Table of Contents:

1. Types of Fees To Consider During Your Crypto Exchange Development

2. 2024 Crypto Exchange Fee Comparison: An Essential Consideration For Crypto Exchange Development

Introduction

The crypto kingdom is bustling! Traders, like eager knights, are jousting for digital coins, but something comes in their way – the pesky exchange fees! As an entrepreneur planning cryptocurrency exchange development in 2024, you must strategize to keep your exchange empire thriving, your treasury well stocked, and your traders happy and trading.

Finding the sweet spot between luring traders with low exchange fees and generating enough revenue to sustain a robust platform is a constant challenge. In this guide, we will explore effective strategies for crypto exchange development that can help you achieve this delicate balance.

Market Overview

The cryptocurrency landscape is brimming with opportunities and why won’t it? – the most awaited moment of the past four years is finally here. Bitcoin is halving. Apart from that, there is a separate fan base of spot crypto ETFs making their way into the crypto ecosystem. The dynamic market arena is experiencing high-intensity volatility due to a soaring influx of new users and the prices of digital assets are skyrocketing gradually.

As more cryptocurrency exchange development projects approach the markets due to increased demand for trading services and platforms, it becomes essential to study market trends, user preferences, and competition strategies for effective crypto exchange development and positioning. Before learning about fee minimization and profit maximization strategies, entrepreneurs must be aware of the types of fees exchanges charge from users.

1. Types of Fees To Consider During Your Crypto Exchange Development

Cryptocurrency exchanges typically charge various types of fees, including

- Trading Fees

- Inactivity Fees

- Account Fees or Subscription Fees

- Maker and Taker Fees

- Deposit and Withdrawal fees

- Listing Fees

- Margin Trading Fees

Each fee type plays a different role in revenue generation and user engagement. Therefore, it is important to consider each of these fees carefully during the cryptocurrency exchange development process and launch of your trading platform.

2. 2024 Crypto Exchange Fee Comparison: An Essential Consideration For Crypto Exchange Development

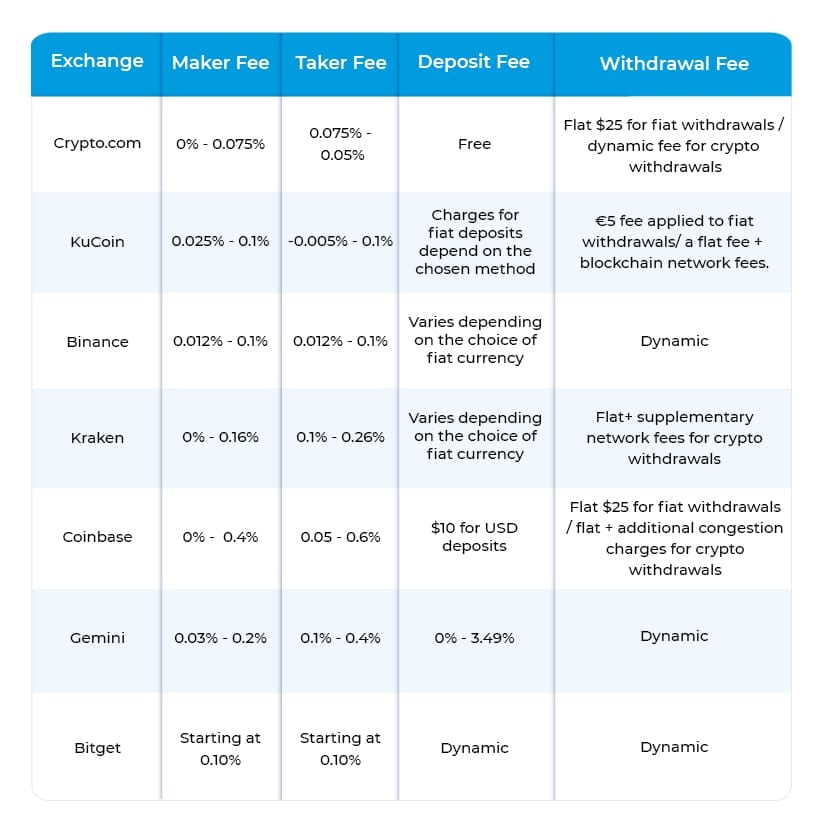

The cryptocurrency exchange market is not less crowded and there are exchanges with a larger piece of the pie than others. While fees are a major factor impacting individuals’ trading platform choice, other factors make a cryptocurrency exchange development stand out. Trading volume, market liquidity, transactional speed, efficiency, etc. are some of those factors. Taking into consideration traders’ preferences for the best cryptocurrency exchanges in 2024, let’s see how some platforms are offering better deals than others:

A comparative analysis of fee structures across cryptocurrency exchanges provides valuable insights into industry trends and best practices. By understanding how leading exchanges structure their fees, new cryptocurrency exchange development projects can set the basis for their decision-making and strategy.

Alert: The charges mentioned above might differ slightly or significantly. For precise and latest information, you can visit the exchange’s website.

Let’s discuss other benefits offered by the popular cryptocurrency exchanges:

1. Crypto.com

– Generous VIP programs with fee reduction benefits

– Exclusive staking benefits with fee elimination for high-volume traders

2. KuCoin

– Suitable for experienced traders

– Offers a huge range of altcoins

– Only “loyalist” KCS holders access trading discounts.

3. Binance

– Known for a decent range of tradeable digital assets.

– Tiered VIP program for BNB holders

– Additional 25% discount on fees when paid in BNB

– Zero trading fee on various FDUSD markets

4. Kraken

– Maker/Taker fee discounts depending on the user’s trading activity

5. Coinbase

– Tiered trading fee structure offering beneficial rates to big-ticket traders

6. Gemini

– A unique and complex fee structure, offering reasonable rates to only those using the Gemini ActiveTrader platform

– The fee lowers as the trading volume increases

7. Bitget

– A generous VIP program with significant reductions for high-volume traders.

A comparative analysis of fee structures across cryptocurrency exchanges provides valuable insights into industry trends and best practices. By understanding how leading exchanges structure their fees, new cryptocurrency exchange development projects can set the basis for their decision-making and strategy.

5 Fee Reduction Strategies For Cryptocurrency Exchange Development Projects

Considering the fee structures and strategies of the above-mentioned top-notch exchanges, we can shortlist these 5 popular fee reduction strategies for crypto exchange development projects.

- Tiered Fee Structure:

Implementing a tiered fee structure that encourages high trading volumes by rewarding them with low fees can be an effective way to attract institutional investors. Strategically determining tiers or slabs can also help generate income from small traders.

- Maker-Taker Fee Model:

It is one of the most prevalently used pricing structures by most cryptocurrency exchange development projects. The model encourages order book depth and market stability by charging lower fees for users who “make” liquidity by placing limit orders and higher fees for “takers” who execute market orders.

- Referral Programs:

This innovative way of rewarding users with fee reductions for referring new users can be a game changer for new crypto exchange development projects. This promotes the organic growth of a trading platform and fosters active participation.

- Fee Discount for Holding Exchange Tokens:

This fee model involves creating a native exchange token with utility for a user base. It works by offering fee discounts to users who hold that native token, fostering a loyal user base, and promoting token adoption.

- Focus on Trading Volume:

While reducing fees directly impacts revenue, increasing trading volume can compensate for lower fees. A power-packed cryptocurrency exchange development project that lures users with low fees, a user-friendly interface, diverse trading options, and competitive listing fees can gain more customers and therefore enhance revenues.

Alternative Revenue Models To Consider To Enhance Revenues

Another way to make up for low trading fees is to diversify revenue streams. Let’s discuss some popular revenue streams that can boost the profitability of an exchange. Considering these revenue streams, crypto exchange development can help businesses make the right decision at the right time.

- Margin Trading

By integrating the margin trading module, traders and businesses can amplify their potential returns. Not only does it generate additional revenue but it also welcomes participation from experienced and institutional investors, diversifying the user base of the trading platform.

- Staking and Lending Services

Deploying staking and lending protocols during cryptocurrency exchange development can enhance user retention and engagement as traders earn interest on crypto holdings. This module strengthens the liquidity and sustainability of the platform while generating passive income.

- Fiat On-Ramp and Off-Ramp Services

It is one of the most-sought after modules for crypto exchange development as it allows them to easily convert fiat currencies into crypto and vice versa. It removes barriers for new entrants and generates handsome transaction fees as well.

- Premium Features

Monetizing the enhanced user experience through premium features like advanced charting tools, arbitrage bots, or VIP customer support can help trading exchange businesses earn additional dollars. This introduces subscription fees and more sophisticated users to the platform.

- Listing Fees

Charging a fee for projects to list their tokens or coins on your exchange can become a healthy revenue stream but cryptocurrency exchange development projects need to be careful while deciding the fees. They need to strike a balance between keeping competitive fees and attracting valuable or high-potential projects.

Optimizing Fee Structure For Your Cryptocurrency Exchange Development

- Market Analysis:

Before you hop on a fee structure, analyze your target market and competitor fee structure. Identifying and studying their mode of revenue can help businesses devise a strategy that keeps them competitively priced without sacrificing profitability.

- Data-Driven Decisions:

Businesses can optimize their fee structures even after launching their project. No intervention from cryptocurrency exchange development services is required. They can regularly track and monitor user data and trading activity and, accordingly, tweak fee structures to promote a particular kind of user behavior and maximize revenue.

- Transparency is the key

Staying competitive is important but keeping things straightforward and clear is more important. Always clearly communicate your fee structure and avoid any hidden fees or complex calculations that may erode users’ trust.

Conclusion

As the world of cryptocurrencies and blockchain expands, more cryptocurrency exchange platforms are emerging with lucrative features and fee structures. Maximizing revenues while keeping fees at bay is indispensable for the success of cryptocurrency exchange development. To enter the booming crypto market in 2024, crypto exchange projects need to understand the dynamics of fee structures and explore strategies to optimize revenue streams.

By partnering with a reliable Crypto Exchange Development Company, a crypto exchange can devise and deploy pertinent strategies that can enhance revenue generation without increasing exchange fees. Take the first step towards building a successful exchange by implementing proven strategies and maximizing your profitability.

Start now and unlock the full potential of your cryptocurrency exchange project with Antier, a leading cryptocurrency exchange development services provider in the domain.