The evolution of financial ecosystems is undergoing a transformative shift, with white-label neo-banking solutions leading the charge. White-label neo-bank platforms based on Layer 2 blockchains provide a cutting-edge substitute for traditional banking systems, which struggle with inefficiencies. These platforms offer real-time financial services, low-cost, high-speed transactions, and seamless crypto integration.

Backed by decentralized architecture and smart contract automation, these solutions empower businesses to create scalable banking systems tailored to their unique requirements. White-label neo-banking solutions are poised to transform the digital finance scene as consumer demand for safe, environmentally friendly, and customer-focused banking continues to grow. This blog delves into the technical frameworks, features, and unparalleled benefits of adopting Layer 2-powered white-label neo banking platforms, charting a roadmap for fintech innovation in a decentralized world.

Why Layer 2 Blockchains Are the Future of Crypto Neo Banking?

Layer 2 blockchains are rapidly emerging as the future of crypto neo-banking, providing scalable, cost-effective solutions to address the limitations of traditional blockchain systems. Layer 2 protocols greatly increase throughput and lower fees without sacrificing security by processing transactions off-chain. This scalability makes them an ideal fit for neo-banking applications, which require high-speed, low-cost transactions to serve a global, digital-first customer base.

As DeFi and cryptocurrency adoption grow, Layer 2 enables seamless integration with digital assets, facilitating real-time payments, cross-border transactions, and innovative financial products. Financial institutions adopting Layer 2 can unlock profitable opportunities by offering diverse services such as crypto-backed lending and investment solutions. Additionally, Layer 2’s effectiveness facilitates business growth by enabling organizations to scale quickly while keeping operating expenses low. For companies hoping to dominate the digital banking market, Layer 2 offers a strategic edge as its popularity keeps growing.

Essential Features: White-Label Neo Bank Platform on Layer 2 Blockchain

Here are the essential features of a white-label neo-banking app built on Layer 2 blockchain, focusing on the platform’s functionalities and how it can leverage the scalability, efficiency, and security of the Layer 2 blockchain network:

- Scalable Banking Operations : Layer 2 blockchain ensures the white-label neo-banking platform can handle a high volume of simultaneous users, offering a scalable solution that can grow with customer demand without compromising performance.

- Instant Settlement for Transactions : White-label neo-banking solutions enable real-time processing without the typical delays of traditional banking systems by utilizing Layer 2’s high-speed processing to provide instant transaction settlement.

- Multi-Currency Support : A white-label neo-bank platform that can integrate multiple currencies, including fiat and cryptocurrencies, leveraging Layer 2 for seamless, low-cost transactions across diverse assets.

- Decentralized Custody & Asset Management : The Layer 2 blockchain enables decentralized custody for assets held within the white-label neo bank, enhancing security and transparency while reducing risks associated with centralized systems.

- Customizable Financial Products : White-label neo-bank apps built on Layer 2 offer flexibility in designing tailored financial products, such as savings plans or loan schemes, through easily customizable interfaces that fit the specific needs of different user groups.

- Seamless User Onboarding : The white-label neo-banking app facilitates fast, secure customer onboarding through streamlined KYC processes, supported by Layer 2’s ability to handle large-scale, decentralized data verification.

- Advanced-Data Privacy and Control : White-label neo-banking solutions that use the Layer 2 blockchain offer improved privacy features that give users more control over their personal information and enable safer transactions without sacrificing regulatory compliance.

- Real-Time Transaction Monitoring : Layer 2 enhances white-label neo-bank platforms with real-time transaction monitoring, offering detailed insights into financial activities and helping users track expenses, manage budgets, and stay compliant with local financial regulations.

- Automated Compliance & Reporting : The white-label neo-banking solutions simplifies compliance processes by automating regulatory reporting and audits, thanks to Layer 2’s ability to quickly process and store transaction data in a secure and immutable ledger.

- Cost-Effective Fee Structures : White-label neo-banking platforms can give businesses and end users a competitive edge in the financial services industry by utilizing Layer 2 blockchain’s cost-efficiency to offer reduced transaction fees and improved cost-effectiveness.

These features help white-label neo-banking development solutions built on Layer 2 blockchain deliver scalable, secure, and innovative financial services, catering to diverse customer needs while ensuring smooth, real-time operations and compliance with regulatory standards.

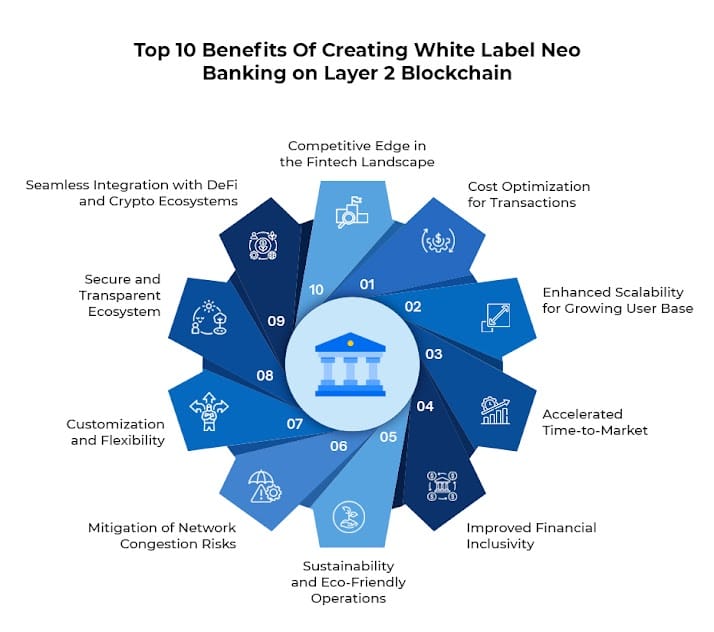

Business Benefits: Build White Label Neo Bank on Layer 2 Blockchain

Layer 2 blockchain technology is revolutionizing the fintech industry, particularly in white-label neo-bank development. Unlike traditional banking solutions, these apps leverage Layer 2 protocols to enhance scalability, reduce costs, and deliver seamless financial services. The business benefits of creating white-label neo-banking solutions on Layer 2 blockchain are examined in detail here, with an emphasis on the most recent perks.

1. Cost Optimization for Transactions

Layer 2 blockchain significantly reduces transaction fees by processing most operations off the main blockchain (Layer 1). This efficiency benefits businesses by:

- Lowering operational costs for high-volume transactions.

- Enabling businesses to offer competitive pricing to their customers.

- Improving profit margins, especially for cross-border payments and microtransactions.

2. Enhanced Scalability for Growing User Base

Scalability is crucial given the growing demand for digital banking.

- Support for handling thousands of transactions per second, ensuring uninterrupted services even during peak usage.

- The ability to onboard a growing number of users and expand to global markets without performance degradation.

3. Accelerated Time-to-Market

Building a white-label neo-bank on Layer 2 streamlines the development and deployment process, allowing businesses to:

- Quickly launch white label neo banking solutions without building infrastructure from scratch.

- Gain a competitive edge by being early adopters in emerging markets.

4. Improved Financial Inclusivity

White label neo bank based on Layer 2 blockchain promotes financial inclusion by reducing the costs and technical barriers associated with traditional banking systems, enabling businesses to:

- Reach underserved and unbanked populations globally.

- Offer tailored financial solutions to emerging markets where traditional banking infrastructure is limited.

5. Sustainability and Eco-Friendly Operations

Layer 2 blockchain solutions consume significantly less energy compared to Layer 1, making white-label neo-banks an eco-conscious choice. Businesses benefit by:

- Aligning with global ESG (Environmental, Social, Governance) goals.

- Enhancing their brand reputation as environmentally responsible organizations.

6. Mitigation of Network Congestion Risks

White label neo bank designed on Layer 2 solutions decongest Layer 1 blockchains by offloading transactions to secondary layers. Businesses enjoy:

- Reliable and fast transaction processing, even during high network activity.

- Greater consistency in service delivery, fostering trust and loyalty among customers.

7. Customization and Flexibility

White-label neo-banking solutions on Layer 2 allow businesses to craft tailored platforms, providing benefits like:

- Adaptability to regional regulatory requirements.

- The ability to integrate niche financial products catering to specific demographics or industries.

8. Secure and Transparent Ecosystem

Layer 2 blockchain, when leveraged to create a white-label neo-bank solution, builds on the inherent security of blockchain technology while ensuring faster and private transactions. Benefits include:

- Enhanced trust among customers and stakeholders through transparent operations.

- A reduced risk of fraud, as data is immutable and transactions are verified cryptographically.

9. Seamless Integration with DeFi and Crypto Ecosystems

Crypto Neo-banking apps can easily incorporate DeFi features by utilizing Layer 2 blockchain, which allows companies to:

- Offer modern financial products such as crypto savings accounts, staking, and lending.

- Attract tech-savvy customers interested in blockchain-powered financial solutions.

10. Competitive Edge in the Fintech Landscape

As blockchain adoption increases, businesses utilizing Layer 2 blockchain networks position themselves as leaders in the fintech space. This advantage manifests in:

- The ability to meet evolving customer expectations with innovative banking services.

- Standing out as pioneers in sustainable, scalable, and inclusive digital banking.

Building white-label neo-bank app development solutions on Layer 2 blockchain is more than a technological shift; it’s a business strategy that enables organizations to reduce costs, expand reach, and stay ahead in an increasingly digital world. You can always partner with a prestigious crypto neo bank development company to seek professional assistance in designing a business-tailored banking solution for

Step-by-step Guide: White Label Neo Bank Development on Layer 2 Blockchain

Step 1 : Business Requirement Analysis and Strategic Framework Design

Initiate the project by conducting a comprehensive analysis of business objectives, market trends, and customer needs. Define the core functionalities of the white label neo-banking platform, ensuring alignment with regulatory requirements and strategic business goals.

Step 2 : Layer 2 Blockchain Selection and System Architecture Design

Choose an appropriate Layer 2 blockchain solution (e.g., Polygon, Arbitrum) that offers enhanced scalability and low-latency transaction processing for white label neo bank platform. Architect the system to leverage the advantages of Layer 2 scalability, ensuring interoperability with the underlying Layer 1 blockchain for seamless integration.

Step 3 : Smart Contract Development and Security Optimization

Develop and deploy secure, efficient smart contracts that manage core crypto neo banking operations such as transactions, deposits, and loans. Optimize for minimal gas fees and ensure rigorous security audits and testing to eliminate vulnerabilities and ensure compliance with financial regulations.

Step 4 : Frontend and Backend Development for User-Centric Experience

Design a highly intuitive, responsive UI optimized for multiple devices, ensuring seamless interaction. Build a robust backend system capable of handling blockchain integrations, real-time data processing, and high transaction volumes while maintaining scalability and security.

Step 5 : Blockchain Integration and Payment Gateway Implementation

Integrate the selected Layer 2 blockchain into the platform to facilitate fast, secure, and low-cost transactions. Implement an advanced crypto payment gateway that supports seamless fiat-to-crypto and crypto-to-fiat transactions, ensuring cross-border transaction efficiency and multi-currency support in white label neo banking applications.

Step 6 : Comprehensive Security Framework and Threat Protection

Implement state-of-the-art encryption, MFA, and blockchain-native security mechanisms to protect user data and transactions. Conduct continuous security audits, penetration tests, and vulnerability assessments to safeguard against emerging threats.

Step 7 : Regulatory Compliance and Risk Management Integration

Ensure the white label neo platform adheres to critical regulatory standards such as AML, KYC, and data privacy laws. Deploy automated tools for real-time compliance monitoring, secure reporting, and transparent audit trails, ensuring ongoing alignment with financial regulations.

Step 8 : Deployment, Post-Launch Monitoring, and Continuous Optimization

Deploy the white label neo bank with a phased rollout, ensuring smooth blockchain integration and system performance. Monitor the platform’s performance post-launch, utilizing real-time analytics to identify areas for improvement, and implement regular updates and optimizations to adapt to evolving business and market demands.

These 8 strategic steps ensure the development of a scalable, secure, and high-performance white-label neo-banking app development solution built on Layer 2 blockchain, providing businesses with a competitive, future-proof banking solution.

Top Use Cases of Layer 2 Blockchain in White-Label Neo Banking

White-label neo-bank development on Layer 2 blockchain has the following five niche use cases, each of which demonstrates the enormous potential of incorporating scalable blockchain technology in the financial industry:

1. Decentralized Cross-Border Payments and Remittances

Layer 2 blockchain enables fast, low-cost, and secure global payments. Businesses can provide smooth cross-border transfers without middlemen by cutting transaction costs and settlement times. This is particularly advantageous for emerging markets where remittances are essential.

2. Tokenized Asset Management and Investment Platforms

Layer 2 network-based white-label neo-banking platform supports fractional ownership of real-world assets, enabling tokenized investments in real estate, commodities, and art. While smart contracts automate tasks like dividend payouts and portfolio rebalancing, transactions can be completed quickly and with minimal fees.

3. Decentralized Lending and Borrowing Platforms

Layer 2 blockchain powers decentralized lending, allowing users to borrow and lend assets directly using smart contracts and collateralized loans. The scalability and low costs make it a viable alternative to traditional lending, especially in underserved regions.

4. Decentralized Identity Management and KYC/AML Solutions

A white label neo bank designed on Layer 2 enables secure and efficient decentralized identity management. In addition to lowering onboarding friction and guaranteeing compliance while protecting privacy, users have control over their data and provide verifiable credentials for KYC/AML procedures across multiple institutions.

5. Green Finance and Sustainable Investment Platforms

A white-label neo bank app development solution built upon Layer 2 blockchain facilitates sustainable investments by tracking environmental impacts and carbon credits. Carbon credit marketplaces can be established, offering low-cost, efficient transactions for businesses and individuals committed to reducing their carbon footprint.

These use cases highlight how Layer 2 blockchain’s scalability, security, and cost-efficiency can disrupt traditional financial systems, offering innovative, decentralized solutions across multiple sectors.

Connect With White Label Neo Banking Development Company

A smart way to capitalize on scalability, cost-effectiveness, and innovation in the fintech industry is to invest in white-label neo-banking solutions developed on the Layer 2 blockchain. This investment offers unparalleled growth and market leadership potential in light of the growing demand for sophisticated, decentralized financial ecosystems.

Why Choose Antier?

At Antier, we specialize in developing state-of-the-art white-label neo-banking platforms tailored to your business needs. Our team of blockchain professionals combines technical expertise with market insights to design scalable and secure platforms, ensuring your venture stands out in the competitive fintech landscape. From customized app development to seamless Layer 2 integrations, we deliver innovative white-label neo bank apps that redefine your digital banking capabilities. Partnering with us means choosing a reliable, forward-thinking team dedicated to achieving your success. Explore our services now!