10 Must-Have Features for a Successful Crypto Launchpad Development

November 19, 2024

Embedding Decentralized Identity in DEXs: A New Era of User Authentication

November 19, 2024There are several advantages of DeFi lending platform development, and the best part is that it allows users to lend or borrow money from anyone across the globe in a risk-free manner. It’s contrary to traditional methods of lending-borrowing that involves intermediaries. Businesses can capitalize on this trend by seeking the help of DeFi lending platform development services.

Let’s continue the discussion!

How Does DeFi Lending and Borrowing Platforms Work?

DeFi lending and borrowing platform development is fundamentally based on blockchain technology, which uses smart contracts to automate lending processes. A detailed overview of this mechanism is provided below.

1. Smart Contract Integration

- Automated lending terms and conditions

- Self-executing loan agreements

- Predetermined interest rates and collateral requirements

2. Liquidity Pools

- Users deposit assets into pools

- Automatic matching of lenders and borrowers

- Dynamic interest rate adjustments based on pool utilization

3. Collateralization Process

- Digital assets served as collateral

- Over-collateralization for risk management

- Automated liquidation protocols

Traditional Finance System Vs. DeFi Lending

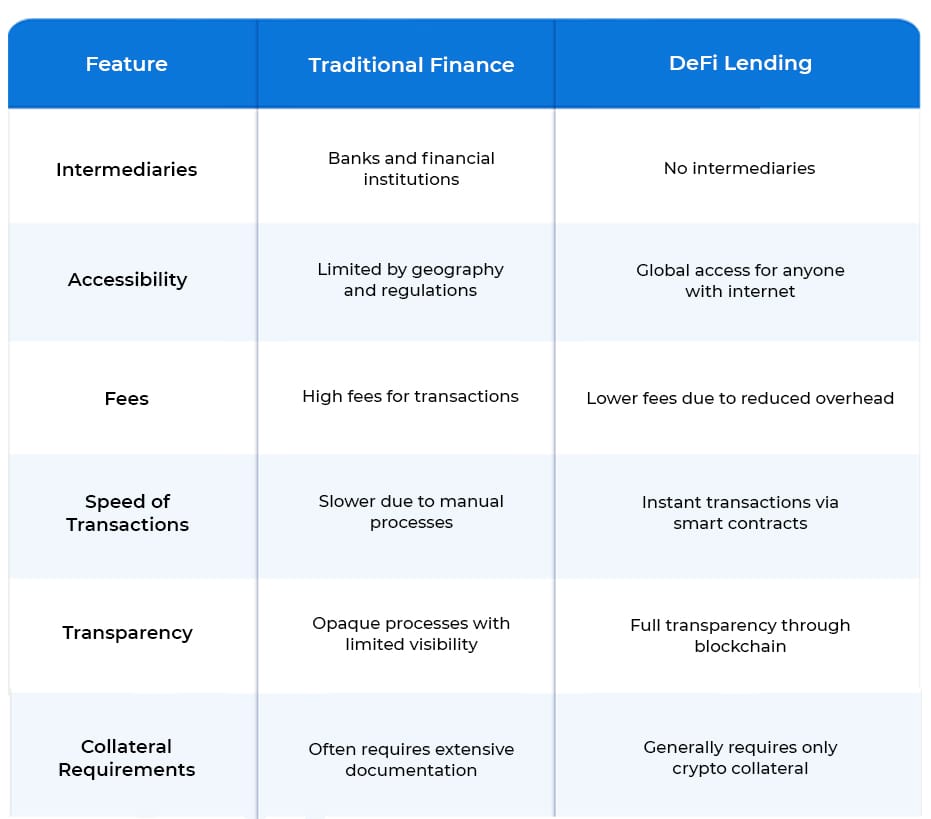

DeFi offers a more inclusive and efficient alternative to traditional financial systems, allowing businesses to operate with greater flexibility.

The contrast between traditional finance and DeFi lending is stark:

6 Benefits of DeFi Lending for Businesses

DeFi lending platform development is beneficial for businesses in the following ways:

1. Cost Efficiency

- Elimination of intermediary fees

- Reduced operational costs

- Automated processes reduce manual labor

- Lower transaction fees

- Minimal administrative overhead

2. Global Market Access

- Borderless lending operations

- 24/7 availability

- Access to an international user base

- Reduced cross-border transaction barriers

- Expanded market reach

3. Enhanced Security and Transparency

- Blockchain-based security protocols

- Immutable transaction records

- Real-time audit capabilities

- Smart contract-driven operations

- Transparent lending terms

4. Improved Liquidity Management

- Efficient capital utilization

- Automated liquidity pools

- Quick asset conversion

- Flexible collateral options

- Dynamic interest rate mechanisms

5. Automated Compliance

- Smart contract-enforced rules

- Automated KYC/AML processes

- Regulatory compliance integration

- Reduced compliance costs

- Minimized human error

6. Multiple Revenue Streams

- Lending fees

- Transaction fees

- Liquidity provider rewards

- Tokenization benefits

- Yield farming opportunities

Earning Yield Through DeFi Lending

DeFi lending and borrowing platform development provide unique opportunities to investors of earning passive income through cryptocurrency holdings. They can deposit their digital assets into lending pools and earn attractive yields on their holdings, often significantly surpassing typical traditional bank returns.

The yield generation in DeFi lending platforms comes from multiple sources:

- Interest payments from borrowers

- Liquidity provision rewards

- Platform governance tokens

- Transaction fee sharing

A seasoned DeFi lending platform development company can implement automated interest rate mechanisms that adjust based on supply and demand. When borrowing demand increases, interest rates rise, providing higher yields for lenders. Users can also participate in yield farming strategies by leveraging multiple lending platforms simultaneously.

Furthermore, some platforms offer additional incentives through their native tokens, allowing lenders to earn supplementary rewards beyond basic interest rates. This creates a dynamic ecosystem where yields can be optimized through strategic asset allocation and platform selection.

Steps for DeFi Lending Platform Development

DeFi lending platform development services need to follow a strategic approach to ensure scalability, security, and user engagement.

DeFi lending and borrowing platform development involves these key steps:

- Market Research

Conduct an in-depth market research and reach a conclusion about the target audience, competition, and features and functionalities you would like to offer.

- Define Features

Identify the essential features you would like to include in the platform, based on the research. It may include user-friendly interface, multi-token support, wallet integration, flexible collateral options, and much more.

- Choose the Right Blockchain

Making a selection of a blockchain platform is necessary. In general, DeFi lending platform development company would like to prefer Ethereum as it supports smart contracts, but there are several other EVM-compatible options that can be tried. You may choose Binance Smart Chain, Solana, or Avalanche, to get better performance and low transaction costs.

- Smart Contract Development

Write efficient smart contracts in order to govern the lending and borrowing processes. These contracts must be tested rigorously to identify vulnerabilities and ensure security.

- User Interface Design

Designing a user-friendly and intuitive interface is an important part of DeFi lending platform development as it facilitates user adoption. Clean design, navigation, mobile responsiveness, real-time updates, and transaction flows must be prioritized.

- Security Audits

Ensure extensive security audits are implemented to identify vulnerabilities in the smart contracts and the general platform. Some DeFi lending platform development services also conduct auditing, while others rely on reputed auditing firms to ensure proper checking of codes.

- Launch and Marketing

Once the platform is developed and tested, launch your DeFi lending solution and implement a marketing strategy to attract users. Focus on community building around the platform for sustained engagement and growth.

- Continuous Improvement

It includes regular security updates, performance monitoring, feature enhancements, community feedback integration, and protocol upgrades.

DeFi Lending Platform Development Company Before Seeking Services

Before engaging with DeFi lending platform development services, it’s crucial to have thorough discussions about several critical aspects to ensure project success:

1. Technical Architecture and Infrastructure

- Blockchain platform selection (Ethereum, Binance Smart Chain, etc.)

- Smart contract architecture and security measures

- Scalability solutions and layer-2 integration options

- Cross-chain compatibility capabilities

- API integration requirements

2. Security Measures

- Smart contract audit procedures

- Multi-signature wallet implementation

- Emergency shutdown protocols

- Insurance coverage options

- Anti-fraud mechanisms

3. Regulatory Compliance

- KYC/AML integration capabilities

- Regional regulatory requirements

- License requirements

- Data protection measures

- Compliance monitoring tools

4. Platform Features

- Lending and borrowing mechanisms

- Interest rate models

- Collateral management systems

- Liquidation protocols

- User interface design

5. Cost Structure

- Development timeline and milestones

- Maintenance and upgrade costs

- Smart contract audit expenses

- Marketing and promotion budget

- Ongoing support services

6. Post-Development Support

- Platform maintenance plans

- Update implementation process

- Technical support availability

- Bug fixing protocols

- Community management assistance

Discussing these aspects thoroughly with your DeFi lending and borrowing platform development partner will help ensure a successful project launch and sustainable operation.

Wrap Up

DeFi lending platform development provides tremendous opportunity for businesses to modernize lending operations and gain magnificiently. With the promise of cost reduction, improved security, global accessibility, operational automation, efficient liquidity management, and multiple sources of income, this investment beckons toward the future-thinking organizations.

Are you willing to get a quick entry to the DeFi space to enable lending facility and start earning a passive income in lieu? The first thing you need to do is to partner with seasoned DeFi lending platform development company, Antier. We, ensure successful implementation, minimize the risks of vulnerabilities in your platform, and unlock the maximum benefits of DeFi lending-borrowing.

We have expertise in developing DeFi lending platforms that provides sure-shot profit. Don’t stay left out, contact us to safely launch your lending platform that can beat the competition without fail. Let’s connect!