How to Create a White Label Meme Coin Wallet: Features, Cost & Development Timeline

February 4, 2025

How Blockchain Carbon Trading Restores Trust in the Carbon Market

February 4, 2025Introduction

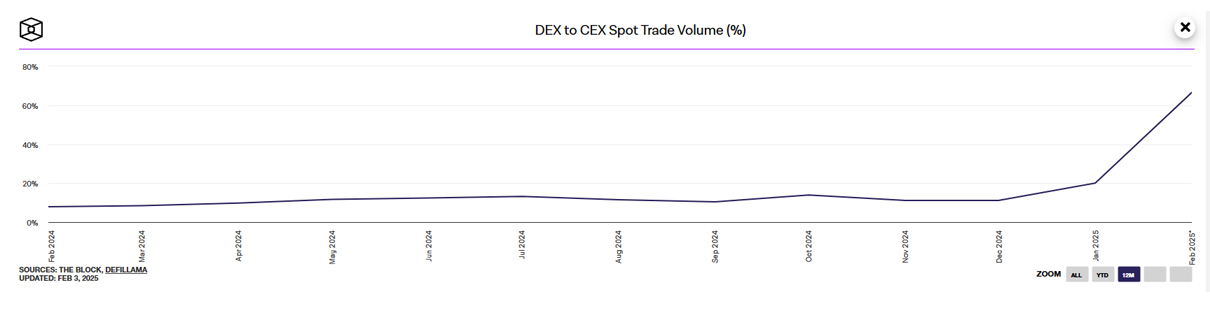

Decentralized exchanges are already making this vision a reality. No doubt why the trading volumes on DEXs have been shattering records, pushing DEX to CEX spot trade volume ratio to 66.53%. The sensational surge observed in January 2025 marks a major milestone in the history of cryptocurrency and DeFi platforms, bringing the decentralization dream of millions closer to reality. While traders have already taken their stance, why haven’t you? Now is the time for DEX development.

Source: The Block

But what makes your platform stand out from the 900+ decentralized crypto exchanges already in existence? In this blog, we’ll explore how to build a next-gen DEX ecosystem that will monopolize the market in 2025 and beyond. From innovative strategies to real-world examples, this is your blueprint for success.

Essential Components For A Future-Proof DEX Development

The cryptocurrency exchange landscape is highly competitive. To dominate the space, you must meticulously analyze your niche and competition. Based on our observations as a leading DEX Development Company, you can’t afford to leave any stone unturned unless you have strong community backing already.

Source: Coingecko

The Imperative of All-in-One Ecosystems

The current DeFi landscape is fragmented. Users juggle multiple platforms for trading, storing assets, and spending crypto. This creates friction, limits adoption, and leaves room for innovation. So, the first ingredient for successful and future-proof DEX development is comprehensiveness.

In 2025 or beyond, the real leaders in this space won’t be those offering standalone decentralized exchange platforms. They’ll be the visionaries who create an all-in-one ecosystem that seamlessly integrates trading, wallets, payment cards, native tokens, staking, etc. This DEX development approach simplifies the user experience and creates a self-sustaining economy that drives growth and loyalty.

Take Crypto.com as an example. Its ecosystem—featuring a wallet, DEX, card, and token—has attracted over 100 million users, and an upcoming project called BestWalletToken brings a similar concept. The potential seems staggering and that’s why it’s the right time for you to kickstart your DEX development.

So how can you create this all-in-one DeFi powerhouse in 2025? Let’s break it down.

Four Pillars of a Next-Gen DEX Ecosystem

To realize the real benefits, it’s essential to focus on these four key components:

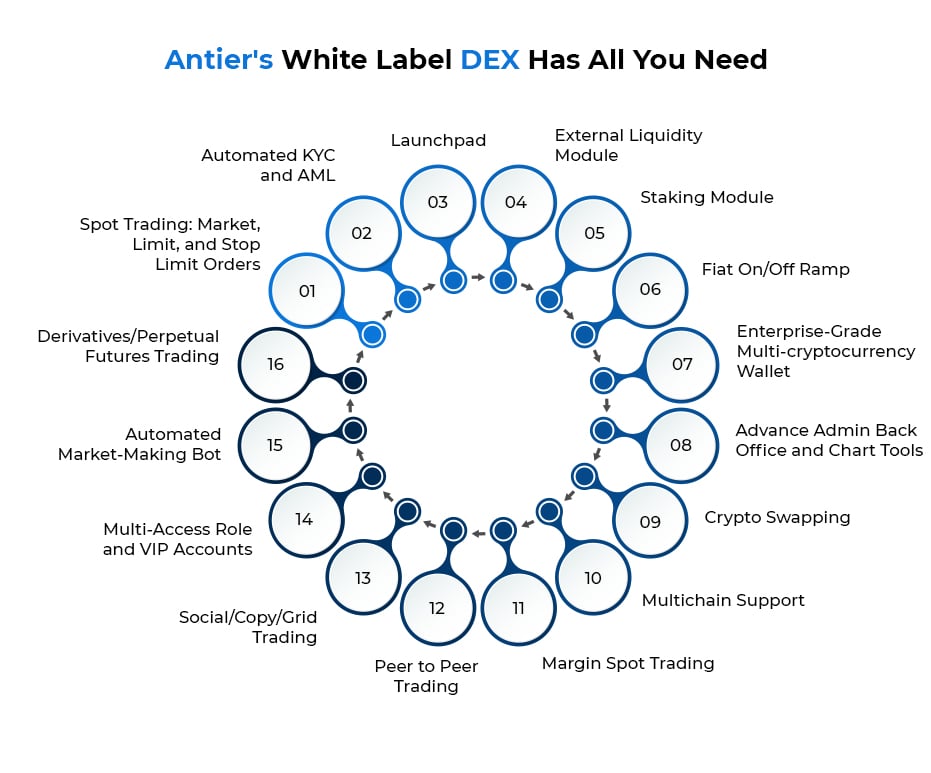

1. The Heart of the Ecosystem: DEX

DEX development serves as the foundation of the ecosystem. With features like permissionless trading, AMMs, and liquidity pools, it enables seamless trading of crypto assets. To stand out in 2025, your decentralized trading platform must offer:

- Low Fees and High Speed: Leverage Layer 2 solutions like Arbitrum or zkSync to reduce gas fees and improve transaction speeds.

- Advanced Trading Features: Introduce limit orders, leverage, stop losses, derivatives, and margin trading during DEX development to compete with centralized exchanges and cater to professional traders.

Also Read>>> Margin Mania: Can Decentralized Margin Trading Exchanges Beat Centralized Giants?

- Cross-Chain Compatibility: Offer interoperability to attract a broader user base by enabling trading across blockchains like Ethereum, Solana, Polygon, and Binance Smart Chain.

- Security: Implement robust smart contract audits, multi-signature approvals, MFA, advanced encryption mechanisms, anti-dDoS and anti-slippage mechanisms, etc. during DEX development to build trust.

Example:

Uniswap v3, the trailblazer in the DEX market, processes over $6-8 billion in daily trading volume. Their focus on AMMs and concentrated liquidity allows users to maximize capital efficiency. Your DEX can take this further by integrating AI-powered trading tools.

2. Your User’s Gateway to Decentralization: DeFi Wallet

Building a secure, multi-functional wallet along with DEX development is essential for managing assets within the ecosystem. It not only supports token storage but also enables seamless interaction with decentralized applications outside of your DeFi ecosystem.

-

- Multi-Chain Support allows storage and management of assets across multiple blockchains.

- NFT integration enables users to store and trade NFTs alongside their crypto assets.

- Staking and Yield Farming module integration during DEX development allows traders to earn incentives on their holdings.

- Fiat Management enables customers to manage all their assets in one place

Also Read: How to Seamlessly Integrate Fiat, Crypto, and NFTs in a Unified Wallet Solution?

- Implement biometric authentication and hardware wallet integrations for enhanced security.

- Enable a user-friendly interface with in-app trading capabilities connected to your DEX.

Example: MetaMask focused on simplicity and functionality during DEX development and has over 30 million monthly active users. Fintopio, a leading wallet, bridges CeFi and DeFi by offering a unified interface for fiat, NFT, and crypto. Your wallet can go a step ahead by integrating a DEX and payment card.

3. Bridging Crypto and Real-World Spending: Crypto Card

A crypto payment card is the missing link between DeFi and everyday life. Make spending crypto as simple as swiping a traditional debit card by adding a crypto card to your ecosystem during DEX development. This feature bridges the gap between digital and real-world utility.

Key Features for a Crypto Payment Card:

- Incentivize spending by rewarding users by offering cashback in your native token.

- Allow users to spend crypto, stablecoins, NFTs, or fiat seamlessly with a unified crypto payment card.

- Collaborate with your DEX development company to integrate with Apple Pay and Google Pay and ensure compatibility with existing payment systems.

- Enable global usability for both online and in-store purchases.

Example: Crypto.com’s Visa card has been a game-changer, offering up to 8% cashback in CRO tokens. Your ecosystem can replicate this success while maintaining decentralization.

4. The Glue Holding the Ecosystem Together: Token

Don’t forget to bind the ecosystem together during DEX development with a token. It powers the DEX, rewards users, and adds utility across the wallet and card features. All popular trading platforms and wallets have this feature in common: a native token.

Utility for Your Native Token:

- Power governance; allow your native token holders to vote on ecosystem upgrades and proposals.

- Drive loyalty by creating a tokenomics model during DEX development that rewards long-term holders and active users.

- Offer discounts on trading fees, enhanced staking rewards, and cashback on the payment card to the native token holders.

Example: PancakeSwap’s CAKE token has thrived by offering multiple utilities, from staking to lottery tickets. BNB serves as the backbone of the Binance ecosystem, enabling trading discounts, token launches, and payments. You can follow a similar path during DEX development while offering your token utility across different platforms.

Top 10 Strategies to Lead the DEX Landscape in 2025 and Beyond

Here are key considerations for building a next-gen DEX ecosystem:

1. Focus on User Experience

DeFi’s complexity is a barrier to mass adoption. The success of your ecosystem therefore depends on making DeFi accessible to everyone. Your DEX development must prioritize simplicity and accessibility. Invest in intuitive interfaces, mobile-first designs, simplified onboarding, fiat on-ramps, educational resources, and customer support.

2. Partner with Traditional Finance

Collaborate with banks, payment processors, and fintech companies to bridge the gap between crypto and traditional finance. This will enhance credibility and attract more retail and institutional investors.

3. Leverage AI, ML, and Emerging Trends

Adaptability is the key to longevity. Ensure that your white label DEX aligns with future trends like AI/ML integration, multi-chain scalability, Web3 social features, etc. DEX projects can leverage AI to offer personalized trading insights, fraud detection, and risk management, setting the ecosystem apart as a tech-driven leader.

4. Prioritize Security and Compliance

Build your reputation with rigorous security measures and be a security-first DeFi ecosystem. Collaborate with the DEX development company to integrate robust security measures, including multi-signature wallets, MFA, advanced encryption, hardware wallet integrations, etc. Even after launching your DEX, businesses must implement regular audits, bug bounty programs, transparent governance mechanisms and work proactively with regulators to ensure compliance.

5. Leverage Partnerships in Web3 Space

Collaborate with blockchain projects, payment networks, and liquidity providers to expand your reach and add value to your ecosystem. Your white label DEX exchange provider can help you scout relevant and effective partnerships for your Web3 project.

6. Sustainability Through Community Engagement

A vibrant community is a hallmark of successful DeFi projects. Let token holders vote on upgrades, features, and tokenomics to create a loyal, engaged community. You can also keep users invested through social media, AMAs and rewarding early adopters with airdrops and exclusive perks.

7. Liquidity Solutions

Collaborate with your DEX development company to develop strategies to ensure ample liquidity, such as concentrated liquidity pools and incentivizing market makers.

8. Cross-Chain Compatibility

As discussed above, don’t miss cross-chain support. Ensure to facilitate transactions across multiple blockchains to provide users with a diverse range of trading options.

9. Gamification

Identify and gamify the unfamiliar features, or maybe those your competitors are doing. Your DEX development company can help determine the features as per your vision that will benefit the most when you gamify.

10. Build Your Exchange MiniApp for Telegram

When building your decentralized exchange, make sure you’re omnipresent when you launch. Your users should be able to access your exchange on the mobile app, web app, desktop browsing, and even Telegram MiniApps.

The Roadmap to Building a Unified Ecosystem

Here’s a step-by-step DEX development guide to ace the DeFi space:

- Define Your Vision: Identify the pain points your ecosystem will solve and the audience you’ll target.

- Develop the DEX: Start with a robust exchange with multi-chain capabilities.

- Integrate the Wallet: Ensure it supports all assets and is directly linked to your DEX.

- Launch the Card: Enable real-world utility to bridge DeFi and TradFi.

- Introduce the Native Token: Collaborate with DEX development company to create use cases and incentives to drive adoption.

- Market Strategically: Use influencer marketing, token airdrops, and community-building initiatives to create buzz.

The Trajectory to Future of Finance

A sensational shift from CeFi to DeFi was just the start. We may see more DEX development for DeFi platforms emerging that club various functionalities such as trading, custody, social media, crypto cards, staking, lending and borrowing, etc. They won’t be the standalone apps but hubs of financial activity where traders trade, earn, spend, and govern—all in one place.

Your next-gen DEX ecosystem has the potential to lead this charge. By combining a powerful DEX, a versatile wallet, a seamless payment card, and a utility-driven token with the help of your DEX development company, you can create a self-sustaining economy that attracts millions of users. At Antier, we specialize in building innovative decentralized exchange platforms that shape the trajectory of digital finance.

The race to 2025 is on, and the winners will be those who innovate, integrate, and inspire. Let’s redefine finance together.