Is AI-driven predictive analytics the new frontier of crypto neo-banking? Or is it merely a fleeting trend in 2025’s digital finance ecosystem? The answer lies in the seismic shift we’re witnessing—where AI, blockchain, and big data converge to redefine financial intelligence, risk management, and customer experience.

Crypto neo-banking is no longer just about decentralized transactions; it’s about predicting the unpredictable. With AI-powered predictive analytics, financial institutions can anticipate market movements, mitigate fraud in real-time, and deliver hyper-personalized banking experiences—all with unparalleled precision.

But what does this mean for businesses and investors? Imagine a banking infrastructure that adapts dynamically to user behavior, analyzes millions of data points in seconds, and preemptively flags financial anomalies before they manifest into risks. So, how do you build a future-proof crypto neo-bank that doesn’t just follow market trends but predicts them? The answer lies in integrating AI-enhanced predictive models

Why is Predictive Analytics an Absolute Imperative for Crypto Neo-Banking?

Predictive analytics has become an indispensable force in modern finance, empowering institutions to anticipate market shifts, decode customer behavior, and mitigate risks proactively. The global predictive analytics market was valued at USD 18.89 billion in 2024 and is expected to surge at a CAGR of 28.3% from 2025 to 2030. This rapid expansion is fueled by increasing demand for advanced credit risk assessment, real-time fraud detection, customer segmentation, and regulatory compliance.

As financial institutions capitalize on predictive models to extract meaningful insights from vast datasets, crypto neo-banks stand to gain a significant competitive edge. The fusion of AI-driven predictive analytics with crypto neo banking platforms unlocks hyper-personalized user experiences, proactive risk management, and seamless transaction security. By integrating predictive intelligence, crypto neo-banks can not only enhance operational efficiency but also attract a global customer base seeking data-driven financial solutions that anticipate their needs in real-time.

AI Integrated Predictive Analytics: Next-Gen Crypto-Friendly Neo-Banking

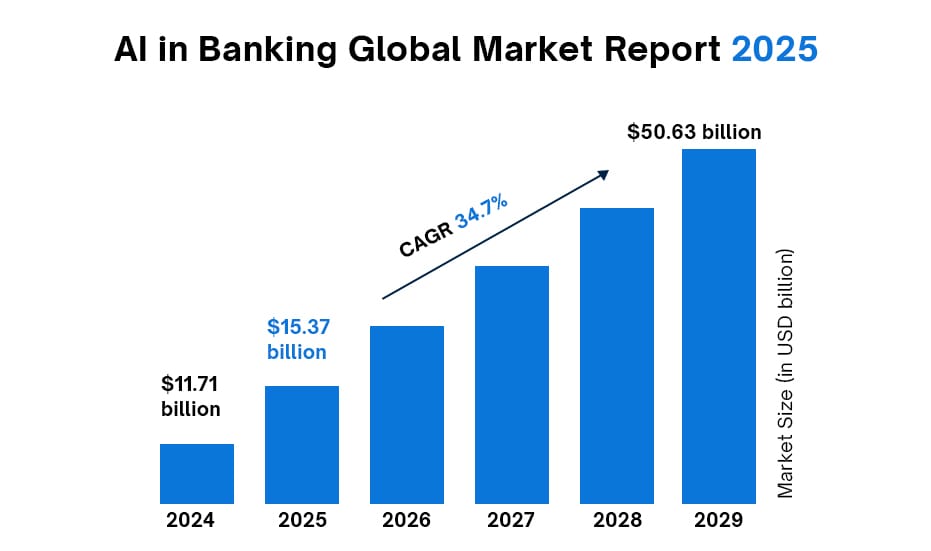

The AI boom in banking is undeniable—its market is projected to grow from $11.71 billion in 2024 to $15.37 billion in 2025, reflecting a CAGR of 31.3%. As AI reshapes financial services, businesses investing in crypto neo-banking platforms are leveraging predictive analytics to drive higher ROI, risk mitigation, and superior customer experiences. AI-driven insights empower crypto banking with precise market forecasting, fraud detection, and automated financial decision-making, ensuring smarter investments in an evolving market.

With hyper-personalized banking services and proactive security measures, AI-integrated crypto neo-banks are redefining digital finance, attracting global customers while optimizing operational efficiency. Moreover, the ability to analyze vast datasets in real time enhances liquidity management, enabling businesses with crypto neo-bank apps to make data-backed financial decisions swiftly. Businesses adopting AI-driven predictive analytics benefit from reduced fraud incidents, streamlined operations, and improved regulatory compliance, solidifying their foothold in the competitive digital banking space. As AI adoption accelerates, its role in crypto neo-bank development space will be instrumental in shaping the future of decentralized finance.

Essential Features of a Crypto Neo-Banking App with Predictive Analytics

What if your banking app could anticipate market shifts, detect fraud before it happens, and tailor financial insights to your needs—all in real-time? That’s the power of predictive analytics in crypto neo-banking. Developing a cutting-edge crypto neo-banking app necessitates the integration of advanced features powered by predictive analytics:

✓ Personalized Financial Insights : Leveraging AI to scrutinize user spending patterns and investment behaviors, thereby providing bespoke advice and forecasts.

✓ Real-Time Fraud Detection : Implementing machine learning algorithms capable of identifying and alerting users to anomalous activities instantaneously.

✓ Dynamic Risk Assessment : Continuously evaluating market conditions and user portfolios to offer proactive risk mitigation strategies.

✓ Adaptive User Interface : Utilizing predictive models to tailor the app interface in alignment with individual user behaviors and preferences.

✓ Regulatory Compliance Automation : Incorporating tools that ensure transactions and operations adhere to the latest financial regulations, thereby minimizing manual oversight.

How AI-Predictive Analytics Neo Banking Is A Smart Investment For Businesses?

Relying on guesswork in financial decisions leads to missed opportunities and increased risks. AI-driven predictive analytics empowers crypto neo-banking with real-time insights, fraud prevention, and precise market forecasting. Understanding these benefits is crucial for investors looking to maximize returns and stay ahead in the competitive digital finance ecosystem.

- Enhanced Risk Mitigation

AI-driven predictive analytics empower enterprises with crypto neo-bank development solutions to anticipate and mitigate potential risks with unprecedented accuracy. By analyzing vast datasets, these systems can identify patterns indicative of fraudulent activities, enabling proactive intervention. For instance, AI models can detect anomalies in transaction behaviors, flagging suspicious activities in real-time and thereby safeguarding both the institution and its clientele. This proactive approach not only reduces financial losses but also fortifies the institution’s reputation for security and reliability.

- Optimized Credit Assessment

Traditional credit scoring models often rely on limited data points, potentially overlooking creditworthy individuals. AI-enhanced predictive analytics revolutionize this process by evaluating a broader spectrum of data, including unconventional indicators of financial behavior. This comprehensive analysis facilitates more accurate credit assessments, expanding access to financial services for underserved populations, and fostering financial inclusion. Moreover, it enables businesses investing in crypto neo-banking platforms to tailor credit products to individual risk profiles, enhancing customer satisfaction and loyalty.

- Personalized Customer Engagement

In an era where customer experience is paramount, AI-driven predictive analytics enable neo-banks to deliver highly personalized services. By scrutinizing user behavior and preferences, these systems can offer customized financial advice, product recommendations, and timely alerts. This level of personalization in crypto neo bank apps not only enhances user satisfaction but also increases engagement and retention rates, as customers feel understood and valued.

- Operational Efficiency and Cost Reduction

The automation capabilities of AI and predictive analytics streamline various operational processes within neo-banks. Tasks such as transaction monitoring, compliance checks, and customer support can be efficiently managed by AI systems, reducing the reliance on manual intervention. This operational efficiency translates into significant cost savings. For example, since early 2024, Klarna has utilized AI technology from OpenAI, enabling the company to perform tasks equivalent to those of 700 employees, thereby optimizing resource allocation and reducing operational expenditures.

- Strategic Decision-Making and Market Adaptability

AI-powered predictive analytics provide neo-banks with actionable insights into market trends and consumer behaviors. This intelligence supports strategic decision-making, allowing institutions to adapt swiftly to evolving market conditions. For example, Tiger Brokers has integrated DeepSeek’s AI model, DeepSeek-R1, into its operations to enhance market analysis and trading capabilities, reflecting a broader trend among financial firms to leverage AI for strategic advantage.

Still wondering if AI predictive analytics is worth the investment? The answer is crystal clear—yes. In a market driven by data, relying on outdated strategies is a risk businesses can’t afford. The future of crypto neo-banking isn’t just digital—it’s predictive. Let’s scroll down to explore the holistic steps of crypto neo banking platform development for a clear understanding.

How to Build a Crypto Neo-Banking Platform With AI-Predictive Analytics?

You think launching a crypto neo-bank app with AI-driven predictive analytics is rocket science? Think again. The real challenge isn’t just building an app—it’s crafting an intelligent, adaptive financial ecosystem. One that predicts risks, personalizes experiences, and optimizes trading in real-time. The secret? A future-proof strategy, cutting-edge AI models, and the right development partner. A specialized crypto neo-banking development company follows these five core steps to engineer a robust, scalable, and future-proof solution.

- Step 1. Strategic Architecture & Compliance Framework

The foundation of a crypto neo-banking platform begins with designing an advanced system architecture that ensures seamless blockchain integration, high-frequency transaction processing, and AI-driven analytical models. Compliance with financial regulations, including AML, KYC, and GDPR, is embedded at this stage, ensuring the platform meets global regulatory standards. Smart contract-based transaction protocols and multi-layered security infrastructures are incorporated to reinforce trust, decentralization, and financial transparency.

- Step 2. AI-Powered Predictive Analytics Model Development

Developing AI-predictive analytic neo banking requires engineering sophisticated machine learning models trained on vast datasets encompassing user transactions, market fluctuations, and behavioral patterns. These models utilize deep learning algorithms for real-time risk assessment, fraud detection, and dynamic credit scoring. The system continuously refines itself through AI model training, ensuring precise financial forecasts, hyper-personalized banking recommendations, and automated investment insights tailored to individual user profiles.

- Step 3. Crypto Payment Infrastructure & Liquidity Engine

A crypto neo-banking platform must support multi-asset transactions, on-chain and off-chain liquidity management, and cross-chain interoperability. This involves integrating a liquidity engine with decentralized and centralized exchange mechanisms, ensuring seamless fiat-to-crypto and crypto-to-crypto transactions. AI-driven trading algorithms optimize liquidity allocation and transaction routing, enhancing capital efficiency. Institutional-grade custodial and non-custodial wallet infrastructure is developed with multi-signature authentication and hardware security modules (HSMs) for secure asset management.

- Step 4. Advanced Security & Fraud Prevention Protocols

Security remains paramount, demanding a multi-tiered approach that fuses AI-driven anomaly detection, zero-trust architecture, and blockchain consensus mechanisms. Encrypted data pipelines, real-time transaction monitoring, and AI-enabled fraud detection algorithms proactively identify suspicious activities. SSI protocols and biometric authentication enhance user verification, ensuring privacy-preserving, secure digital banking experiences. Automated compliance reporting and real-time regulatory updates strengthen governance while mitigating cyber threats.

- Step 5. Deployment, Scaling & Continuous Optimization

The final stage involves deploying the crypto-friendly neo banking platform on a cloud-native, highly scalable infrastructure that ensures optimal performance across high-volume transaction environments. AI-driven system monitoring ensures real-time performance analytics, automatic load balancing, and predictive infrastructure scaling. Smart contract audits, penetration testing, and security compliance checks are executed pre-launch. Post-deployment, AI feedback loops refine predictive models, enhancing financial recommendations and fraud prevention capabilities. Regular software upgrades and blockchain protocol enhancements future-proof the platform, ensuring sustained growth in an evolving digital banking landscape.

The aforementioned steps are followed by an experienced crypto-neo-banking solution provider that holds immense expertise in designing and delivering business-catered apps that help businesses offer enhanced customer experience. Thus, make sure you hire comprehensive services from a reputable company.

Investment Considerations: How Much Does AI-Predictive Analytic Neo Banking Development Cost?

Investing in the crypto neo-banking platform development with integrated predictive analytics entails a comprehensive understanding of the associated costs.It involves multiple cost-driving factors primarily influenced by technological complexity, security protocols, regulatory compliance, and AI integration. The development process requires advanced machine learning models for real-time financial forecasting, fraud detection, and personalized banking experiences, increasing computational demands and infrastructure costs. Ensuring regulatory compliance, including KYC, AML, and data protection laws, adds another layer of investment, requiring legal expertise and ongoing audits. Security measures, such as blockchain encryption, biometric authentication, and anomaly detection systems, further escalate costs while fortifying the crypto neo Bank app against cyber threats.

Additionally, AI-driven automation in customer support, transaction processing, and risk assessment necessitates continuous model training and cloud computing resources. Scalability also plays a crucial role, as businesses must invest in a flexible architecture capable of adapting to market demands while maintaining seamless performance and operational efficiency. Partnering with crypto Neobank solution providers and hiring their services can ensure a streamlined approach to building a robust and future-ready solution.

Build AI-Predictive Analytics Crypto Neo Bank Apps With Antier

What’s stopping you from building the next-gen AI-powered crypto neo bank?At Antier, our experts redefine banking with AI-powered predictive analytics, ensuring a smarter, faster, and more secure experience. Our team of AI and blockchain specialists is always ahead of market trends, designing solutions that set you apart. We offer a wide range of comprehensive crypto neo banking development services. Explore them-

🔹 AI & Blockchain Pioneers: Specialists in cutting-edge tech integration.

🔹 Predictive Analytics: Smarter insights for informed financial decisions.

🔹 Seamless Development: End-to-end solutions tailored to your needs.

🔹 Security & Compliance: Future-proofing your banking ecosystem.

Contact us today to share your requirements and create the crypto-neo-banking platforms of your dreams!