The Fragmented Trading Revolution

Imagine a world where a chef must cook in three separate kitchens to prepare a single meal. One for spices, another for meats, and a third for desserts. Absurd, right? Yet, this is the reality for today’s traders. Stocks thrive on NYSE and Nasdaq, forex pulses through MetaTrader’s charts, and crypto dances on Binance and Coinbase—all disconnected worlds. But what if you could trade Tesla shares, hedge with EUR/USD, and stake Bitcoin in one place? That’s what a crypto trading platform that brings together stocks, forex, and digital currencies offers.

Markets Overview And The Need For Convergence

Before you review your cryptocurrency exchange development strategy, you must learn these facts about TradFi. The global stock market has demonstrated robust performance recently, with major indices like the Nasdaq Composite, S&P 500, FTSE 100, DAX, and Nikkei all showing positive momentum over various timeframes. Similarly, the forex market continues its reign as the world’s largest financial arena, with daily trading volumes reaching unprecedented levels, highlighting its immense liquidity and the constant flow of opportunities. Despite its inherent volatility, the cryptocurrency market has also shown significant growth and positive trends, with Bitcoin and Ethereum experiencing substantial price movements and a growing overall market capitalization.

Pushing the boundaries of TradFi and digital finance, your crypto exchange software can tap the $124 trillion global stock market and $861 billion forex market along with the $3 trillion cryptocurrency market.

These markets are booming, but traders are juggling and drowning in tabs, apps, and fees. So, a unified platform that unites these major asset classes (stocks, forex, and crypto) empowers traders with unparalleled convenience, enhanced capital efficiency, and access to a diverse spectrum of investment possibilities, all within a single, integrated interface.

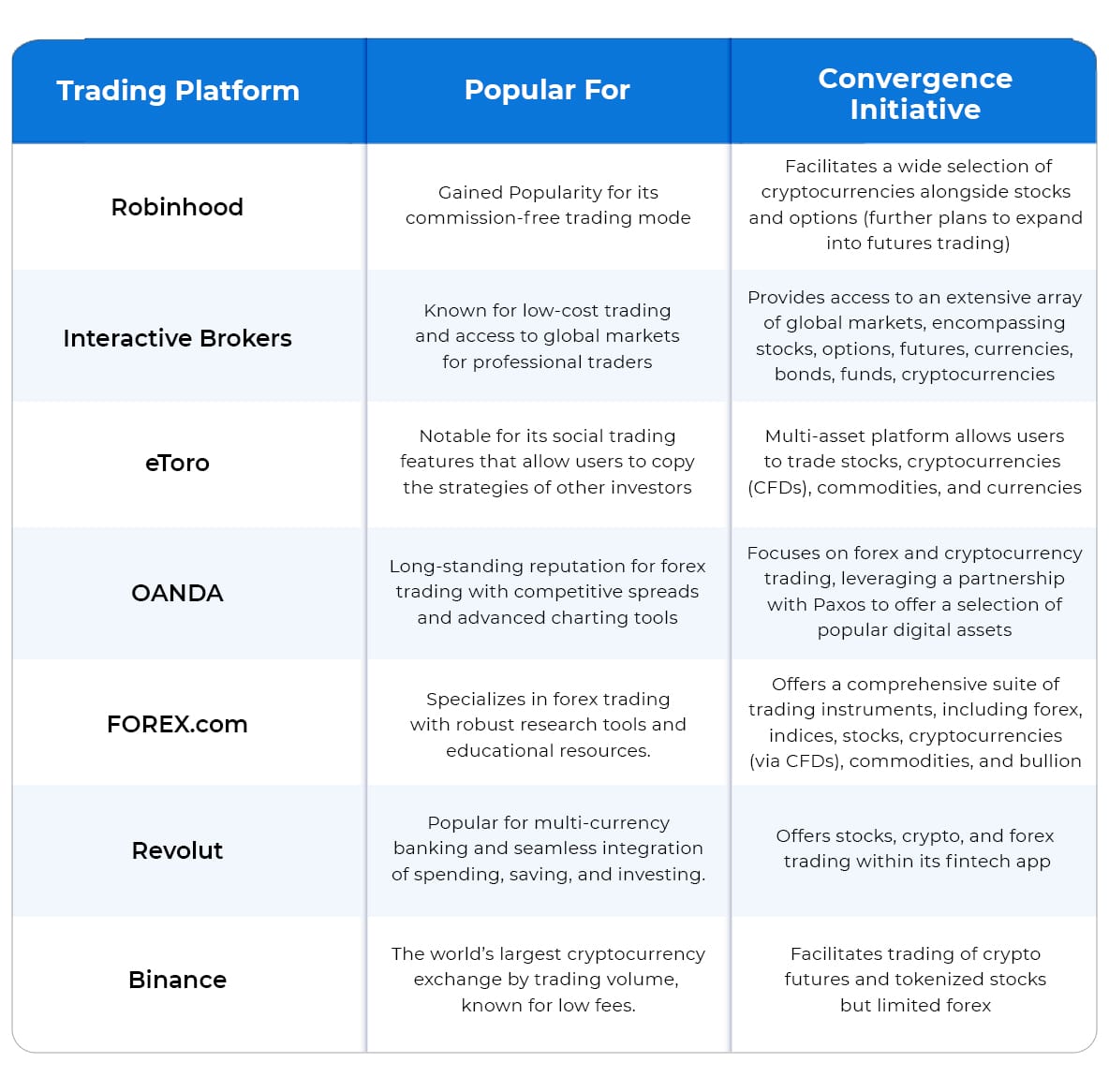

Who’s Bridging TradFi and Crypto? Lessons from the Frontlines

A handful of pioneers are stitching together fragments of these revolutionary markets, bridging the gap between TradFi and the burgeoning world of cryptocurrencies with unified forex, stocks, and crypto exchange software.

Even Fidelity (a traditional brokerage firm), Blackrock (the world’s largest asset manager), CME Group, Franklin Templeton, Morgan Stanley, and Charles Schwab have entered the cryptocurrency trading space, although initially with limited offerings.

A very recent acquisition of NinjaTrader, a leading US retail futures trading platform, by the cryptocurrency exchange software Kraken underscores this trend of convergence. This strategic move aims to position Kraken as a leader in the US futures market for both traditional and crypto assets, with ambitions to include equities trading and payments in the future. This highlights the industry’s recognition of the synergies between these financial domains, clarifying that the demand exists. But the TradFi and crypto trading platforms discussed above are halfway houses, not finished products. For example, platforms like Robinhood and Webull dabble in stocks and crypto but ignore forex. Revolut stitches together stocks, crypto, and forex but lacks DeFi’s edge. The race is on to build the ultimate hub—and blockchain may be the secret weapon for merging forex, stocks, and crypto trading platforms.

The Blockchain Advantage: How Blockchain Helps Unified Exchanges Dominate Multi-Asset Trading

To lead the next wave and establish a new standard, a platform must leverage blockchain’s DNA: transparency, speed, and interoperability. Blockchain’s inherent characteristics offer several compelling advantages that can address existing limitations and enhance the trading experience across stocks, forex, and cryptocurrencies. Here’s the blueprint:

Enhanced Security and Trust

Blockchain’s robust security framework makes it a standout tech for cryptocurrency exchange development integrating TradFi assets. By employing cryptographic hashing, decentralization, and immutability, blockchain creates a tamper-proof record of transactions, significantly reducing the risks of fraud and unauthorized access. It also eliminates the centralized authority, minimizing the risk of a single point of failure, making it significantly harder for malicious actors to compromise the system. This level of security is paramount in the financial trading space, where the protection of funds and sensitive data is of utmost concern.

Increased Transparency and Accountability:

Besides security, the distributed ledger tech introduces unprecedented levels of transparency, with every transaction being recorded on blockchain, creating an auditable and immutable environment for crypto exchange software solutions bridging TradFi and crypto. This fosters greater trust for traders who value transparency in their financial dealings and seek platforms that minimize the potential for hidden fees or unfair practices. In markets that have historically been perceived as opaque, such as certain aspects of forex and over-the-counter stock trading, blockchain-based stock, forex, and cryptocurrency exchange software can offer a new level of clarity and accountability.

Improved Efficiency and Reduced Costs

Traditional financial markets often involve a complex web of brokers, clearinghouses, and custodians, each adding time and cost to the transaction process. Blockchain-based unified trading platforms can facilitate direct peer-to-peer transactions, reducing settlement times and lowering transaction fees. Furthermore, the unified cryptocurrency exchange software development solutions that bring together stocks, forex, and other securities eliminate the need to juggle multiple accounts, remember different login credentials, and navigate disparate user interfaces. Blockchain can also streamline the often cumbersome KYC/AML, as once a user is verified on the blockchain, the identity can be securely and efficiently shared across different trading activities within the crypto exchange software platform. This reduces the need for repeated verification processes, streamlining the experience and saving traders valuable time and effort that they can use in trading strategies rather than administrative hurdles.

Unlocking Synergies: The New Offerings

1. Cross-Margin Collateral

- Enable your users to pledge Bitcoin as collateral to short GBP/JPY.

- Users on your crypto exchange software featuring stocks and forex can borrow against Apple stock to buy Ethereum—all in one margin account.

2. Unified Wallet, Unlimited Assets

- Enable your customers to hold TSLA shares, Bitcoin, and EUR/USD positions in a single non-custodial wallet.

- Use MPC technology (e.g., Fireblocks) to secure TradFi assets while enabling DeFi staking.

3. Tokenized TradFi Assets

- Mirror stocks and forex pairs as blockchain tokens (e.g., Tesla Token = TSLA-X). Your unified crypto trading platform for forex, crypto, and stocks can bring more variety to the table.

- These tokenized TradFi assets can be fractionalized, democratizing ownership of stocks, real estate, or commodities that were less accessible to retail traders or illiquid.

- Settle trades instantly (no T+2 delays) and enable 24/7 trading for all assets with smart contract integration.

4. DeFi Integrations and In-Exchange Staking Modules.

- Your crypto exchange software should not be limited to trading. You can enable users to earn yield on idle USD via Aave or stake BTC while holding Amazon stock.

- Offer governance tokens (e.g., the platform’s native token) for fee discounts and voting rights.

How To Build A Unified Trading Platform for Forex, Crypto, and Stocks?

Building this cryptocurrency exchange software requires the following:

- APIs: Polygon for cheap crypto transactions, Plaid for stock brokerage links, and FXCM for forex liquidity.

- Liquidity Pools: Curve for stablecoin forex pairs, Uniswap for crypto, and Cboe for stock order routing.

- Compliance: Chainalysis for crypto AML, partnership with SEC-regulated brokers or regional/state-regulated brokers for stocks.

How Are Top DEX Aggregators Optimizing Trades in 2025?

Building this cryptocurrency exchange software requires the following:

- APIs: Polygon for cheap crypto transactions, Plaid for stock brokerage links, and FXCM for forex liquidity.

- Liquidity Pools: Curve for stablecoin forex pairs, Uniswap for crypto, and Cboe for stock order routing.

- Compliance: Chainalysis for crypto AML, partnership with SEC-regulated brokers or regional/state-regulated brokers for stocks.

Regulatory Hurdles (and How to Jump Them)

- Stocks: Partner with a FINRA-licensed broker (e.g., DriveWealth).

- Forex: Obtain CFTC licensing or white-label a provider like Pepperstone.

Crypto: Embrace MiCA (EU) and state-level MTLs (U.S.).

The Future Is a Symphony, Not a Solo

The next Robinhood won’t be a stock app or a crypto exchange software—it’ll be a conductor, harmonizing TradFi’s stability with DeFi’s innovation, or maybe a centralized crypto trading platform that brings together different securities.

No platform today merges self-custody crypto wallets, stock trading, and forex leverage seamlessly. By prioritizing the following, you’ll attract the 100M+ global traders stuck in today’s fragmented system.

The question isn’t if someone will build this platform. It’s who—and how fast they’ll move.

Get the first-mover opportunity with Antier, a leading cryptocurrency exchange software development company offering turnkey as well as custom solutions for businesses planning to lead the revolution.

The tools exist. The market is hungry. All that’s missing is you. 🚀

Schedule your call today!

Frequently Asked Questions

01. What is the main challenge faced by today's traders in the financial markets?

Today's traders face the challenge of navigating fragmented markets, as they must use separate platforms for stocks, forex, and cryptocurrencies, leading to inefficiencies and increased complexity.

02. How can a unified trading platform benefit traders?

A unified trading platform allows traders to access stocks, forex, and cryptocurrencies in one place, providing unparalleled convenience, enhanced capital efficiency, and a broader range of investment opportunities.

03. What are the current trends in the global financial markets?

The global stock market is performing well with positive momentum in major indices, the forex market is experiencing unprecedented trading volumes, and the cryptocurrency market is showing significant growth and price movements.