Top 5 Crypto Stablecoin Wallets for USDT, USDC, BUSD, TUSD & FDUSD in 2025

April 9, 2025

Margin Trading Exchanges Are Printing Profits in 2025 — Will Yours Be Next?

April 9, 2025Artificial Intelligence in Asset Tokenization is setting the stage for explosive development in the Real Estate Market. While AI can play a huge role in empowering the decision-making process, its amalgamation with Blockchain in Real Estate Tokenization Platform development can enhance the user experience, control, security, and privacy.

This guide talks about how Tokenizing Real Assets with AI can expand platform potential and enable investors and owners to amplify their earnings.

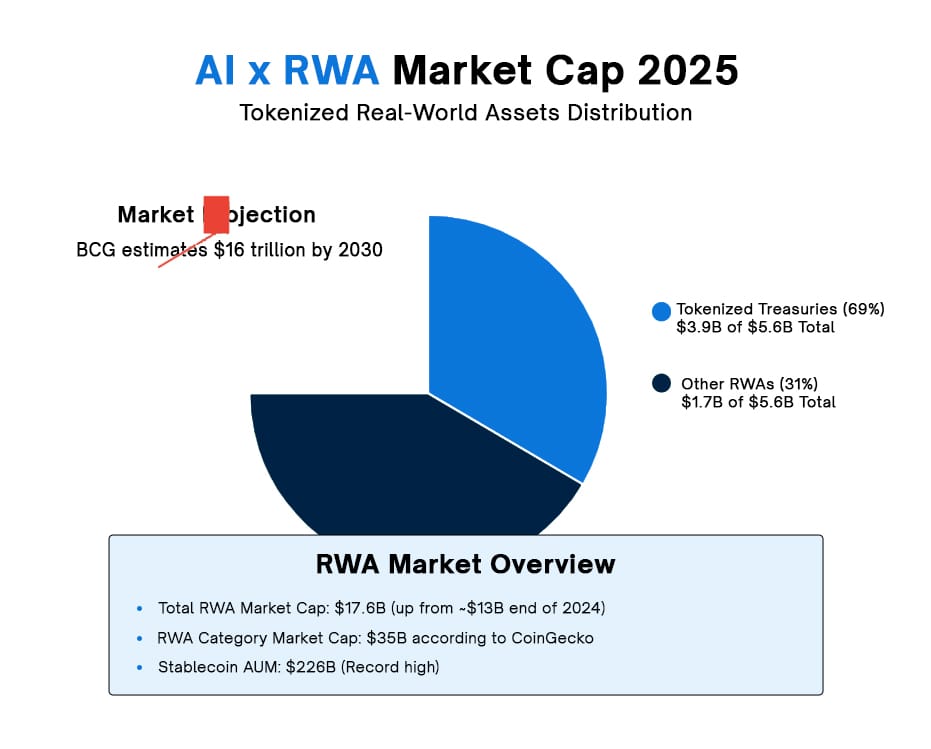

Asset Tokenization AI Impact: Market Insights

Current Limitations of Tokenization and How AI Helps Overcome Them

Limitations

- Data Silos Between Blockchains

When blockchains remain isolated from each other, RWAs face a serious challenge. Assets issued on one blockchain can be reissued on another, creating duplicate ownership claims. This happens because these separate systems don’t communicate effectively with each other. Think of it as having the same house deed registered in two different counties – it creates confusion about who owns the property. This isolation increases the risk of accidental or deliberate “double spend” issues across platforms.

- Regulatory Compliance Challenges

Navigating regulations adds another layer of complexity to Real Estate Tokenization. Different regions might force companies to select just one blockchain for deployment, creating unnecessary barriers to entry. In regulated markets like real estate, there are restrictions on who can access certain products – like buyer ban. Meeting these requirements often demands digital ID verification, raising privacy concerns among users who prefer anonymity. These compliance hurdles add costs and slow down the widespread adoption of the technology.

- Physical Asset Ownership Verification

RWAs rely heavily on Special Purpose Vehicles (SPVs) to establish legal separation between ownership and the primary asset. These complex structures protect token holders if the parent company faces financial trouble. However, managing this legal relationship between digital tokens and physical assets creates its risks. If something goes wrong with the verification process, people could lose ownership of valuable physical assets, causing real-world harm and damaging trust in the entire industry.

- Market Inefficiencies

Traditional asset management lacks the fluidity that modern finance demands. Assets get stuck in slow, outdated systems that prevent optimal capital allocation across markets. RWAs promise to solve this by making traditionally illiquid assets more tradable, but technical and regulatory complexities have slowed this transformation. The result is inefficient markets that don’t fully leverage the potential of tokenized assets.

How AI Helps Overcome These Limitations

- Cross-Chain Verification and Provenance

AI and Blockchain for Real Estate transform asset ownership verification across different blockchains. By analyzing data in real time across multiple platforms, AI creates a comprehensive view of who owns what. This technology acts like a universal translator between blockchains, improving interoperability while maintaining security. AI can quickly spot inconsistencies or duplicate issuances, preventing fraud before it happens and establishing clear ownership trails that everyone can trust.

- Enhanced Risk Assessment

AI brings powerful protection to the Real Estate ecosystem through advanced risk assessment. The technology can spot potential issues before they become problems, analyzing patterns that humans might miss. This early detection system prevents fraud and protects the reputation of the entire industry. With AI monitoring transactions, investors can feel more confident about the security of their tokenized assets, encouraging wider adoption.

- Regulatory Compliance Automation

Keeping up with regulations across different jurisdictions becomes manageable with AI. The technology constantly monitors changing rules and helps platforms adapt automatically. AI systems can balance privacy needs with regulatory demands, making compliance less burdensome for all participants. This automation reduces the costs associated with compliance while ensuring that Real Estate platforms remain on the right side of the law.

- Market Efficiency Optimization

Just as AI has revolutionized yield optimization in DeFi, it’s now improving how capital flows through Real Estate markets. AI analyzes market conditions and directs resources where they’ll generate the best returns. This creates more efficient markets for tokenized assets ranging from real estate to fine art. As efficiency improves, more people are drawn to these platforms, driving overall adoption and growth of the ecosystem.

- Real-Time Monitoring and Analysis

The power of continuous monitoring gives AI a unique advantage in the Real Estate space. Rather than periodic checks, AI provides around-the-clock analysis of market conditions and asset performance. This real-time insight reduces risk and strengthens the connection between physical property and its digital tokens. As tokens represent increasingly diverse real-world assets, this monitoring becomes essential for maintaining trust in the system.

Features To Unlock With AI-Powered RWA Platform Development

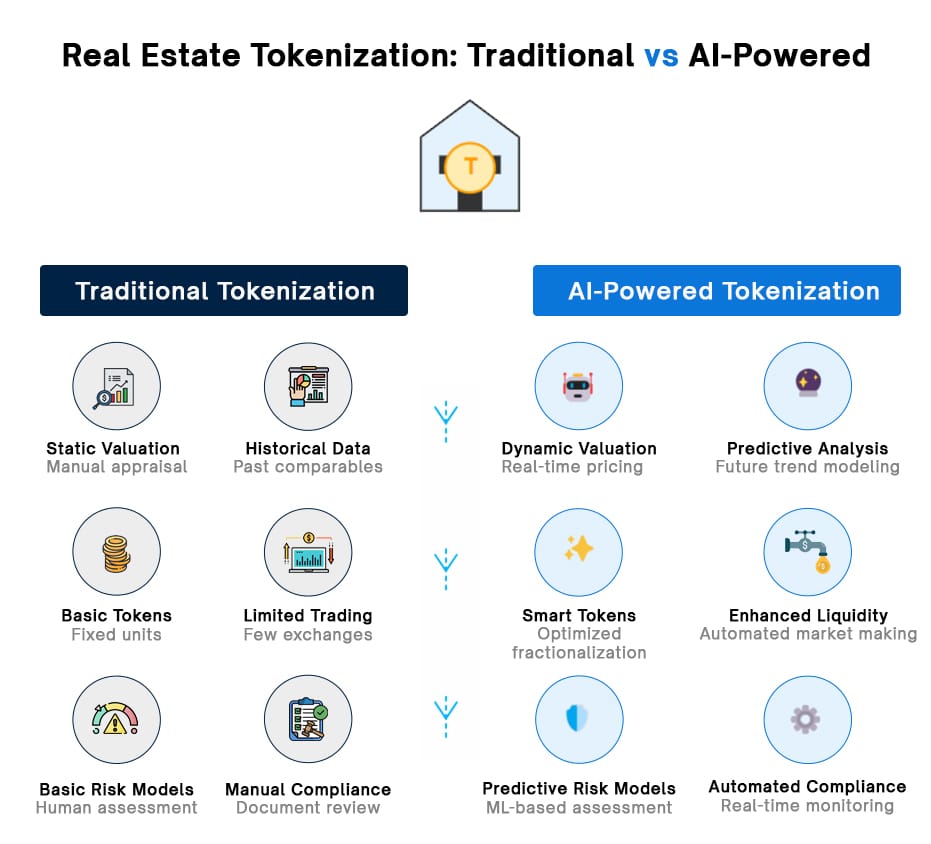

- Real-Time Asset Valuation

With AI, Real Estate Platforms can process vast amounts of information to deliver accurate asset valuations instantly. By examining historical performance data, current market conditions, and economic indicators, it can provide transparent and fair pricing that everyone can rely on. This advancement eliminates time-consuming manual appraisals and reduces the potential for human error or bias in determining asset values.

- Predictive Analytics

Prediction models in the Real Estate Tokenization Platform can help the investors to identify emerging market trends and potential risks before they become obvious to others. These tools provide valuable insights that help stakeholders make better decisions based on data rather than hunches. For tokenized real estate, commodities, or art collections, this means spotting potential problems early and making strategic adjustments to protect investments.

- Self-Executing Contracts

AI enables the Smart contracts to work beyond simple if-then statements into responsive systems that optimize for efficiency and adapt to changing conditions. When these enhanced contracts manage processes like dividend payments, ownership transfers, or compliance verification, they do so with greater reliability and less friction. This creates a smoother experience for everyone involved in the Real Estate ecosystem.

- Liquidity Management

Advanced market analysis tools can help to maintain the balance of supply and demand dynamics for tokenized assets. These systems work continuously to maintain healthy trading environments, stabilize prices, and reduce market inefficiencies. The result is greater confidence among investors and more predictable performance for asset owners—critical ingredients for the widespread adoption of tokenized real-world assets.

- AI Security

Real Estate firms can integrate sophisticated AI patterns in their platform to identify unusual activities that might indicate fraud attempts. These security measures, alongside improved verification systems, create multiple layers of protection for all participants. The enhanced security protocols for identity verification and transaction monitoring safeguard the entire ecosystem while maintaining appropriate privacy levels.

How To Integrate AI in Real Estate Tokenization Platform: A Step-By-Step Guide

- Define Objective

Identify areas where AI can enhance tokenization, such as automating property valuation, streamlining compliance, or improving investor onboarding.

- Develop a Data Strategy

Collect and organize data on property listings, market trends, and transactions. Ensure data quality and privacy compliance to train AI models effectively.

- Implement AI-Powered Valuation

Use predictive analytics to assess property values and forecast market trends for accurate token pricing.

- Integrate Smart Contracts

Automate token creation and management using blockchain-based smart contracts enhanced by AI for fraud detection and risk mitigation.

- Enhance User Experience

Deploy AI-driven chatbots for investor support and virtual assistants for seamless onboarding and portfolio optimization.

- Test and Optimize

Launch pilot projects to refine AI tools, ensuring scalability and regulatory compliance before full implementation.

Take Away

As we move toward the projected ten trillion-dollar valuation for tokenized assets, AI will play an indispensable role in making this vision a reality. From reducing risks to establishing clear ownership to creating truly efficient markets, Tokenizing Real Assets with AI is transforming how we bring real-world assets into the digital age.

Invest Smarter with an AI-Powered Real Estate Platform

Own property? Transform how you trade with our Real Estate Tokenization Platform Development. Our experts can help to build secure, tamper-proof Tokenization Infrastructure that verifies and manages the assets with complete transparency.

We integrate the AI technology that analyzes market data to help your investors make better investment choices. We spot trends and assess risks before they impact your bottom line.

With Our Real Estate Tokenization Platform, you will get:

- Secure tokenization across multiple blockchains

- Data-driven investment insights

- Flexible infrastructure that grows with your portfolio

Whether you’re managing a single property or a large portfolio, our platform adapts to your needs while connecting with all major blockchain networks. Contact us today to see how an AI-powered platform can transform your property portfolio.