Top 5 Banks to Watch Out for Crypto Friendly Banking Solutions 2023

July 6, 2023

How Blockchain Healthcare Solutions can Transform the Pharmaceutical Supply Chain?

July 6, 2023The DeFi development industry has been growing rapidly, offering innovative solutions and financial opportunities built on blockchain technology. One of the prominent players in the DeFi space is Arbitrum, a layer 2 scaling solution for Ethereum. In this blog, we will dive deep into the Arbitrum DeFi ecosystem, exploring its key features, benefits, and potential impact on the broader DeFi landscape, applications and projects.

Understanding Arbitrum

Arbitrum is a layer 2 scaling solution developed by Offchain Labs that aims to address Ethereum’s scalability challenges. It achieves this by utilizing a technique called Optimistic Rollup, which enables the execution of smart contracts on a sidechain while leveraging Ethereum’s security and consensus mechanism. The DeFi ecosystem on Arbitrum brings scalability, faster transaction confirmations, and lower fees to the Ethereum ecosystem, making it an attractive option for DeFi applications.

Optimistic Rollup

Let’s get to know what exactly is Optimistic Rollup and its role in Arbitrum:

Optimistic Rollup is a technique that enables the execution of smart contracts on a sidechain while leveraging the security and consensus mechanism of the Ethereum mainnet. In Arbitrum, transactions are initially processed off-chain, and the sidechain acts as a “rollup” where the validity of transactions is verified. The sidechain periodically submits a summary of transactions to the Ethereum mainnet, ensuring the security and finality of the executed transactions.

Benefits of Arbitrum for DeFi

Arbitrum is designed to address the scalability and high transaction fees issues that have plagued the Ethereum network. When it comes to DeFi development, Arbitrum offers several benefits:

Scalability and Throughput

Arbitrum significantly improves the scalability and throughput of Ethereum, enabling DeFi protocols to handle a higher volume of transactions. With faster transaction confirmations and reduced congestion, users can enjoy a smoother and more efficient DeFi experience.

Lower Transaction Fees

By moving transactions to the Arbitrum sidechain, users can benefit from lower gas fees compared to the Ethereum mainnet. This reduction in fees makes DeFi more accessible and cost-effective for both retail and institutional users.

Seamless Compatibility

Arbitrum maintains compatibility with Ethereum’s programming language, Solidity, and existing smart contracts. This means that DeFi applications and protocols built on Ethereum can easily migrate to Arbitrum, leveraging its scalability benefits without significant modifications to their codebase.

Enhanced Security

Arbitrum inherits the security guarantees of Ethereum’s mainnet through a process called “optimistic execution.” While transactions are initially processed off-chain, the sidechain’s consensus mechanism ensures that any discrepancies or malicious activities are caught and resolved, maintaining the integrity of the DeFi ecosystem.

How Does Arbitrum Work?

Arbitrum’s architecture combines off-chain transaction processing, transaction batching, fraud proofs, and settlement on the Ethereum mainnet to achieve scalability and reduce transaction costs while maintaining compatibility and security with the Ethereum ecosystem.

Smart Contract Deployment

in order to use Arbitrum, developers deploy their smart contracts to the Arbitrum chain. These contracts are written in Solidity, the same programming language used for Ethereum contracts, making it easy to port existing contracts to Arbitrum.

Off-chain Transaction Processing

When a user initiates a transaction on Arbitrum, it is processed off-chain. The transaction is validated and executed by a set of validators known as Arbitrum sequencers. Sequencers maintain a copy of the Arbitrum chain and keep track of all transactions.

Transaction Batching

Instead of processing each transaction individually, DeFi ecosystem on Arbitrum batches multiple transactions together. This batching significantly reduces the number of transactions that need to be settled on the Ethereum mainnet, improving scalability.

Fraud Proofs and Verification

Once the transactions are processed off-chain, Arbitrum generates a succinct proof called a “fraud proof” for each batch of transactions. These proofs contain cryptographic evidence that attests to the correctness of the transaction execution. Users can challenge any fraudulent transactions by submitting these proofs to the Ethereum mainnet.

Ethereum Mainnet Settlement

Periodically, the aggregated batch of transactions, along with their associated fraud proofs, is submitted to the Ethereum mainnet for settlement. This settlement process ensures the security and finality of the transactions by anchoring them to the Ethereum blockchain.

User Experience

From the user’s perspective, interacting with Arbitrum is similar to using Ethereum. Users can send transactions, interact with smart contracts, and access various DeFi applications through wallets and interfaces that support Arbitrum. The difference lies in the improved scalability and reduced transaction fees provided by Arbitrum.

Security and Trust

Arbitrum leverages the security of the Ethereum mainnet as its anchor. The fraud proofs generated by Arbitrum provide a mechanism for ensuring the correctness of transactions and preventing malicious activities. In case of any disputes or fraudulent behavior, users can rely on the Ethereum mainnet to resolve issues and enforce the correct state of the system.

DeFi Applications on Arbitrum

Decentralized Exchanges (DEXs)

Arbitrum enables decentralized exchanges to offer fast and low-cost trading experiences. Projects like Uniswap and SushiSwap have already deployed on Arbitrum, allowing users to swap tokens with reduced fees and faster settlement times.

Lending and Borrowing Platforms

Another popular type of DeFi application on Arbitrum is lending and borrowing platforms. These platforms allow users to lend their cryptocurrencies and other digital assets to other users in exchange for interest payments. Borrowers can then use these funds for a variety of purposes, such as trading, investing, or covering unexpected expenses. Decentralized Lending on Arbitrum makes borrowing and lending activities more accessible and cost-effective for users.

Yield Farming and Staking

Yield farming and staking protocols on Arbitrum provide users with opportunities to earn rewards by providing liquidity or locking their assets. These protocols can capitalize on Arbitrum’s scalability to enhance the yield farming experience while minimizing gas fees.

Synthetic Assets and Derivatives

Arbitrum enables the creation of synthetic assets and derivative products, allowing users to gain exposure to various assets without owning them physically. Projects like Synthetix can utilize Arbitrum’s scalability to enhance the performance and trading experience of synthetic assets.

The Impact of Arbitrum on DeFi

Increased Adoption and Accessibility

Arbitrum’s scalability benefits and lower transaction fees attract new users to the DeFi space. Lower costs and improved user experiences make DeFi protocols more accessible, facilitating wider adoption among retail and institutional investors.

Reduced Congestion on Ethereum

As more DeFi applications and DeFi development services migrate to Arbitrum, Ethereum’s mainnet experiences relief from congestion, leading to improved network performance and reduced gas fees for those who continue to use Ethereum directly.

Innovation and Experimentation

Arbitrum’s scalability unlocks new possibilities for DeFi developers and entrepreneurs to experiment with innovative solutions and build more complex applications. This fosters further innovation within the DeFi ecosystem.

Network Effect

Arbitrum benefits from Ethereum’s existing network effect, as DeFi projects and users naturally gravitate towards this layer 2 solution. The growing number of applications and users on Arbitrum creates a positive feedback loop, attracting even more projects and users to join the ecosystem.

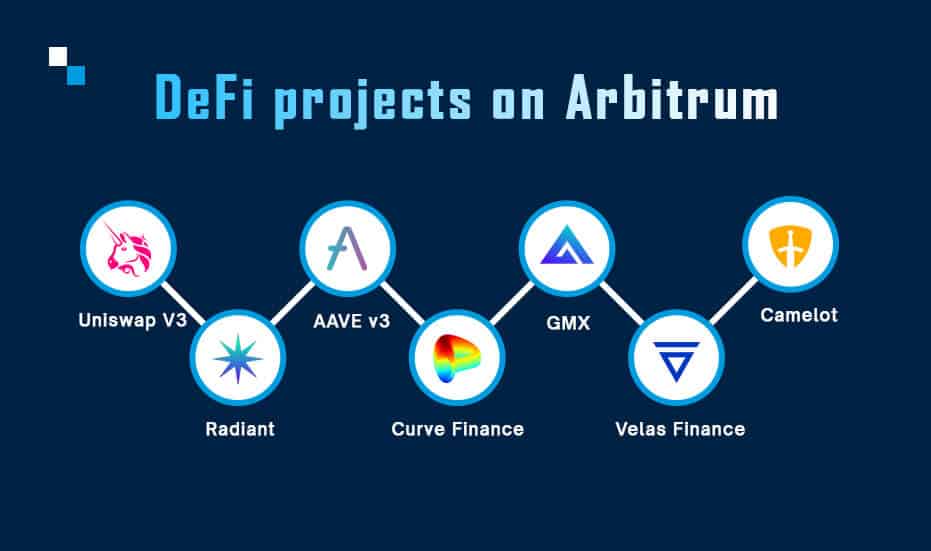

DeFi projects on Arbitrum

Here are some of the Arbitrum-based DeFi projects:

Uniswap V3

Uniswap V3 is a decentralized exchange (DEX) that allows users to trade a variety of DeFi tokens with low gas fees. It is one of the most popular DeFi projects on Ethereum, and its Arbitrum version offers the same features and liquidity as the mainnet version, but with much lower gas fees.

Radiant

Radiant is a money market protocol that allows users to lend and borrow assets with high yields. It offers a variety of features, including fixed-rate lending, variable-rate lending, and margin trading. With the popularity of DeFi Lending Platform Development, Radiant is quite in demand.

AAVE v3

AAVE v3 is a decentralized lending protocol that allows users to lend and borrow a variety of assets, including cryptocurrencies, stablecoins, and NFTs. It offers a variety of features, including flash loans, permissionless lending, and collateralized loans.

Curve Finance

Curve Finance is a decentralized exchange that specializes in stablecoins. Curve Finance offers a number of features that make it a popular choice for trading stablecoins, including low fees, liquidity, and stable prices.

GMX

GMX is a decentralized exchange (DEX) that allows users to trade a variety of DeFi tokens with low gas fees. It offers a variety of features, including margin trading, limit orders, and stop-loss orders.

Velas Finance

Velas Finance is a decentralized finance (DeFi) platform that offers a variety of products and services, including a DEX, a lending protocol, and a staking platform. It is one of the most popular DeFi platforms on Arbitrum, and it offers a variety of features that are not available on other DeFi platforms.

Camelot

Camelot is a decentralized finance (DeFi) platform that allows users to trade, lend, and borrow assets with high yields. It is one of the most popular DeFi projects on Arbitrum, and it offers a variety of features that are not available on other DeFi platforms.

These are just a few of the many DeFi projects that are available on Arbitrum. As the network continues to grow, we can expect to see even more DeFi projects launch on Arbitrum in the future.

Conclusion

Arbitrum’s emergence as a layer 2 scaling solution brings tremendous potential for the DeFi ecosystem. With its scalability, lower transaction fees, and seamless compatibility with Ethereum, Arbitrum offers an improved user experience while driving innovation and adoption within the DeFi space. As more DeFi applications migrate to Arbitrum, we can expect a more scalable, accessible, and cost-effective DeFi ecosystem that empowers users and unlocks new financial opportunities.

Looking for the best Defi Development Company for Arbitrum-based DeFi projects? Get in touch with subject matter experts at Antier, the best DeFi development company!