Once upon a time, decentralized exchanges were just an alternative—a way to trade without relying on centralized gatekeepers. But now? They’re becoming the backbone of a financial revolution. The game is no longer just swapping tokens; it’s about who controls liquidity, who earns from the ecosystem, and who gets left behind.

Pumpfun DEX didn’t rise by accident. It challenged outdated structures, erased unfair migration costs, and redefined how liquidity flows in decentralized markets. But here’s the real question—what does its success tell us about the future of DEX innovation? And more importantly, how do you build something even better? Let’s explore!

What Market Dynamics Fueled Pumpfun DEX’s Ascent?

Pumpfun DEX’s rapid rise is fueled by strategic innovations and market-driven features. Pumpfun made it easier for projects to transition seamlessly, boosting adoption by eliminating the 6 SOL token migration fee. The platform’s permissionless liquidity pools empower anyone to create and contribute liquidity without additional costs, fostering a truly decentralized ecosystem. Pumpfun maintains a balanced ecosystem with a 0.25% trading fee per transaction, ensuring 0.20% rewards for liquidity providers while 0.05% supports platform sustainability.

These market-driven innovations have positioned Pumpfun DEX as a game-changer in Solana’s DeFi landscape, redefining decentralized trading with a seamless, inclusive, and efficient user experience.

What Core Features Make Pumpfun DEX Unique?

Pumpfun DEX empowers traders and token creators, setting a new standard in decentralized exchange development by enhancing liquidity management and eliminating barriers.

Standout Features of PumpSwap-

- Effortless Token Migration: Tokens smoothly transition from their bonding curve to PumpSwap, ensuring uninterrupted trading without manual intervention.

- Zero Migration Fees: The removal of the previous 6 SOL fee makes token migration more accessible, encouraging broader participation.

- Automated Market Maker (AMM) Protocol: Inspired by Uniswap V2 and Raydium V4, PumpSwap employs a constant product formula to facilitate efficient, decentralized trading.

- Permissionless Liquidity Pools: Anyone can create and contribute to liquidity pools without additional fees, promoting a decentralized and inclusive trading environment.

- Optimized Trading Fees: With a 0.25% transaction fee—0.20% rewarding liquidity providers and 0.05% supporting platform sustainability—PumpSwap balances incentives effectively.

- Creator Revenue Sharing (Upcoming): A future update will introduce earnings for token creators, fostering high-quality projects and stronger community engagement.

- Enhanced Security & Transparency: PumpSwap undergoes multiple independent audits and plans an open-source release to ensure trust and reliability for its users.

With these robust features, Pumpfun DEX redefines decentralized trading by fostering seamless liquidity management, reducing entry barriers, and prioritizing user incentives. As the platform continues to evolve with upcoming innovations like creator revenue sharing and enhanced security measures, it remains a key player in Solana’s DeFi ecosystem. Whether you’re an entrepreneur aiming to launch a token, optimize liquidity strategies, or create a thriving trading ecosystem, decentralized exchange development provides a robust and inclusive foundation, setting new benchmarks in innovation.

Why Entrepreneurs Should Consider Building a DEX Like Pumpfun?

The surge in DeFi has created an unprecedented demand for decentralized crypto exchange software, making now the perfect time for entrepreneurs to build a next-generation DEX like Pumpfun. Traditional exchanges are riddled with inefficiencies—high fees, custodial risks, and centralization—while a well-designed DEX offers autonomy, transparency, and seamless liquidity management, positioning your business for long-term success.

Entrepreneurs can create a permissionless trading ecosystem where users enjoy effortless token migration, zero migration fees, and an optimized AMM protocol. These features attract traders and empower token creators, fostering a thriving, self-sustaining ecosystem. Additionally, integrating revenue-sharing mechanisms for liquidity providers and token creators enhances engagement, ensuring user retention and platform growth. Security and trust are at the core of any successful DEX. A decentralized crypto exchange platform built with independent audits, open-source architecture, and transparent fee structures strengthens credibility and fosters rapid adoption. As institutional interest in DeFi grows, launching a decentralized crypto exchange software today presents a lucrative opportunity to lead in this evolving market. But how can you go beyond just replicating Pumpfun? To dominate the market, you need to build a DEX that doesn’t just match its features but surpasses them with cutting-edge innovation and strategic enhancements.

Strategic Approaches to Surpassing Pumpfun DEX’s Success

Surpassing the success of Pumpfun DEX requires innovation and a clear, strategic vision. Here are five detailed pointers to help entrepreneurs build a next-gen decentralized exchange development platform that leads the market:

- Leverage Multi-Chain Integration: Pumpfun DEX has proven the power of Solana, but a successful DEX in 2025 will need to embrace multi-chain compatibility. You can ensure higher liquidity and reduce bottlenecks, allowing for cross-chain trades and better scalability by integrating networks like Ethereum, Avalanche, and Cosmos.

- Customizable Fee Structures: The traditional flat fee model doesn’t work for all users. Implementing dynamic fee structures, where fees can be adjusted based on liquidity, trading volume, or user activity, provides better flexibility and incentivizes traders. This can boost volume and foster deeper market engagement.

- Advanced AMM Mechanisms: Introducing concentrated liquidity pools or MEV-resistant protocols can offer better pricing, efficiency, and a competitive edge, attracting high-frequency traders and liquidity providers.

- Enhanced User Experience with AI: To keep users engaged, offer a personalized trading experience using AI-powered features such as price alerts, tailored analytics, and automated trading strategies. This simplifies trading and adds value to your platform’s ecosystem.

- Innovative Governance & Revenue Sharing Models: Introducing community-driven governance and revenue-sharing models that benefit token creators and liquidity providers establishes long-term sustainability and encourages active participation. This fosters loyalty and builds a self-sustaining ecosystem.

By incorporating these strategies, your DEX can not only rival but also surpass Pumpfun DEX, creating a platform that’s both scalable and user-centric. But a successful decentralized crypto exchange software doesn’t simply evolve on its own—it takes meticulous planning, innovation, and execution. So, how do you turn these strategies into reality? How can you implement them effectively to ensure your platform doesn’t just compete with Pumpfun, but truly surpasses it? Let’s explore!

How to Build a Decentralized Exchange That Surpasses Pumpfun?

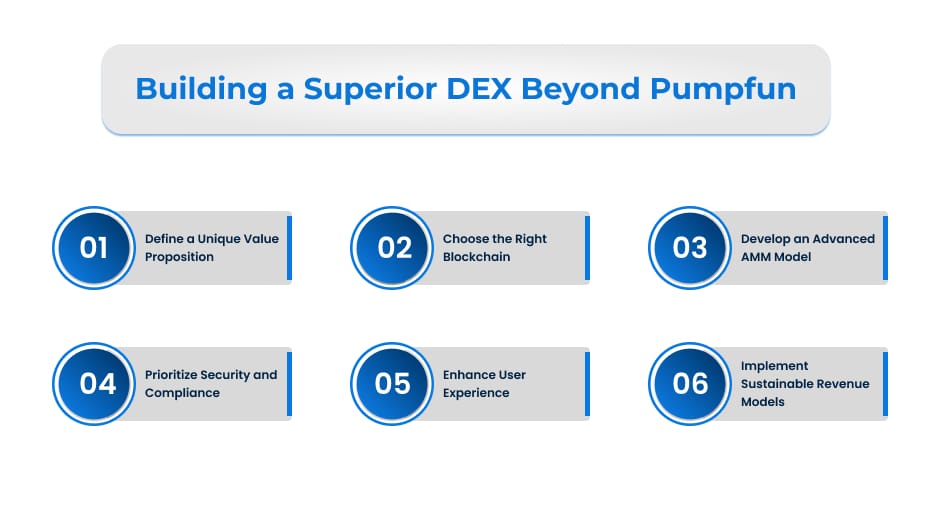

Building a DEX beyond Pumpfun requires a strategic approach, innovation, and a deep understanding of decentralized trading. Here’s how you can create a superior DEX in six key steps:

- Define a Unique Value Proposition – Analyze Pumpfun’s strengths and limitations to identify gaps. Introduce features such as lower trading fees, multi-chain compatibility, or AI-driven market analytics to attract more users.

- Choose the Right Blockchain – While Solana is known for speed and low costs, consider integrating Ethereum L2s, Avalanche, or Cosmos to offer a multi-chain trading experience, reducing congestion risks.

- Develop an Advanced AMM Model – Enhance automated market-making by integrating concentrated liquidity pools, customizable fee tiers, and MEV-resistant mechanisms for better pricing and efficiency.

- Prioritize Security and Compliance – Conduct independent audits, implement robust smart contract security measures, and ensure compliance with evolving regulations to build trust among traders and liquidity providers.

- Enhance User Experience – Introduce a seamless UI/UX with advanced trading tools, gasless transactions, and cross-platform accessibility to improve user engagement and retention.

- Implement Sustainable Revenue Models – Go beyond traditional fee structures by incorporating token staking, revenue-sharing for liquidity providers, and governance models that reward active users.

Your decentralized crypto exchange software can rival Pumpfun and redefine the standards for decentralized trading by strategically enhancing these aspects. However, before diving into development, it’s crucial to understand the investment required to build a high-performance DEX. So, how much does it take to create a robust and scalable decentralized exchange? Let’s break it down:

How Much Does Decentralized Exchange Development Cost?

The cost of developing a decentralized crypto exchange software depends on multiple factors, including the chosen blockchain, technical complexity, security protocols, and feature set. A basic DEX with fundamental trading capabilities differs significantly from an advanced platform with multi-chain integration, automated liquidity management, and governance mechanisms. Additionally, expenses vary based on development approach—whether building from scratch, using white label decentralized exchange solutions, or leveraging open-source frameworks. Smart contract audits, regulatory compliance, and ongoing maintenance further influence the investment required. Strategic planning and expert development are essential to create a high-performance DEX.

Should You Build from Scratch or Choose White Label Decentralized Exchange Solutions?

Depending on your business goals, budget, and timeline, you can choose between building a decentralized crypto exchange software from scratch or using a white-label solution. Both approaches offer unique advantages, making them suitable for different needs.

Building from Scratch: Full Control & Innovation

- Custom Features – Tailor functionalities, liquidity mechanisms, and trading tools to match your vision.

- Scalability – Easily integrate multi-chain support, advanced security, and governance models.

- Brand Authority – Develop a distinct identity with proprietary technology and unique offerings.

White Label Decentralized Exchange Solutions: Speed & Efficiency

- Faster Deployment – Launch within weeks with a ready-made, fully functional exchange framework.

- Cost-Effective – Optimize resources while still ensuring high performance and security.

- Proven Reliability – Benefit from pre-tested smart contracts and compliance-ready infrastructure.

Both options present strong opportunities. If speed and cost-efficiency are key, a white-label DEX is a great choice. If innovation and full customization are priorities, building from scratch offers long-term advantages. The right approach depends on your strategic vision. Partnering with an experienced decentralized crypto exchange development company can help you navigate this decision, ensuring you choose the best solution tailored to your business goals.

Your DEX, Your Rules—Antier Makes It Happen

Why settle for a standard exchange when you can create a DEX tailored to your vision? At Antier, a leading decentralized exchange development company, we empower you to build a high-performance, secure, scalable trading platform that stands out in the market. Whether you need a custom-built solution or a white label decentralized exchange, we deliver cutting-edge technology, seamless UI/UX, and advanced liquidity models to give your users an unmatched experience.

Ready to take control? Let’s build a DEX that truly reflects your goals. Partner with Antier today!