Top 12 RWA Tokenization Platforms and Companies in 2025

January 3, 2025

Popular Use Cases of Metaverse in Healthcare for 2025

January 6, 2025As consumer expectations shift towards hyper-personalized, on-demand financial services, BaaS provides the infrastructure to meet these evolving demands. BaaS frameworks are being used by traditional banks, which were previously constrained by unwieldy legacy systems, to update their products without engaging in an expensive technological revolution. Businesses can quickly implement game-changing solutions like digital wallets, real-time payment processing, and instant credit facilities by integrating with BaaS solution providers. This effectively closes the gap between traditional banking and next-generation fintech. The global BaaS market is expected to reach $74.55 billion by 2030, having grown from a 2021 valuation of $19.65 billion at an astounding 16.2% compound annual growth rate.

This remarkable expansion is driven by the proliferation of API-first platforms, which serve as the cornerstone of BaaS ecosystems by enabling the seamless integration of diverse financial services into digital applications. The need for BaaS software platforms is being fueled by the growth of embedded finance in sectors like travel, healthcare, and e-commerce. Businesses can integrate financial services seamlessly, creating new revenue streams while enhancing customer engagement and loyalty.

Bank as a Service Vs Open Banking

Banking-as-a-Service (BaaS) and Open Banking are both key innovations in the financial sector, but they serve distinct purposes. BaaS enables businesses to access banking infrastructure through API-driven software platforms, allowing non-bank entities to offer banking services like payments, loans, and account management. BaaS providers offer a complete, integrated banking solution without requiring a banking license, catering to industries such as fintech and crypto banking services.

In contrast, Open Banking mandates banks to share customer data with third-party providers (with consent) via secure APIs, fostering competition and innovation. While Open Banking enables data sharing, BaaS provides a full suite of banking capabilities. Both drive digital transformation, but BaaS software platforms offer a more comprehensive service, including white-label crypto banks, empowering businesses to launch their banking solutions.

How does Baas Solutions Function?

Banking-as-a-Service (BaaS) solutions seamlessly integrate traditional banks, fintech companies, and regulatory bodies, leveraging APIs to provide banking services within non-bank platforms. The primary function of BaaS is to enable non-financial institutions to offer financial products, such as payments, loans, and accounts, by using the infrastructure of licensed banks. BaaS software platforms serve as the backbone, connecting fintech companies to banks’ core systems while maintaining regulatory compliance. The process begins with the collaboration between Bank as a Service (BaaS) providers and licensed banks, where the bank provides the regulatory framework, licenses, and the core banking infrastructure. Banks also develop and manage the APIs that expose essential services like payment processing, loan management, and account opening to third-party platforms. These fintech companies, leveraging crypto banking services or traditional banking functionalities, integrate the provided APIs into their applications, thus enabling end-users to access banking services directly.

Regulatory oversight ensures the safety of data and compliance with AML and KYC regulations, thus providing a secure and compliant framework for both fintech companies and their customers. The interconnected system allows for enhanced scalability and operational efficiency, reducing the time-to-market for new crypto-banking services and enabling businesses to scale quickly without having to develop a banking infrastructure from scratch. BaaS solution providers empower businesses by offering a complete financial ecosystem where non-bank entities can embed banking services while staying compliant with regulatory guidelines.

Non-Negotiable Features of BaaS Software Platforms

Incorporating advanced capabilities into BaaS solutions is no longer a luxury but a necessity for businesses aiming to stay competitive in the evolving financial ecosystem. Bank-as-a-service (BaaS) solution providers empower businesses to integrate cutting-edge financial functionalities seamlessly, driving innovation, scalability, and customer satisfaction. Understanding these essential features helps investors and businesses make informed decisions for building robust, future-ready financial solutions. Let us scroll down to explore them in detail-

✓ API-First Architecture : BaaS software platforms leverage robust APIs to offer seamless integration of financial services, enabling businesses to embed payments, loans, and account management directly into their platforms with minimal technical overhead.

✓ White-Label Crypto Banking : The integration of crypto banking services through white-label solutions allows fintech companies to offer digital asset management, crypto payments, and trading services under their brand, enhancing flexibility and expanding service offerings.

✓ Real-Time Data Processing and Analytics : BaaS software platforms support instant transaction processing and provide real-time data insights, allowing businesses to optimize customer experiences, mitigate risks, and enhance decision-making capabilities.

✓ Advanced Compliance Automation : BaaS solutions include automated compliance workflows that minimize human error, lessen regulatory burden, and guarantee seamless service delivery in multiple jurisdictions to ensure businesses meet KYC, AML, and data protection regulations.

✓ Scalable Modular Services : BaaS software platforms offer modular banking services that businesses can mix and match based on their specific needs, allowing cost-efficient, scalable, and tailored banking services without overextending resources.

✓ Multi-Currency and Cross-Border Transactions : For businesses offering global financial services, BaaS platforms provide seamless multi-currency support, allowing businesses to manage cross-border transactions effortlessly while ensuring currency conversion compliance.

✓ Cloud-Native Infrastructure : Bank as a Service (BaaS) solution providers utilize cloud-based systems for improved scalability, reliability, and cost-efficiency, enabling businesses to quickly deploy, update, and manage financial services on demand with high uptime and security.

✓ Embedded Lending and Credit Services : BaaS solutions offer embedded lending products that allow businesses to seamlessly integrate credit services, such as personal loans or credit lines, into their platforms, expanding their financial offerings without managing the core lending infrastructure.

✓ Instant KYC/AML Verification : BaaS software platforms integrate real-time identity verification and anti-money laundering checks, streamlining the onboarding process and ensuring compliance with local and international financial regulations.

Each of these features plays a crucial role in the ongoing transformation of the financial ecosystem, giving businesses the tools they need to stay ahead in the competitive market. BaaS software platforms and Bank as a service (BaaS) solution providers are enabling fintech firms and crypto startups to scale operations rapidly, all while ensuring secure, compliant, and efficient financial services.

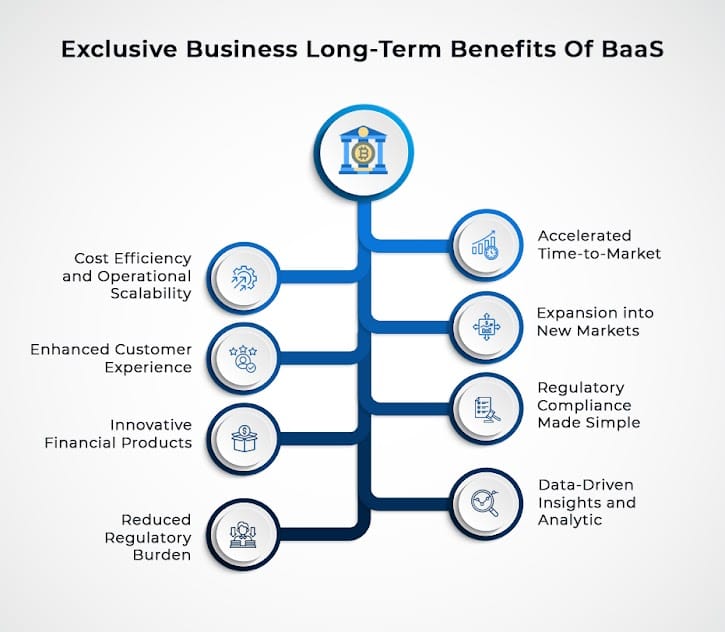

Sustained Advantages of BaaS Solutions for Businesses

- Accelerated Time-to-Market : Companies can drastically cut down on the amount of time needed to introduce financial services by utilizing BaaS software platforms. Rather than building infrastructure from scratch, companies can integrate pre-built banking features such as payments, lending, and account management into their platforms, enabling rapid deployment and competitive advantage.

- Cost Efficiency and Operational Scalability : BaaS solution providers allow businesses to scale their operations seamlessly without the burden of maintaining traditional banking infrastructure. This enables firms to scale their offerings in line with market demands, optimizing both operational costs and resource allocation.

- Expansion into New Markets : With Banking-as-a-Service (BaaS) solution providers, businesses gain the flexibility to expand into international markets without the complexity of navigating regulatory environments and acquiring local banking licenses. This is especially crucial in the rapidly growing markets for crypto banking services, where global reach is essential for success.

- Enhanced Customer Experience : Businesses leveraging white-label crypto bank solutions can offer highly personalized, seamless financial services that integrate directly into their platforms. This improves customer satisfaction by providing them with frictionless access to a range of financial services within the same environment they already use.

- Regulatory Compliance Made Easy : Businesses or investors can make sure they adhere to stringent regulatory requirements, such as KYC, AML, and data protection laws, by depending on reputable BaaS providers. These providers help businesses automate compliance processes, reducing legal risks and operational burdens while maintaining adherence to evolving financial regulations.

- Innovative Financial Products : BaaS enables companies to offer innovative products like embedded lending, instant payments, and real-time transactions. By integrating these offerings into their platforms, businesses can diversify their revenue streams and build stronger customer loyalty, especially in emerging sectors like crypto banking services.

- Data-Driven Insights and Analytics : Businesses that integrate BaaS solutions benefit from access to real-time data analytics and transaction monitoring. This data-driven approach allows businesses to gain deeper insights into customer behavior, enabling more informed decisions and better-targeted financial products.

- Reduced Regulatory Burden : Through partnerships with BaaS providers, companies can offload the complexities of regulatory compliance, including obtaining banking licenses, to their service providers. This allows businesses to focus on product innovation and market expansion without worrying about the technicalities of banking regulations.

Businesses can position themselves for long-term growth, lower operating costs, and improved customer engagement by implementing Banking-as-a-Service (BaaS) solutions. This gives them a competitive advantage in the rapidly changing digital finance market. However, for a company that intends to invest in BaaS software platforms, understanding its use cases is just as crucial as understanding its benefits. Thus, let us scroll through the blog to know more about its real-world applications.

Real World Applications: Who Leverages BaaS?

Banking-as-a-Service is a game-changing solution adopted by various industries to meet evolving financial needs. Neobanks and fintech startups use it to launch digital-first financial products without investing in costly banking infrastructure. Retailers, e-commerce platforms, and travel companies integrate BaaS to embed financial services like payments, lending, or loyalty rewards. Non-Banking Financial Companies (NBFCs) and microfinance institutions leverage BaaS to drive financial inclusion. This diverse audience turns to Banking-as-a-Service (BaaS) solution providers to create tailored financial ecosystems.

- Embedded Finance in E-Commerce

E-commerce platforms integrate BaaS to enable financing options like Buy Now, Pay Later (BNPL) and embedded payments, streamlining the checkout experience for customers while boosting conversions.

- Fintech Product Innovation

Fintech startups use BaaS software platforms to deliver features like AI-driven investment advisors, digital wallets with advanced budgeting, and enterprise-level expense management tools.

- SME Banking Enablement

Small and medium enterprises benefit from BaaS providers offering simplified invoicing, real-time payment processing, and fast business loan applications integrated directly into digital platforms.

- Digital Wallet Solutions

Traditional banks and non-banking companies collaborate with Banking-as-a-Service providers to deploy next-gen digital wallets with enhanced functionalities such as instant payments, cross-border transfers, and crypto integration.

- Financial Inclusion for Underserved Populations

Microfinance institutions and NBFCs employ BaaS providers to provide accessible financial services, such as affordable credit and simplified savings accounts, in rural and underserved areas.

- Travel and Hospitality Innovations

Travel companies integrate BaaS to offer embedded insurance, seamless currency conversion, and co-branded travel cards, enriching the customer journey.

- White-Label Crypto Banks

Emerging crypto ventures utilize white-label crypto bank platforms to deliver decentralized banking services, crypto wallets, and integrated trading options to a global audience.

- Healthcare Financing

BaaS enables healthcare providers to introduce flexible financing options for patients, such as medical loans or subscription models, embedded within their payment systems.

- Real-Time Payroll Solutions

Businesses leverage BaaS software platforms to streamline employee payroll with instant payment capabilities, integrating these solutions into human resource management systems.

The aforementioned use cases highlight how BaaS software platforms empower businesses and investors to stay attuned to evolving financial applications, enhancing their market presence. By leveraging BaaS-driven innovations, organizations can create tailored, scalable solutions that position them as leaders in the competitive financial landscape.

Build BaaS Platforms 10X Faster Now—Partner With Antier

Businesses and investors must carefully weigh several factors before beginning their BaaS journey. Advanced functionality, smooth integration, and scalability are essential elements of a successful BaaS software platform. Equally important is ensuring compliance with evolving market standards while addressing the ever-increasing demand for innovative financial products. Focusing on these essentials helps businesses stay competitive and align with customer expectations, positioning them for sustainable growth and market leadership.

Throughout your BaaS journey, Antier is ready to support you in growing your business. We are a leading Bank as a Service (BaaS) solution provider holding expertise that extends beyond regulatory compliance to delivering bespoke, high-performance BaaS software platforms, meticulously crafted to align with your vision. Leveraging the prowess of blockchain professionals, we create innovative solutions that redefine customer experiences and amplify your market presence. Partner with us to shape a future-ready BaaS platform, ensuring long-term growth and unmatched industry leadership.