The UAE is rapidly emerging as a pivotal player in the global asset tokenization landscape, driven by its dynamic financial markets, growing interest in digital innovation, and strategic economic reforms. Asset tokenization—the process of converting physical or traditional assets into digital tokens on a blockchain—presents a transformative opportunity for the region, promising enhanced liquidity, transparency, and accessibility in asset management.

As the adoption of blockchain technology and digital assets accelerates, regulatory frameworks are evolving to address the unique challenges and opportunities associated with tokenized assets. In this region, the regulatory environment is undergoing significant changes to balance innovation with robust oversight, ensuring both investor protection and market integrity.

With the increasing popularity in asset tokenization, the countries within the Middle East region are making efforts to progressively set clear rules and guidelines and establish a proper framework for protecting the rights of investors and market integrity.

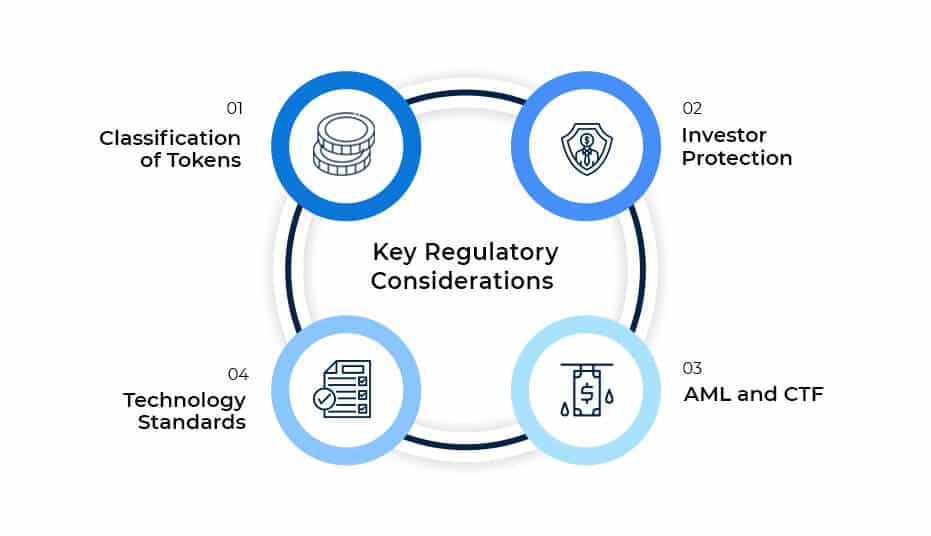

Key Regulatory Considerations for Tokenization in UAE

Key regulatory considerations in the UAE include:

- Classification of Tokens: Determining whether a token is a security, commodity, or other asset class is crucial as it determines the applicable regulations. For instance, security tokens often fall under the purview of securities regulators, while utility tokens might be subject to different rules.

- Investor Protection: Regulators prioritize protecting investors from fraud, market manipulation, and other risks. It includes requiring issuers to disclose information about the underlying asset, its risks, and the rights of token holders.

- Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF): Tokenization can be used for illicit activities, so regulators implement AML/CTF measures to prevent money laundering and terrorist financing.

- Technology Standards: Ensuring that tokenization platforms adhere to technical standards and best practices is essential for interoperability, security, and consumer protection.

Regulatory Landscape in the UAE

The Emirates Securities and Commodities Authority (ESCA) has issued several specific guidelines for the regulation of tokenized assets in the UAE. Here are the key elements of these guidelines:

Classification of Tokenized Assets

ESCA categorizes tokenized assets as securities, and hence they are subjected to the exact regulatory system applicable in traditional securities. The classification ensures that tokenized assets adhere to already-existing securities laws; hence, there will be a proper legal environment for their issuance and trading.

Issuing security tokens

It categorically states the needs and requisitions for issuing a security token that is:

- Licensing: For any organization that intends to offer security tokens, it must obtain the necessary licensing from the ESCA.

- Disclosure requirements: Issuers must satisfy the guideline of full disclosure in regard to the tokenized assets and the risks and rights of tokens attached therewith.

Regulation of Security Token Exchanges

The security token exchange is regulated by the ESCA. These exchanges operate under specific standards in operation, which includes AML and CTF.

Real Estate Tokenization

The guidelines clearly outline the tokenization of real estate, which is continuously becoming popular in the UAE. ESCA issued guidance on the following:

- Tokenized Real Estate Classification: Tokenized real estate shall be regarded as security; therefore, it must comply before the laws and regulations applicable to conventional real estate investments.

- Real Estate Investment Trusts (REITs): The framework shall be thus, which allows tokenized REITs to advance fractional ownership and increased liquidity in real estate investments.

ESCA Legal Recognition of Tokenized Assets

The ESCA guidelines do provide such a legal framework for tokenized assets, including appropriate transfer of tokens for transferring the ownership of the underlying assets, and with the effect of ensuring that those rights are legally enforceable with a view of ensuring legal certainty covers the investors.

Continuous Monitoring and Adaptation

ESCA remains strongly committed to regular monitoring of all related developments related to the fast-evolving field of tokenized assets and updating its regulatory framework whenever required. This would mean that the regulations stay relevant and effective in promoting innovation while protecting investors.

Abu Dhabi

Abu Dhabi Global Market (ADGM) remains the pioneer in regulating asset tokenization in the UAE. Guidelines on digital securities and virtual asset activities have been issued by The Financial Services Regulatory Authority (FSRA).

Key regulatory considerations in Abu Dhabi include:

- Investor Protection: Ensuring that the investors are adequately informed and protected from any fraudulent actions.

- Market Integrity: Maintaining fairness and transparency in the tokenization market.

- AML and CTF: Appropriate measures to safeguard it from illicit activities.

- Technology standards: Adhering to technical standardizations and best practices regarding the technology of blockchain.

Recent Developments:

- Expanded regulatory scope: The ADGM has widened its scope of regulation by targeting new activities that were not previously covered.

- International Collaboration: ADGM has worked closely with international regulators to develop converged best practices of the industry in tokenizing an asset.

- Focus on Sustainability: Increased effort has been sustainable Asset Tokenization, propelling the use in Blockchain technology in ESG agendas by ADGM.

Dubai

Another significant financial free zone is the Dubai International Financial Centre (DIFC). DIFC has been quite active in the regulation of asset tokenization. The Dubai Financial Services Authority has issued guidance on digital tokens and virtual assets.

Dubai has paid more attention to two key regulatory considerations:

- Investor protection: Similar to ADGM, Dubai focuses on investor protection and transparency.

- Market integrity: The DFSA envisions a fair and orderly market for tokenized assets.

- AML and CTF: Dubai has stringent measures in place to combat illicit activities.

- Innovation: The DFSA encourages innovation while ensuring compliance with regulations.

Recent Developments

- Fintech focus: Dubai has assumed the crown of Fintech capital of the UAE, and Asset tokenization is at the heart.

- Clarity in regulation: The DFSA has been working to provide clear guidance and regulatory frameworks for tokenization activities.

Other Emirates

Sharjah

Sharjah Media City (SMC) has grown to become a digital media and technology hub. While its core focus is still on the media and technology industries, SMC does have a few laws that relate to asset tokenization operations.

Ras Al Khaimah

RAK Digital Assets Oasis (RA DAO) is a special purpose free zone that has been established with the purpose of developing digital asset-related activities. It also has its set of specific regulations of relevance to digital assets with regards to tokenization. The ecosystem sets itself up as a favorable environment for the digital asset businesses.

Ajman, Umm Al Quwain, Fujairah

There are also free zones in Ajman, Umm Al Quwain, and Fujairah, which, while not of a digital asset focus, can stand to be free zones that will focus on asset tokenization in the near future.

Why Businesses Should Consider the UAE for Asset Tokenization

There will be market access opportunities for different businesses in the UAE since it’s a fast-growing market with a huge population and increasing disposable income.

- Innovation Hub: The concentration of innovation and technology in the region can create an enabling ecosystem for the growth of tokenization projects.

- Diversification: Foreign investors stand to diversify within the UAE, thus reducing the risks encountered in other regions due to overexposure.

- Strategic Partnerships: Collaboration with local partners will ease the process of compliance for a firm and help in creating bonds in the region.

Case Studies

Although relatively nascent, a few tokenization initiatives are model examples of successful projects and platforms in the UAE region. Some include:

- Emirates NBD: As part of its work on blockchain for trade finance and supply chain management, the bank has also been a player in initiatives in tokenization.

- Dubai Multi Commodities Centre (DMCC): DMCC has been one of the premiers sensitizing the trading of commodities in Dubai towards blockchain technology and the ideal ways to use it. It has supported various tokenization projects toward this end.

- Masdar City: This sustainable city in Abu Dhabi has explored the use of blockchain technology for energy trading and other initiatives.

Impact on Global Investors and Businesses

The regulatory environment in the UAE is evolving to create a more conducive environment for tokenization. As regulations become clearer and more harmonized, we can expect to see increased interest from global investors and businesses.

Key Considerations for Global Investors and Businesses

- Due Diligence: Carry out extensive due diligence in understanding the regulatory landscape and the particular requirements in different emirates.

- Local Partnerships: Consider feasibility in partnering with local entities to enable effective navigation in the regulatory environment and for relationship building.

Final Thoughts

The UAE is at the forefront of the asset tokenization revolution, leveraging its strategic financial hubs and regulatory agility to shape a dynamic landscape for digital assets. As the region embraces blockchain technology for the transformation of traditional asset management, the associated regulatory frameworks are thusly changed to find the most innovative way to protect the investor: from Emirates Securities and Commodities Authority’s comprehensive guidelines to Abu Dhabi.