Why Launch a Game on Telegram Apps Center?

July 31, 2024

6 Key Features of a Successful TAP TO EARN Game Script

August 1, 2024

Table of Contents:

- Introduction

- 5 Compelling Reasons To Launch Your Exchange Admist Ethereum ETF Hype

- White Label Cryptocurrency Exchange: A Strategic Play for the Ethereum ETF Hype

- Top White Label Crypto Exchange Software Features For 2024

- Leveraging the ETF Buzz With White Label Exchange: Key Strategies To Consider

- Turning Challenges Into Potential Opportunities with Antier

Introduction

The impending launch of Ethereum Exchange Trading Funds, or ETFs, kept the community glued for a long time and finally, the SEC gave the go-ahead on July 23, 2024. The long-awaited phenomenon will now elicit many things, especially huge funds for the world’s second-largest cryptocurrency. The watershed moment is expected to usher in a new wave of institutional investors and retail traders into the crypto market. This presents a lucrative opportunity for exchange businesses or fintech that can capitalize on the surging interest in Ethereum by setting up a crypto trading platform.

Are you still thinking about why you need a white label cryptocurrency exchange?

No worries; we have got you covered.

5 Compelling Reasons To Launch Your Exchange Admist Ethereum ETF Hype

Yep, we have partially answered your question in the heading itself but there’s a lot more to it. The Ethereum ETF approval is poised to reshape the cryptocurrency era sooner or later. Let us study certain trends that could emerge and how they’ll snowball cryptocurrency adoption, making every dollar spent on white label crypto exchange software worth:

1. Regulatory Awakening:

From zero regulations around crypto to regulatory bodies reviewing ETFs and exchange businesses, cryptocurrency regulatory environments have come a long way. As regulatory bodies continue to develop laws around cryptocurrencies and crypto ETFs, a profound impact on the market’s credibility, legitimacy, and investors’ confidence is expected, which will broaden the customer base for your white label exchange platform project.

2. Rise In Institutional Investment:

Ethereum ETFs are a promising investment for institutional investors. As conventional finance and cryptocurrency converge, there is a chance of more institutional investments in Ethereum. Institutional investment means a rush of huge capital into cryptocurrencies, contributing to the overall growth of the ecosystem. This will increase the prospects of profitability for your exchange developed using white label cryptocurrency exchange.

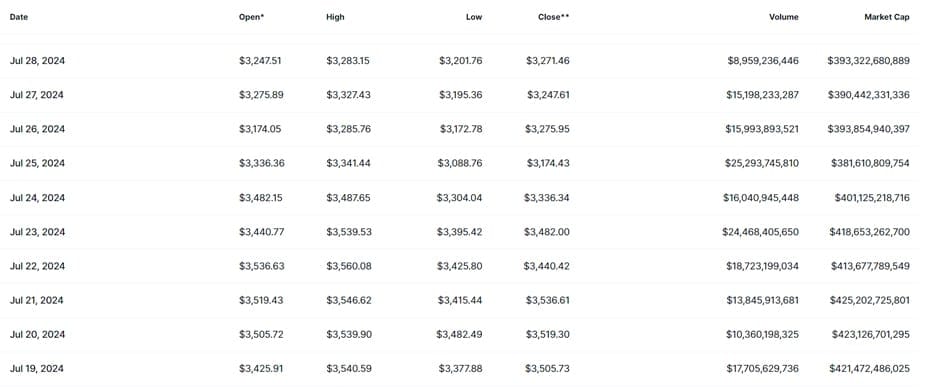

3. Impact on Market Sentiment: According to Bloomberg, US Spot ETH ETFs observed a strong debut with $107 million in inflows on the approval day. It will enhance the interest of institutional and retail investors in digital currency, possibly leading to higher trading volumes of Ethereum. However, it is too early to study the impact; one can still look at the volume trends of the past few days. These are some figures from a renowned market intelligence firm that can be considered by entrepreneurs planning to launch an exchange using a white label exchange.

Image Source: Coinmarketcap

4. Increased Inflows of More Crypto ETFs:

It was Bitcoin ETF approval at the beginning of this year and Ethereum ETF approval now. As regulatory bodies start validating the cryptocurrency sector (even after rigorous examinations), more digital assets will be invited into the conventional finance landscape, unlocking doors for wider adoption. This certainly means more customers for your white label cryptocurrency exchange project. Many renowned authorities discussed Solana ETFs after the approval of Bitcoin ETFs. To date, renowned financial institutions like BlackRock, Fidelity, Invesco, and VanEck have filed for approval of crypto ETFs.

5. Aggrandized Markets and Bolstered Market Liquidity:

History approves of the fact that ETFs boost the value of underlying assets. Just after the approval of the Ethereum ETF by the Securities and Exchange Commission (SEC), there was an immediate surge in the Ethereum price. This could mean that the second-largest cryptocurrency will follow the code. With more inflows into the Ethereum ETFs, market liquidity will also rise, leading to enhanced institutional interest, heightened crypto adoption rates, and ripened and stabilized cryptocurrency markets. All of this will ultimately benefit your white label exchange platform-derived project.

Also Read>>> White Label Exchange Software: What to Expect and How to Pick

White Label Cryptocurrency Exchange: A Strategic Play for the Ethereum ETF Hype

The clock’s ticking. If you aren’t the first to jump into the market with some unique plan, someone else will do it and take your share of profits and fame. White label cryptocurrency exchange solutions are ready-made, customizable trading platforms that allow businesses to launch their exchange quickly and efficiently. Pre-packed with all essential exchange features, these incredible turnkey solutions can be branded to suit an individual company’s requirements.

Here’s why these solutions can be your copilots, navigating your journey in the dynamic cryptoverse.

- Speed to Market:

White label exchange solutions enable quick and effortless deployment, allowing businesses to swiftly capitalize on short-lived market trends. Whether it is some ETF brewing in the crypto world or some surging digital currency, these turnkey solutions tighten the time-to-market.

- Cost Efficiency:

While building a cryptocurrency exchange from scratch can be overwhelming and resource-intensive, white label exchange platforms are a perfect alternative. They slash the costs and quicken up the launch as they require only minor UI/UX and feature adjustments.

- Customization:

Those choosing a ready-to-deploy solution can tailor it to meet specific needs, including branding, user experience, and unique trading features. However, they must consider the level of customization and cost modifications imposed by the white label exchange provider.

- Regulatory Compliance:

The ready-to-deploy trading platforms offered by reputable technology providers often have compliance features that help exchanges meet general regulatory requirements. Even so, the exchanges must collaborate with legal specialists to gain the necessary licenses and approvals.

- Market Penetration:

Since interest in Ethereum ETFs is growing, the crypto market is brimming with opportunities for exchanges. With white label crypto exchange software, entrepreneurs can leverage the opportunity to attract a broad range of investors, from retail to institutional.

Also Read>>> White Label Crypto Exchange Solutions: 2024’s Top 7 Picks

Top White Label Crypto Exchange Software Features For 2024

With the evolving industry, the users are also evolving. Following the evolution, some trading features have been removed from the premium category, making their place as a market standard. If you are planning to penetrate the crypto market with a powerful white label exchange, these are some of the features that you must not miss in 2024 and beyond:

- High TPS and Advanced Matching Engine

- Spot Trading- Market, Limit, and Stop Limit Orders

- Automated KYC and AML

- 500+ Cryptocurrencies & Fiat Support

- External Liquidity Module

- Referral and Reward Program

- Fiat On/Off Ramp

- Enterprise-Grade Multi-cryptocurrency Wallet

- Advanced Admin Back Office

- Advanced Chart Tools

- Crypto Swapping

- Multichain Support

- Margin Spot Trading

- Derivatives/ Perpetual Futures Trading

- Automated Market Making Bot

- Multi-Lingual Support

- Peer-to-Peer Trading

- Customer Support Chat

Also Read>>> Your 2024 Guide To Trend-Setter Exchange App Development

Leveraging the ETF Buzz With White Label Exchange: Key Strategies To Consider

The recent arrival of ETFs for Bitcoin and Ethereum marks a pivotal moment for the digital currency landscape. As per market experts, this industry trend is set to trigger a surge in trading volumes, proposing a profitable opportunity for crypto exchange businesses. In this context, white label exchange platforms can be strategically positioned for immediate market penetration and expansion, enabling businesses to reap the maximum benefits of the impending historic shift. Without further ado, let’s explore your potential game plan to succeed in an ETF-fueled economy.

- Be Ready For A Multi-Module Model

Spot trading is no longer a solo marketable module for exchanges. Ensure your platform is ready to offer a comprehensive suite of trading modules, including spot trading, derivatives, perpetual trading, the NFT marketplace and staking. Confirm with your white label exchange provider about these integrations, even if they aren’t in your current launch plan.

- Enhanced User Experience:

No matter what, user experience should be a foremost priority for those planning to break into the crypto exchange market. With a simple and intuitive interface, exchanges can penetrate the fast-growing exchange market effectively. Join forces with your white label cryptocurrency exchange provider to tailor the trading experience for both novice and experienced traders.

- Cast Educational Content Across Relevant Platforms

The cut-throat competition is brutally killing the obsolete, and undermarketed businesses in the industry. If your exchange business is not marketed appropriately, start engaging your audience by creating informative content about Ethereum, ETFs, and trading strategies to attract new users and educate existing ones.

- Strategic Partnerships:

Whether you are building from scratch or leveraging a ready-made white label exchange platform, strategic collaborations are key to success. Join forces with popular financial institutions and market makers to increase liquidity, enhance security, provide real-time price tracking, and build trust. Don’t forget to prioritize security to enhance users’ confidence in your platform.

- Become a Customer-Friendly Exchange:

Befriend your customers by offering competitive trading fees and incentives. This retains your existing customers and also enhances customer acquisition for your white label exchange project. Also, excellent customer support is an irreplaceable parameter to build trust and loyalty among platform users.

Also Read>>> Optimizing Fee Structure For Your Cryptocurrency Exchange Development

Thrive in the Ethereum ETF Era with A Powerful White Label Exchange

Schedule a demo now

Turning Challenges Into Potential Opportunities with Antier

With significant opportunities, hail challenges for exchange owners in this blooming trend. Businesses planning to enter the cryptocurrency market with a power-packed white label cryptocurrency exchange must be prepared to deal with the challenges in these opportune times.

- Increased Competition:

As crypto ETFs enter the conventional finance markets, expect heightened competition from more businesses entering the lucrative market, all vying for market share. But be mindful that there’s nothing an incredibly built cryptocurrency exchange cannot beat. So, shake hands with an experienced and reliable white label crypto exchange software provider and rest assured that everything from idea inception, and exchange development to marketing and beyond will be executed meticulously.

- Regulatory Compliance:

The launch of Bitcoin or Ethereum exchange-traded funds suggests a convergence of conventional and digital finance. The SEC and other regulatory authorities might pay more attention to the operations of various DeFi protocols and other cryptocurrency-based businesses operating in the domain. Those starting with a white label exchange can dodge regulatory scrutiny and the warnings are to stay abreast of evolving regulations surrounding cryptocurrencies and ETFs and adapt proactively to any evolving regulatory need.

- Market Volatility:

Exchange-traded funds approved by top authorities will potentially impact the industry’s outlook, which will directly influence people’s perceptions of cryptocurrency and blockchain ecosystems. A huge new batch of new users is soon expected to join the cryptocurrency industry. Tighten your seatbelts and embrace scalable white label exchange platforms with robust infrastructures that can frictionlessly manage market volatility and high trading volumes.

Antier is a pioneering Web3 consulting firm equipped with the best talents for building, marketing, and maintaining your trading empire. With more than 8 years of exclusive blockchain development experience and hundreds of successfully delivered projects, we effortlessly manage everything from idea refining to exchange maintenance and upgrades. Our comprehensive suite of ready-made exchange platforms and white label crypto exchange software solutions are packed with everything you need to thrive in the industry.

So, if you are looking for a technology partner on whom you can rely for the simplest and toughest endeavors related to your exchange launch, count on Antier today and you won’t ever regret it.

Share your project requirements today!