Introduction

Atmos Research reveals that the UAE tops the charts as the crypto-obsessed country in 2025, with 210% crypto adoption growth and 25.3% ownership rates.

Forward-thinking regulations supporting cryptocurrencies, development of regulatory sandboxes like the Dubai Blockchain Center, startup-friendly policies, blockchain R&D initiatives, and an unwavering commitment to technological excellence make Dubai a leader in blockchain innovation. It also ranks third on the Henley crypto adoption index 2024. Dubai’s fast-paced progression toward cryptocurrencies signals a significant surge in demand for secure, user-friendly crypto wallet development.

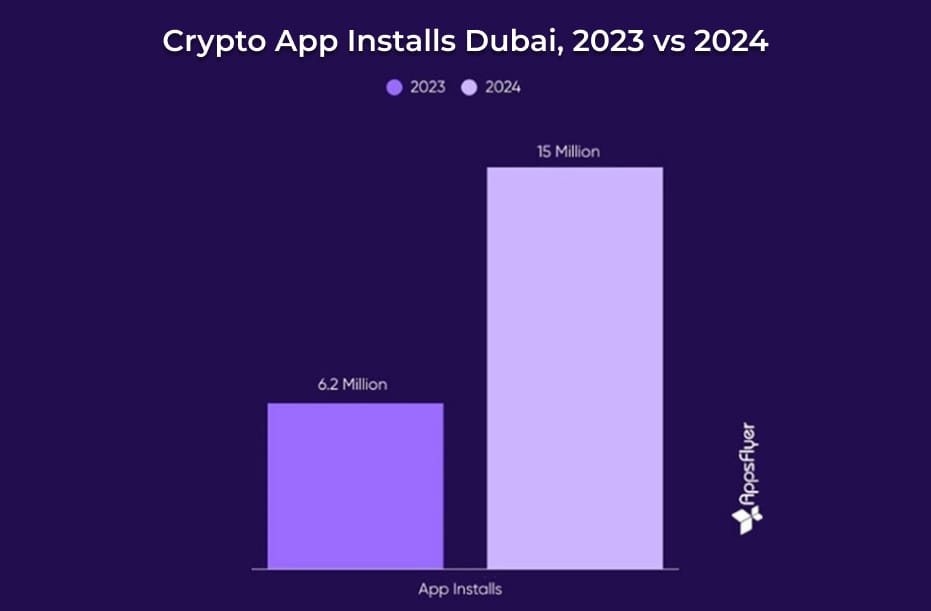

The UAE saw a 41% increase in crypto app downloads.

Source: Appsflyer

Not just the government’s Dubai Blockchain Strategy and cultural adoption with digital Eidiya, cryptocurrency adoption in the UAE has a long way to go. But the question is, who can tap into the opportunity set forth by the skyrocketing crypto adoption? Let’s discover it ahead…

Top Businesses That Can Benefit From Crypto Wallet Development in 2025

Did You Know?

In 2023, Dubai ranked as the second most crypto-ready country in the world, with 772 crypto-based companies operating.

1. Financial Services & Fintech

Dubai’s fintech sector, including platforms like BitOasis and Sarwa, relies on crypto wallets to enable seamless trading, cross-border payments, and decentralized finance integrations. Emirates NBD also recently launched trading on Liv X, legalizing the crypto stance in the UAE. Banks, being the ultimate custodians, can also offer crypto custody services to institutional and retail investors by leveraging bank-grade white label crypto wallets with multi-currency support.

Use Cases :

- Digital Banking : Emirates NBD, Dubai Islamic Bank (DIB), and Wio Bank have already launched their custody services. More banks like First Abu Dhabi Bank can launch their crypto custody solutions.

- Peer-to-Peer Payments : Companies like Boundless Pay, BitOasis, and RedotPay leverage wallets for instant cross-border settlements. More such P2P payment facilitators can develop tailored crypto wallet development solutions.

Remittance Services Providers : Ripple has recently received a license from the DFSA (Dubai Financial Services Authority) for offering crypto-based remittance services. Triple-A is another licensed digital payment institution that offers global payout solutions in stablecoins and local currencies.

2. Real Estate & Tokenization

Tokenizing real estate assets allows fractional ownership and enhances liquidity. Crypto wallet development enables secure storage and transfer of property tokens, as seen with Bofiya, a blockchain-based real estate crowdfunding platform.

Use Cases :

- Fractional Ownership : RWA tokenization projects can launch their crypto wallets that manage tokens representing shares in high-value properties.

- Smart Contracts : Automate rental agreements or sales through wallet-integrated DeFi protocols.

3. Supply Chain & Logistics

Blockchain’s transparency and traceability are revolutionizing supply chains. Crypto wallet development solutions can store transaction records, certifications, and IoT data securely, bringing a new era of supply chain management.

Use Cases :

- Provenance Tracking : Wallets verify product authenticity (e.g., luxury goods, pharmaceuticals).

- Automated Payments : Instant settlements between suppliers and distributors.

4. Retail & E-Commerce

With 72% of UAE residents interested in crypto, retailers can attract tech-savvy customers by accepting crypto payments. Wallets like UPay facilitate seamless crypto-to-fiat conversions for everyday purchases. Similarly, retail and e-commerce businesses can opt for payment gateway and crypto wallet development with fiat on/off ramps to tap into the craze.

Use Cases :

- Loyalty Programs : Tokenized rewards stored in wallets.

- NFT Marketplaces : Platforms like Colexion use wallets for NFT transactions.

5. Tourism & Hospitality

Dubai’s tourism sector, which contributes 11.5% to its GDP, can leverage crypto wallets for frictionless bookings, loyalty points, and global payments. Companies like Emirates Airlines are exploring blockchain and crypto wallet development service for ticketing and rewards.

Use Cases :

- Crypto Travel Cards : Pre-loaded wallets for tourists (e.g., Revolut-style solutions).

- Metaverse Integration : Virtual tours and NFT-based experiences.

6. Healthcare

Secure patient data management and transparent billing are critical. Cryptocurrency wallet development solutions can store encrypted health records and enable instant insurance claims, as piloted by Suffescom Solutions.

Use Cases :

- Medical NFTs : Verify credentials or research participation.

- Pharma Supply Chains : Track drug authenticity via wallet-linked blockchain ledgers.

7. Gaming & Entertainment

The GameFi sector is booming in Dubai, with platforms like Colexion offering play-to-earn models. White label crypto wallet development solutions can enable in-game asset ownership and cross-platform interoperability.

Use Cases :

- NFT Collectibles : Trade in-game items securely.

- DeFi Integration : Stake tokens for rewards through wallets.

8. Government & Public Services

Dubai aims to become the first blockchain-powered government. Wallets can streamline citizen services, such as visa applications or utility payments, as seen in Dubai’s Blockchain Strategy.

Use Cases :

- Digital IDs : Securely stored in wallets for authentication.

- Smart City Initiatives : IoT devices interacting with blockchain via wallets.

9. SMEs & Startups

Affordable crypto wallet development solutions empower SMEs to compete globally. Companies like Technoloader offer customizable wallets for small businesses, reducing transaction costs and enhancing financial inclusion.

Use Cases :

- Microtransactions : Accept crypto payments without high fees.

- Tokenized Crowdfunding : Raise capital via wallet-based platforms.

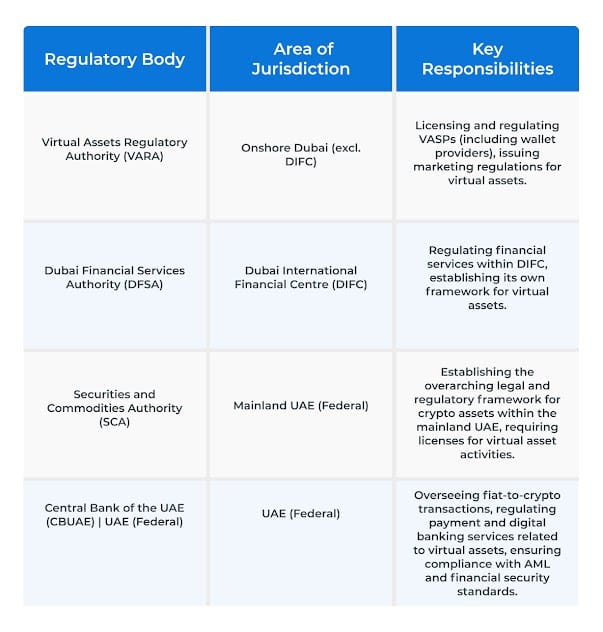

Key Regulatory Bodies For Cryptocurrencies in Dubai

The regulatory landscape for cryptocurrencies and blockchain is ruled by these four major players. Based on your business model and crypto vision, you can attain licenses and accreditations from the concerned bodies. A crypto wallet development company based in Dubai can also help you navigate the complexities of launching your cryptocurrency wallets.

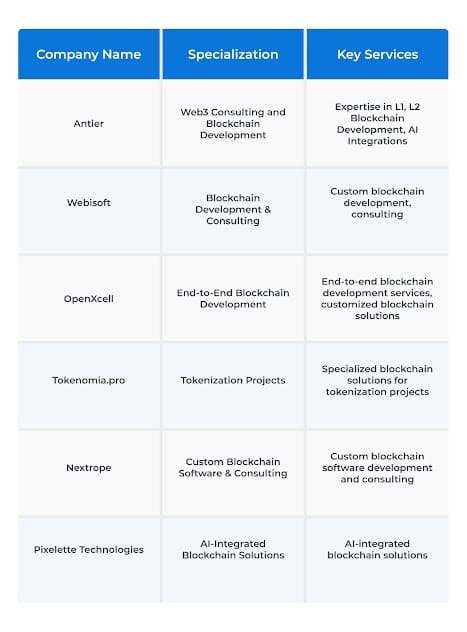

Top Crypto Wallet Development Companies in 2025

Dubai’s dynamic tech ecosystem is home to several esteemed blockchain development companies specializing in crypto wallet creation. Here are some notable crypto wallet development companies leading the charge in crypto wallet development.

Conclusion

From real estate tokenization to decentralized healthcare, crypto wallets are reshaping Dubai’s economic landscape. By partnering with leading developers like Antier, businesses can harness secure, scalable solutions tailored to their needs. As Dubai accelerates toward its vision of a blockchain-driven future, adopting crypto wallets is no longer optional—it’s a strategic imperative.

Streamline transactions, enhance security, and tap into the trillion-dollar crypto market with Antier’s crypto wallet development services.