Top 10 P2P Crypto Exchanges That Inspire Your Platform Development in 2025

January 16, 2025

How Do Aesthetics and Functionality Shape AAA Game Character Design?

January 17, 2025Blockchain has paved the way for a new kind of bond issuance- tokenized bonds. While a bond is a fixed-interest financial instrument representing a loan agreement between issuer and borrower, tokenized bonds are a digital representation of them. Governed by smart contracts, tokenized bonds eliminate the intermediaries, enhance liquidity, and boost the sales of securities, contributing to a more cost-effective and accessible market for investors. Read on to find out how Bond Tokenization opens up a new stream for investors to raise capital and invest in fixed-income securities.

“Singapore’s Second Largest Bank OCBC launches blockchain-based bond tokenization, enabling corporate clients to invest from S$1,000, with customizable durations, coupons, and access to investment-grade bonds.

– This move by OCBC is setting the stage for more accessible, efficient, and liquid financial markets. It’s a perfect opportunity for businesses and investors looking to enter the Tokenized Bond Market”

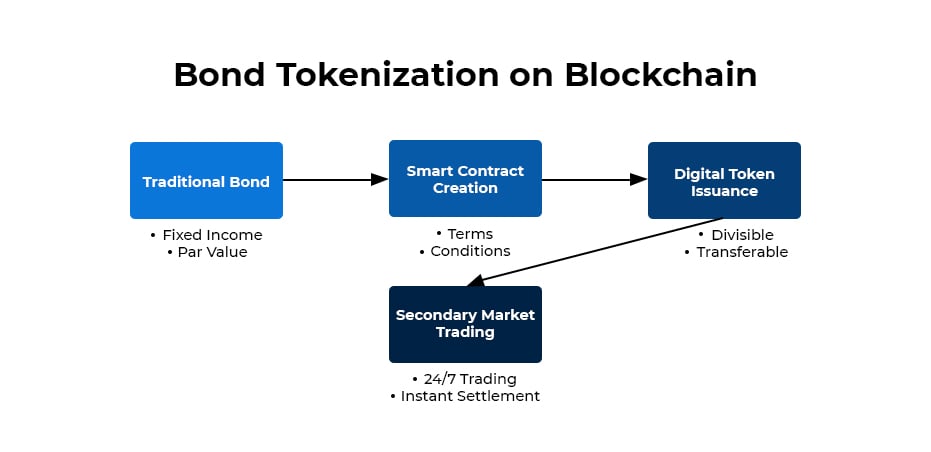

Understanding Bond Tokenization on Blockchain

Bond Tokenization on Blockchain is the process of creating a digital representation of a specific bond, where every aspect of it – including the ownership and trading history, interest payments, and covenant compliance – is automated and transparent. The process is an amalgamation of the traditional approach of bond issuance with the benefits of blockchain.

Tokenized bonds can be held, exchanged, and recorded on the Blockchain. They can be denominated in Crypto or Fiat currency and can be purchased or sold easily on Digital Asset agencies. These bonds can be programmed with a plethora of features like Maturity Dates, Principal, repayment, and Interest Payments through smart contracts. And, as these bonds are recorded on smart contracts, it eliminates the risk of fraud while ensuring compliance with security laws.

Step 1: Bond Structuring

The first step involves Bond Structuring in which:

- Traditional bond parameters are defined (principal amount, interest rate, maturity date).

- Legal documentation is prepared.

- Regulatory compliance requirements are identified.

Step 2: Smart Contract Development

A smart contract is coded to issue digital tokens representing fractional ownership of the bond. This includes:

- Functions for token transfers, interest payments, and redemption.

- Implement regulatory compliance rules (KYC/AML).

- Add automated interest payment calculations.

Step 3: Token Creation

Tokens are minted for easy trading on the secondary market which involves:

- Deploying smart contracts to the chosen blockchain

- Generating digital tokens representing bond fractions and portion value

- Inheriting all rights and obligations of the traditional bond

Step 4: Token Distribution

This step proceeds with the Initial token distribution to primary investors. It includes:

- KYC/AML verification of investors

- Recording of ownership on the blockchain

- Integration with custody solutions

Step 4: Token Trading

Here the Tokens become available on secondary markets with features like:

- 24/7 trading capability

- Real-time price discovery

- Fractional ownership enabled

- Automated compliance checks

Step 5: Token Life cycle management

The last step is to use a blockchain platform to manage the bond’s life cycle from issuance to redemption.

- Automated coupon payments to token holders

- Real-time tracking of ownership

- Automated corporate actions

- Smart contract handles final redemption

- Maintaining compliance throughout the bond’s lifecycle

Bond Tokenization: What Are the Benefits?

1. Increased Liquidity through Fractional Ownership

Tokenized bonds enhance liquidity by allowing fractional ownership, enabling investors to purchase smaller portions of a bond. This democratization lowers entry barriers, facilitating participation from retail investors who may not have the capital to buy full bonds. Consequently, the market becomes more active, as tokenized bonds can be traded more frequently and easily, increasing overall liquidity and creating a more dynamic trading environment.

2. Reduced Settlement Time (T+0)

The adoption of blockchain technology in tokenized bonds allows for near-instantaneous settlement of transactions, referred to as T+0. Unlike traditional markets where settlement can take days, tokenized bonds enable immediate ownership transfer upon transaction execution. This rapid settlement reduces counterparty risk and enhances market efficiency, making it easier for investors to manage their portfolios and react swiftly to market changes.

3. Lower Administrative Costs

Tokenization significantly reduces administrative costs associated with bond management. By automating processes through smart contracts on the blockchain, the need for intermediaries is minimized. This streamlining of operations lowers transaction fees and reduces human error, allowing issuers and investors to save on costs typically incurred in traditional bond transactions.

4. Automated Compliance

Smart contracts embedded in tokenized bonds automate compliance with regulatory requirements. These contracts can include built-in checks for KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, ensuring that only eligible investors can participate. This automation not only enhances efficiency but also reduces the risk of non-compliance, making the entire process smoother for issuers and investors alike.

5. Transparent Ownership Records

Tokenized bonds leverage blockchain technology to provide transparent and immutable ownership records. Each transaction is recorded on a public ledger, allowing all stakeholders to access real-time information regarding ownership and transaction history. This transparency fosters trust among participants and simplifies auditing processes, enhancing compliance with regulatory standards.

6. Programmable Interest Payments

With tokenized bonds, interest payments can be programmed into smart contracts, allowing for automatic distribution on specified dates. This feature eliminates the need for manual processing of coupon payments, reducing operational overhead and ensuring timely payments to bondholders. As a result, investors benefit from a more reliable income stream without the complexities associated with traditional bond management.

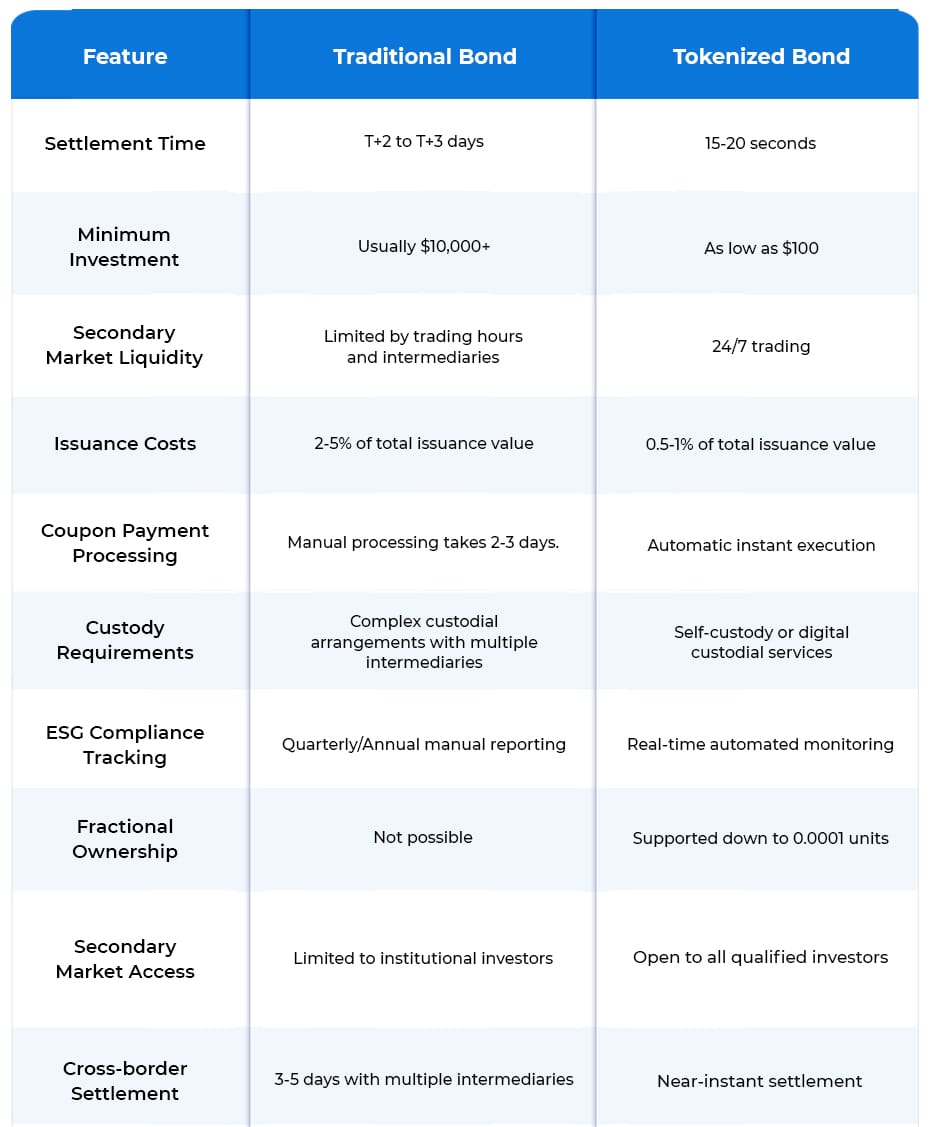

Why Tokenized Bonds Over Traditional Bonds?

The transition from traditional to tokenized bonds represents more than a technological upgrade—fundamentally reimagines how debt markets can function. While traditional bonds have served markets well for centuries, tokenized bonds leverage blockchain technology to address long-standing inefficiencies and create new opportunities for issuers and investors.

Tokenized Bonds: Real-World Success Stories and Market Impact

The adoption of tokenized bonds isn’t just theoretical—major financial institution’s Tokenized Bonds Use Cases have demonstrated significant benefits:

HSBC’s Digital Bond Program (2023)

HSBC’s tokenized bond platform demonstrated a 90% reduction in settlement times and a 65% decrease in operational costs. The program processed over $2.5 billion in tokenized bonds within its first six months, achieving a 99.99% settlement success rate.

Singapore’s SGX Digital Asset Platform

SGX’s digital bond platform increased market participation by 300% through reduced minimum investments and fractional ownership. The platform processed over $850 million in tokenized bonds in 2023, with retail investors accounting for 35% of trading volume—a dramatic increase from 2% in traditional bond trading.

European Investment Bank’s Digital Bond Initiative

EIB’s €100M digital bond issuance achieved:

- 82% reduction in documentation processing time

- 76% decrease in KYC/AML verification costs

- 94% faster settlement compared to traditional bonds

- 65% lower overall issuance costs

Standard Chartered’s Tokenization Platform

Standard Chartered’s bond tokenization program demonstrated:

- 78% reduction in cross-border settlement costs

- 92% faster coupon payment processing

- 85% decrease in reconciliation efforts

- 300% increase in secondary market liquidity

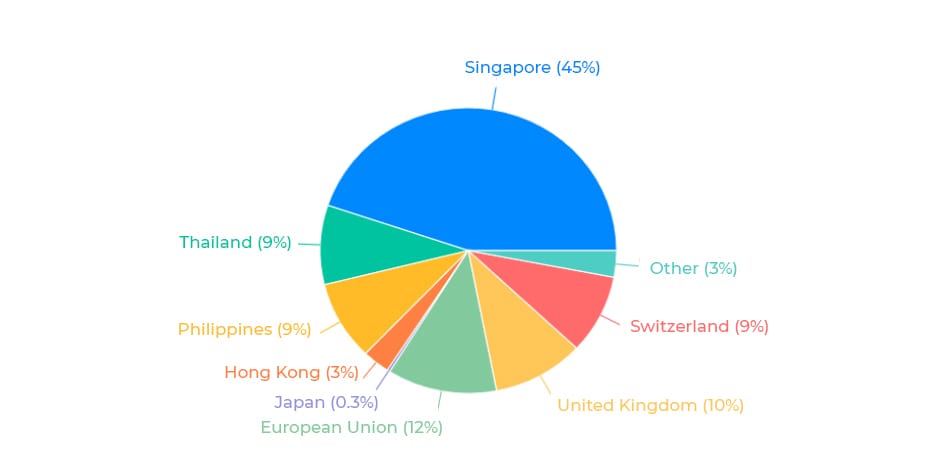

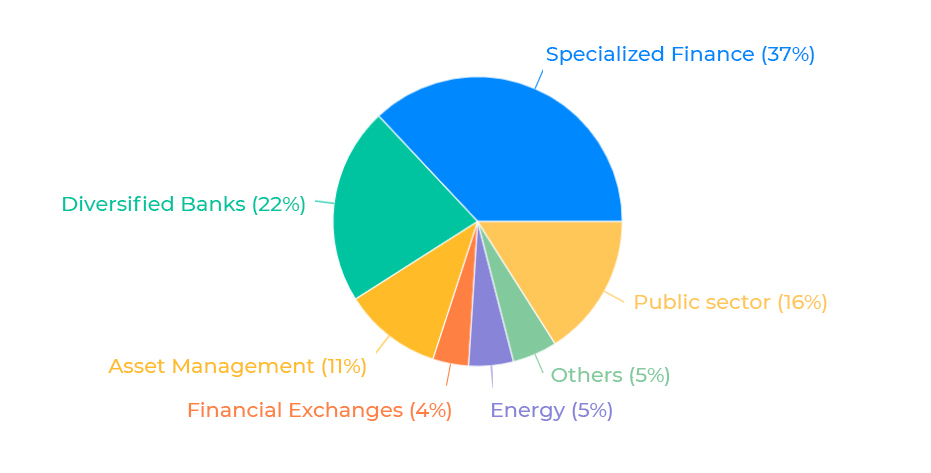

Tokenized Bonds Distribution Analysis

Industrial Distribution

Geographic Distribution

Regulatory Requirements for Bond Tokenization on Blockchain

Successful bond tokenization requires a comprehensive regulatory strategy across different jurisdictions:

Global Regulatory Framework

1. United States: The SEC regulates digital asset securities. Issuers must use the Howey Test to determine if tokenized bonds are securities and comply with registration and disclosure requirements.

2. European Union: The MiCA framework is being developed to regulate crypto assets, including tokenized bonds, ensuring investor protection and market integrity.

3. Singapore: The Payment Services Act and Securities and Futures Act governs tokenized assets, requiring compliance with licensing and securities regulations.

4. Switzerland: The DLT Act provides a framework for blockchain-based securities, allowing tokenized bonds while adhering to existing laws.

Compliance Requirements

Issuers must meet several key compliance requirements:

- KYC/AML: Implement KYC and AML measures to verify investor identities and prevent fraud.

- Securities Laws: Compliance with local securities laws, including registration, disclosure, and investor protection.

- Trading Rules: Prevent market manipulation and insider trading with monitoring systems.

- Data Protection: Adhere to data protection laws like GDPR to secure investor data.

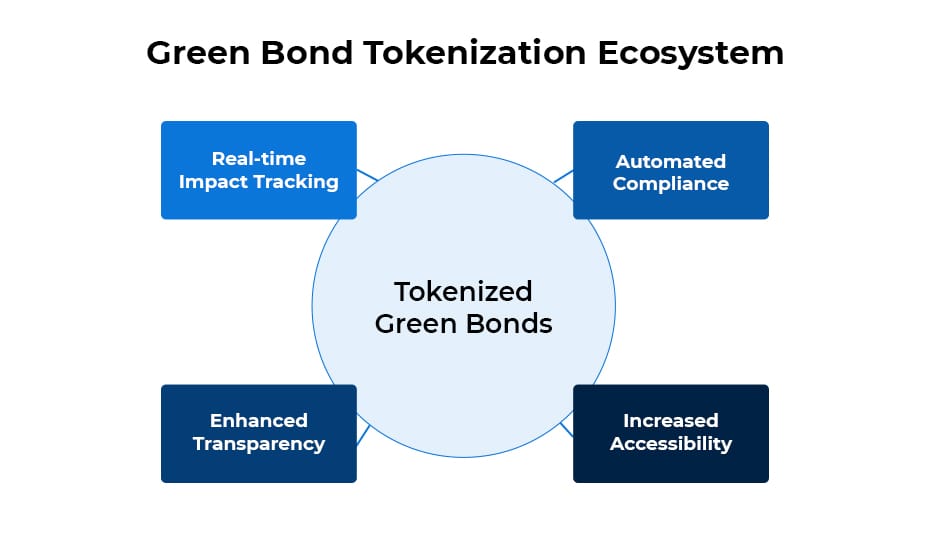

Blockchain Meets Bonds: The Rise of Tokenized Green Finance

What is your take on the investment that not only grows but also nurtures the planet. Green bond tokenization—make it possible with sustainable finance.

Recently, The NUS, Northern Trust, and UOB collaboration tokenized green bond data to improve transparency, investor confidence, and ESG reporting.

By converting green bonds into digital tokens on a blockchain, this approach enhances transparency and traceability. Each token symbolizes a stake in specific projects, allowing investors to track how funds are allocated—whether for renewable energy initiatives or conservation efforts.

This innovation democratizes access to sustainable investments, enabling fractional ownership that opens doors for smaller investors. The result is a more inclusive investment with:

- Real-time Impact Tracking: Tokenization allows for continuous monitoring of how funds are utilized, ensuring accountability and fostering investor confidence in environmental outcomes.

- Automated ESG Reporting: Blockchain technology streamlines the reporting process, providing timely updates on environmental, social, and governance metrics without manual intervention.

- Performance-linked Interest Rates: Financial returns can be aligned with sustainability goals by linking interest rates to the performance of funded projects, incentivizing positive environmental impacts.

- Transparent Use of Proceeds: Clear visibility into fund allocation helps prevent greenwashing, as stakeholders can verify that investments are directed towards genuine environmental initiatives.

- Enhanced Accessibility and Liquidity: Tokenization lowers entry barriers for investors, enabling fractional ownership and facilitating easier trading, which increases market participation and liquidity.

Bond Tokenization: Emerging Market Opportunities

- Breaking Free from Traditional Clearing Systems

Emerging markets can now bypass costly international clearing systems through blockchain-based bond tokenization. Countries like Brazil and Indonesia are setting great Bond Tokenization examples by issuing sovereign bonds directly on blockchain platforms, significantly reducing settlement times from T+3 to near instantaneous, enhancing operational independence and efficiency in the bond issuance process.

- Cost Efficiency for Local Issuers

Tokenization dramatically lowers the financial barriers for local companies seeking to access debt markets. By automating compliance with smart contracts, eliminating manual paperwork, and reducing intermediary fees, issuers can achieve cost reductions of 35-50% compared to traditional bond issuance methods, making financing more accessible.

- Global Investor Access

Bond tokenization creates a truly global market by breaking geographical barriers. With 24/7 trading capabilities, fractional ownership allowing smaller investment tickets, and simplified cross-border settlements, investors can easily participate in diverse opportunities. Multi-currency support through stablecoins further enhances accessibility for a wider range of investors.

- Enhanced ESG Reporting and Compliance

Tokenized bonds revolutionize ESG considerations by enabling real-time tracking of proceeds and automated impact measurement. Smart contracts enforce ESG covenants while transparent verification of sustainability metrics ensures accountability. Integration with IoT devices allows for direct environmental monitoring, aligning investments with responsible practices.

- Transparency and Trust Framework

Blockchain technology establishes an unprecedented level of transparency in bond markets. An immutable record of transactions, real-time pricing data, and automated coupon payments foster trust among investors. Clear audit trails ensure regulatory compliance, while enhanced security through cryptographic protocols protects against fraud and enhances market integrity.

DeFi Integration: Expanding the Possibilities

The integration of tokenized bonds with Decentralized Finance (DeFi) protocols opens new avenues for market participants. Bonds can serve as collateral for instant loans, enabling dynamic loan-to-value ratios and automated margin calls. This reduces counterparty risk and enhances liquidity management within the financial ecosystem.

The Future of Bond Markets

By 2030, we expect:

- 25% of global bond issuance to be tokenized

- $7 trillion in tokenized bond trading volume

- 80% reduction in settlement costs

- Universal adoption of smart contract automation

Partner with Antier to Take the First Step

Ready to explore bond tokenization Solutions for your organization? Antier can help you:

- Assess tokenization opportunities

- Design your technical architecture

- Navigate regulatory requirements

- Implement secure solutions

Contact us today to schedule a consultation and learn how we can help you leverage bond tokenization to achieve your financial goals.