Profit Prowess: Unleashing the Power of DeFi Staking and Yield Farming

June 15, 2023

Is Play-to-Earn Games Profitable? A Definitive Guide

June 15, 2023Table of Contents

Introduction:

The fast-paced and ever-evolving world of cryptocurrencies presents vast opportunities for businesses and individuals. In highly volatile markets, market making activity ensures trade-friendly environments by facilitating optimal pricing and smooth transactions.

Artificial intelligence (AI) is revivifying the traditional market making process. AI-based crypto market making software exhibits ingenious capabilities, empowering traders and exchanges with advanced algorithms that reinforce liquidity, reduce risks, and enhance overall trading efficiency.

Let’s delve in to discover possibilities that stem when artificial intelligence and machine learning (ML) step ahead to spur on efficiencies and curb challenges in market making.

Role of Market Making Services

Before we dive deep into the new generation of market making practices, here is a quick revision for you to understand the basic substance of market making.

Market making is a crucial component of any trading landscape that lacks liquidity. In the absence of market making services, the fast and seamless execution of buy and sell trades would remain a dream in illiquid markets, as there would be no one on the other side of the trades.

Market makers generate or significantly amplify liquidity and minimize price fluctuations in cryptocurrency markets. They function to ensure that the market is fair, transparent, and steady so that traders can confidently put their hard-earned money into it.

Traditional Market Making Vs AI-Based Crypto Market Making

Traditional market making mechanisms involve human traders who manually examine market trends and make decisions based on their expertise and experience. The market making approach is effective but time-consuming and susceptible to human flaws simultaneously.

The newfangled crypto market making software leverages advanced AI algorithms and machine learning powers to analyze large market data batches, identify patterns, and make informed trading decisions in real-time. AI-based crypto market making technology can facilitate automation and execute trades much faster than humans with enhanced efficiency. Therefore, modernistic technology, with its extensive abilities, can lend a competitive edge to businesses facilitating cryptocurrency trading as well as seasoned and novice traders.

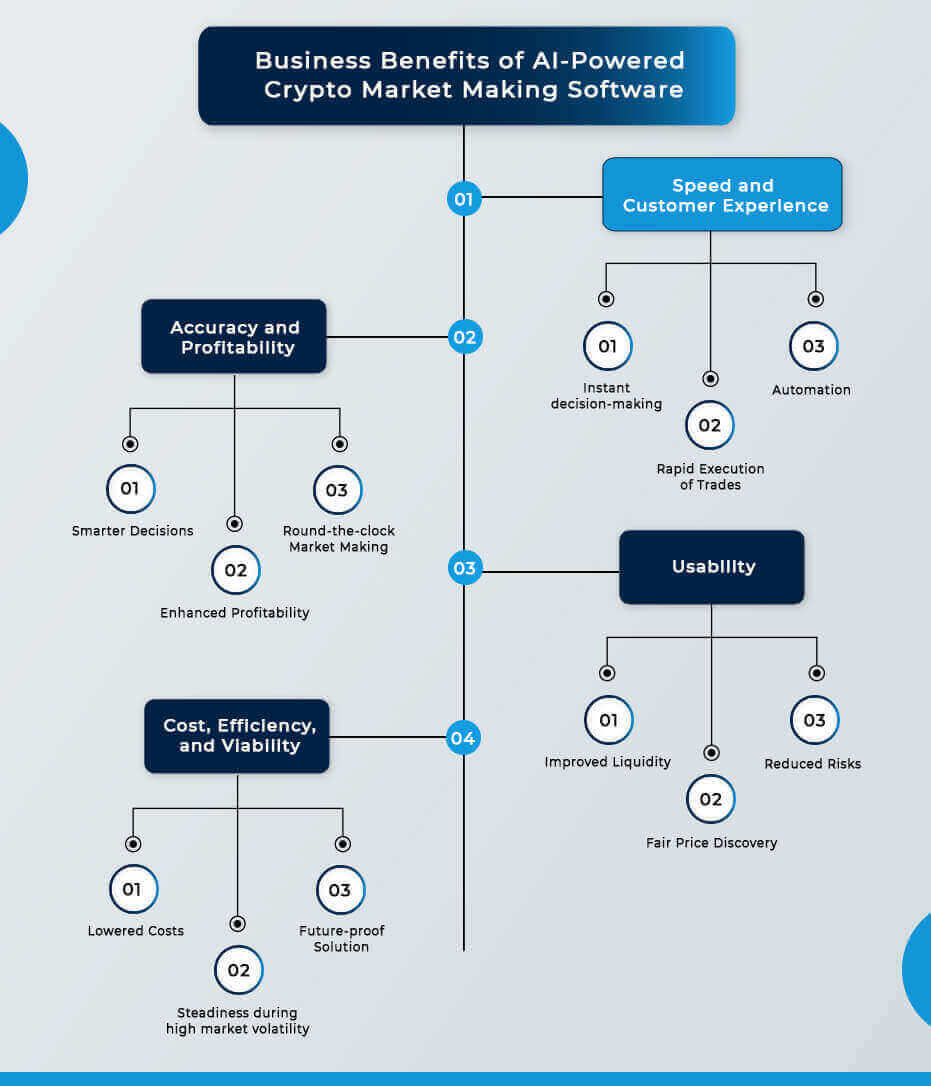

Business Benefits of AI-Powered Crypto Market Making Software

Artificial intelligence is expeditiously transforming the cryptocurrency industry, and market making is no exception. AI-powered market makers have numerous advantages over traditional market making services, including:

1. Speed and Customer Experience

- Instant decision-making:

AI algorithms can process huge amounts of market data within milliseconds, allowing traders to make decisions much faster. The innovative technology offers agility to market makers, which enables them to quickly adapt to market movements and maintain competitive bid-ask spreads.

- Rapid Execution of Trades:

As AI advances to assure quick response times to altering market dynamics, traders can execute a trade within a fraction of a second. This means crypto market maker companies can act as counterparties in a large number of trades in a shorter period of time, subsequently leading to an increase in profitability and an enhanced customer experience.

- Automation

AI integration brings utter convenience as it automates the majority of the functions and makes the process of the crypto market making convenient, efficient, and self-executing.

2. Accuracy and Profitability

- Smarter Decisions:

AI and ML integration gives rise to the ability to access and analyze vast amounts of historical and real-time data, which market makers use to determine trends, patterns, and correlations. It results in more accurate market movement predictions, data-driven decisions based on bulk data, and an optimized crypto market maker strategy.

- Enhanced Profitability

AI-powered market making software can intelligently optimize bid-ask spreads and execute trades with minimal slippage. Besides, agile technology can adjust bid and ask prices more rapidly, assisting market makers to capture and capitalize on more trading opportunities and amplifying overall profitability.

- Round-the-clock Market Making

A power-packed AI-based market making software can churn buy and sell trades 24/7 without any need for breaks. This gives market makers, as well as cryptocurrency exchange businesses, a competitive advantage as they can generate profits and offer liquidity nonstop.

3. Usability

- Improved Liquidity

AI enables the real-time adjustment of prices based on market conditions, leading to tighter spreads, minimized price swings, and increased liquidity.

- Fair Price Discovery:

By regulating liquid and stable markets, AI-driven crypto market making software ultimately makes sure that prices reflect the true value of digital assets.

- Reduced Risks:

AI-based market makers can use predefined risk parameters to locate and mitigate any potential risks in the market. They keep monitoring and analyzing the market conditions to identify changes in demand and supply dynamics, volatility, and other factors to devise and implement a pertinent crypto market maker strategy. This way, they can either reduce their exposure to risks, stop trading for a while, or turn the situation to their advantage.

4. Cost, Efficiency, and Viability

- Lowered Costs:

By eliminating human intervention in many tasks pertaining to market making, AI can reduce the cost of market making for crypto exchanges and market maker businesses significantly.

- Steadiness during high market volatility:

AI can automate large volumes of trade effortlessly. Therefore, they help market making services scale their operations seamlessly. This ultimately increases the efficiency of the market and ensures smooth trading experiences for traders, even during adverse market conditions.

- Future-proof Solution

AI-based crypto market making software is not a short-term solution that goes obsolete with time. AI and ML integration make the market making software timeless as it keeps on learning from its past trading experiences and gets better at adjusting its trading strategies over time, leading to improved performance every now and then.

Choosing the Right AI-Based Market Making Software

By sticking to a few checkpoints, you can ensure that you are opting for a success-oriented AI-driven market maker. Let’s discuss some of the factors you should consider while picking the best AI-based crypto market making software for your business:

- Reputation and reviews of the market making software provider

- Availability of functionality and features that you require

- Speed and overall performance of market making software

- Availability of required compliance and security features for smooth functioning

- Ease of use so that it can be suitable for a wider trader base

- Flexibility and customization options to make it compatible with your preferred crypto market maker strategy

- Affordability and scalability of the crypto market maker

- Connectivity and compatibility with liquidity providers or trading platforms that you intend to use

- Risk management mechanisms to combat market, counterparty, and operational risks

- Level of Support and maintenance offered by the provider

However, if you choose to set up your own crypto market making software, you can refer to this brief guide.

Final Thoughts

Traders, crypto market maker companies, and exchange owners need to constantly adapt and employ the latest technologies to stay ahead of the game. An ideal market maker software fastened to a trading platform can enhance its overall efficiency and increase its chances of success.

However, it doesn’t imply that it can replace market making services completely. While AI has the ability to automate many aspects of market making, the significance of human oversight and decision-making remains irreplaceable. Exchange owners specifically must turn both things to their advantage to attain success in the competitive cryptocurrency exchange market.

If you are looking for a leading market maker software provider that offers best-in-class market making services, look no further than Antier. They specialize in building high-end solutions for cryptocurrency businesses striving to achieve success in the billion-dollar digital asset market.