RWA Tokenization Lending Platforms: Overcoming Traditional Financing Limitations

April 7, 2025

On-Chain Asset Security Exchange: Why the Market is Moving Toward Decentralized Trading?

April 7, 2025An individual responsibly pays their health insurance premium, believing that they will be financially covered for life’s unpredictable health emergencies. When they get hospitalized for an unforeseen condition, they gather their bills, submit a claim, and wait for the claim approval and disbursement, and the waiting period continues to grow with each passing day. Instead of financial relief, they’re met with delayed approvals, endless paperwork, unclear communication, and sometimes outright claim denials. No doubt, the insurance industry is plagued with numerous inefficiencies, fraudulent activities, opaque processes, and administrative overheads.

A survey conducted by the Global Healthcare Anti-Fraud Network reveals that health insurance fraud results in a global loss of around $260 billion annually, which is equivalent to nearly 6% of total healthcare spending worldwide. So, the question is- “can this broken process be fixed?” The answer lies in a technology that has already transformed banking, supply chains, and digital identity systems- Blockchain.

This blog explores how blockchain healthcare solutions can effectively address the key challenges faced by the insurance industry. We’ve also included a comparison between traditional healthcare systems and blockchain-enabled ecosystems to provide better clarity and insight.

How the Current Health Insurance Ecosystem Works

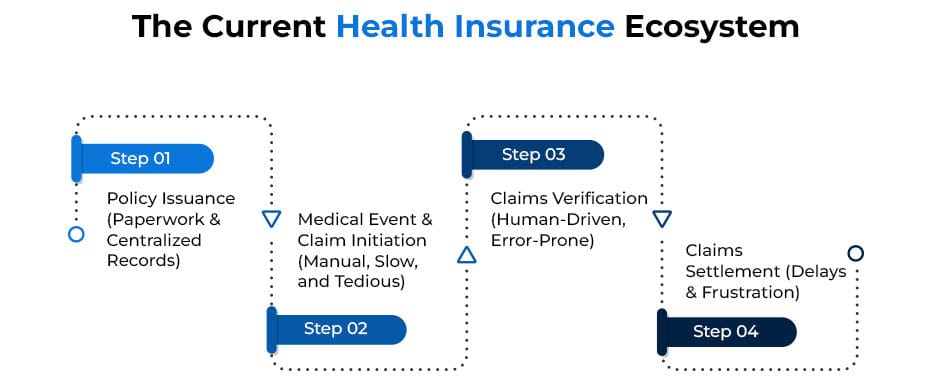

Before we dive into how blockchain transforms health insurance, let’s first understand how the current health insurance ecosystem operates—and why it’s full of bottlenecks.

Step 1: Policy Issuance — Paperwork & Centralized Records

When a customer buys a health insurance policy today, all their policy details, including coverage limits, exclusions, and terms, are stored in the insurance company’s centralize

d database. This information is also printed and sent to the customer via physical documents or PDFs. If any changes are made to the policy later, customers are usually notified manually.

The Key Issue:

The insurer fully controls this data. There’s no neutral or transparent system to ensure that policy terms remain unchanged or accessible to the customer without dependency on the insurer.

Step 2: Medical Event & Claim Initiation — Manual, Slow, and Tedious

If the insured person undergoes treatment, they must collect a mountain of documents: hospital bills, diagnostic reports, discharge summary, doctor’s prescriptions, identification proof, and more. The patient or hospital then submits these documents to the insurance company, either physically or via email.

The Key Issue:

The entire claim initiation process is manual and paper-based. Any missing or incorrect documents can lead to delays, repeated follow-ups, or claim rejection.

Step 3: Claims Verification — Human-Driven, Error-Prone

Insurance companies rely heavily on human agents and Third-Party Administrators (TPAs) to verify:

- Whether the claim is genuine

- If the treatment is covered

- Whether policy conditions are met

- If any fraudulent activity is suspected

This process involves back-and-forth communication between hospitals, patients, and insurers.

The Key Issue:

Verification is human-dependent, prone to errors, biased decision-making, and susceptible to manipulation or fraud.

Step 4: Claims Settlement — Delays & Frustration

Once verification is complete, the insurer initiates the payment process. This could take weeks or months, depending on document accuracy, claim complexity, and internal approval delays. Many customers complain about opaque communication, unexplained delays, and unfair claim denials.

The Key Issue:

Claim settlement lacks transparency and speed, often leaving patients in financial distress when they need help the most.

How the Blockchain-Enabled Health Insurance Ecosystem Works

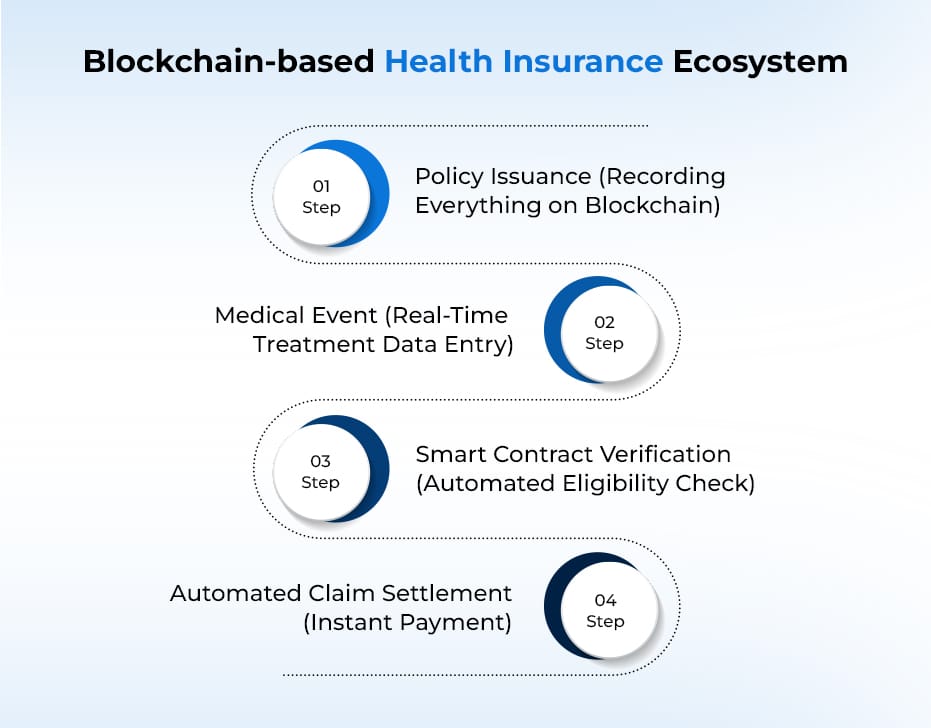

Let’s visualize how blockchain can redefine the entire insurance process:

Step 1: Policy Issuance – Recording Everything on Blockchain

Once the policy is purchased, the entire policy information is digitally recorded on a blockchain ledger. This ledger is:

- Immutable (cannot be changed or tampered with later).

- Transparent (accessible to all authorized parties: insurer, policyholder, healthcare providers).

- Time-stamped (ensuring proof of when the policy was created and under what terms).

Why it matters:

Blockchain for health insurance removes disputes or confusion around what the policy covers. Neither the insurer nor the policyholder can later argue that terms were unclear or modified.

Step 2: Medical Event – Real-Time Treatment Data Entry

The moment the policyholder is hospitalized, the hospital updates the patient’s treatment data on the blockchain healthcare solutions. This could include:

- Diagnosis

- Admission date

- Treatment plan

- Estimated costs

- Discharge summary

However, this only happens with the patient’s consent. Blockchain platforms can be designed so that no hospital can upload or access patient data without approval.

Why it matters:

This ensures that the insurer, hospital, and patient are all looking at the same, real-time, verified data. It eliminates the back-and-forth exchange of documents.

Step 3: Smart Contract Verification – Automated Eligibility Check

A smart contract is embedded into the blockchain. A smart contract is a self-executing digital agreement that automatically checks if a claim meets the policy conditions.

The smart contract will instantly:

- Verify if the treatment is covered under the policy.

- Check the sum insured and remaining balance.

- Apply deductibles, co-payments, or waiting period rules.

- Approve or reject the claim accordingly.

Why it matters:

There’s no need for human intervention or manual review in blockchain health insurance claims. The verification happens in seconds, reducing claim settlement time drastically.

Step 4: Automated Claim Settlement – Instant Payment

Once the smart contract verifies that the treatment is eligible, it automatically triggers the claim payout.

The payment can be:

- Directly transferred to the hospital to settle the bill.

- Credited to the policyholder’s account (in case of reimbursement).

This eliminates delays, human errors, and unnecessary paperwork.

Why it matters:

Policyholders get their claims approved and settled in real-time without the frustration of following up, resubmitting documents, or fighting disputes.

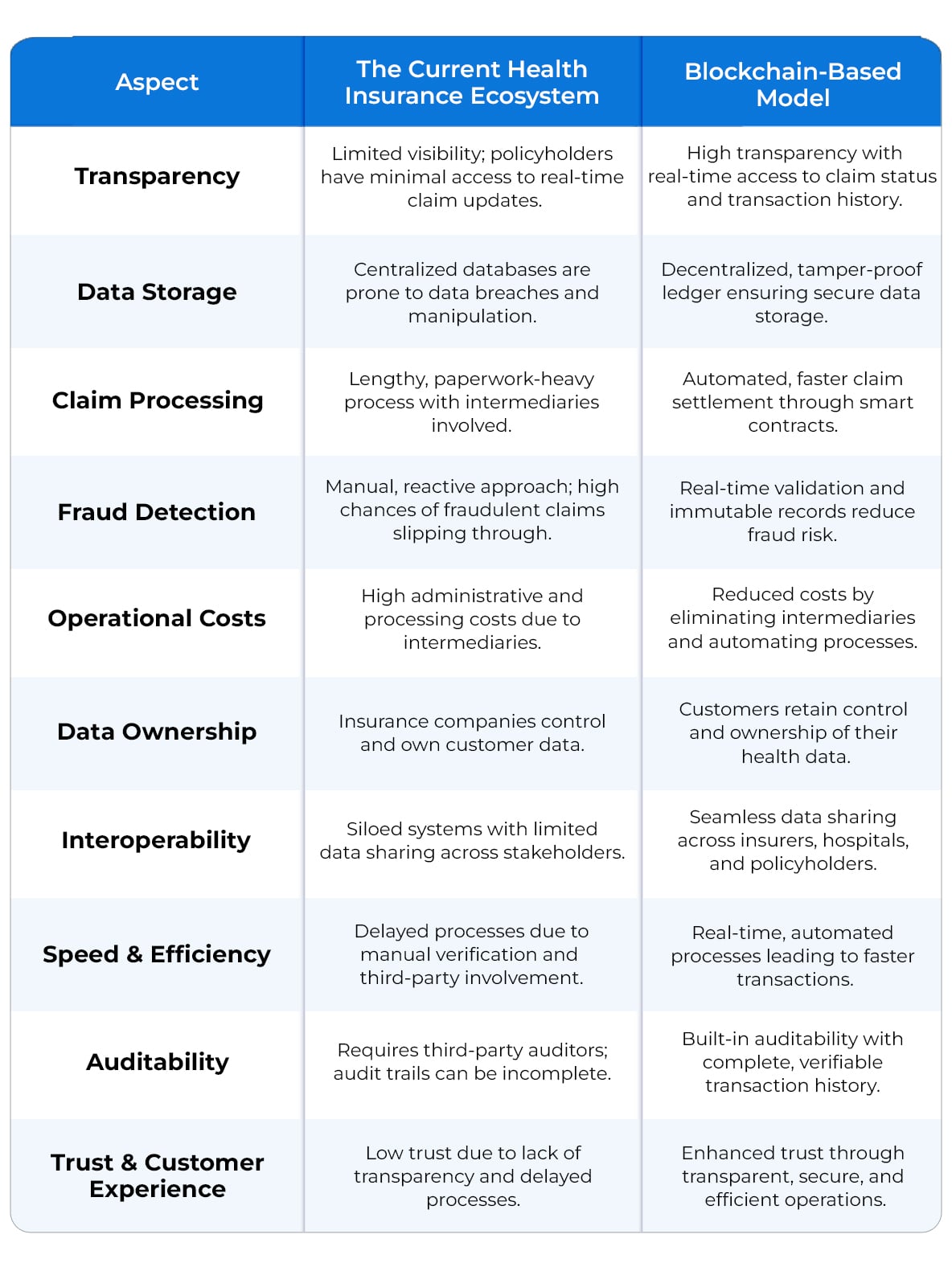

The Current Health Insurance Ecosystem vs. Blockchain-Based Model

Real-World Examples of Blockchain in the Health Insurance Sector

Embracing blockchain for health insurance is a smart approach to improve transparency, reduce fraud, and streamline processes. Several real-world examples demonstrate how blockchain health insurance claims are transforming the sector.

-

Anthem Inc

One notable example is Anthem Inc., which launched a blockchain-based pilot program to give patients secure access to their medical data. The initiative allows members to control access to their information. This improves data privacy and interoperability between healthcare providers and insurers.

-

MetLife’s LumenLab

MetLife’s LumenLab in Singapore introduced an innovative blockchain-based solution called Vitana. It is the world’s first blockchain-powered insurance product offering real-time claims for gestational diabetes. Vitana uses blockchain to issue policies and automate payouts when medical records meet predefined conditions, eliminating the need for paperwork or prolonged claims processes.

Conclusion

The health insurance sector is at a turning point. Customers demand speed, transparency, and trust, and blockchain is uniquely positioned to deliver all three. Beyond technological innovation, blockchain for health insurance brings a cultural shift toward fairness, efficiency, and patient empowerment. Blockchain for health insurance is emerging as a game-changer, which streamlines claims, reduces fraud, and builds trust between insurers, healthcare providers, and policyholders like never before. If you’re an insurer, healthcare provider, or health-tech leader, utilizing the power of blockchain in medical insurance has become a competitive necessity.

At Antier, we specialize in developing advanced blockchain healthcare solutions tailored for insurers, hospitals, and health tech startups. Whether you’re looking to integrate blockchain in claims processing, securing patient data, or lowering operational costs, our blockchain healthcare development services are designed to help you lead the change.

Get in touch today and let’s build a transparent, efficient, and trusted health insurance ecosystem—powered by blockchain.