How Can Blockchain Strengthen the Integrity of University Research?

March 24, 2025

How Can Dubai Banks Win the Crypto Race With White Label Crypto Exchange?

March 25, 2025Is the global financial landscape on the brink of a seismic transformation? As enterprises rethink their strategies, is the shift from legacy neo-banking frameworks to permissionless, decentralized banking infrastructures becoming inevitable? This isn’t just an incremental upgrade—it’s a tectonic shift towards trustless finance, smart contract-driven automation, and immutable on-chain liquidity protocols. As centralized banking models buckle under the weight of regulatory bottlenecks and custodial vulnerabilities, enterprises are actively embracing DeFi-native banking ecosystems that enable self-sovereign asset control, algorithmic credit underwriting, and seamless cross-chain interoperability. This transition eradicates inefficiencies, fortifies financial sovereignty, and unlocks hyper-efficient capital flows in a globally decentralized economy.

In the Web3 paradigm, DeFi banks are not an alternative—they are the inevitable evolution. The question is no longer if businesses should transition, but how fast they can pivot to harness borderless, programmable, and censorship-resistant financial ecosystems. Are you ready to future-proof your banking model?

Understanding The Concept Of On-Chain Neo Banking Solutions

On-chain neo-banking solutions epitomize the convergence of decentralized finance and digital banking, offering a paradigm shift in financial services. These platforms operate without traditional intermediaries by leveraging blockchain technology, ensuring transparency, security, and efficiency. A decentralized crypto neo-banking platform enables users to manage digital assets, execute transactions, and access financial services directly on the blockchain. The architecture of on-chain neo-banking apps is meticulously designed to harness the full potential of blockchain. At its core, smart contracts automate processes such as payments, lending, and compliance, reducing manual intervention and operational costs. Decentralized identity management systems empower users with control over their data, enhancing privacy and security. Moreover, integration with DeFi protocols expands the suite of services, offering features like yield farming and staking.

The development of a decentralized on-chain neo-banking platform necessitates a robust technical stack. Selecting an appropriate blockchain platform, such as Ethereum or Polkadot, is crucial for scalability and interoperability. Programming languages like Solidity or Rust are employed to craft secure and efficient smart contracts. Additionally, implementing advanced cryptographic techniques ensures data integrity and confidentiality, fortifying the platform against potential threats. Incorporating open banking APIs facilitates seamless integration with external services, enhancing the platform’s versatility. Furthermore, a user-centric design ensures intuitive navigation and accessibility, catering to both novice and seasoned users. By embracing these technological advancements, neo-banking app development is poised to redefine the financial landscape, offering decentralized, efficient, and secure banking solutions for the modern era.

Crypto Neo-Banking: Current Market Trend Analysis

In 2024, the global neobanking market was valued at USD 143.29 billion. The market is expected to grow from USD 210.16 billion in 2025 to USD 3,406.47 billion in 2032, with a CAGR of 48.9% over the forecast period. Apart from the market capitalization, we must also have a closer look at the areas where the interest for neo banking is growing or already where the market is booming.

Why Should Businesses Invest in an On-Chain Neo Banking Platform?

Is your business prepared to embrace the next evolution in financial infrastructure that eliminates intermediaries, enhances liquidity, and seamlessly integrates with DeFi ecosystems? In an era where traditional banking models are increasingly restrictive, an on-chain neo-banking solution offers enterprises a direct gateway to decentralized, borderless, and crypto-native financial operations. By leveraging decentralized crypto neo banking platforms, businesses can unlock unprecedented financial autonomy, transparency, and efficiency, redefining their competitive edge in the digital economy.

- Elimination of Intermediaries : By leveraging blockchain technology, on-chain neo-banking apps facilitate direct transactions between parties, effectively removing the need for traditional financial intermediaries. This reduction in intermediaries leads to decreased transaction costs and enhanced operational efficiency.

- Enhanced Financial Inclusion : Decentralized crypto neo-banking platforms provide borderless banking services, enabling businesses to operate globally without the constraints imposed by traditional banking systems. This inclusivity particularly benefits enterprises in regions underserved by conventional financial institutions.

- Advanced Security Protocols : On-chain neo-banking solutions utilize robust cryptographic mechanisms inherent to blockchain technology, ensuring data integrity and protecting against fraudulent activities. This heightened security fosters trust and reliability within the financial ecosystem.

- Seamless Integration with DeFi Services : By adopting decentralized on-chain neo-banking, businesses can effortlessly access a suite of DeFi services, including staking, lending, and liquidity provision. This integration allows for diversified financial strategies and potential revenue streams.

- Transparency and Immutability : The transparent nature of blockchain ensures that all transactions are recorded on an immutable ledger, providing an auditable trail. This feature enhances accountability and simplifies compliance processes for businesses.

- Cost Efficiency : By eliminating intermediaries and automating processes through smart contracts, businesses can significantly reduce operational costs associated with traditional banking services.

- Global Accessibility : On-chain non-banking platforms operate on a decentralized network, allowing businesses to access banking services from anywhere in the world, thereby enhancing operational flexibility and reach.

Embracing neo-banking app development enables businesses to stay at the forefront of financial innovation, offering a crypto-friendly neo-banking solution that aligns with the evolving digital asset landscape. Collaborating with a reputable neo-banking app development company ensures the creation of a tailored platform that meets specific business needs, positioning enterprises for sustained growth in the DeFi era.

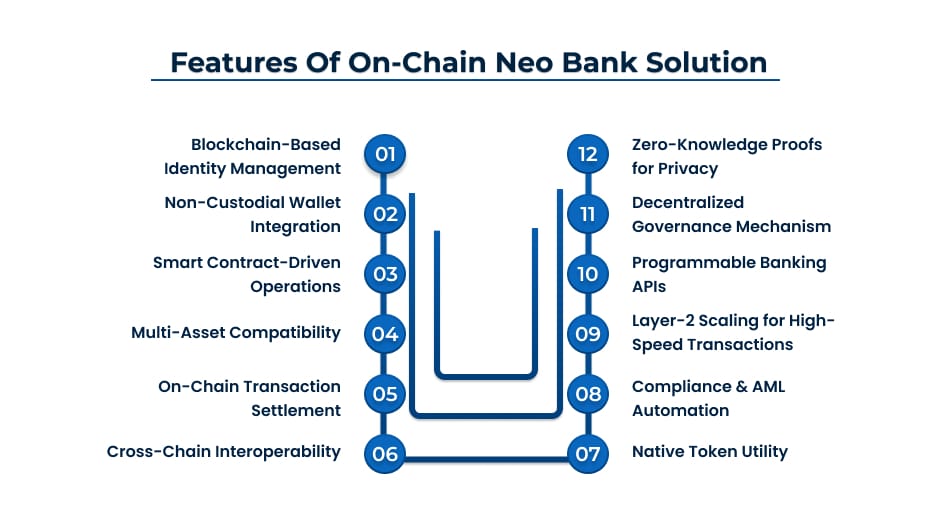

Core Features of On-Chain Neo Banking App

- Blockchain-Based Identity Management- Every user’s identity is verified and stored on-chain, leveraging decentralized identifiers (DIDs) and cryptographic proofs. This eliminates reliance on centralized databases, enhancing security and user privacy.

- Non-Custodial Wallet Integration- On-chain neo-banking apps must integrate non-custodial wallets, giving users full control over their funds without intermediaries. This feature ensures true decentralization and self-sovereignty over digital assets.

- Smart Contract-Driven Operations- Automated smart contracts govern all financial transactions, ensuring transparent, tamper-proof, and immutable agreements between users. This eliminates manual intervention and speeds up transaction settlements.

- Multi-Asset Compatibility– A decentralized crypto neo-banking platform must support multiple cryptocurrencies and stablecoins, allowing seamless cross-chain transactions and eliminating dependence on fiat systems.

- On-Chain Transaction Settlement- Unlike traditional digital banking, all transactions are executed and recorded directly on the blockchain. This ensures real-time transparency, irreversible ledger entries, and complete auditability.

- Cross-Chain Interoperability- The decentralized on-chain neo-banking infrastructure must support cross-chain functionalities, enabling users to transact across different blockchain networks without liquidity fragmentation.

- Zero-Knowledge Proofs (ZKPs) for Privacy- For enhanced confidentiality, crypto-friendly neo-banking solutions leverage Zero-Knowledge Proofs (ZKPs) to verify transactions without exposing sensitive data, maintaining regulatory compliance without compromising privacy.

- Decentralized Governance Mechanism- A well-structured on-chain neo-banking solution integrates DAO-based governance, allowing users to vote on protocol upgrades, new features, and policy changes, ensuring a transparent and community-driven approach.

- Programmable Banking APIs- Advanced APIs allow businesses to integrate decentralized financial services into their operations, enabling seamless payment processing, lending, and asset management functionalities directly within their platforms.

- Layer-2 Scaling for High-Speed Transactions- To enhance transaction throughput and reduce gas fees, neo-banking app development incorporates Layer-2 solutions like rollups and sidechains, making transactions faster and more cost-efficient.

- Compliance & AML Automation- Smart contract-driven KYC/AML compliance modules ensure regulatory adherence without the need for third-party verification, making it easier for businesses to operate in different jurisdictions.

- Native Token Utility- Some on-chain neo-banking apps issue their own governance or utility tokens, which power transactions, incentivize participation, and ensure ecosystem liquidity.

Building the Future of Banking—On-Chain, Transparent, and Trustless

Developing a robust on-chain neo-banking solution demands a highly structured and technically sophisticated approach. A leading crypto neo-bank development company follows these key strategic steps to build successful solutions. Let us follow these steps:

Step 1. Define the On-Chain Neo Banking Architecture

The foundation of a decentralized crypto neo-banking platform begins with designing an advanced blockchain architecture. The selection of a scalable blockchain, interoperability mechanisms, and consensus protocols ensures efficiency, security, and compliance.

Step 2. Develop Smart Contracts for Banking Operations

Programmable smart contracts govern the core financial functions, automating transactions, loan disbursements, KYC verification, and regulatory compliance. These contracts eliminate intermediaries, ensuring transparency and immutability in on-chain neo-banking apps.

Step 3. Integrate Non-Custodial Wallets & Secure Key Management

A crypto-friendly neo-banking solution requires seamless wallet integration, ensuring users retain full control over their assets. Implementing multi-signature authentication and MPC-based cryptographic security enhances fund protection and transaction integrity.

Step 4. Implement Cross-Chain & Multi-Asset Support

Interoperability is essential for decentralized on-chain neo-banking, enabling seamless transactions across various blockchain ecosystems. Cross-chain liquidity pools and atomic swaps facilitate fluid asset exchanges without intermediaries.

Step 5. Develop Regulatory-Compliant Identity Verification Modules

A sophisticated KYC/AML framework is embedded within the neo-banking app development process to align with regulatory requirements. Decentralized identifiers (DIDs) and Zero-Knowledge Proofs (ZKPs) balance privacy with compliance.

Step 6. Establish DAO-Based Governance for Decentralization

A decentralized crypto neo-banking platform must integrate a governance model that empowers users to participate in decision-making. A DAO ensures community-driven policy upgrades and operational transparency.

Step 7. Optimize for High-Speed & Low-Cost Transactions

To enhance scalability, on-chain neo-banking apps utilize Layer-2 rollups, sidechains, and state channels. These technologies reduce congestion and transaction fees while maintaining on-chain security and verifiability.

Step 8. Deploy AI-Powered Risk & Compliance Engines

An advanced risk assessment engine powered by AI and machine learning strengthens fraud detection, transaction monitoring, and regulatory audits. This ensures the on-chain neo-banking solution remains compliant with evolving global financial standards.

Step 9. Conduct Extensive Security Audits & Penetration Testing

A leading neo-banking app development company prioritizes rigorous security assessments, including smart contract audits, blockchain forensics, and real-time anomaly detection, ensuring maximum protocol resilience.

Step 10. Launch, Monitor, and Upgrade for Continuous Innovation

Post-deployment, the decentralized on-chain neo-banking system undergoes continuous performance monitoring, bug fixes, and feature enhancements. Upgrades are executed through governance proposals to maintain adaptability in the evolving DeFi ecosystem.

These meticulously crafted steps ensure the development of a next-generation on-chain neo banking solution, fostering financial innovation while upholding decentralization, security, and regulatory compliance.

Necessary Compliance & Regulatory Frameworks for On-Chain Neo Banks

Ensuring compliance is a fundamental aspect of on-chain neo banking apps, as decentralized financial institutions must align with global regulatory standards to maintain operational integrity and legal acceptance. The key compliance frameworks include:

✓ Financial Action Task Force (FATF) Guidelines

✓ Anti-Money Laundering (AML) & Counter-Terrorism Financing (CTF) Laws

✓ Know Your Customer (KYC) & Customer Due Diligence (CDD) Regulations

✓ General Data Protection Regulation (GDPR)

✓ Markets in Crypto-Assets (MiCA) Regulation

✓ Bank Secrecy Act (BSA)

✓ Securities and Exchange Commission (SEC) Compliance

✓ Electronic Fund Transfer Act (EFTA)

✓ Payment Services Directive 2 (PSD2) & PSD3

Regulatory compliance is critical for ensuring legitimacy, fostering trust, and preventing illicit activities. Decentralized crypto neo banking platforms must adhere to these laws to enable seamless global adoption while mitigating financial risks and ensuring long-term sustainability.

Act Now: Future-Proof Your Banking with On-Chain Innovation!

The financial revolution is here—don’t get left behind! Take action today by investing in on-chain neo-banking solutions that eliminate intermediaries, cut costs, and unlock seamless DeFi integration. Build your decentralized banking platform now to stay ahead in the digital finance race. Partner with a leading development company and launch your on-chain banking app in record time.

At Antier, we pioneer on-chain neo-banking solutions that redefine financial transactions with security, efficiency, and decentralization. Our blockchain expertise ensures a seamless, future-ready banking ecosystem. Why wait? Collaborate with us to build a scalable, compliant, and innovative banking platform. Let’s shape the future of decentralized finance together—get started today!