reliable order book decentralized crypto exchange software built on Solana, suitable for traders seeking a high-speed, feature-rich, and seamless trading experience.

- Key Features:

- Limit orders, stop-loss orders, and other advanced order types, equipping traders with more control and flexibility over their trading strategies.

- A unique Centralized Order Book (COB) model for efficient price discovery.

- Integration with a high-performance blockchain.

- Strengths:

- Fast transaction processing, minimal fees, and cross-chain compatibility. So, traders can efficiently trade assets from different blockchains on decentralized crypto exchange software without complex processes.

- A familiar interface for experienced traders transitioning from CEXs.

- Deep liquidity pools, thanks to integration with major market makers and exchanges like Binance. So, traders can execute huge buy/sell orders without stressing over the platform’s liquidity.

- Considerations:

- Less user-friendly for beginners compared to AMM-based DEXs.

2. Jupiter

Unlike others on the list, this platform doesn’t function as standalone decentralized crypto exchange software but the aggregator platform certainly deserves a top spot among Solana DEXs as it offers a streamlined decentralized trading experience with the best rates.

- Key Features:

-

- A multi-wallet support exchange with limit order, DCA, bridging, and perpetual trading features.

- No need to switch windows, as the DEX aggregator presents a unified platform where traders can trade at the best rates within a few clicks.

- Acts as a search engine for Solana DEXs by scouring the depth of various decentralized crypto exchange software solutions such as Saber, Raydium, etc. to find the best possible rates for your desired trade.

- Enhanced liquidity through aggregation means reduced slippage for traders.

- Strengths:

- Beginner-Friendly as it simplifies user onboarding and removes the complexity of navigating multiple DEXs for price advantage.

- Exposes users to a wider range of trading options on Solana

- Supports hundreds of tokens and thousands of trading pairs.

- Improved time efficiency among Solana decentralized crypto exchange software solutions as it automates the process of finding the best price for a certain asset.

- Considerations:

-

- While the core functionalities of the DEXs that Jupiter aggregates are decentralized, the aggregation itself resembles an element of centralization.

- Reliance on existing infrastructure as unlike other Solana DEXs, Jupiter itself doesn’t hold liquidity pools or facilitate order book trading.

3. Raydium:

An Automated Market Maker decentralized crypto exchange software with an integrated order book system, rich liquidity pools, gamified features and yield farming opportunities, enabling traders to engage in various DeFi activities while benefiting from the speed and low costs of Solana.

- Key Features:

- AMM model powered by the Constant Function Market Maker (CFMM) algorithm integrated with order book model – A unique blend, enhancing convenience.

- Liquidity pools incentivize users to provide liquidity and earn rewards (RAY tokens). Users can stake tokens to earn lucrative rewards, making the decentralized crypto exchange software a top choice.

- Staking options for RAY tokens allow you to earn additional rewards.

- Launchpad for Initial DEX Offerings (IDOs) for promising Solana projects.

- Strengths:

- The fusion of AMM and order books brings the benefits of deepened liquidity, reduced slippage, and improved price discovery.

- User-friendly interface suitable for both experienced and novice traders.

- Gamified features and yield farming opportunities in decentralized crypto exchange software attract users and boost liquidity.

- IDO Launchpad provides early access to innovative projects.

- Considerations:

- Potential impermanent losses for liquidity providers due to price fluctuations.

- Relies on the CFMM algorithm, which may not always provide optimal pricing for all assets.

4. Saber:

A prominent AMM decentralized crypto exchange software specializing in seamless stablecoin and wrapped asset swaps and on-chain lending functionalities. The cross-chain DEX is suitable for users seeking stability while diversifying their portfolio.

- Key Features:

- AMM optimized for efficient stablecoin swaps with minimal slippage.

- Yield farming and staking modules where traders offer liquidity to unique stablecoins, wrapped token pools, and SBR (Saber’s native token) in return for rewards.

- Wrapped asset trading module within decentralized crypto exchange software allows traders to bridge their favorite assets from other blockchains onto Solana and execute trades.

- Lending and borrowing functionalities powered by Saber’s liquidity pools.

- Integrates with Solana lending and other DeFi protocols to offer a comprehensive financial ecosystem to traders.

- Strengths:

- On-chain lending functionalities promote a more holistic DeFi experience.

- A niche decentralized crypto exchange software ideal for users seeking efficient and cost-effective stablecoin swaps.

- Competitive interest rates for lenders and borrowers.

- A security-first DEX conducting regular smart contract audits, penetration testing, and consistent infrastructure monitoring.

- Considerations:

- A focus on stablecoins may not appeal to users seeking a wider range of assets.

5. Orca:

One of the largest AMM decentralized crypto exchange software based on TVL, often appreciated for its user-friendly interface, emphasis on community governance, and enhanced overall trading experience.

- Key Features:

- AMM model with an unwavering focus on ease of use and competitive fees.

- Serum integration for access to order book functionality (optional).

- Access to a convenient user balance displaying panel without the need for separate browser extensions.

- A fair price indicator that ensures that cryptos’ prices on decentralized crypto exchange software remain within 1% of CoinGecko’s aggregated range.

- Community-driven governance through the ORCA token.

- The magic bar feature enables frictionless access to desired pairs by just typing tickers.

- Liquidity mining opportunities to incentivize user participation.

- Strengths:

- Deep liquidity across multiple liquidity pools supported by the trading fee distribution liquidity pool model originally initiated by UniSwap.

- Advanced order types enable traders to practice precise strategies

- Serum integration with decentralized crypto exchange software offers flexibility for experienced traders.

- Simple and intuitive interface, ideal for beginner traders.

- Community governance fosters a sense of ownership and participation.

- Considerations:

- Relatively new entrant compared to some other Solana DEXes.

- Liquidity in some pools might be lower compared to established DEXes.

6. Mango Markets (MNGO):

A top perpetual futures DEX development inspiration offering leveraged trading with margin capabilities. The DEX offers a robust and user-friendly trading experience despite its diversity of features.

- Key Features:

- Perpetual contracts allow users to speculate on the future price of crypto assets with leverage.

- Leveraged trading enables users to amplify their potential gains (and losses).

- Decentralized Oracle network for price feeds and risk management.

- MNGO token governance and staking opportunities.

- The lending and borrowing module in decentralized crypto exchange software offers traders additional flexibility and income generation opportunities.

- Strengths:

- Dedicatedly caters to advanced traders seeking leveraged trading opportunities.

- Cross-chain compatibility, allows users to trade cryptos from different chains seamlessly and expand their reach to wider asset markets.

- A decentralized oracle network promotes transparency and reduces reliance on centralized entities.

- Staking and governance features incentivize user participation.

- Considerations:

- Complex interfaces and features within decentralized crypto exchange software might deter beginners’ trading experiences.

Building A Thriving Decentralized Crypto Exchange Software On Solana: 10 Steps

Decentralized Cryptocurrency Exchange Development on Solana may involve the following five steps:

- Strategic Planning: Market analysis, technical feasibility, and roadmap creation.

- Picking the best technology specialists: Hiring an experienced decentralized cryptocurrency exchange development team with expertise in Rust, Solana, and DEX development.

- Environment Setup: Configuring Solana CLI, Rust, and CI/CD pipelines.

- Smart Contract Development: Developing and testing modular smart contracts using Rust and SPL.

- Order Book and Liquidity Integration: Implementing decentralized order books and liquidity pools.

- Frontend Development: Creating a user-friendly interface with React.js and Solana Web3.js.

- Security and Compliance: Conducting security audits, implementing protocols, and ensuring regulatory compliance.

- Testing and QA: Performing extensive testing on local and DevNet environments.

- Deployment and Monitoring: Collaborating with the technology team at a decentralized cryptocurrency exchange development company while they deploy on Mainnet and monitoring performance, extending user support afterward.

- Continuous Improvement: Collect feedback, iterate on development, and scale infrastructure.

Future Outlook: DEX Development On Solana

The Solana network is home to hundreds of thriving dApps, mostly DEXs. Unique AMM and order book models separate the Solana DeFi from the rest of the DeFi ecosystem. The future upgrades that can potentially refine and enhance the Solana decentralized crypto exchange software ecosystem may include lowering latency and enhancing efficiency for perpetual contracts. Filtering and sorting of tokens to simplify token search is another area of improvement that can greatly influence the trading experience. While slippage, safety, and convenience also remain alarming issues within the Solana DEX development landscape, many established and new projects would work on them to offer a standout experience.

Conclusion

Not one, but several aspects of Solana make it an exceptionally efficient chain for DEXs. Taking advantage of this fact, many entrepreneurs have given birth to some of the best non-custodial trading platforms that compete not just within the Solana ecosystem but with the entire industry.

If you are an entrepreneur planning decentralized cryptocurrency exchange development on Solana, you can consider the guide mentioned above to understand the fast-paced ecosystem.

At Antier, we specialize in building cutting-edge DEXs on different blockchain platforms. Share your unique requirements right away to get started with your journey in the ever-evolving world of cryptos.